Americans need many things right now beyond tax cuts or cash payments. But for people whose incomes have declined or evaporated, money is the obvious, immediate need to prevent missed rent or mortgage payments, skipped hospital visits and other cascading catastrophes. So, what should Congress do next to get money to those who need it?

Additional Tax Rebates Should Provide More Effective Assistance for All Low- and Middle-Income People

Automatic Payments Should be Made to All Low-Income People

The final rebate approved in the CARES Act is technically available to all low-income people regardless of whether they had earnings or filed a tax return in 2018 or 2019. But not everyone who is eligible receives a payment automatically and quickly under the CARES Act. Only those who have filed a tax return for 2018 or 2019 or receive Social Security benefits will get an automatic payment. (The administration had even briefly flirted with delaying payments to non-filers receiving Social Security.) Millions of very low-income seniors and people with disabilities receiving SSI and others whose income is too low to require filing will not receive automatic payments. These people will receive payments months from now, and only if they know to file a return.

A House Democratic proposal would have made payments automatic to recipients of SSI and other benefit programs. Any future tax rebates should take the same approach.

Payments Should Be Made for All Low- and Middle-Income People and Dependents

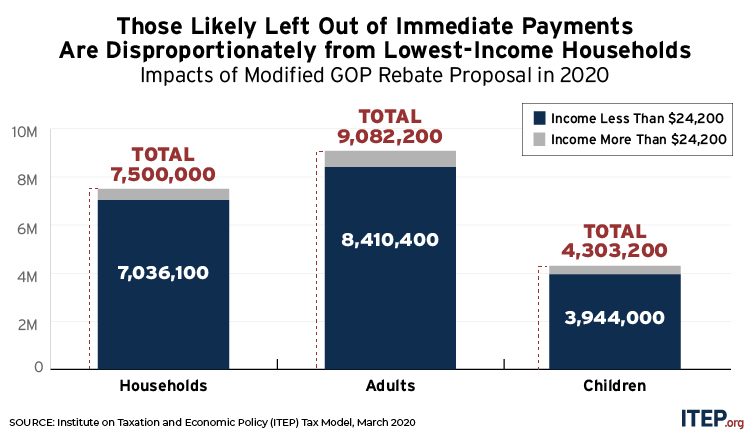

The CARES Act provides a payment up to $2,400 for married couples, $1,200 for unmarried taxpayers, and $500 for each child under age 17. Legislators excluded dependents over age 16, elderly dependents, and dependents with disabilities. The law also likely leaves behind young adults who are now independent filers. A Senate Democratic proposal for a (much larger) tax rebate would have provided a flat dollar amount for every member of the household, which makes more sense if the goal is to help people meet the expenses that grow with the size of their household. Any future rebates should reach every low- and middle-income adult and child regardless of age.

Payments Should Be Made to All Immigrants

The CARES Act tax rebates are unavailable to immigrants, primarily undocumented immigrants, working in the United States and filing taxes using an Individual Taxpayer Identification Number (ITIN). This excludes an additional estimated 4.3 million adults and 3.5 million children from the benefit. The Act also denies a rebate for any member of a household where even one member has an ITIN rather than a Social Security number, leaving behind citizen adults and children. In contrast, the Democratic proposals offered during the debate included all ITIN filers and members of their households, recognizing their contribution to the economy. Any future rebate should include all immigrants.

What Should Not Be in the Next Bill: Tax Breaks for the Wealthy

Payroll Tax Cut

According to one report, the Trump administration is considering another push for a payroll tax cut. A previous ITEP analysis found that 65 percent of the benefits of this proposal would go to the richest 20 percent of taxpayers and a quarter of the benefits would go to the richest 1 percent. Anything that disproportionately benefits the wealthiest taxpayers by definition neglects low- and middle-income people. It is also true that Black and brown people are underrepresented among the top 20 percent of taxpayers and dramatically underrepresented among the richest 1 percent, making this provision inequitable along racial as well as economic lines. Trump’s proposal would cut the part of the tax paid by employers, as well as the part paid by employees. Cutting the employer side of the tax would provide a windfall to the mostly high-income owners of corporate stocks and other business assets.

Capital Gains Tax Cut

The administration, reportedly, is also pursuing a cut in income taxes on capital gains, profits that taxpayers receive from selling assets. If there is anything holding back our economy right now, it is not taxes on capital gains. Capital gains are already taxed more lightly than other types of income, thanks to several different breaks in our tax code, as explained by this ITEP analysis. The most well-known of these breaks is the special, lower personal income tax rates that apply to long-term capital gains (and stock dividends). More than three-fourths of the benefits of that break flow to the richest 1 percent of taxpayers.

Repeal of Cap on State and Local Tax (SALT) Deductions

The Trump administration does not have a monopoly on bad ideas for the next COVID-19 legislation. As ITEP has explained, the 2017 Trump-GOP tax law includes many provisions that should be repealed. Unfortunately, Congressional Democrats want to start by repealing the $10,000 cap on SALT deductions, one of the law’s few provisions that restrict tax breaks for the rich. Recently Democratic leaders suggested that a version of this would be in the next legislation to address the COVID-19 crisis.

A Democratic aide suggested that this could be tailored to benefit the middle-class, but previous attempts to do this were failures. An ITEP analysis demonstrated that the last time the Democrats attempted this, their proposal provided more than half of its benefits to the richest 1 percent.

Cash Payments Are Just One Important Part of the Next Round of Legislation

Congress acted quickly in late March to pass the CARES Act, which provides individual payments to many Americans, state and local fiscal relief, unemployment compensation expansion, and aid to corporations and small businesses. The law included many essential provisions but also contained expensive problematic elements and left out important components. As lawmakers put together the next economic package, they should do much more to assist struggling families and state and local government, and proceed much more carefully on any corporate aid.