Budget

Despite wintry conditions across much of the country, that hasn’t stopped state lawmakers from debating major tax policy changes.

As state legislative sessions ramp up across the country, property taxes are one of many issues dominating tax policy conversations in statehouses.

As federal aid ends and economic uncertainty grows, local governments face tough budget choices. Now is the time for localities to protect vulnerable residents and build stronger, more equitable fiscal foundations.

Lawmakers have repeatedly stepped on the same rake of slashing tax rates and expecting revenues to magically go up. Now they want middle-class Americans to be the ones who get hit in the face. The con is getting tired. If Congress wants to reel in the debt then it’s time to raise taxes on the wealthy.

Revenue-Raising Proposals in President Biden’s Fiscal Year 2024 Budget Plan

March 10, 2023 • By Steve Wamhoff

President Biden’s latest budget proposal includes trillions of dollars of new revenue that would be paid by the richest Americans, both directly through increases in personal income, Medicare and estate taxes, and indirectly through increases in corporate income taxes.

Revenue-Raising Proposals in President Biden’s Fiscal Year 2023 Budget Plan

April 26, 2022 • By Steve Wamhoff

President Biden's latest budget plan includes proposals that would raise $2.5 trillion in new revenue. While many of these reforms appeared in his previous budget, some of them are brand new, such as his proposal to prevent basis-shifting in partnerships and his Billionaires Minimum Income Tax.

President Trump’s 2021 Budget: Promises Made, Promises Broken

February 10, 2020 • By Steve Wamhoff

President Trump has kept only one of his promises--his pledge to lower taxes for corporations and their investors. The budget plan he released today again breaks his promise to reject cuts in Medicaid that would affect millions of people. His budget once again fails to eliminate the deficit, much the less the national debt, during his presidency as he promised. It cuts trillions from safety net programs and student aid programs despite his pledge to stand for forgotten Americans.

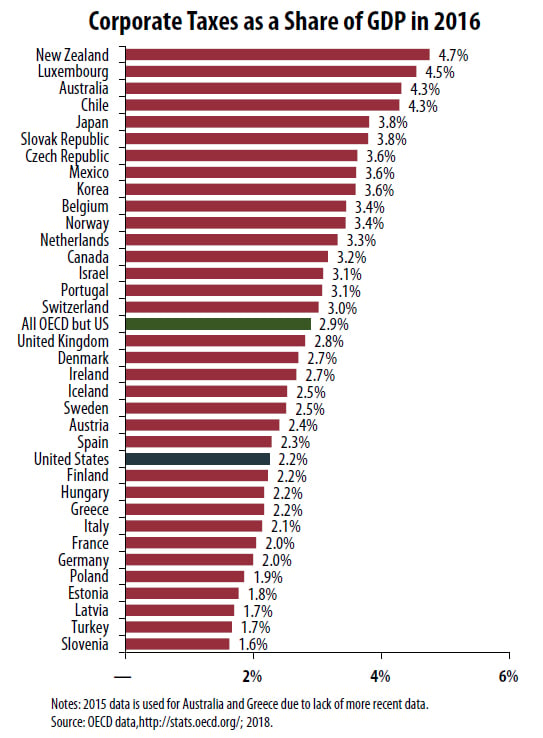

Trump Tax Cuts Likely Make U.S. Corporate Tax Level Lowest Among Developed Countries

April 11, 2018 • By Richard Phillips

U.S. corporate tax collection was equal to 2.2 percent of the nation’s gross domestic product (GDP) in 2016, significantly less than the average 2.9 percent collected by the other 34 other OECD countries for which data were available.

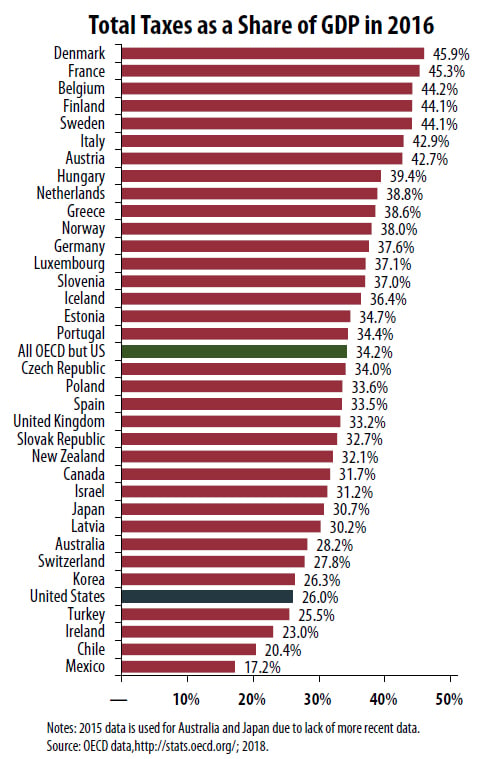

The most recent data from the Organization for Economic Cooperation and Development (OECD) show that the United States is one of the least taxed of the developed nations.

Passing the Buck: Forcing Spending Cuts through a Balanced Budget Amendment

April 5, 2018 • By Ronald Mak

House leaders are preparing a vote on a balanced budget amendment next week that could force massive spending cuts and restrict the ability of lawmakers to raise revenue. Although a balanced budget amendment will likely be pitched as a way to address our nation’s long-term fiscal challenges, such proposals are economically harmful, ineffective, and one-sided.

GOP Dilemma: Love the Tax Cut, Hate the Agency that Administers It

February 14, 2018 • By Matthew Gardner

The president’s budget proposal would cut the agency’s baseline funding from $12 billion to $11.1 billion this year. This is almost a quarter less, in inflation-adjusted terms, than the $14.4 billion the agency received in fiscal year 2010. Not surprisingly, the long, steady decline of IRS funding during this period has led to a reduction in staffing: the agency’s 2016 employee total of 77,000 was 17,000 lower than at the beginning of the decade.