California

State Rundown 12/5: Familiar Questions Returning to Fore as 2019 Approaches

December 5, 2018 • By ITEP Staff

State lawmakers are preparing their agendas for 2019 and looking at all sorts of tax and budget policies in the process, raising many familiar questions. Oregon legislators, for example, will try to fill in the blanks in a proposal to boost investments in education that left out detail on how to fund them, while their counterparts in Texas face the inverse problem of a proposed property tax cut that fails to clarify how schools could be protected from cuts. Similar school finance debates will play out in many other states. Alabama, Kansas, and Louisiana will look at gas tax updates,…

State Rundown 11/16: Election Results Clarify Agendas as Real Work Begins

November 16, 2018 • By ITEP Staff

State policymakers, voters, and observers have been reflecting on this year’s campaigns and looking ahead to how the policy opportunities in their states have shifted as a result. For example, Arkansas’s governor sees a fresh chance to slash income taxes on the state’s wealthiest residents, while the governor-elect of Illinois will be doing just the opposite, launching into a promised effort to shore up the state’s budget by asking the wealthy to pay more. New York and Virginia residents may end up with buyers’ remorse after Amazon accepted their combined $2 billion tax subsidy offers for its HQ2 project. And…

Tuesday’s elections shook up statehouses, governors’ offices, and tax laws in many states, and in this week’s Rundown we bring you the top 3 election state tax policy stories to emerge. First, voters in Kansas and other states sent a message that regressive tax cuts and supply-side economics have not succeeded and are not welcome among their state fiscal policies. Meanwhile, residents of many other states, including most notably Illinois, voted for representatives who reflect their preference for equitable, sustainable policies to improve their state economies through smart public investments and improve the lives of all residents through progressive tax structures. Lastly, while some states missed…

Washington Post: In blow to liberal efforts, voters across the country reject tax increases. (California is the exception.)

November 7, 2018

North Carolina voters, for instance, approved a change to their state constitution bringing down the maximum allowable tax rate from 10 percent to 7 percent. That will effectively only spare the rich from higher taxes, because no tax increases in that neighborhood are on the table for the middle class, but the average voter may […]

State Rundown 10/31: Trick or Treat Advice to Savor for Tonight

October 31, 2018 • By ITEP Staff

Look out for potholes if you’re out trick-or-treating in Alabama tonight, where crumbling infrastructure figures to be a dominant debate in the coming legislative session. And be prepared to share the streets with disgruntled teachers if you‘re in Louisiana, where teachers are walking out to protest regressive tax policies that are sucking the lifeblood from the state’s schools. Meanwhile, Wisconsin residents are sharing scary stories of grotesquely large business tax subsidies and the “dark store” tax loophole they’ll be voting on next week. And you better expect the unexpected if you’re in Delaware, where Gov. John Carney shocked everyone by vetoing two broadly supported tax bills last week.

California Budget & Policy Center: Last Year’s Federal Tax Law Exacerbates the Racial Wealth Gap

October 29, 2018

Much has been written about how the Tax Cuts and Jobs Act (TCJA), pushed by Republican leaders in Congress and signed into law by President Trump in December 2017, mostly benefits wealthy households while driving up the federal deficit by $1.9 trillion over the next 10 years. This growing deficit — already 17% higher in the federal fiscal year that ended on September 30 than in the previous year — threatens federal funding for critical investments and services that provide economic security and opportunity for low- and middle-income households.

PolitiFact: Does Vermont Have the ‘Most Progressive’ Tax System in the Country?

October 29, 2018

Carl Davis, the research director for ITEP, said he doesn’t believe it would be accurate to call Vermont the most progressive state. California has a much higher top rate for the wealthiest taxpayers, he said. "In our research Vermont does not have the most progressive system in the nation, but it is certainly far less regressive than the vast majority of states," Davis said.

In this special edition of the Rundown we bring you a voters’ guide to help make sense of tax-related ballot questions that will go before voters in many states in November. Interests in Arizona, Florida, North Carolina, Oregon, and Washington state have placed process-related questions on those states’ ballots in attempts to make it even harder to raise revenue or improve progressivity of their state and/or local tax codes. In response to underfunded schools and teacher strikes around the nation, Colorado voters will have a chance to raise revenue for their schools and improve their upside-down tax system at the…

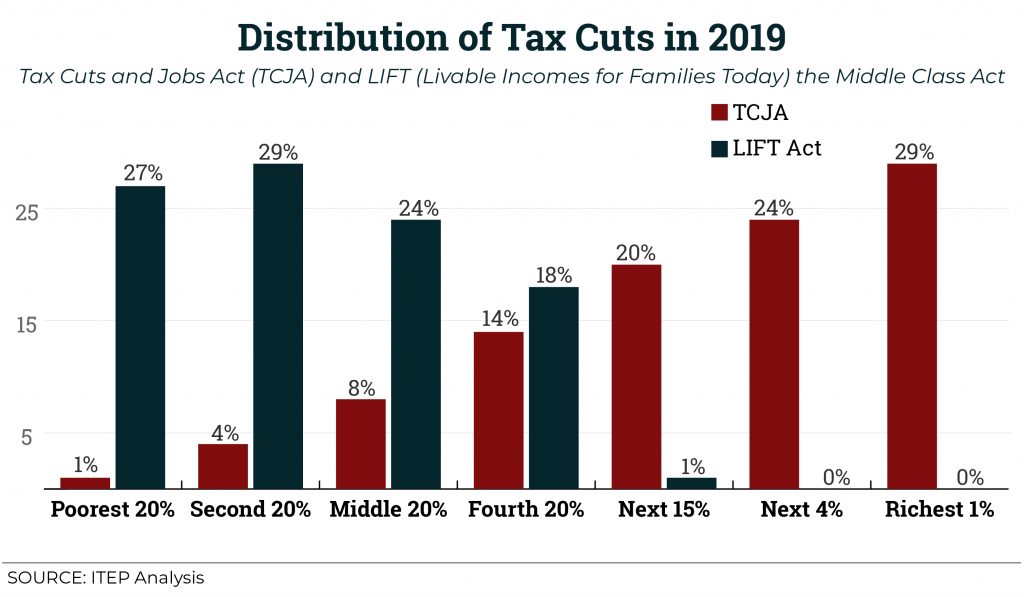

Shaking up TCJA: How a Proposed New Credit Could Shift Federal Tax Cuts from the Wealthy and Corporations to Working People

October 24, 2018 • By Aidan Davis

A new federal proposal, the Livable Incomes for Families Today (LIFT) the Middle Class Act, would create a new refundable tax credit for low- and middle-income working families who were little more than an afterthought in last year’s federal tax overhaul. This proposal would take the place of TCJA, providing tax cuts similar in cost to the recent federal tax law but targeted toward working people rather than the wealthy. ITEP analyzed the bill, proposed by California Senator Kamala Harris, and compared its potential impact to TCJA.

Policymakers and residents in all 50 states and the District of Columbia got new ITEP data this week on how their tax structures and decisions affect their high-, middle-, and low-income residents. As our “Who Pays?” report outlines, most state and local tax codes exacerbate economic inequalities and all states have room to improve. The data can serve as an important informative backdrop to all state and local tax policy debates, such as whether to change the valuation of commercial property in California, how to improve funding for early childhood education in Indiana, and how to evaluate tax-related ballot measures…

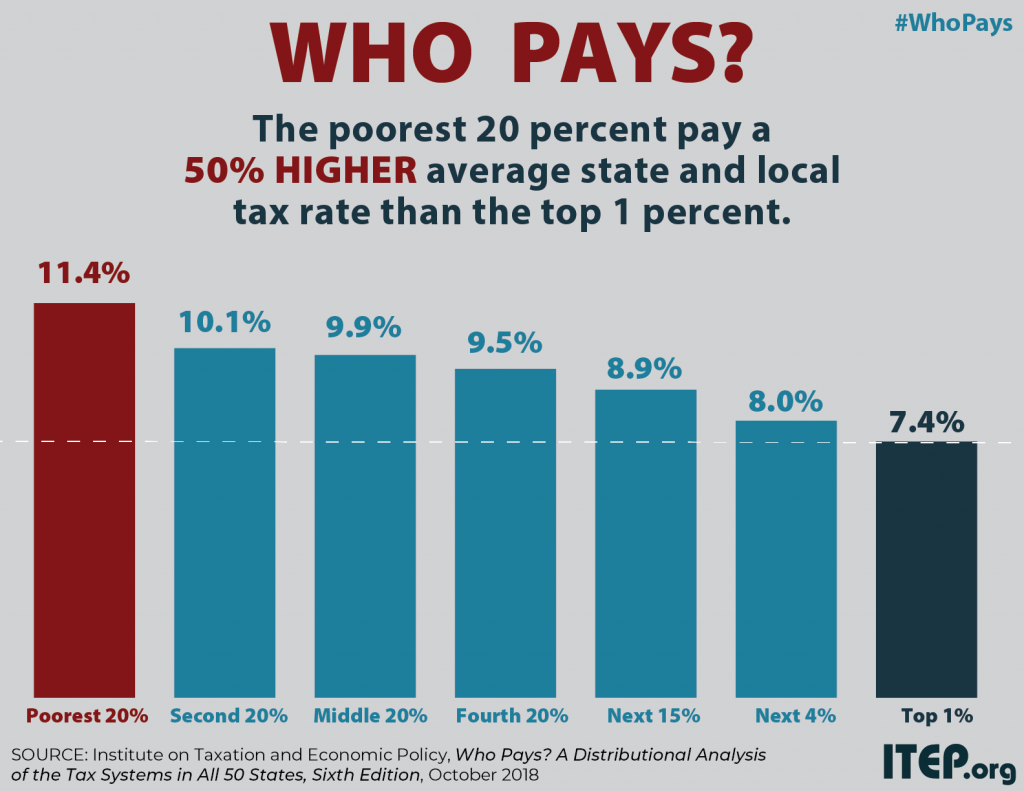

Poorest 20 Percent Pays a 50 Percent Higher Effective State and Local Tax Rate than the Top 1 Percent

October 17, 2018 • By ITEP Staff

A comprehensive 50-state study released today by the Institute on Taxation and Economic Policy (ITEP) finds that most state and local tax systems tax low- and middle-income households at significantly higher rates than wealthy taxpayers, with the lowest-income households paying an average of 50 percent more of their income in taxes than the very rich.

New Report Finds that Upside-down State and Local Tax Systems Persist, Contributing to Inequality in Most States

October 17, 2018 • By Aidan Davis

State and local tax systems in 45 states worsen income inequality by making incomes more unequal after taxes. The worst among these are identified in ITEP’s Terrible 10. Washington, Texas, Florida, South Dakota, Nevada, Tennessee, Pennsylvania, Illinois, Oklahoma, and Wyoming hold the dubious honor of having the most regressive state and local tax systems in the nation. These states ask far more of their lower- and middle-income residents than of their wealthiest taxpayers.

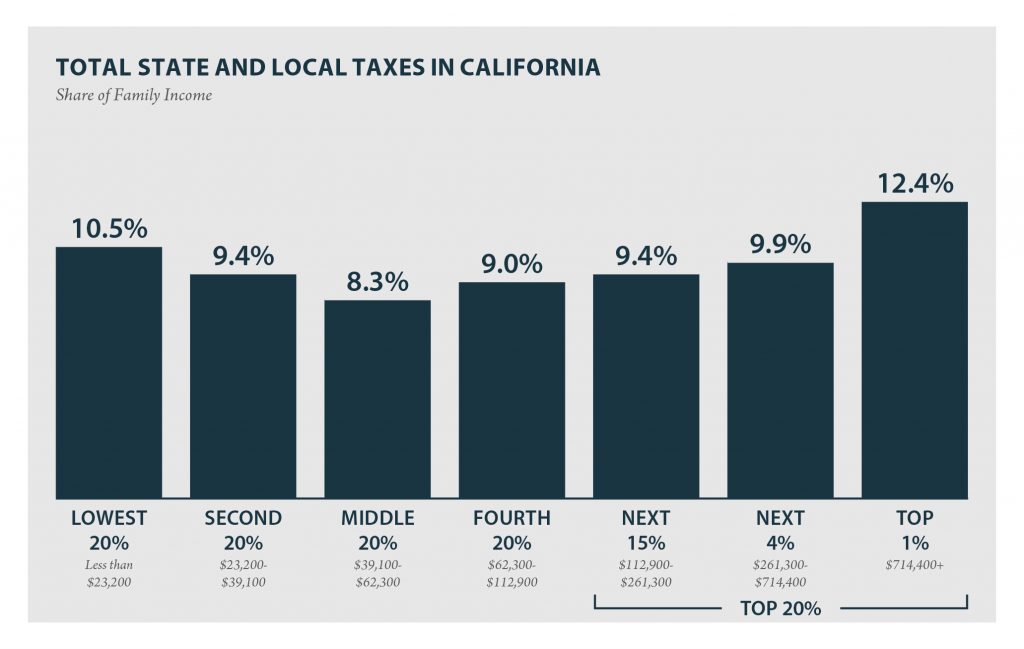

California: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

CALIFORNIA Read as PDF CALIFORNIA STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $23,200 $23,200 to $39,100 $39,100 to $62,300 $62,300 to $112,900 $112,900 to $261,300 $261,300 to $714,400 over $714,400 […]

State Rundown 10/12: Local Jurisdictions Fighting for Revenues, Independence

October 12, 2018 • By ITEP Staff

Voters all around the country are educating themselves for the upcoming elections, notably this week around ballot initiatives in Arizona and Colorado and competing gubernatorial tax proposals in Georgia and Illinois. But not all eyes are on the elections, as the relationship between state and local policy made news in Delaware, Idaho, North Dakota, and Ohio.

The Guardian: I’m Undocumented. It’s Time to Reveal What That Actually Means

October 12, 2018

Nationwide, the amount of taxes that the Internal Revenue Service collects from undocumented workers ranges from almost $2.2m in Montana, which has an estimated undocumented population of 4,000, to more than $3.1bn in California, which is home to more than 3 million undocumented immigrants. According to the non-partisan Institute on Taxation and Economic Policy, undocumented immigrants nationwide pay an estimated 8% of their incomes in state and local taxes on average. To put that in perspective, the top 1% of taxpayers pay an average nationwide effective tax rate of just 5.4%.

South Carolina lawmakers have finally passed a federal conformity bill in response to last year’s federal tax-cut legislation. Voters in many states are hearing a lot about tax-related questions they’ll see on the ballot in November, particularly residents of Florida, Montana, and Oregon, where corporate donors and other anti-tax interests are spending major sums to alter policy in their states. And states continue to work on ensuring they can collect online sales taxes and, in some states, online sports betting taxes.

Tax Cuts 2.0 – California

September 26, 2018 • By ITEP Staff

The $2 trillion 2017 Tax Cuts and Jobs Act (TCJA) includes several provisions set to expire at the end of 2025. Now, GOP leaders have introduced a bill informally called “Tax Cuts 2.0” or “Tax Reform 2.0,” which would make the temporary provisions permanent. And they falsely claim that making these provisions permanent will benefit […]

State Rundown 9/26: States Cleaning Up from Florence, Gearing Up for November

September 26, 2018 • By ITEP Staff

Affordable housing efforts made news in Minnesota and Virginia this week, as tax breaks for homeowners and other victims of Hurricane Florence were made available in multiple states. Meanwhile, New Jersey is still looking into legalizing and taxing cannabis, and Wyoming continues to consider a corporate income tax. And gubernatorial candidates and ballot initiative efforts will give voters in many states much to consider in the November elections.

NJ.com: Murphy Pushes Plan to Save Property Tax Breaks

September 26, 2018

Only residents of New York, Connecticut, and California deduct more from federal taxes than New Jerseyans, according the progressive Institute on Taxation and Economic Policy. Most of the states hit hardest send billions of dollars more to Washington than they get back in services. Read more

State Tax Codes Can Help Mitigate Poverty and Impact of Federal Tax Cuts on Low- and Middle-Income Families

September 20, 2018 • By Misha Hill

The national poverty rate declined by 0.4 percentage points to 12.3 percent in 2017. According to the U.S. Census, this was not a statistically significant change from the previous year. 39.7 million Americans, including 12.8 million children, lived in poverty in 2017. Median household income also increased for the third consecutive year, but this was […]

The Rundown is back after a few-week hiatus, with lots of state fiscal news and quality research to share! Maine lawmakers found agreement on a response to the federal tax-cut bill, states continue to sort out how they’ll collect online sales taxes in the wake of the Wayfair decision, and policymakers in several states have been working on summer tax studies and other preparations for 2019 legislative sessions. Meanwhile, work on ballot measures and candidate tax plans to go before voters in November has been even more active, particularly in Arizona, California, Florida, Hawaii, and Missouri. Our “What We’re Reading” section has lots of great research and reading on inequalities, cities turning…

State Tax Codes as Poverty Fighting Tools: 2018 Update on Four Key Policies in All 50 States

September 17, 2018 • By Aidan Davis, Misha Hill

This report presents a comprehensive overview of anti-poverty tax policies, surveys tax policy decisions made in the states in 2018, and offers recommendations that every state should consider to help families rise out of poverty. States can jumpstart their anti-poverty efforts by enacting one or more of four proven and effective tax strategies to reduce the share of taxes paid by low- and moderate-income families: state Earned Income Tax Credits, property tax circuit breakers, targeted low-income credits, and child-related tax credits.

Rewarding Work Through State Earned Income Tax Credits in 2018

September 17, 2018 • By ITEP Staff

The Earned Income Tax Credit (EITC) is a policy designed to bolster the earnings of low-wage workers and offset some of the taxes they pay, providing the opportunity for struggling families to step up and out of poverty toward meaningful economic security. The federal EITC has kept millions of Americans out of poverty since its enactment in the mid-1970s. Over the past several decades, the effectiveness of the EITC has been magnified as many states have enacted and later expanded their own credits. The effectiveness of the EITC as an anti-poverty policy can be increased by expanding the credit at…

Reducing the Cost of Child Care Through State Tax Codes in 2018

September 17, 2018 • By Aidan Davis

Families in poverty contribute over 30 percent of their income to child care compared to about 6 percent for families at or above 200 percent of poverty. Most families with children need one or more incomes to make ends meet which means child care expenses are an increasingly unavoidable and unaffordable expense. This policy brief examines state tax policy tools that can be used to make child care more affordable: a dependent care tax credit modeled after the federal program and a deduction for child care expenses.

Education Week: How a Proposed Tax Rule Could Hurt School Vouchers

September 11, 2018

Under the Tax Cuts and Jobs Act passed in 2017, wealthy residents in states such as New York and California face sizable increases in their federal tax bills because of a $10,000 cap on state and local tax deductions they can make on their federal returns. Democratic lawmakers allege the so-called SALT-cap unfairly targets left-leaning […]