California

Extending Temporary Provisions of the 2017 Trump Tax Law: Updated National and State-by-State Estimates

September 13, 2024 • By Steve Wamhoff

The TCJA Permanency Act would make permanent the provisions of the Tax Cuts and Jobs Act of 2017 that are set to expire at the end of 2025. The legislation would disproportionately benefit the richest Americans. Below are graphics for each state that show the effects of making TCJA permanent across income groups. See ITEP’s […]

State Earned Income Tax Credits Support Families and Workers in 2024

September 12, 2024 • By Neva Butkus

Nearly two-thirds of states (31 plus the District of Columbia and Puerto Rico) have an Earned Income Tax Credit. These credits boost low-paid workers’ incomes and offset some of the taxes they pay, helping lower-income families achieve greater economic security.

State Child Tax Credits Boosted Financial Security for Families and Children in 2024

September 12, 2024 • By Neva Butkus

Fifteen states plus the District of Columbia provide Child Tax Credits to reduce poverty, boost economic security, and invest in children. This year alone, lawmakers in three states – Colorado, New York, and Utah – expanded their Child Tax Credits while lawmakers in the District of Columbia created a new credit that will take effect in 2025.

State Rundown 9/5: Property Tax Policy Continues to Make Headlines

September 5, 2024 • By ITEP Staff

Property tax bills are undeniably a concern for many low- and moderate-income households across the nation...

The IRS has opened its free tax filing service called Direct File to every state for the 2025 tax filing season. Direct File was made possible by President Biden’s Inflation Reduction Act, which provided new resources for the IRS to improve customer service and ensure taxpayers claim the benefits and deductions for which they are […]

Steven Moore Sanchez

August 26, 2024 • By ITEP Staff

As Development Manager, Steven manages ITEP’s fundraising strategy and activities, helping to grow and sustain the organization. Prior to joining ITEP, Steven served as Development Coordinator at the National Low Income Housing Coalition, where he managed relations with donor partners and collaborated closely with senior staff on development activities. He previously worked as a Development […]

Many cities, counties, and townships across the country are in a difficult, or at least unstable, budgetary position. Localities are responding to these financial pressures in a variety of ways with some charging ahead with enacting innovative reforms like short-term rental and vacancy taxes, and others setting up local tax commissions to study the problem.

America’s Voice: Immigrants Contribute a Lot – Just Ask the Researchers

August 13, 2024

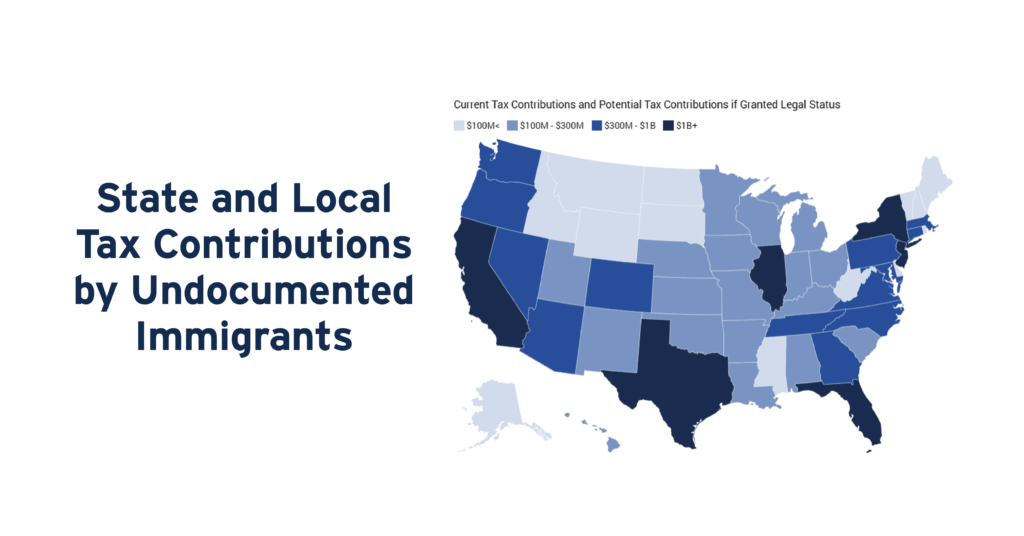

Recent research from the Institute on Taxation and Economic Policy (ITEP) reveals that undocumented immigrants contributed an astounding $96.7 billion in federal, state, and local taxes in 2022. Six of the most immigrant-populous states accounted for a combined $21.1 billion of these contributions, with California leading the way at $8.5 billion in tax revenue. The research further showed that these workers pay into programs that they’re barred from accessing, and in most areas pay higher state and local tax rates than their wealthiest neighbors.

Undocumented immigrants pay taxes that help fund public infrastructure, institutions, and services in every U.S. state. Nearly 39 percent of the total tax dollars paid by undocumented immigrants in 2022 ($37.3 billion) went to state and local governments.

McClatchy DC: Undocumented Immigrants in California Are Paying Billions in Taxes. Here’s How Much.

July 30, 2024

Amid pledges for mass deportations of undocumented immigrants by presidential candidate Donald Trump, a new study has highlighted the increasingly positive economic effects of this community. The report from the Institute on Taxation and Economic Policy, a Washington-based progressive research group, found undocumented immigrants nationwide paid an estimated $96.7 billion in taxes in 2022. About $37.3 billion was spent on state and local taxes, and the rest went to federal taxes.

Study: Undocumented Immigrants Contribute Nearly $100 Billion in Taxes a Year

July 30, 2024 • By ITEP Staff

Contact: Jon Whiten ([email protected]) Immigration policies have taken center stage in public debates this year, but much of the conversation has been driven by emotion, not data. A new in-depth study from the Institute on Taxation and Economic Policy aims to help change that by quantifying how much undocumented immigrants pay in taxes – both […]

Undocumented immigrants paid $96.7 billion in federal, state, and local taxes in 2022. Providing access to work authorization for undocumented immigrants would increase their tax contributions both because their wages would rise and because their rates of tax compliance would increase.

State Rundown 7/25: Summertime Hits Different in Different States

July 25, 2024 • By ITEP Staff

State lawmakers will have a lot to discuss when they compare notes on how they spent their summer vacations this year...

Improving Refundable Tax Credits by Making Them Immigrant-Inclusive

July 17, 2024 • By Emma Sifre, Marco Guzman

Undocumented immigrants who work and pay taxes but don't have a valid Social Security number for either themselves or their children are excluded from federal EITC and CTC benefits. Fortunately, several states have stepped in to ensure undocumented immigrants are not left behind by the gaps in the federal EITC and CTC. State lawmakers should continue to ensure that immigrants who are otherwise eligible for these tax credits receive them.

Tax the Wealthy and Reject Austerity for a More Just and Thriving Democracy

July 1, 2024 • By Amy Hanauer

Two of the last five presidents won office over the objection of the majority of the people; California, with 65 times more people, has the same voting power in the U.S Senate as Wyoming; and the U.S. Supreme Court just permitted South Carolina lawmakers to dilute Black votes in drawing districts. These obvious flaws undermine our claim to be a strong democracy. One less appreciated but similarly undemocratic trend is our extreme inequality that supercharges the power and wealth of corporations and the uber-rich, weakens what the public sector can deliver, and often feeds on itself.

New York Times: Newsom Uses Annual State Address to Confront Republicans Across the Nation

June 27, 2024

Gov. Gavin Newsom of California, whose liberal state has been hammered by Republicans for months as a hellscape of homelessness, crime and high taxes, used his annual State of the State address on Tuesday to slam “conservatives and delusional California bashers” and defend “the California way of life.”

State Rundown 6/26: Summer Special Sessions Are In, Anti-tax Ballot Initiatives Out

June 26, 2024 • By ITEP Staff

Many families are heading out on summer vacations, but legislators across the country are heading back to statehouses for special sessions...

Sacramento Bee: Governor Gavin Newsom Claims California Is Not a ‘High-Tax State.’ Is He Correct?

June 26, 2024

“Here’s the truth Republicans never tell you: California is not a high tax state,” Gov. Gavin Newsom declared Tuesday in his taped State of the State address.

States Should Enact, Expand Mansion Taxes to Advance Fairness and Shared Prosperity

June 26, 2024 • By Carl Davis, Erika Frankel

The report was produced in partnership with the Center on Budget and Policy Priorities and co-authored by CBPP’s Deputy Director of State Policy Research Samantha Waxman.[1] Click here to use our State Mansion Tax Estimator A historically large share of the nation’s wealth is concentrated in the hands of a few, a reality glaring in […]

This week, it was the best of times or, in some cases, the worst of times for tax policy in two different states...

Legislative sessions across the country are still very much in for summer, which means more pencils, more budgets, and more tax plans...

States Should Opt Into IRS Direct File as the Program is Made Permanent

May 30, 2024 • By Jon Whiten

While there is plenty of room to expand Direct File at the federal level, states can take matters into their own hands and bring this benefit to their residents by opting into the program.

Yahoo Finance: Jeff Bezos Spent $237 Million On Florida Mansions — Billionaires Flock To ‘Upside Down’ Tax Haven Where Rich Pay Less Than Poor

May 20, 2024

The Sunshine State has become a magnet for billionaires seeking tax relief. Among the latest to join the trend is Amazon founder Jeff Bezos, who has recently expanded his real estate holdings in Miami’s exclusive Billionaire Bunker area. Bezos’ acquisitions include three properties, bringing his total investment in the neighborhood to $237 million.

Forbes: California Is Not Actually a High-Tax State According To New Study

May 17, 2024

Depending on where you fall on the income scale, California may not actually be that high tax of a state. For many in the middle class and below, California may let you keep more of your hard-earned income than many other states, according to a new study, “Who Pays” from the Institute on Taxation and Economic Policy (ITEP). While California has the highest marginal tax rate in the nation at 13.3%, only some households pay this rate on their income. That doesn’t stop so-called low-tax states like Texas and Florida from blasting the tax policy of the Golden State.

There are a variety of factors that affect teacher pay. But one often overlooked factor is progressive tax policies that allow states to raise and provide the funding educators and their students deserve.