Education Tax Breaks

It’s a Fact: Voucher Tax Credits Offer Profits for Some “Donors”

August 9, 2017 • By Carl Davis

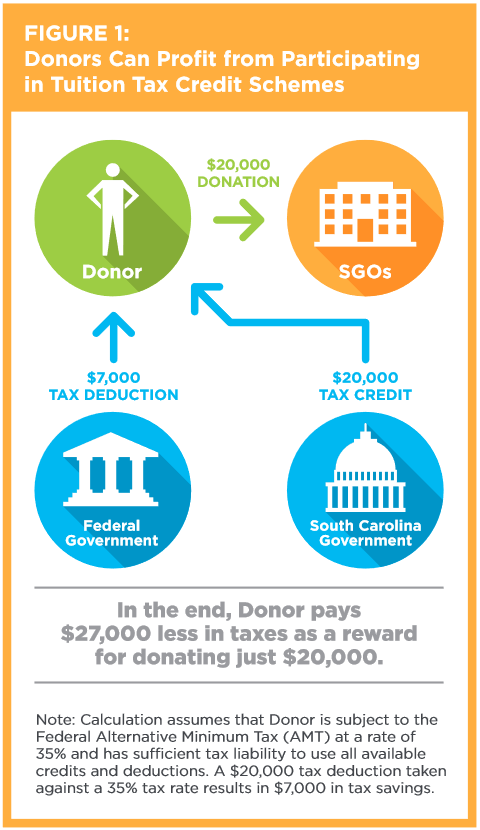

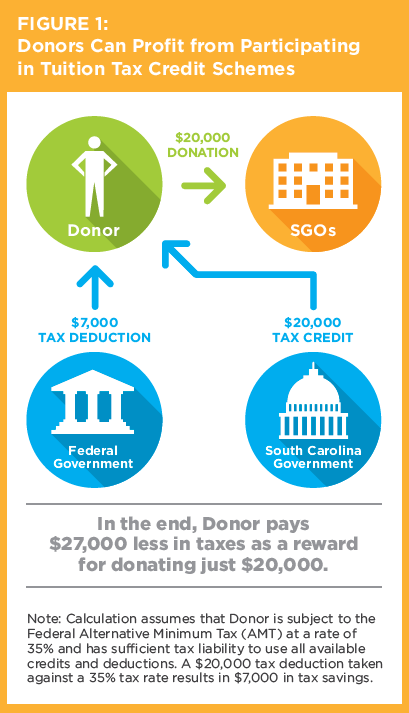

In nine states, tax rewards gained by donating to fund private K-12 vouchers are so oversized that “donors” can turn a profit. This is the shocking but true finding of a pair of studies released by ITEP over the last year.

Investors and Corporations Would Profit from a Federal Private School Voucher Tax Credit

May 17, 2017 • By Carl Davis

A new report by the Institute on Taxation and Economic Policy (ITEP) and AASA, the School Superintendents Association, details how tax subsidies that funnel money toward private schools are being used as profitable tax shelters by high-income taxpayers. By exploiting interactions between federal and state tax law, high-income taxpayers in nine states are currently able […]

Public Loss Private Gain: How School Voucher Tax Shelters Undermine Public Education

May 17, 2017 • By Carl Davis, Sasha Pudelski

One of the most important functions of government is to maintain a high-quality public education system. In many states, however, this objective is being undermined by tax policies that redirect public dollars for K-12 education toward private schools.

American Prospect: How States Turn K-12 Scholarships Into Money-Laundering Schemes

March 3, 2017

This article was originally published in The American Prospect. By Carl Davis Politicians have long had a knack for framing policy proposals, however controversial, in terms that make them more palatable to voters. This is why unpopular tax cuts for the wealthy are often sold as plans to “invest” in America or to stimulate “growth.” […]

This report explains the workings, and problems, with state-level tax subsidies for private K-12 education. It also discusses how the Internal Revenue Service (IRS) has exacerbated some of these problems by allowing taxpayers to claim federal charitable deductions even on private school contributions that were not truly charitable in nature. Finally, an appendix to this report provides additional detail on the specific K-12 private school tax subsidies made available by each state.

Higher Education Income Tax Deductions and Credits in the States

March 22, 2016 • By Carl Davis

Read full report in PDF Download detailed appendix with state-by-state information on deductions and credits (Excel) Every state levying a personal income tax offers at least one deduction or credit designed to defray the cost of higher education. In theory, these policies help families cope with rising tuition prices by incentivizing college savings or partially […]

The Institute on Taxation and Economic Policy (ITEP) has analyzed the proposed “Virginia Children’s Educational Opportunity Act 2000” (H.B. 68 and S.B. 336), to measure the effects of the bill’s proposed tuition subsidies on Virginia families with children by income group. H.B. 68 and S.B. 336 would provide Virginia parents with children in kindergarten though […]

Education tax credits are an emerging area of research for ITEP. In 2016, ITEP released a noteworthy report that examined how states are subverting public will and, in some cases, their state constitutions by funneling public money to private and parochial schools via controversial and generous tax credits. A surprising finding was that in at least nine states, these tax credits are so incredibly generous that upper-income taxpayers can turn a profit. Because public, taxpayer dollars remain critical for high quality public education, ITEP continues to explore the effect education tax credits are having on state budgets and public school funding.