On the Map - Cannabis Taxes

5 posts

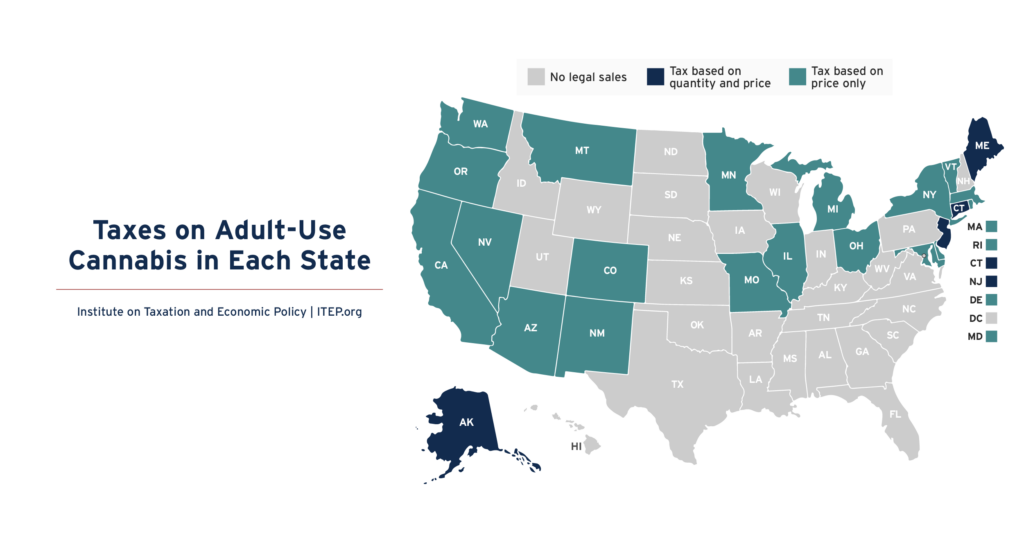

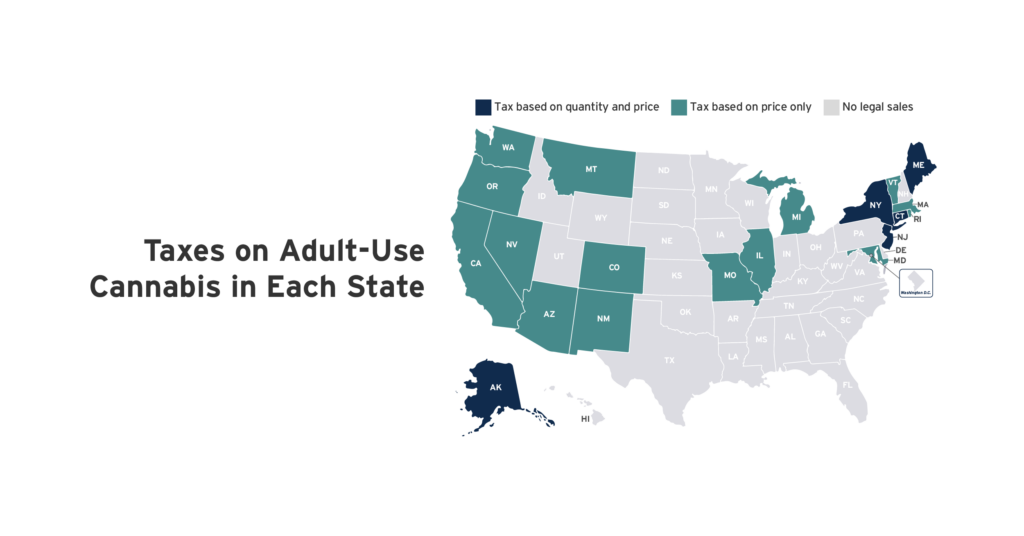

Twenty-three states have legalized the sale of cannabis for general adult use. Every state allowing legal sales applies an excise tax to cannabis based on the product’s quantity, its price, or both. Quantity taxes can be based on either overall product weight or the amount of THC sold. ITEP research indicates that taxes based on […]

How is Adult-Use Cannabis Taxed by Your Local Government?

April 19, 2023 • By Carl Davis, Eli Byerly-Duke

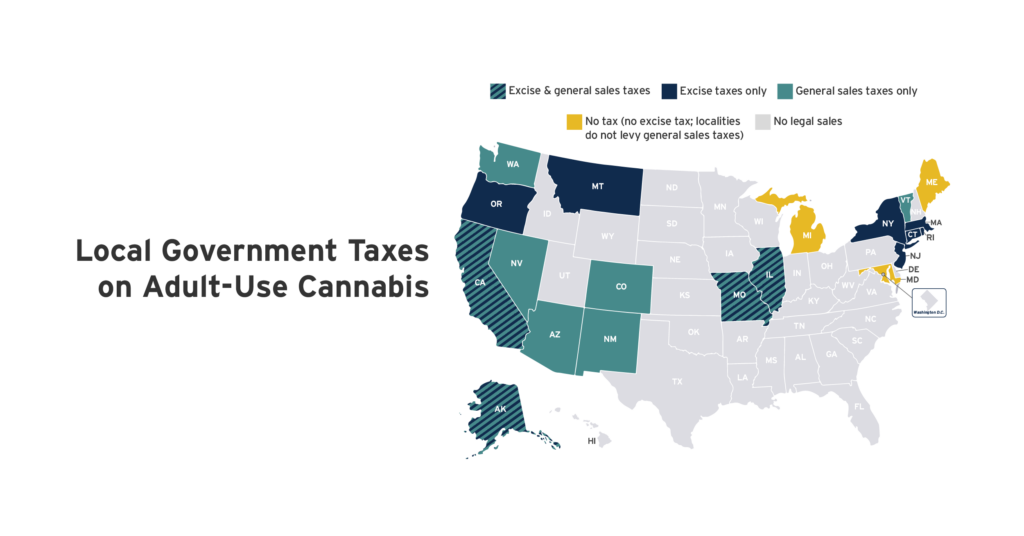

Twenty states have legalized the sale of cannabis for general adult use. Cannabis taxes vary considerably depending on local authority. Some states allow local governments to levy standalone excise taxes applying narrowly to cannabis purchases. Most local excise taxes on cannabis are levied in states that do not permit local governments to levy general sales taxes.

Twenty states have legalized cannabis sales for general adult use. Every state allowing legal sales applies a cannabis tax based on the product’s quantity, its price, or both. ITEP research indicates that taxes based on quantity will be more sustainable over time because prices are widely expected to fall as the cannabis industry matures.

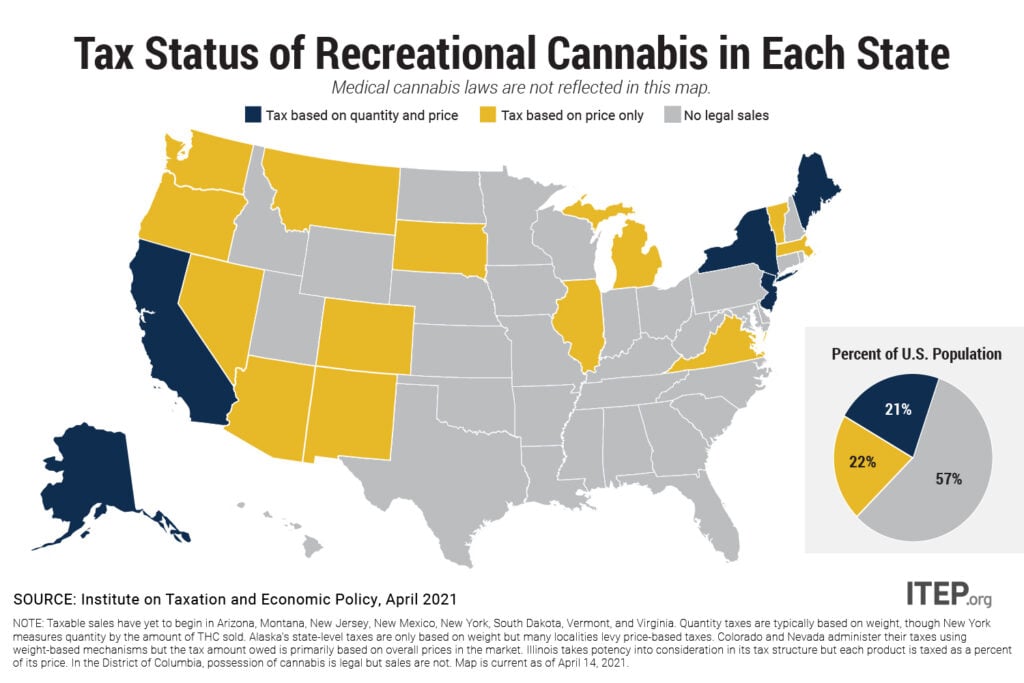

Eighteen states have legalized the sale of cannabis for general adult use and sales are already underway in 10 of those states. Every state allowing legal sales applies an excise tax to cannabis based on the product’s quantity, its price, or both. Quantity taxes are typically based on weight, though New York measures quantity by the amount of THC sold. ITEP research indicates that taxes based on quantity will be more sustainable over time because prices are widely expected to fall as the cannabis industry matures. Most states allowing for legal cannabis sales apply their general sales taxes to the…

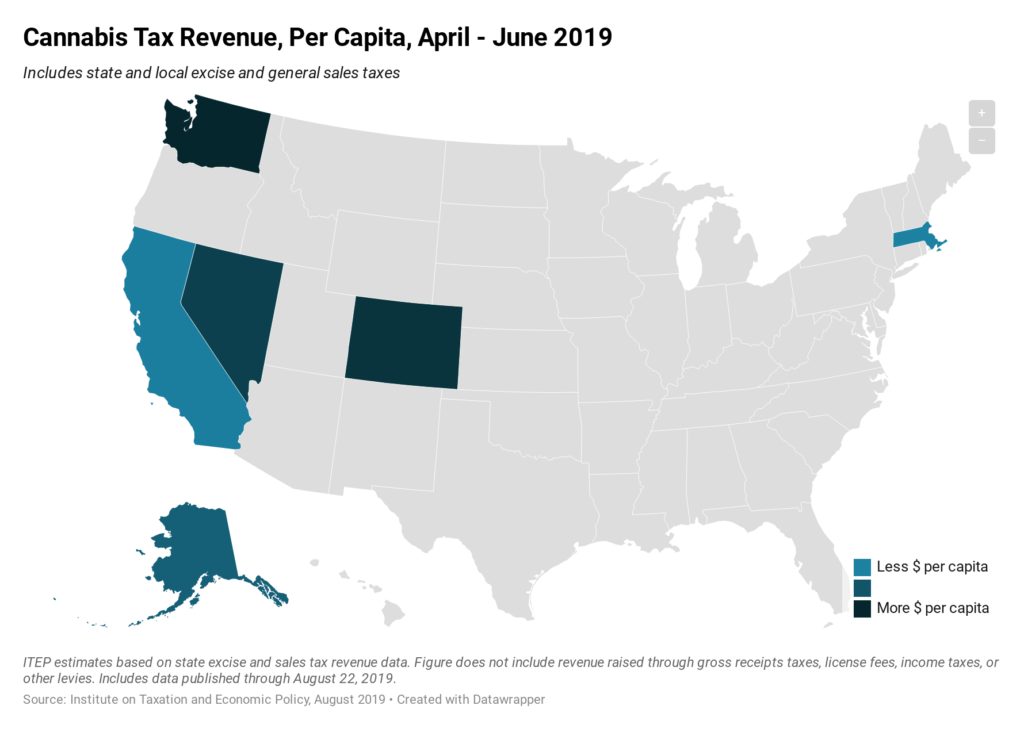

Seven states currently allow for the legal, taxable sale of recreational cannabis. The above map shows per capita revenue collections from excise and sales taxes on cannabis during the second quarter of 2019, the most recent period for which data are available in every state. The most lucrative cannabis market in the country, from a tax revenue perspective, is in Washington State where the 46 percent combined tax rate applied to cannabis is the highest in the country. Collections in California and Massachusetts, by contrast, remain low as these states are still in the early stages of establishing their legal…