On the Map - Reports

4 posts

State Child Tax Credits and Child Poverty: A 50-State Analysis

November 16, 2022 • By Aidan Davis

Regardless of future Child Tax Credit developments at the federal level, state policies can supplement the federal credit to deliver additional benefits to children and families. State credits can be specifically tailored to meet the needs of local populations while also producing long-term benefits for society as a whole

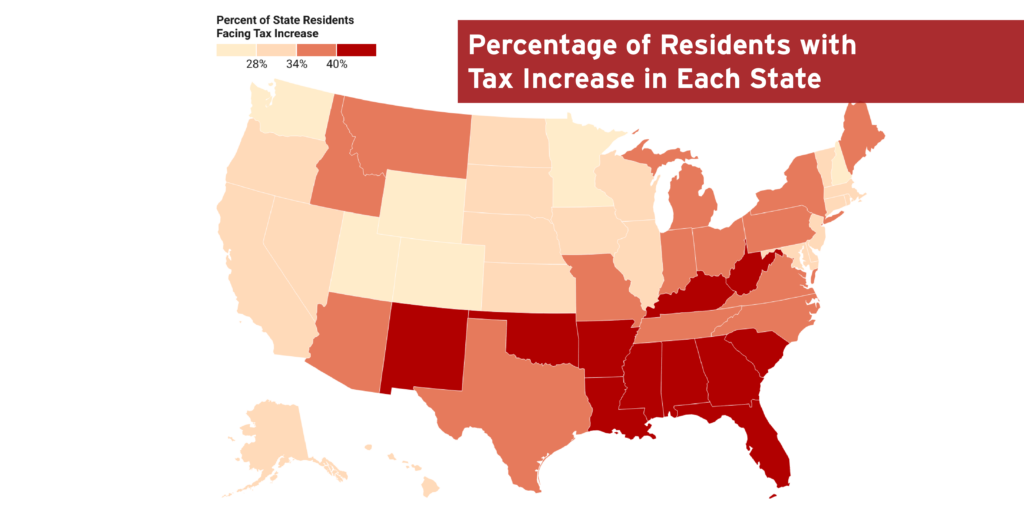

State-by-State Estimates of Sen. Rick Scott’s “Skin in the Game” Proposal

March 7, 2022 • By Steve Wamhoff

A proposal from Sen. Rick Scott would increase taxes for more than 35% of Americans, with the poorest fifth of Americans paying 34% of the tax increase.

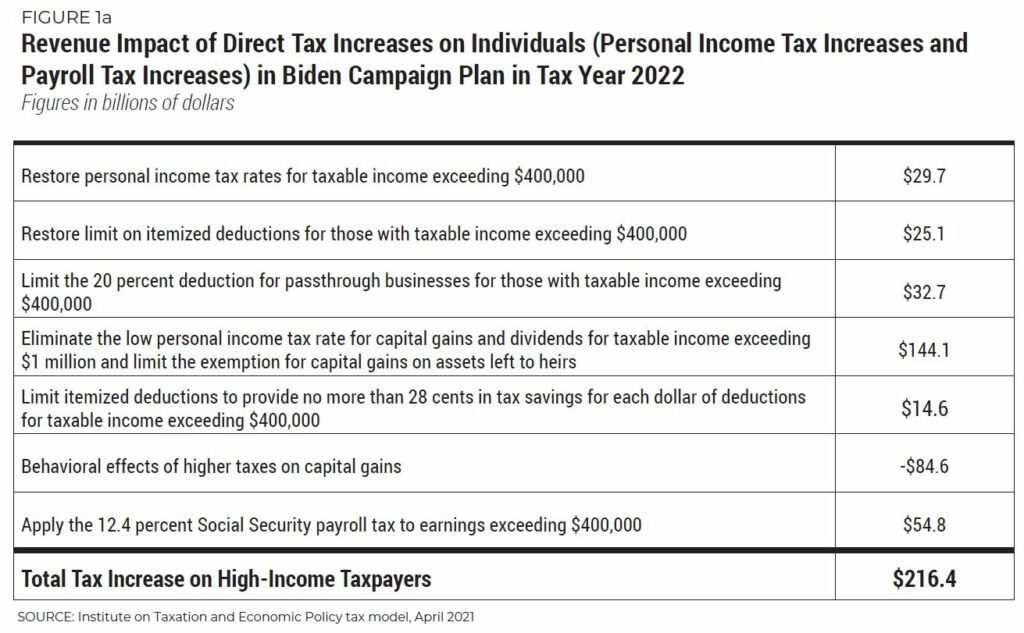

National and State-by-State Estimates of President Biden’s Campaign Proposals for Revenue

April 8, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

During his presidential campaign, Joe Biden proposed to change the tax code to raise revenue directly from households with income exceeding $400,000. More precisely, Biden proposed to raise personal income taxes on unmarried individuals and married couples with taxable income exceeding $400,000, and he also proposed to raise payroll taxes on individual workers with earnings exceeding $400,000. Just 2 percent of taxpayers would see a direct tax hike (an increase in either personal income taxes, payroll taxes, or both) if Biden’s campaign proposals were in effect in 2022. The share of taxpayers affected in each state would vary from a…

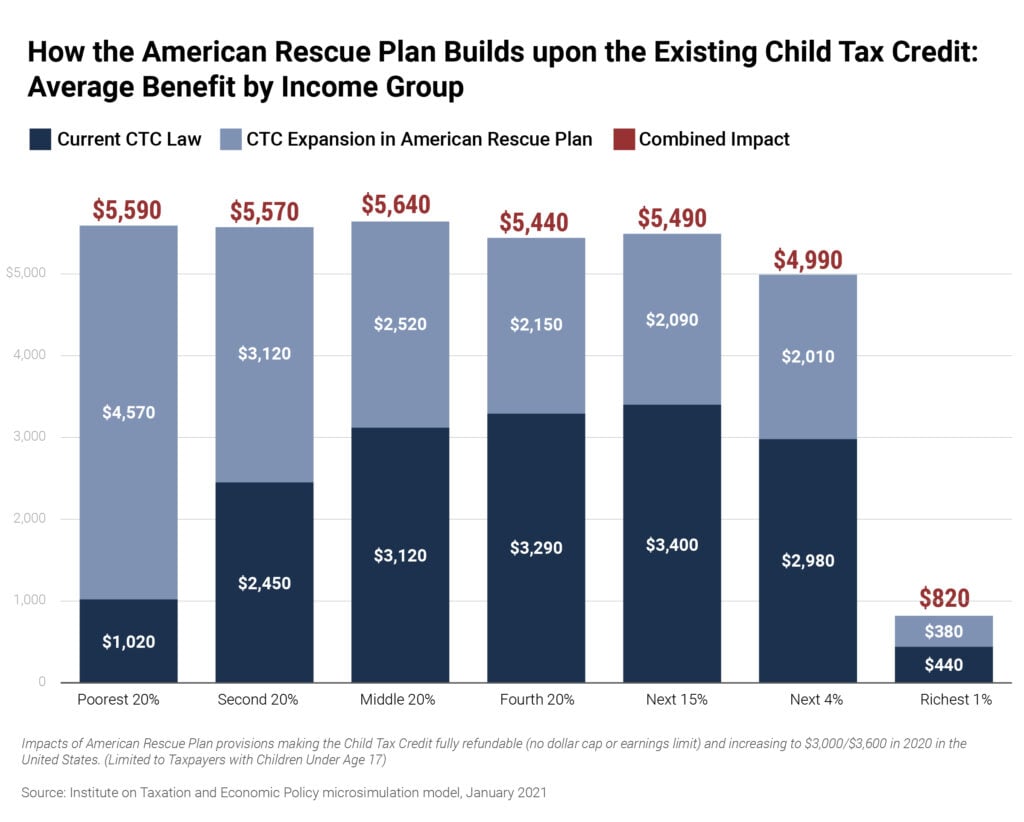

Child Tax Credit Enhancements Under the American Rescue Plan

January 26, 2021 • By Aidan Davis, Jessica Schieder

President Joe Biden’s coronavirus relief package, the American Rescue Plan, includes a significant expansion of the Child Tax Credit (CTC). The president’s proposal provides a $125 billion boost in funding for the program, which would essentially double the size of the existing federal credit for households with children. Combined with existing law, the CTC provisions in Biden's plan would provide a 37.4 percent income boost to the poorest 20 percent of families with children who make $21,300 or less a year.