On the Map - Tax Credits for Workers and Families

5 posts

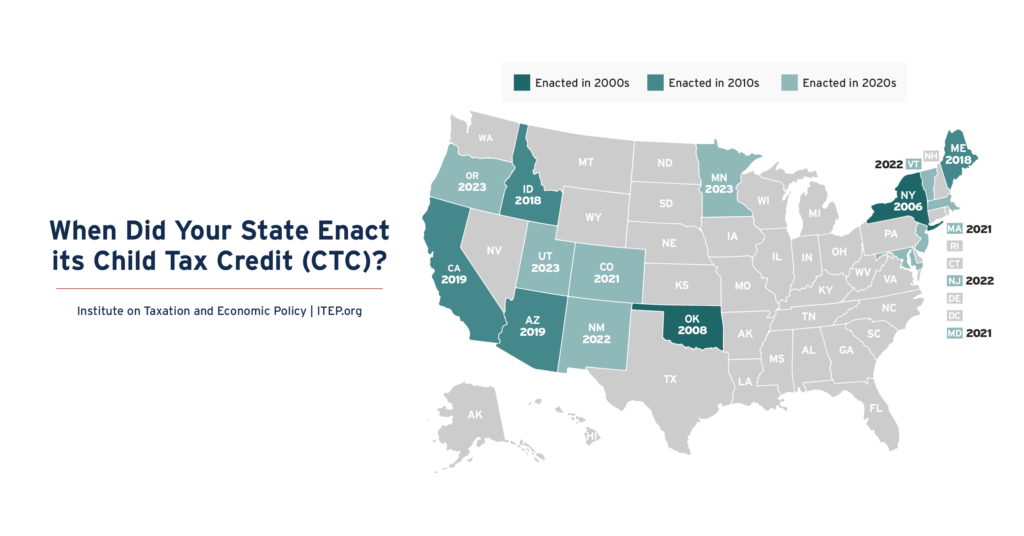

The Child Tax Credit (CTC) is an important tool to fight child poverty and help families make ends meet. When designed well, it can also make tax systems less regressive. As of 2020, only six states had CTCs. Today, 15 states have CTCs, with many credits exceeding $1,000 per qualifying child.

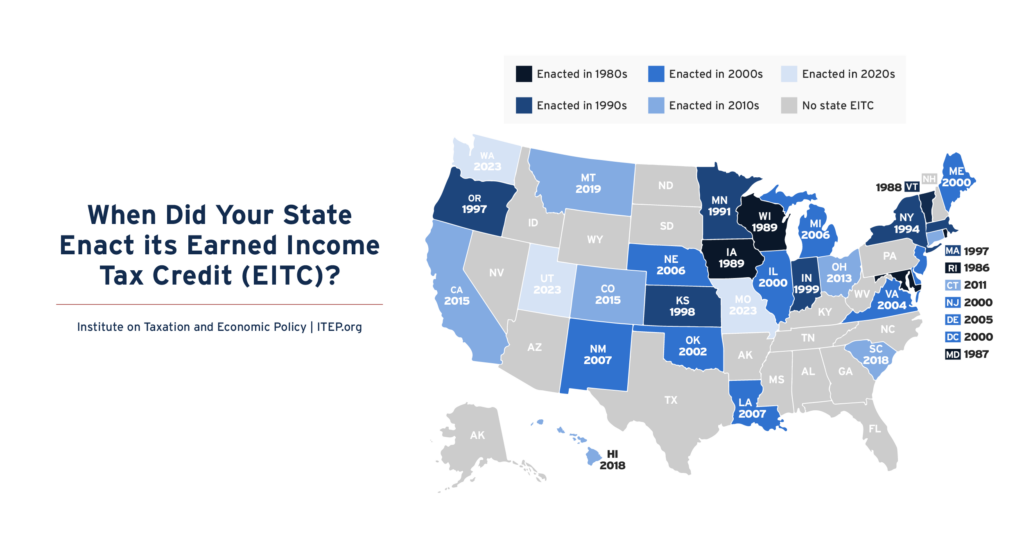

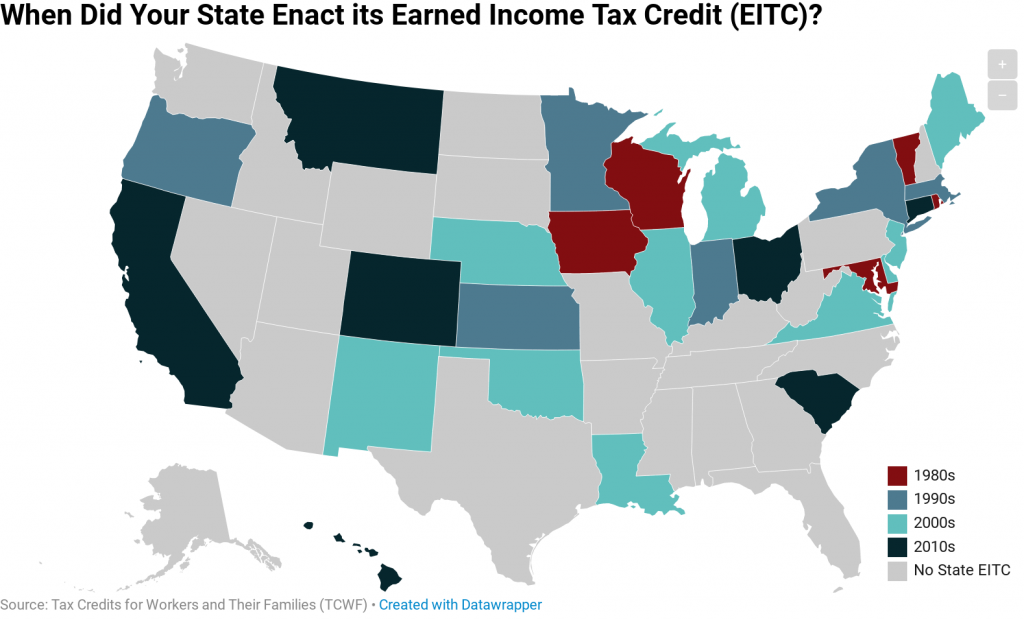

The Earned Income Tax Credit (EITC) supports millions of workers and families and continues to grow in states and localities across the country. Today, 31 states plus the District of Columbia and Puerto Rico offer EITCs. Local EITCs can also now be found in Montgomery County, Maryland, New York City, and San Francisco, where they benefited 700,000 households in 2023.

This week, we celebrate 50 years of the federal Earned Income Tax Credit (EITC) and the impact it's had on millions of workers and families. In 2023 alone, the latest year of available data, the federal EITC alongside the refundable portion of the Child Tax Credit lifted 6.4 million people and 3.4 million children out of poverty.

State Child Tax Credits and Child Poverty: A 50-State Analysis

November 16, 2022 • By Aidan Davis

Regardless of future Child Tax Credit developments at the federal level, state policies can supplement the federal credit to deliver additional benefits to children and families. State credits can be specifically tailored to meet the needs of local populations while also producing long-term benefits for society as a whole

In 1986, Rhode Island became the first state to enact a tax credit patterned after the federal Earned Income Tax Credit (EITC). Since then, EITCs have become increasingly widespread at the state level with 28 states and the District of Columbia now offering them. These credits are designed to improve family economic security by bolstering […]