News Releases

More of the Same: Tax Cuts 2.0 Will Benefit the Rich

September 10, 2018 • By Alan Essig

Media Contact Following is a statement from Alan Essig, executive director of the Institute on Taxation and Economic Policy, regarding the tax bill introduced today by House GOP leadership. “Once again, lawmakers are attempting to force tax cuts that primarily benefit the wealthy on an unwilling public. Nearly nine months after the tax law passed, […]

Proposed IRS Regulations Would End SALT Workarounds and Rightly Tamp Down on School Voucher Tax Shelters

August 23, 2018 • By Carl Davis

The main difference between states that recently passed SALT workaround legislation and states that provide overly generous credits for donations to private schools are their political leanings. Private school supporters were hoping for a special carve out that would allow their tax shelter to remain intact, but the IRS was correct not to pick winners and losers.

House Republicans’ Not-So-New Tax Plan: Crumbs for Working People 2.0

July 24, 2018 • By ITEP Staff

Media Contact Rep. Kevin Brady, the top tax-writer in the House of Representatives, today called on his colleagues to make permanent the temporary provisions that were enacted as part of the Tax Cuts and Jobs Act (TCJA). These provisions, which will otherwise expire at the end of 2025, mostly benefit the richest households. As illustrated […]

The lack of investment in public school systems is a problem in jurisdictions throughout the country. So, at this time of year when many states across the country are temporarily suspending sales taxes to provide a break to taxpayers who have to purchase back-to-school supplies, it’s worth examining whether this is the most effective use of resources.

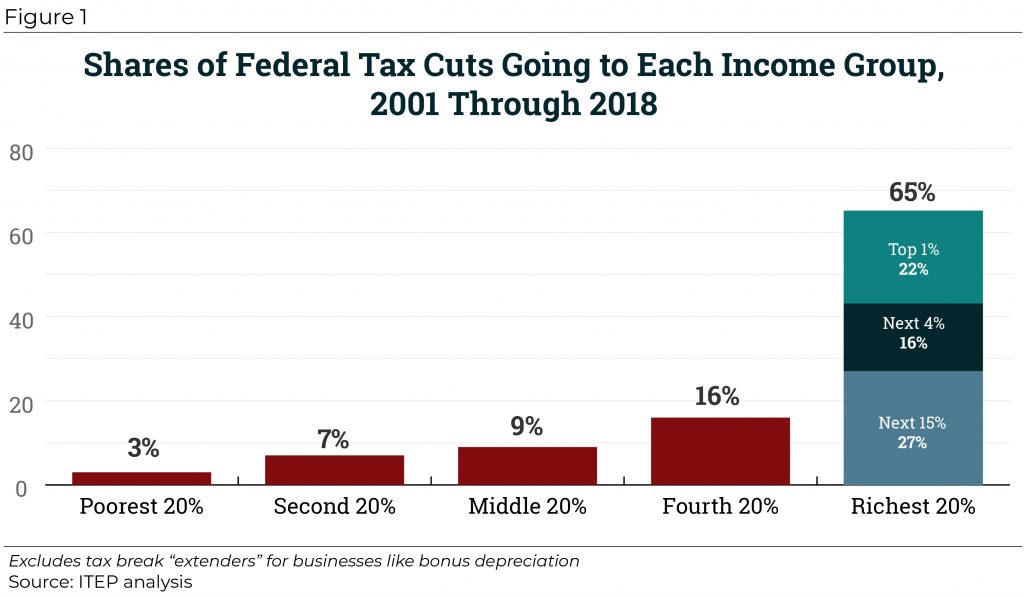

65 Percent of Federal Tax Cuts Since 2000 Have Gone to Richest 20 Percent

July 11, 2018 • By ITEP Staff

Since 2000, Congress has passed several rounds of tax cuts that have increased the federal deficit by nearly $6 trillion and disproportionately benefited the top 20 percent of households, which received nearly two-thirds (65 percent) of the value of all tax changes.

New Report Highlights Growing Tax Breaks for Wealthy Real Estate Investors Like Donald Trump

July 5, 2018 • By Steve Wamhoff

Following is a statement by Steve Wamhoff, the director of federal tax policy at the Institute on Taxation and Economic Policy, regarding the report released today by Democrats on the House Oversight and Government Reform Committee addressing tax breaks for real estate developers in the new tax law. “The conclusion of this report should surprise […]

South Dakota v. Wayfair Decision Brings Overdue Fairness to Retail Sales Tax

June 21, 2018 • By Carl Davis

Following is a statement by Carl Davis, research director at the Institute on Taxation and Economic Policy, regarding the Supreme Court’s decision in South Dakota v. Wayfair. Mr. Davis has authored numerous policy briefs regarding how online retailers that fail to collect sales taxes deprive states of necessary sales tax revenue and maintain an unfair advantage over bricks and mortar retailers.

State Efforts to Shield Taxpayers From SALT Cap Expose Deeper Flaws with Tax Incentives for Charitable Contributions

May 23, 2018 • By Carl Davis

Long before the tax law passed, some states abused the idea of charitable giving to funnel public money to various activities, such as private K-12 education, by reimbursing up to 100 percent of their taxpayers’ donations with tax credits. The flimsy, hastily-written SALT deduction cap enacted last year made this type of gaming even easier than before, and it was entirely predictable that states would respond by enacting more tax credits of this type.

Millionaires Average Annual Tax Cut in North Carolina Is Comparable to Average Teacher’s Salary

May 11, 2018 • By Meg Wiehe

North Carolina lawmakers' misplaced priorities are evident: The recent rounds of tax cuts will provide the state’s millionaires with an average annual tax break of more than $45,000, which is nearly as much as the average teacher’s annual salary of about $50,000.

Arizona and Other Teachers’ Strikes are Directly Connected to Tax-Cutting Fervor

April 24, 2018 • By ITEP Staff

Following is a statement by Meg Wiehe, deputy director of the Institute on Taxation and Economic Policy, regarding the pending teachers’ strike in Arizona. “The Arizona teachers’ strike, like other recent strikes and walkouts before it, is as much a state fiscal policy story as it is an education story. Year after year, lawmakers in […]

Two recent Congressional Budget Office reports underscore why the nation needs progressive tax policies. The first, published in March, demonstrates that tax and other public policies have a measurable effect on income disparity. According to CBO data, tax policies (think Earned Income Tax Credit and Child Tax Credit) and means-tested programs (Children’s Health Insurance Program, Medicaid, food assistance, etc.) have helped alleviate growing income inequality. The second CBO report, released this week, reveals that the national debt will soar to untenable levels in the coming years due in part to the recent Trump-GOP tax cuts.

Same Old Same: 50-State Analysis Finds Extending the New Tax Law’s Temporary Provisions Would Mainly Benefit the Wealthy

April 10, 2018 • By ITEP Staff

While rhetoric may bill this tax law and proposed extension as a middle-class tax cut, the data tell the real story: the Trump-GOP tax law was and remains a giveaway to corporations and the wealthy.

Amazon Maintains Sales Tax Advantage over Local Businesses

March 26, 2018 • By ITEP Staff

This report concludes that lack of consistent sales tax collection is contributing to an unlevel playing field for local businesses “because millions of shoppers are able to pay less tax if they choose to buy from out-of-state companies over the Internet rather than at local stores.” It recommends that states explore reforms to bring their sales tax policies into the digital age.

Two Months after Top-Heavy Tax Cuts, Trump Budget Proposes “Savings” by Making Cuts to Safety Net Programs

February 12, 2018 • By Alan Essig

“In case it was not apparent after the White House pushed for a tax plan that overwhelmingly benefits corporations and the rich, the White House budget proposal is clear on what and whom it prioritizes: wealth over work, corporate interest before the public good.”

Congress Snubs the Will of the People, Appeases Wealthy Donors

December 19, 2017 • By Alan Essig

The 2010 Citizens United decision shoved open already leaky floodgates that have allowed the well-heeled to dictate our nation’s electoral outcomes and public policies. Lawmakers have been clear that their ‘donors’ and ‘corporate CEOs’ are the driving force behind this tax overhaul, and they have been content to ignore opinion polling that indicates the public is against this legislation by a margin of 2-to-1.

ITEP 50-State Distributional Analysis of Final House-Senate Tax Bill

December 17, 2017 • By ITEP Staff

Like the initial House and Senate tax bills, the final tax legislation reserves the greatest share of the benefit for the wealthy and foreign investors and would hike taxes for average taxpayers in the lowest-earning three-fifths of households.

Corporations and the Rich Get Everything They Want in Pending Tax Bill, Working People, Not So Much

December 15, 2017 • By Alan Essig

Nearly 30 years ago, Trump was well connected enough that he was able to go to Congress and testify about how tax changes affected his business. Ordinary working people are rarely lucky enough to talk about their personal experiences in front of a congressional committee. So if they want to make their views known about the catastrophe of 2017, it will have to be in election of 2018.

What voters want—the people who put elected officials in office—matters. Members of Congress should take pause before proceeding with their profoundly unpopular tax bill that the vast majority of voters have said lawmakers should not pass.

Senate Okays Unpopular Plan to Widen Income Inequality, Make the Rich Richer

December 2, 2017 • By Alan Essig

But so far, Republican leaders have demonstrated that, for them, the only voices that matter in this debate are those that fund their campaigns.

New 50-State Analysis: Senate Tax Plan Would Increase Taxes on at Least 29 Percent by 2027

November 18, 2017 • By ITEP Staff

Poorest 20 percent would receive the biggest tax hike A 50-state analysis of the tax plan that passed the Senate Finance Committee finds that the bottom 60 percent of households overall would face a tax hike in the later years of the plan, while the richest 1 percent, corporations, and foreign investors would continue to […]

House Passes Tax Cuts for the Rich and Corporations as a False Cure for Working People’s Economic Anxiety

November 16, 2017 • By ITEP Staff

For months, Speaker Paul Ryan has cited working people’s “economic anxiety” as a reason to push through tax reform. While the speaker has correctly diagnosed a defining social issue of our time, he and other Republican leaders continue to focus on a top-down remedy that will only make this problem worse.

Senate Tax Plan Is a Conflagration That Attempts to Address Ideological Grievances

November 15, 2017 • By ITEP Staff

There are a few things that have been clear since this tax bill’s inception. It was never a plan to help the middle class. Now, the legislation being considered before the Senate Finance Committee is no longer a tax bill. It is an ACA repeal bill.

Senate Tax Plan Reserves Greatest Benefit for Richest Americans, Millions Face an Increase

November 13, 2017 • By ITEP Staff

A 50-state analysis of the Senate tax proposal finds that not only would greatest share of benefits go to the richest Americans, but also more than one in 10 taxpayers would face a tax hike, with a large number of those taxpayers residing in states where residents pay higher state and local taxes.

Senate Tax Plan Includes Some Changes but Maintains Focus on Tax Cuts for the Rich

November 9, 2017 • By Alan Essig

Following is a statement by Alan Essig, executive director of the Institute on Taxation and Economic Policy, regarding the Senate tax plan released today. While it will take a complete analysis to determine how each income group is affected by the Senate’s proposal, an initial overview of the plan leads ITEP’s analysts to conclude that […]

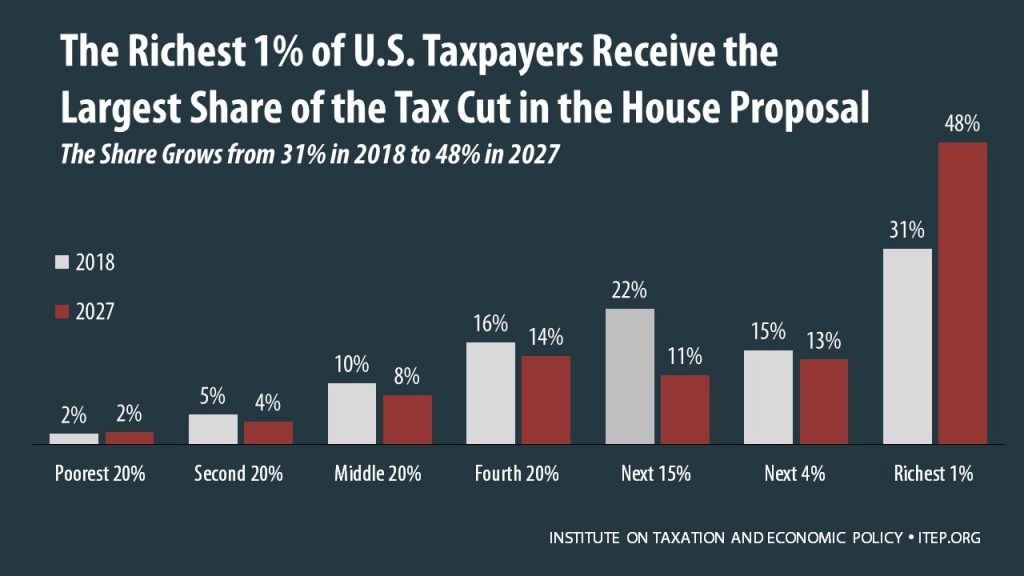

New Analysis: Wealthy Will Receive a Growing Share of Tax Cuts in House Tax Plan Over Time

November 6, 2017 • By Alan Essig

A national and 50-state distributional analysis of the House tax plan released late last week reveals that not only would the wealthiest 1 percent receive the greatest share of the total tax cut in year one, but their share would grow over time due to phase-ins of tax cuts that mostly benefit the rich and the eventual elimination or erosion in value of provisions that benefit low- and middle-income taxpayers.