State Corporate Taxes

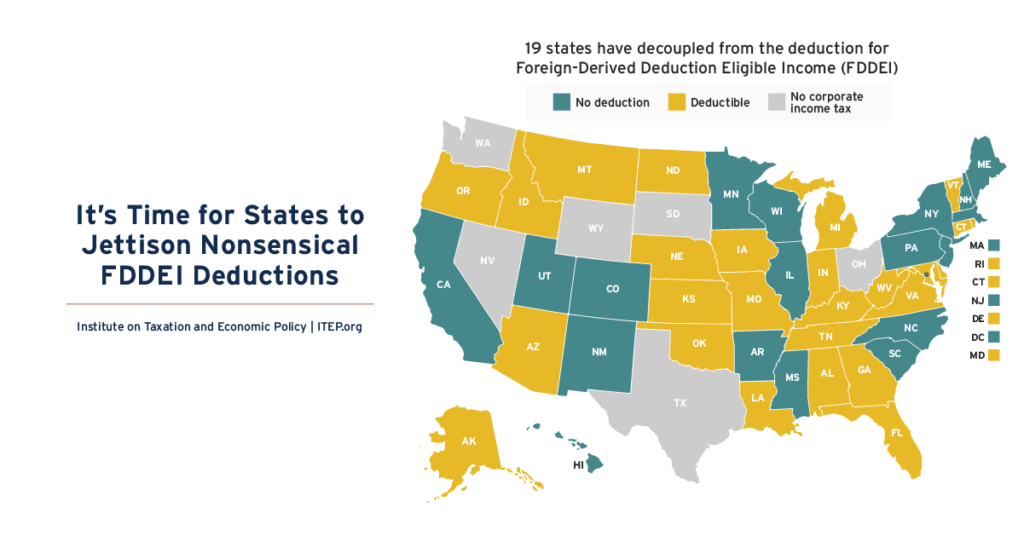

It’s Time for States to Jettison Nonsensical FDDEI Deductions

February 19, 2026 • By Carl Davis

States often link their tax laws to the federal code in significant ways. Many of these links are justified and can simplify tax administration for both taxpayers and state officials. But in other cases, something can get lost in translation, and states end up copying federal provisions that just don’t make sense at the state […]

Michigan Ballot Proposal Would Boost Public Education While Creating a Fairer Tax System

February 17, 2026 • By Miles Trinidad, Matthew Gardner

A new proposal in Michigan would create a 5-percentage point surcharge on top earners with taxable incomes over $1 million for joint filers and $500,000 for single filers. This would raise about $1.7 billion a year, which would be used for public education priorities.

State Tax Watch 2026

February 2, 2026 • By ITEP Staff

ITEP tracks tax discussions in legislatures across the country and uses our unique data capacity to analyze the revenue, distributional, and racial and ethnic impacts of many of these proposals. State Tax Watch offers the latest news and movement from each state.

An Anti-Affordability Agenda: Trump’s Advisors Call on States to Raise Taxes on the Working Class and Drastically Cut Taxes for the Rich

January 29, 2026 • By Carl Davis

The Trump administration’s Council of Economic Advisors suggests that states consider drastically raising sales taxes and using those new revenues to pay for repealing taxes on corporate and personal income. Working-class families would face dramatic tax increases while the nation’s wealthiest families would see their state tax bills plummet.

Historical State Tax Rate Data

January 14, 2026 • By ITEP Staff

Download the Data Overview This historical dataset of state tax rates includes data on top personal income tax rates, top corporate income tax rates, and sales tax rates for all 50 states and the District of Columbia, back to the adoption of modern forms of state taxation at the start of the 20th century. The […]

Show Me Where We’re Going: Missouri’s Fiscally Irresponsible Path Will Be Paid for by Everyday People

January 8, 2026 • By Logan Liguore

Missouri lawmakers have been pushing regressive and shortsighted tax policies that undermine everyday workers and sabotage the Show-Me State’s ability to raise revenue.

Advantaging Affluence: A Distributional Analysis of Missouri HB 798’s Uneven Tax Cuts for Wealth and Work

March 28, 2025 • By Aidan Davis, Carl Davis, Dylan Grundman O'Neill, Eli Byerly-Duke, Matthew Gardner

Missouri House Bill 798 would reduce personal and corporate income tax rates, fully eliminate taxes on capital gains income from sale of assets, and eliminates the state’s modest Earned Income Tax Credit that assists many working people in lower-paid jobs. HB 798 would radically transform Missouri’s income tax code into a system that privileges income from wealth over income from work, leaving many middle-income families to pay a higher income tax rate than wealthy people living off their investments.

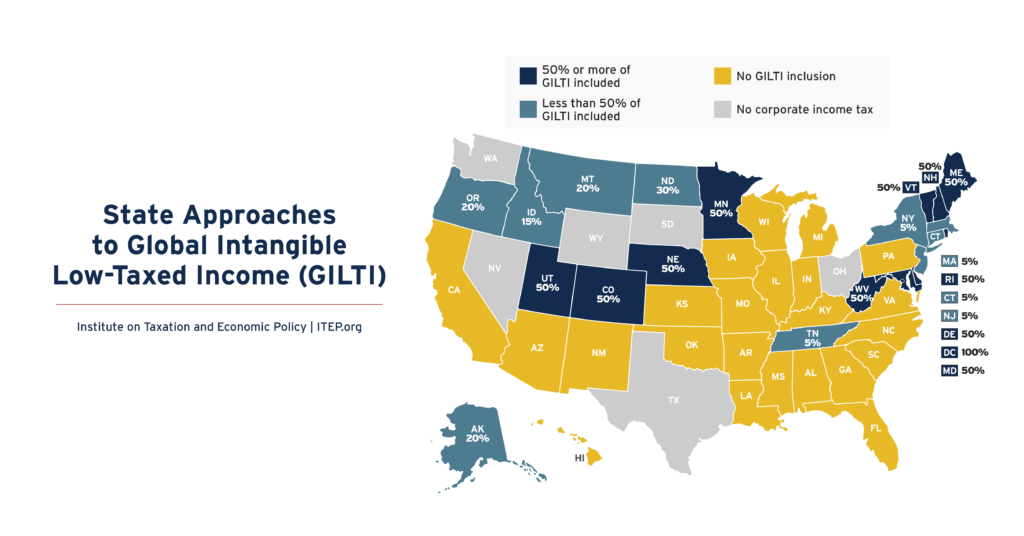

Many states with corporate income taxes include some amount of federally defined Global Intangible Low-Taxed Income (GILTI) in their tax bases. Twenty-one states plus D.C. include some amount of GILTI in their tax calculations in 2025.

Revenue Effect of Mandatory Worldwide Combined Reporting by State

February 21, 2025 • By ITEP Staff

Universal adoption of mandatory worldwide combined reporting (WWCR) in states with corporate income taxes would boost state tax revenue by $18.7 billion per year. The revenue effects of mandatory WWCR would vary across states. We estimate that 38 states and the District of Columbia would experience revenue increases totaling $19.1 billion. The top 10 states […]

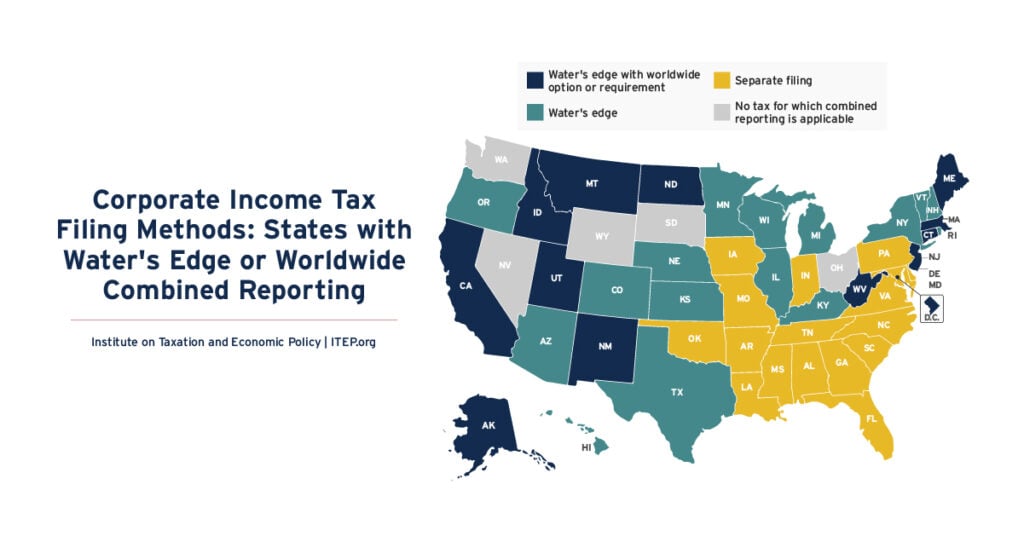

Corporate Income Tax Filing Methods: States with Water’s Edge or Worldwide Combined Reporting

February 21, 2025 • By ITEP Staff

The purpose of state corporate income taxes is to tax the profit, or net income, an incorporated business earns in each state. Ascertaining the state where profits are earned is, however, complicated for companies that conduct business in multiple jurisdictions. Twenty-eight states plus D.C. now require a limited version of combined reporting called “water’s edge” […]

A Revenue Analysis of Worldwide Combined Reporting in the States

February 20, 2025 • By Carl Davis, Matthew Gardner, Michael Mazerov

Universal adoption of mandatory worldwide combined reporting would boost state corporate income tax revenues by roughly 14 percent. Thirty-eight states and the District of Columbia would experience revenue increases totaling $19.1 billion.

Louisiana Gov. Jeff Landry called the legislature back to the capitol the day after the national election to take up his plan to overhaul the state’s tax system during a 20-day special session. Our analysis shows the tax overhaul would worsen the inequity already rampant in Louisiana’s tax system while potentially shortchanging essential services for families across the state.

2024 State Tax Ballot Questions: Voters to Weigh in on Tax Changes Big and Small

October 17, 2024 • By Jon Whiten

As we approach November’s election, voters in several states will be weighing in on tax policy changes. The outcomes will impact the equity of state and local tax systems and the adequacy of the revenue those systems are able to raise to fund public services.

Major tax cuts were largely rejected this year, but states continue to chip away at income taxes. And while property tax cuts were a hot topic across the country, many states failed to deliver effective solutions to affordability issues.

Five Things to Know About Tax Foundation’s Critique of Maryland’s Worldwide Combined Reporting Proposal

April 1, 2024 • By Carl Davis, Matthew Gardner

Maryland lawmakers are considering enacting worldwide combined reporting (WWCR), also known as complete reporting. This policy offers a more accurate, and less gameable, way to calculate the amount of profit subject to state corporate tax. Enacting WWCR in Maryland would represent a huge step toward eliminating state corporate tax avoidance as it neutralizes a wide […]

These forward-thinking states are demonstrating the wide variety of options for policymakers who want to raise more from the wealthiest people, rein in corporate tax avoidance, create fair tax codes and build strong communities.

State Tax Watch 2024

January 23, 2024 • By ITEP Staff

Updated July 15, 2024 In 2024, state lawmakers have a choice: advance tax policy that improves equity and helps communities thrive, or push tax policies that disproportionately benefit the wealthy, drain funding for critical public services, and make it harder for low-income and working families to get ahead. Despite worsening state fiscal conditions, we expect […]

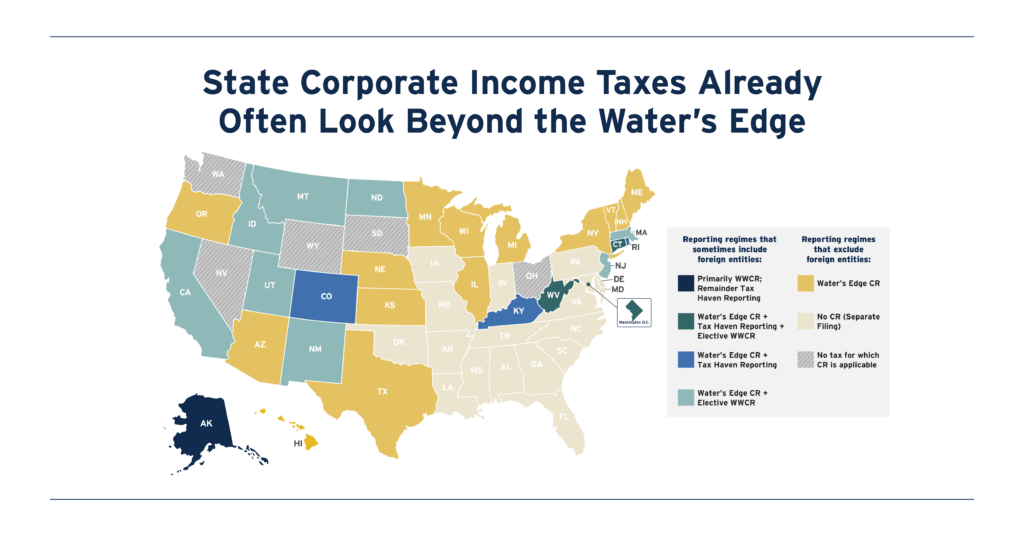

Far From Radical: State Corporate Income Taxes Already Often Look Beyond the Water’s Edge

November 7, 2023 • By Carl Davis, Matthew Gardner

State lawmakers are increasingly interested in reforming their corporate tax bases to start from a comprehensive measure of worldwide profit. This provides a more accurate, and less gameable, starting point for calculating profits subject to state corporate tax. Mandating this kind of filing system, known as worldwide combined reporting (WWCR), would be transformative, as it would all but eliminate state corporate tax avoidance done through the artificial shifting of profits into low-tax countries.

Nearly one-third of states took steps to improve their tax systems this year by investing in people through refundable tax credits, and in a few notable cases by raising revenue from those most able to pay. But another third of states lost ground, continuing a trend of permanent tax cuts that overwhelmingly benefit high-income households and make tax codes less adequate and equitable.

Minnesota’s Tax Battle of 2023 Signals a Turning of the Tide Against Corporate Tax Avoidance

July 7, 2023 • By Matthew Gardner

The qualified success of Minnesota’s GILTI conformity—to say nothing of the state’s serious dalliance with the game-changing worldwide combined reporting--sends a clear signal that the days may be coming to an end when big multinationals can scare state lawmakers into allowing them to game the tax system.

Minnesota Poised to Enact Landmark Loophole-Closing Corporate Tax Reforms

May 7, 2023 • By Matthew Gardner

With Minnesota poised to enact worldwide combined reporting of corporate income taxes, business lobbyists are pulling out all the stops to make state lawmakers believe the apocalypse is upon them.

Minnesota’s House, Senate and Governor’s office have each proposed their own vision as to how the state should maximize its $17.5 billion surplus and raise new revenue, and these tax plans make one thing clear: Minnesota lawmakers are serious about using tax policy to advance tax equity and improve the lives of Minnesotans.

New Jersey, New York, and Connecticut Should Keep Corporate Taxes Strong, Extend Surcharges

February 28, 2023 • By Marco Guzman

At a time when corporations are seeing record profits while not paying their fair share of federal taxes, state corporate income taxes can and should play a role in raising sustainable revenue and adding progressivity to state tax codes. Right now, lawmakers in New Jersey, New York, and Connecticut have a unique opportunity to extend targeted tax changes that have raised billions of dollars from profitable corporations for meaningful public investments.

The word “tax” appears 97 times and counting in one recent summary of governors’ addresses to state legislators so far this year. The policy visions that governors are bringing, however, vary enormously. While there's good reason to worry about tax cuts for wealthy families and the flattening or elimination of income taxes, there are at least five great tax ideas coming directly out of governors’ offices this year.

Tax Foundation’s ‘State Business Tax Climate Index’ Bears Little Connection to Business Reality

October 31, 2022 • By Carl Davis, Matthew Gardner

The big problem with the Index is that it peddles a solution that not only falls short of the goal of generating business investment, but one that actively harms state lawmakers’ ability to provide the kinds of public goods – like good schools and modern, efficient transportation networks – that businesses need and want.

ITEP’s state corporate tax work examines the tax-paying habits of Fortune 500 corporations and corporate contributions to state revenue. It occasionally releases a comprehensive state corporate tax study as a companion to its national report on federal taxes paid (or not paid) by profitable corporations. ITEP also examines state tax incentives provided to corporations in exchange for the promise of economic growth.