States

North Carolina Justice Center: State Tax Policy Is Not Race Neutral

April 13, 2021

North Carolina’s tax code and budget are wrought with such policy choices, which can result in racist outcomes that worsen barriers to well-being for people and communities of color, according to new data from the Institute on Taxation and Economic Policy (ITEP). The greater tax load carried by Black, Indigenous, and Latinx residents has been […]

Oregon Center for Public Policy: A better reality for Oregonians requires flipping the tax system

April 7, 2021

As vaccines for COVID-19 make their way into the arms of Americans, a sense of normality feels within reach. But going back to normal is not what working Oregonians need. We need a reimagined sense of “normal” – one in which workers get paid living wages and the rich pay their fair share. When you […]

Louisiana Budget Project: Who Pays? Racial Injustice in Louisiana’s Tax System

April 5, 2021

Historic and current injustices – both in public policy and in society more broadly – have resulted in vast disparities in income across race and ethnicity in Louisiana. Unfortunately, our tax system plays an active role in worsening these disparities by asking those with the least to contribute the largest share of their income to […]

Inequality.org: Sales Taxes Widen the Racial Wealth Divide. States and Cities Have Far Better Options.

April 2, 2021

The public discourse over inequality and racial disparities has rightly shifted to how to dismantle structural challenges that create these gross inequities. Addressing racial disparities will require a concerted effort by government across all policy areas. A new report from the Institute on Taxation and Economic Policy (ITEP) offers some perspective on how state and […]

Illinois ITIN Impact

March 10, 2020 • By ITEP Staff

Impact of Including Illinois ITIN Filers in State & Federal EITCs Based on IRS 2015 ITIN Filer Counts and Current EITC Policy Notes: ITIN filer counts represent estimate of EITC eligible ITIN filers in tax year 2015. All $s expressed in 2020. STATE EITC 2015 Assuming Full Participation EITC eligible ITIN Filers: 156,330 State EITC […]

State Tax Codes as Poverty Fighting Tools: 2019 Update on Four Key Policies in All 50 States

September 26, 2019 • By Aidan Davis

This report presents a comprehensive overview of anti-poverty tax policies, surveys tax policy decisions made in the states in 2019 and offers recommendations that every state should consider to help families rise out of poverty. States can jump start their anti-poverty efforts by enacting one or more of four proven and effective tax strategies to reduce the share of taxes paid by low- and moderate-income families: state Earned Income Tax Credits, property tax circuit breakers, targeted low-income credits, and child-related tax credits.

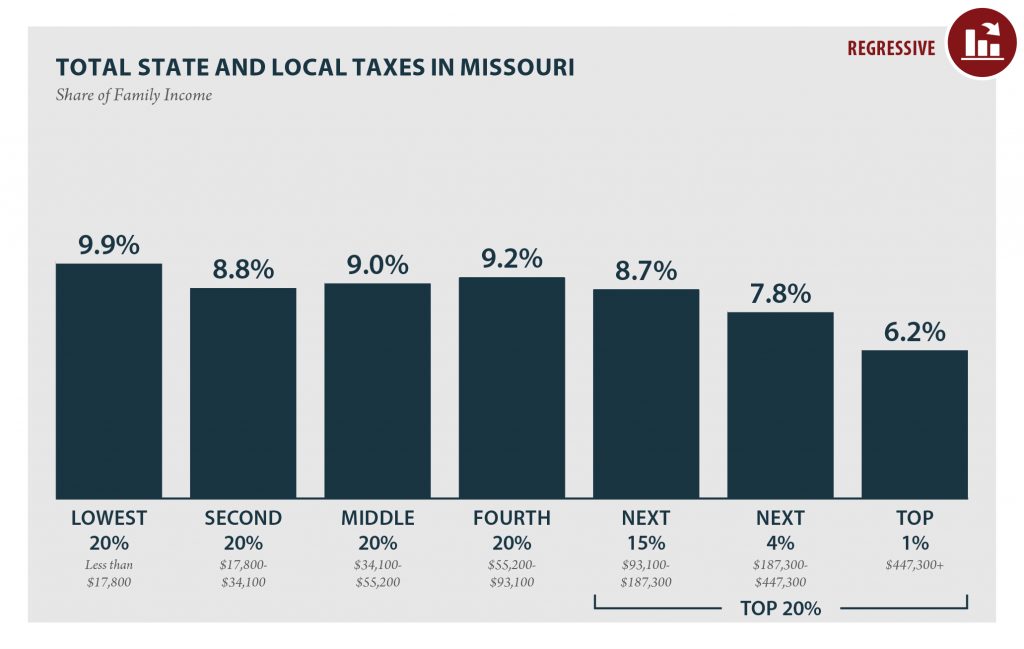

Missouri: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

MISSOURI Read as PDF MISSOURI STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $17,800 $17,800 to $34,100 $34,100 to $55,200 $55,200 to $93,100 $93,100 to $187,300 $187,300 to $447,300 over $447,300 […]

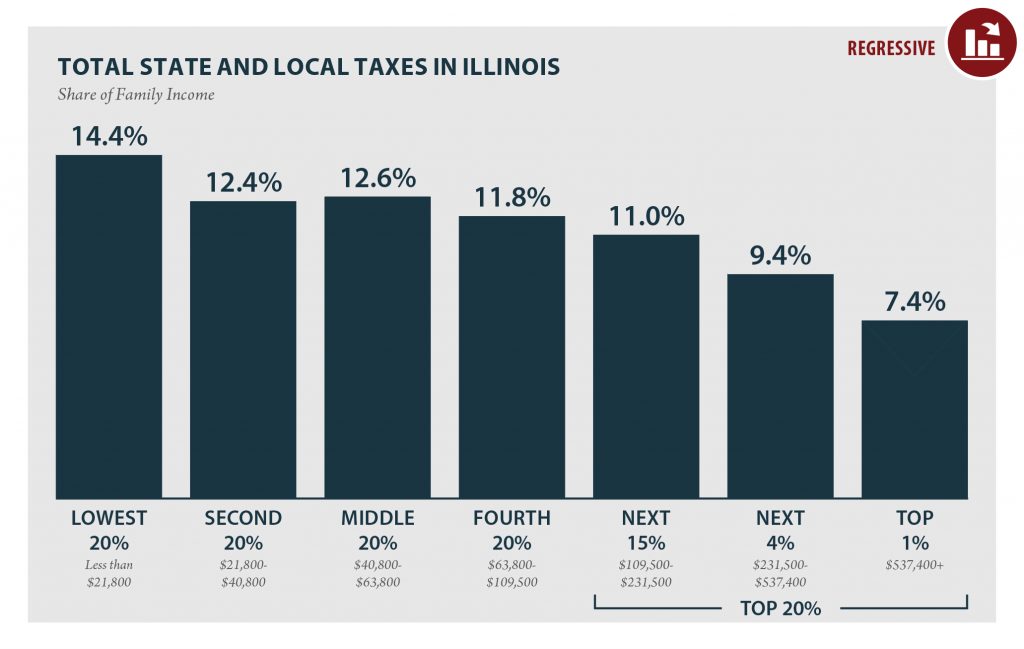

Illinois: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

ILLINOIS Read as PDF ILLINOIS STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $21,800 $21,800 to $40,800 $40,800 to $63,800 $63,800 to $109,500 $109,500 to $231,500 $231,500 to $537,400 over $537,400 […]

BTC Report: Income tax rate cap amendment is costly for taxpayers, communities

September 28, 2018

Imposing an arbitrary income tax cap in the North Carolina Constitution could fundamentally compromise our state’s ability to fund our schools, roads, and public health, as well as raise the cost of borrowing. This could all happen even as the tax load shifts even further onto middle- and low-income taxpayers and the state’s highest income taxpayers — the top 1 percent — continue to benefit from recent tax changes since 2013.

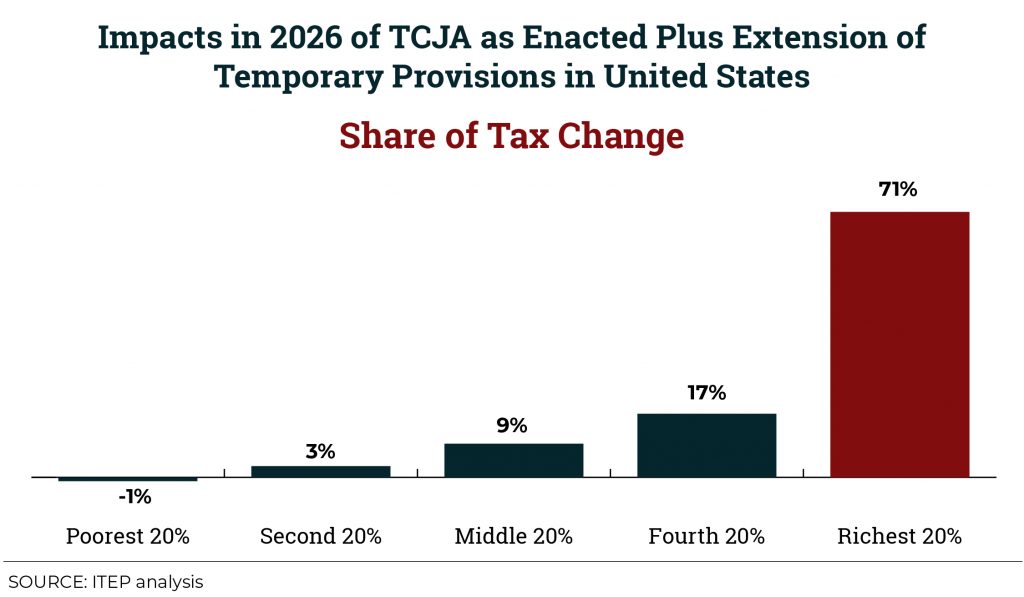

Tax Cuts 2.0 Resources

September 26, 2018 • By ITEP Staff

The $2 trillion 2017 Tax Cuts and Jobs Act (TCJA) includes several provisions set to expire at the end of 2025. GOP leaders wrote the bill this way to adhere to their own rule that limits how much a piece of legislation can add to the federal debt. But it’s clear that proponents planned all along to make those provisions permanent. Less than a month after the law passed, the White House and Republican leaders began calling for a second round of tax cuts. Now, they have introduced a bill informally called “Tax Cuts 2.0” or “Tax Reform 2.0,” which…

Tax Cuts 2.0 – Alabama

September 26, 2018 • By ITEP Staff

The $2 trillion 2017 Tax Cuts and Jobs Act (TCJA) includes several provisions set to expire at the end of 2025. Now, GOP leaders have introduced a bill informally called “Tax Cuts 2.0” or “Tax Reform 2.0,” which would make the temporary provisions permanent. And they falsely claim that making these provisions permanent will benefit […]

Tax Cuts 2.0 – Alaska

September 26, 2018 • By ITEP Staff

The $2 trillion 2017 Tax Cuts and Jobs Act (TCJA) includes several provisions set to expire at the end of 2025. Now, GOP leaders have introduced a bill informally called “Tax Cuts 2.0” or “Tax Reform 2.0,” which would make the temporary provisions permanent. And they falsely claim that making these provisions permanent will benefit […]

Tax Cuts 2.0 – Arkansas

September 26, 2018 • By ITEP Staff

The $2 trillion 2017 Tax Cuts and Jobs Act (TCJA) includes several provisions set to expire at the end of 2025. Now, GOP leaders have introduced a bill informally called “Tax Cuts 2.0” or “Tax Reform 2.0,” which would make the temporary provisions permanent. And they falsely claim that making these provisions permanent will benefit […]

Tax Cuts 2.0 – Arizona

September 26, 2018 • By ITEP Staff

The $2 trillion 2017 Tax Cuts and Jobs Act (TCJA) includes several provisions set to expire at the end of 2025. Now, GOP leaders have introduced a bill informally called “Tax Cuts 2.0” or “Tax Reform 2.0,” which would make the temporary provisions permanent. And they falsely claim that making these provisions permanent will benefit […]

Tax Cuts 2.0 – California

September 26, 2018 • By ITEP Staff

The $2 trillion 2017 Tax Cuts and Jobs Act (TCJA) includes several provisions set to expire at the end of 2025. Now, GOP leaders have introduced a bill informally called “Tax Cuts 2.0” or “Tax Reform 2.0,” which would make the temporary provisions permanent. And they falsely claim that making these provisions permanent will benefit […]

Tax Cuts 2.0 – Colorado

September 26, 2018 • By ITEP Staff

The $2 trillion 2017 Tax Cuts and Jobs Act (TCJA) includes several provisions set to expire at the end of 2025. Now, GOP leaders have introduced a bill informally called “Tax Cuts 2.0” or “Tax Reform 2.0,” which would make the temporary provisions permanent. And they falsely claim that making these provisions permanent will benefit […]

Tax Cuts 2.0 – Delaware

September 26, 2018 • By ITEP Staff

The $2 trillion 2017 Tax Cuts and Jobs Act (TCJA) includes several provisions set to expire at the end of 2025. Now, GOP leaders have introduced a bill informally called “Tax Cuts 2.0” or “Tax Reform 2.0,” which would make the temporary provisions permanent. And they falsely claim that making these provisions permanent will benefit […]

Tax Cuts 2.0 – District of Columbia

September 26, 2018 • By ITEP Staff

The $2 trillion 2017 Tax Cuts and Jobs Act (TCJA) includes several provisions set to expire at the end of 2025. Now, GOP leaders have introduced a bill informally called “Tax Cuts 2.0” or “Tax Reform 2.0,” which would make the temporary provisions permanent. And they falsely claim that making these provisions permanent will benefit […]

Tax Cuts 2.0 – Florida

September 26, 2018 • By ITEP Staff

The $2 trillion 2017 Tax Cuts and Jobs Act (TCJA) includes several provisions set to expire at the end of 2025. Now, GOP leaders have introduced a bill informally called “Tax Cuts 2.0” or “Tax Reform 2.0,” which would make the temporary provisions permanent. And they falsely claim that making these provisions permanent will benefit […]

Tax Cuts 2.0 – Georgia

September 26, 2018 • By ITEP Staff

The $2 trillion 2017 Tax Cuts and Jobs Act (TCJA) includes several provisions set to expire at the end of 2025. Now, GOP leaders have introduced a bill informally called “Tax Cuts 2.0” or “Tax Reform 2.0,” which would make the temporary provisions permanent. And they falsely claim that making these provisions permanent will benefit […]

Tax Cuts 2.0 – Hawaii

September 26, 2018 • By ITEP Staff

The $2 trillion 2017 Tax Cuts and Jobs Act (TCJA) includes several provisions set to expire at the end of 2025. Now, GOP leaders have introduced a bill informally called “Tax Cuts 2.0” or “Tax Reform 2.0,” which would make the temporary provisions permanent. And they falsely claim that making these provisions permanent will benefit […]

Tax Cuts 2.0 – Idaho

September 26, 2018 • By ITEP Staff

The $2 trillion 2017 Tax Cuts and Jobs Act (TCJA) includes several provisions set to expire at the end of 2025. Now, GOP leaders have introduced a bill informally called “Tax Cuts 2.0” or “Tax Reform 2.0,” which would make the temporary provisions permanent. And they falsely claim that making these provisions permanent will benefit […]

Tax Cuts 2.0 – Illinois

September 26, 2018 • By ITEP Staff

The $2 trillion 2017 Tax Cuts and Jobs Act (TCJA) includes several provisions set to expire at the end of 2025. Now, GOP leaders have introduced a bill informally called “Tax Cuts 2.0” or “Tax Reform 2.0,” which would make the temporary provisions permanent. And they falsely claim that making these provisions permanent will benefit […]

Tax Cuts 2.0 – Indiana

September 26, 2018 • By ITEP Staff

The $2 trillion 2017 Tax Cuts and Jobs Act (TCJA) includes several provisions set to expire at the end of 2025. Now, GOP leaders have introduced a bill informally called “Tax Cuts 2.0” or “Tax Reform 2.0,” which would make the temporary provisions permanent. And they falsely claim that making these provisions permanent will benefit […]

Tax Cuts 2.0 – Iowa

September 26, 2018 • By ITEP Staff

The $2 trillion 2017 Tax Cuts and Jobs Act (TCJA) includes several provisions set to expire at the end of 2025. Now, GOP leaders have introduced a bill informally called “Tax Cuts 2.0” or “Tax Reform 2.0,” which would make the temporary provisions permanent. And they falsely claim that making these provisions permanent will benefit […]