Tax Analyses

How Will the Trump Megabill Change Americans’ Taxes in 2026?

July 22, 2025 • By Steve Wamhoff, Michael Ettlinger, Carl Davis, Jon Whiten

The megabill will raise taxes on the poorest 40 percent of Americans, barely cut them for the middle 20 percent, and cut them tremendously for the wealthiest Americans next year.

There Were Far Cheaper and Fairer Options Than the Trump Megabill

July 8, 2025 • By Steve Wamhoff, Joe Hughes, Jessica Vela

Congress and the president could have spent less than half that much money on a tax bill that does more for working-class and middle-class households.

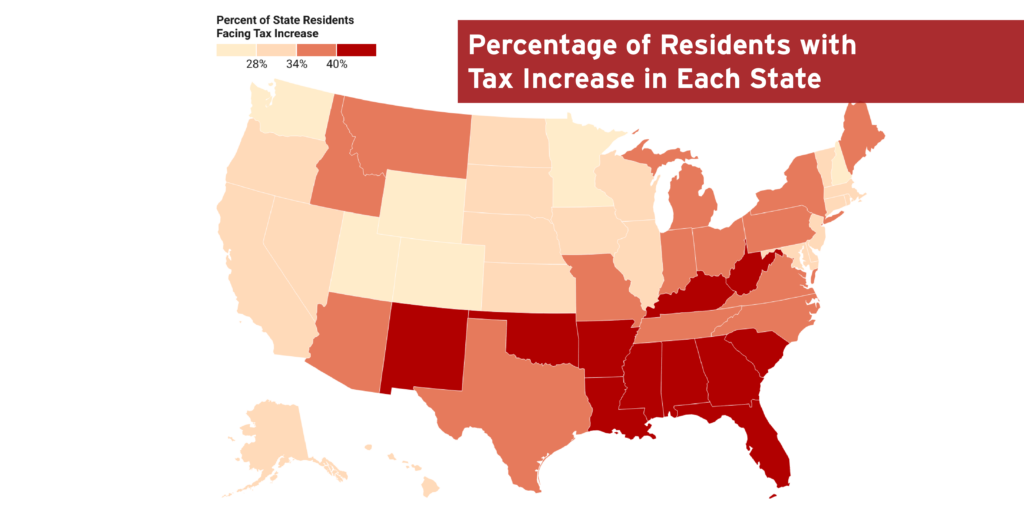

Analysis of Tax Provisions in the Trump Megabill as Signed into Law: National and State Level Estimates

July 7, 2025 • By Steve Wamhoff, Carl Davis, Joe Hughes, Jessica Vela

President Trump has signed into law the tax and spending “megabill” that largely favors the richest taxpayers and provides working-class Americans with relatively small tax cuts that will in many cases be more than offset by Trump's tariffs.

Top 1% to Receive $1 Trillion Tax Cut from Trump Megabill Over the Next Decade

July 3, 2025 • By Carl Davis

The Trump megabill will give the top 1 percent tax cuts totaling $1.02 trillion over the next decade. For comparison, the bill’s cuts to the Medicaid health care program will total $930 billion over the same period.

Analysis of Tax Provisions in the Senate Reconciliation Bill: National and State Level Estimates

June 25, 2025 • By Carl Davis, Jessica Vela, Joe Hughes, Steve Wamhoff

Compared to its House counterpart, the Senate bill makes certain tax provisions more generous, including corporate tax breaks that it makes permanent rather than temporary. But the bottom line for both is the same. Both bills give more tax cuts to the richest 1 percent than to the entire bottom 60 percent of Americans, and both bills particularly favor high-income people living in more conservative states.

Analysis of Tax Provisions in the House Reconciliation Bill: National and State Level Estimates

May 22, 2025 • By Carl Davis, Jessica Vela, Joe Hughes, Steve Wamhoff

The poorest fifth of Americans would receive 1 percent of the House reconciliation bill's net tax cuts in 2026 while the richest fifth of Americans would receive two-thirds of the tax cuts. The richest 5 percent alone would receive a little less than half of the net tax cuts that year.

The House of Representatives unveiled a sprawling piece of tax legislation earlier this week that would extend temporary tax changes enacted in 2017 and layer various kinds of tax cuts and increases on top. The JCT analysis makes clear that the House tax plan would be regressive, meaning it would offer larger tax cuts as a share of income to high-income taxpayers than to either middle-class or working-class families. It also makes clear that most of the tax cuts would go to families with above-average incomes.

The tariffs proposed by Donald Trump, which are far larger than any on the books today, would significantly raise the prices faced by American consumers across the income scale.

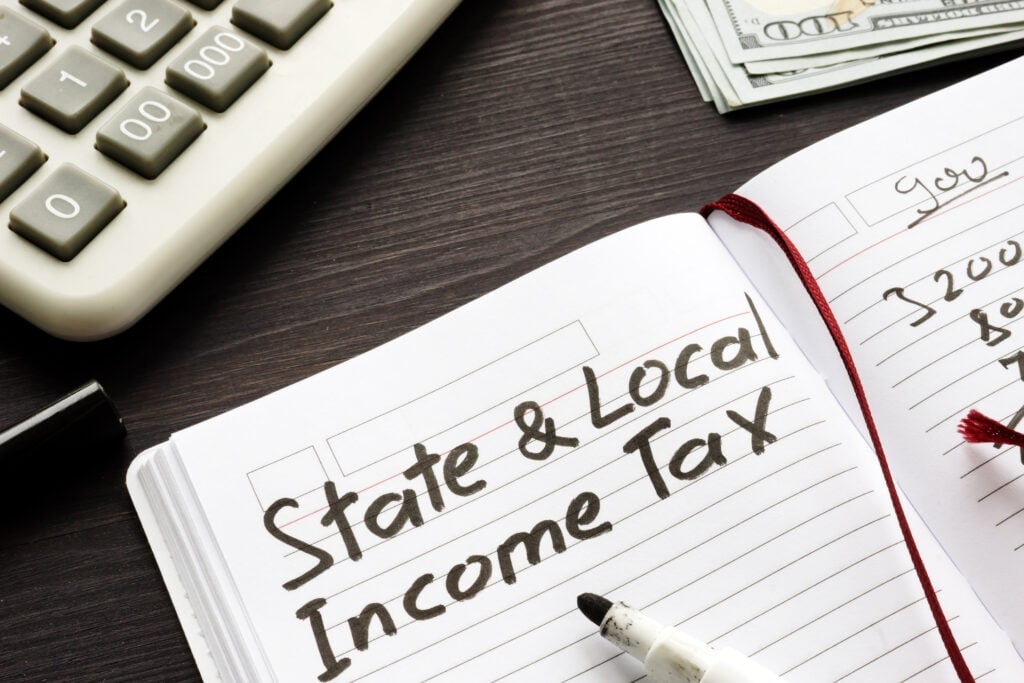

Different Approaches to the Trump Tax Law’s Cap on Deductions for State and Local Taxes (SALT)

January 17, 2025 • By Steve Wamhoff

President Trump and the Republican majorities in the House and Senate may not extend the $10,000 cap on federal income tax deductions for state and local taxes (SALT), the one part of the 2017 law that significantly limits tax breaks for the rich. And, depending on which proposal they settle on, leaving out the existing cap on SALT deductions could add between $10 billion and over $100 billion each year to the total cost of their tax plan.

Trump’s Plan to Extend His 2017 Tax Provisions: Updated National and State-by-State Estimates

January 8, 2025 • By Steve Wamhoff

Trump’s plan to make most of the temporary provisions of his 2017 tax law permanent would disproportionately benefit the richest Americans. This includes all major provisions except the $10,000 cap on deductions for state and local taxes (SALT) paid.

How Would the Harris and Trump Tax Plans Affect Different Income Groups?

October 23, 2024 • By Jon Whiten

Presidential candidates Kamala Harris and Donald Trump have put forward a wide range of different tax proposals during this year’s campaign. We have now fully analyzed the distributional impacts of the major proposals of both Vice President Harris and former President Trump in separate analyses. In all, the tax proposals announced by Harris would, on average, lead to a tax cut for all income groups except the richest 1 percent of Americans, while the proposals announced by Trump would, on average, lead to a tax increase for all income groups except the richest 5 percent of Americans.

The tax proposals from Vice President Kamala Harris would, on average, lead to a tax increase for the richest 1 percent of Americans and a tax cut for all other income groups.

A Distributional Analysis of Donald Trump’s Tax Plan

October 7, 2024 • By Carl Davis, Erika Frankel, Galen Hendricks, Joe Hughes, Matthew Gardner, Michael Ettlinger, Steve Wamhoff

Former President Donald Trump has proposed a wide variety of tax policy changes. Taken together, these proposals would, on average, lead to a tax cut for the richest 5 percent of Americans and a tax increase for all other income groups.

Extending Temporary Provisions of the 2017 Trump Tax Law: Updated National and State-by-State Estimates

September 13, 2024 • By Steve Wamhoff

The TCJA Permanency Act would make permanent the provisions of the Tax Cuts and Jobs Act of 2017 that are set to expire at the end of 2025. The legislation would disproportionately benefit the richest Americans. Below are graphics for each state that show the effects of making TCJA permanent across income groups. See ITEP’s […]

Voucher Boondoggle: House Advances Plan to Give the Wealthy $1.20 for Every $1 They Steer to Private K-12 Schools

September 12, 2024 • By Carl Davis

The U.S. House Ways & Means Committee has advanced a new school voucher bill. H.R. 9462—the Educational Choice for Children Act of 2024—would create an unprecedented tax incentive designed to fund private, mostly religious, K-12 schools.

House SALT Proposal is Expensive, Unneeded, and Poorly Designed

February 2, 2024 • By Joe Hughes

The SALT Marriage Penalty Elimination Act passed by the House Rules Committee on February 1 is costly, decreasing tax revenue by about $8 billion in 2023. It also mostly only helps taxpayers who are already well off.

Weakening the SALT Cap Would Make House Tax Package More Expensive and More Tilted in Favor of the Wealthiest

August 7, 2023 • By Steve Wamhoff

The three tax bills that cleared the House Ways and Means Committee in June are reportedly stalled due to some House Republicans’ demands that the package include provisions weakening the $10,000 cap on deductions for state and local taxes (SALT). Modifying the House tax package in this way would make it much more expensive while benefiting the richest fifth of taxpayers almost exclusively.

‘Fair Share Act’ Would Strengthen Medicare and Social Security Taxes

July 11, 2023 • By Joe Hughes, Steve Wamhoff

The Medicare and Social Security Fair Share Act would reform the taxes that Americans pay to finance these two important programs so that the richest 2 percent of Americans pay these taxes on most of their income the way that middle-class taxpayers already do.

Trio of GOP Tax Bills Would Expand Corporate Tax Breaks While Doing Little for Americans Who Most Need Help

June 11, 2023 • By Steve Wamhoff

The trio of tax bills that cleared the House Ways and Means Committee in June include tax cuts that would mostly benefit the richest one percent of Americans and foreign investors.

What Tax Provisions are in the Senate-Passed Inflation Reduction Act?

August 9, 2022 • By Steve Wamhoff

The Inflation Reduction Act approved by the Senate on Aug. 7 would raise more than $700 billion in new revenue over a decade by closing corporate tax loopholes, empowering the IRS to enforce the tax laws on the books, taxing stock buybacks, and extending a limitation on deductions for business losses. The IRA – if […]

State-by-State Estimates of Sen. Rick Scott’s “Skin in the Game” Proposal

March 7, 2022 • By Steve Wamhoff

A proposal from Sen. Rick Scott would increase taxes for more than 35% of Americans, with the poorest fifth of Americans paying 34% of the tax increase.

Repealing the SALT Cap Would Wipe Out Revenue Raised by the House Ways and Means Bill’s Income Tax Provisions

September 23, 2021 • By Steve Wamhoff

There are several ways that the House leadership could avoid this problem. One approach is for lawmakers to replace the SALT cap with a different kind of limit on tax breaks for the rich that actually raises revenue and avoids disfavoring some states compared to others as the SALT cap does. ITEP has suggested a way to do this.

New ITEP Report Examines the Tax Changes in the House Ways and Means Build Back Better Bill

September 21, 2021 • By Steve Wamhoff

The vast majority of these tax increases would be paid by the richest 1 percent of Americans and foreign investors. The bill’s most significant tax cuts -- expansions of the Child Tax Credit (CTC) and Earned Income Tax Credit (EITC) -- would more than offset the tax increases for the average taxpayer in all income groups except for the richest 5 percent.

Tax Changes in the House Ways and Means Committee Build Back Better Bill

September 21, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

This report finds that the vast majority of these tax increases would be paid by the richest 1 percent of Americans and foreign investors. The bill’s most significant tax cuts -- expansions of the Child Tax Credit (CTC) and Earned Income Tax Credit (EITC) -- would more than offset the tax increases for the average taxpayer in all income groups except for the richest 5 percent.

House Ways and Means Provisions to Raise Revenue Would Significantly Improve Our Tax System But Fall Short of the President’s Plan

September 15, 2021 • By Steve Wamhoff

High-income people and corporations would pay more than they do today, which is a monumental change. But some wealthy billionaires like Jeff Bezos would continue to pay an effective rate of zero percent on most of their income, and American corporations would still have some incentives to shift profits offshore.

ITEP staff uses the ITEP Microsimulation model to produce quantitative analyses of current and proposed federal tax policies, creating distributional analyses (analyzing the effect on taxpayers according to their income group), producing revenue estimates (how much a tax policy would affect annual federal revenue collection), and even breaking down the impact of federal policies on each of the 50 states and the District of Columbia.