Refundable Tax Credits

The Rise Credit would replace the existing EITC. In most cases, the Rise Credit would be $4,000 for single people and $8,000 for married couples. Eligible taxpayers would be allowed a credit equal to the maximum amount or their earnings, whichever is less.

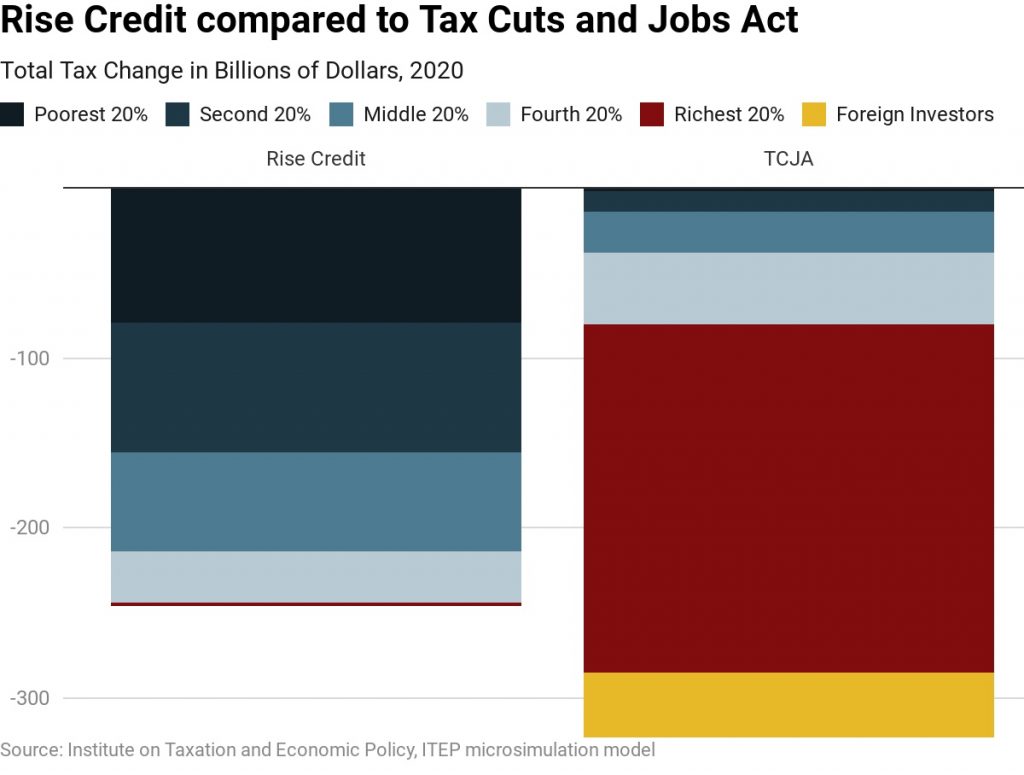

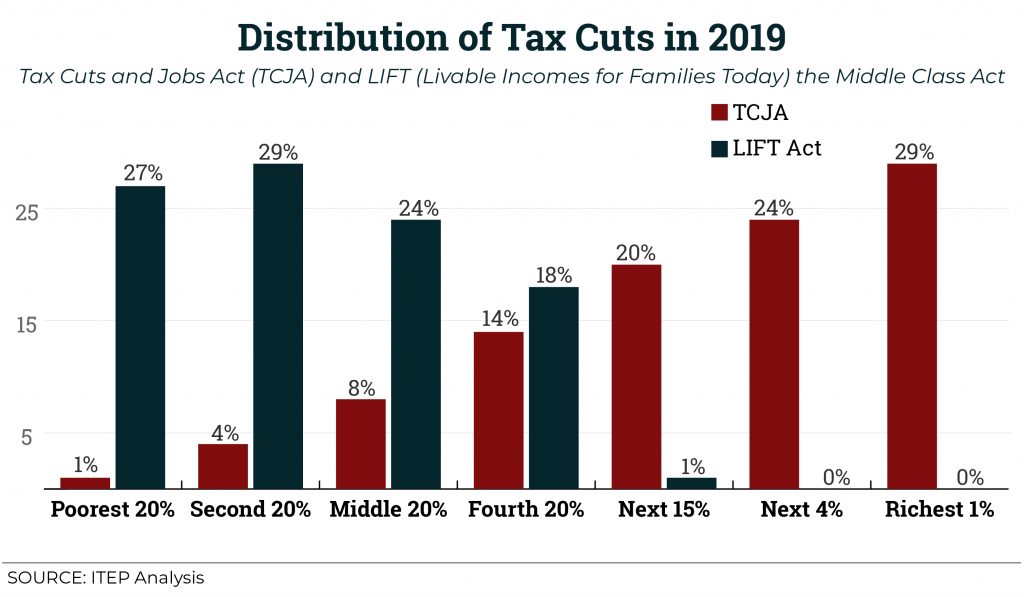

Shaking up TCJA: How a Proposed New Credit Could Shift Federal Tax Cuts from the Wealthy and Corporations to Working People

October 24, 2018 • By Aidan Davis

A new federal proposal, the Livable Incomes for Families Today (LIFT) the Middle Class Act, would create a new refundable tax credit for low- and middle-income working families who were little more than an afterthought in last year’s federal tax overhaul. This proposal would take the place of TCJA, providing tax cuts similar in cost to the recent federal tax law but targeted toward working people rather than the wealthy. ITEP analyzed the bill, proposed by California Senator Kamala Harris, and compared its potential impact to TCJA.

Final Tax Bill Reported to Provide Senator Rubio With Much Smaller Improvement for Children than He Demanded

December 15, 2017 • By Steve Wamhoff

The latest news on the GOP tax bill is that, in order to secure the vote of Senator Marco Rubio, Republican leaders have agreed to expand the child tax credit — but only by a fraction of the amount that Rubio initially demanded.

Chained CPI Would Raise Everyone’s Personal Income Taxes in the Future, Would Hurt the Poor Right Away

November 30, 2017 • By Steve Wamhoff

One of the findings is that every income group would face higher personal income taxes in years after 2025 (including 2027). Chained CPI would gradually push taxpayers into higher income tax brackets and make the standard deduction, the Earned Income Tax Credit, and several other breaks less generous over time. The switch to chained CPI would cause some low-income people to face a tax hike starting in 2019, the second year the plan would be in effect.

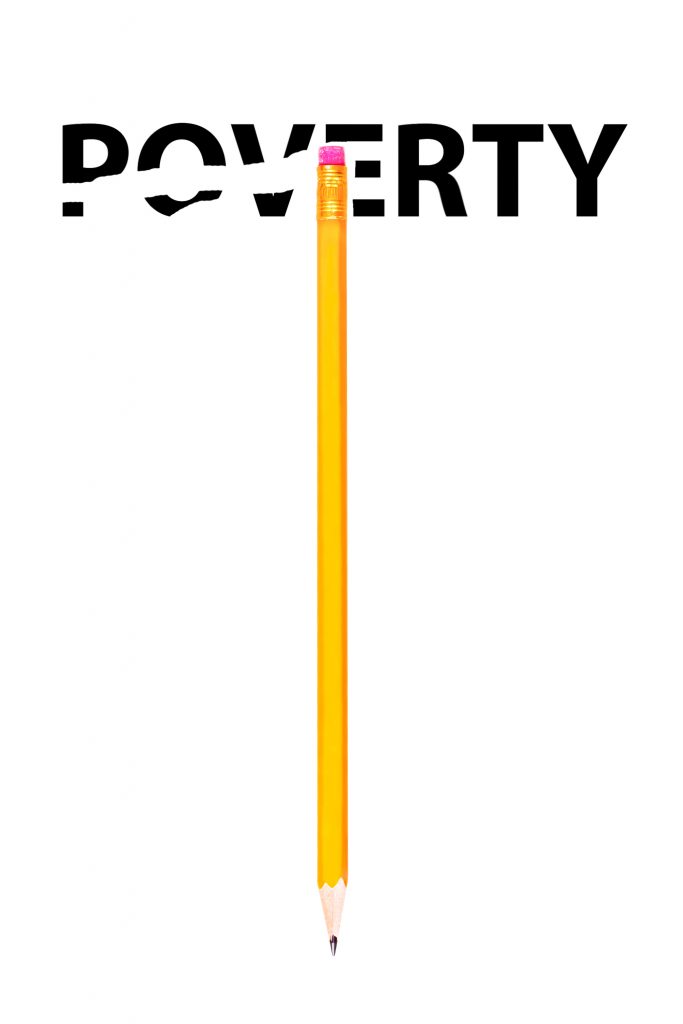

Poverty is Down, But State Tax Codes Could Bring It Even Lower

September 15, 2017 • By Misha Hill

The U.S. Census Bureau released its annual data on income, poverty and health insurance coverage this week. For the second consecutive year, the national poverty rate declined and the well-being of America’s most economically vulnerable has generally improved. In 2016, the year of the latest available data, 40.6 million (or nearly 1 in 8) Americans were living in poverty.

Astonishingly, tax policies in virtually every state make it harder for those living in poverty to make ends meet. When all the taxes imposed by state and local governments are taken into account, every state imposes higher effective tax rates on poor families than on the richest taxpayers.

Rewarding Work Through State Earned Income Tax Credits in 2017

September 11, 2017 • By ITEP Staff

The Earned Income Tax Credit (EITC) is a policy designed to bolster the earnings of low-wage workers and offset some of the taxes they pay, providing the opportunity for struggling families to step up and out of poverty toward meaningful economic security. The federal EITC has kept millions of Americans out of poverty since its enactment in the mid-1970s. Over the past several decades, the effectiveness of the EITC has been magnified as many states have enacted and later expanded their own credits.

Refundable credits like the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC) boost the economic security of working families. ITEP examines how such tax credits affect working people’s incomes and how this would change under proposals to modify the credits or create new ones.