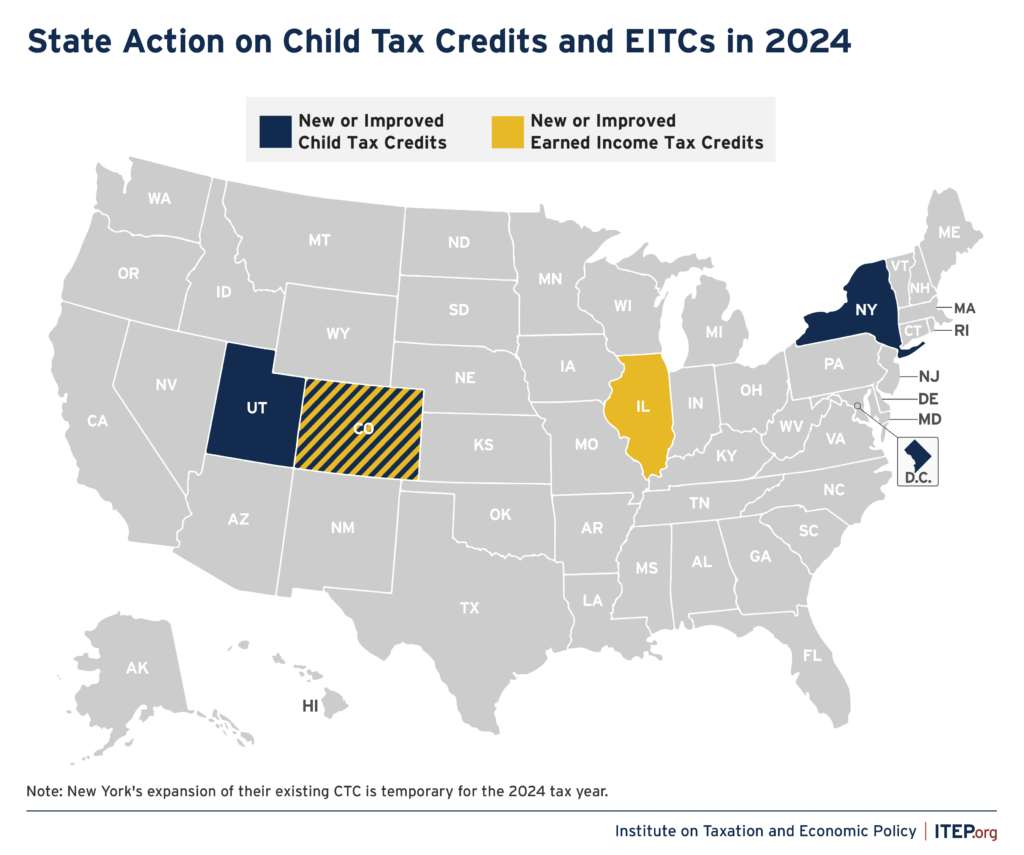

During the almost-finished 2024 legislative season, four states expanded or boosted refundable tax credits for children and families, and the District of Columbia is poised to create a new Child Tax Credit. These actions — in Colorado, Illinois, New York, Utah, and D.C. — continue the recent trend of improving the well-being of children and families with refundable tax credits.

Two of these four states plus D.C. have credits that are fully refundable. When credits are refundable, households receive the full value of the credit regardless of how much they owe in state income taxes, meaning the credit can help offset the impact of more regressive taxes like sales and property taxes. This makes both EITCs and CTCs better at improving equity in state tax codes.

Colorado passed an expansion of its Earned Income Tax Credit that will bring its match to 50 percent of the federal credit for the 2024 tax year. Lawmakers there also created a new credit — called the Family Affordability Tax Credit – that will boost the state’s existing Child Tax Credit and could provide an additional credit of up to $3,200 per child in years of strong economic growth. D.C’s new Child Tax Credit of $420 per qualifying child under 6 will also be fully refundable. And Illinois created a new child benefit through its existing Earned Income Tax Credit that will boost the credit for EITC-qualifying families with children under 12 years old.

Utah expanded its nonrefundable Child Tax Credit to include four-year-olds (it previously cut off once a child was over three). On the administrative side, Minnesota lawmakers built out the structure to provide periodic payments for the state’s historic Child Tax Credit passed in 2023. Additionally, New York is providing a one-time boost to its Empire State Child Tax Credit for 2024.

For nearly 40 years, states have used EITCs to boost the economic security of low- and middle-income families. States only began administering CTCs in 2006 when New York created their Empire State Child Credit. After the federal expansions of the EITC and CTC in the American Rescue Plan Act expired in 2022, many state lawmakers took the future of these powerful poverty-reducing credits into their own hands. Since 2022, 12 states plus D.C. have either created or expanded CTCs. And 17 states plus D.C. have created or expanded EITCs.

As state Child Tax Credits and Earned Income Tax Credits increase in popularity, lawmakers have also merged these two policies to create more impactful credits. In recent years, we have witnessed this in states like Washington and Minnesota. Washington is the first state that has no income tax but has passed an EITC — but unlike traditional EITCs, it has no income phase-in. In 2023, Minnesota lawmakers restructured their EITC – known as the Working Families Credit – so it could better couple and phasedown simultaneously with the state’s new CTC.

This continued in 2024 as Illinois passed a new child benefit boosting the state’s Earned Income Credit for households with a child under 12 by matching the state credit at 40 percent (the match will be 20 percent in 2024 as it phases in). Conversations are still ongoing in many states on merging their credits. For example, New York lawmakers have considered merging their Empire State Child Credit and EITC in a way that better targets the lowest-earning families while also ensuring no family is penalized by the changes.

Another noticeable trend this year was movement on Child and Dependent Care Credits (CDCTCs). This is a nonrefundable federal credit that reimburses families for a small portion of their childcare expenses; some states offer either a refundable or nonrefundable match of this credit. This year states such as Kansas, Colorado, and Wisconsin expanded their Child and Dependent Care Credits.

Often conversations about CDCTCs and CTCs went hand-in-hand. But despite their similar names, the CDCTC and CTC are very different policies. While CTCs provide low- and moderate-income families with a larger tax return that allows them to make their own spending decisions, a CDCTC is essentially a reimbursement for childcare expenses already paid. Most families claiming the CDCTC must also make enough to afford childcare in the first place while a CTC gives families unrestricted dollars to be spent on childcare or other needs.

Refundable credits such as EITCs and CTCs make our state tax systems more equitable, build stronger communities, and help families afford necessities. Lawmakers in Colorado, Illinois, New York, Utah, D.C., and the many states who have created and expanded these credits in recent years know these credits are a proven investment in their state’s workers and families.