DOWNLOAD NATIONAL AND STATE-BY-STATE DATA

Democrats in the House recently introduced a proposal to enhance the federal Child Tax Credit (CTC) based on the successful temporary expansion of the credit in 2021. The temporary expansion – part of President Biden’s economic rescue plan in response to the COVID-19 pandemic – cut child poverty roughly in half that year and was designed to help nearly every middle-class family with kids. The new proposal has the support of over 200 House Democrats and largely mirrors a proposal included in the President’s annual budget request.

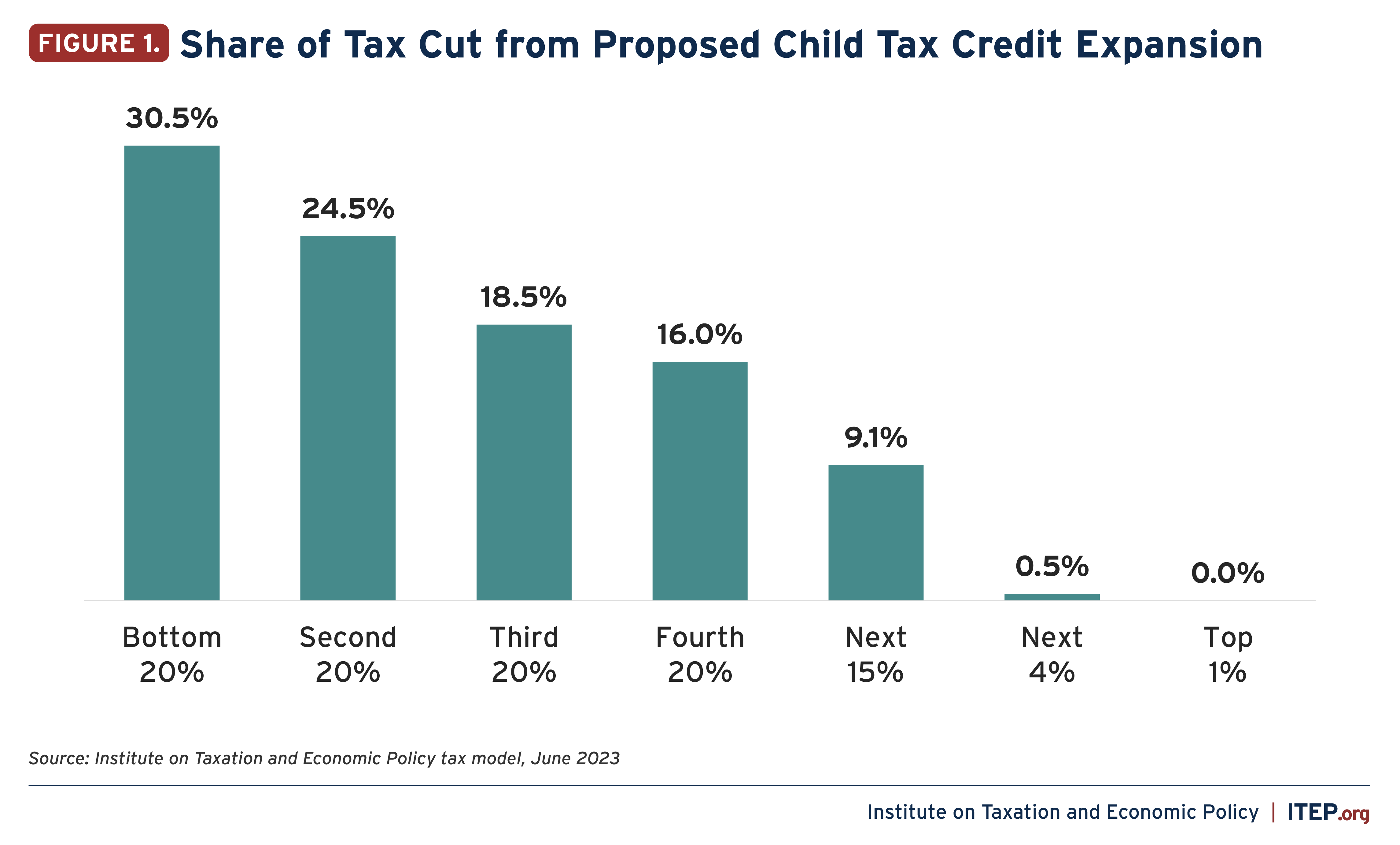

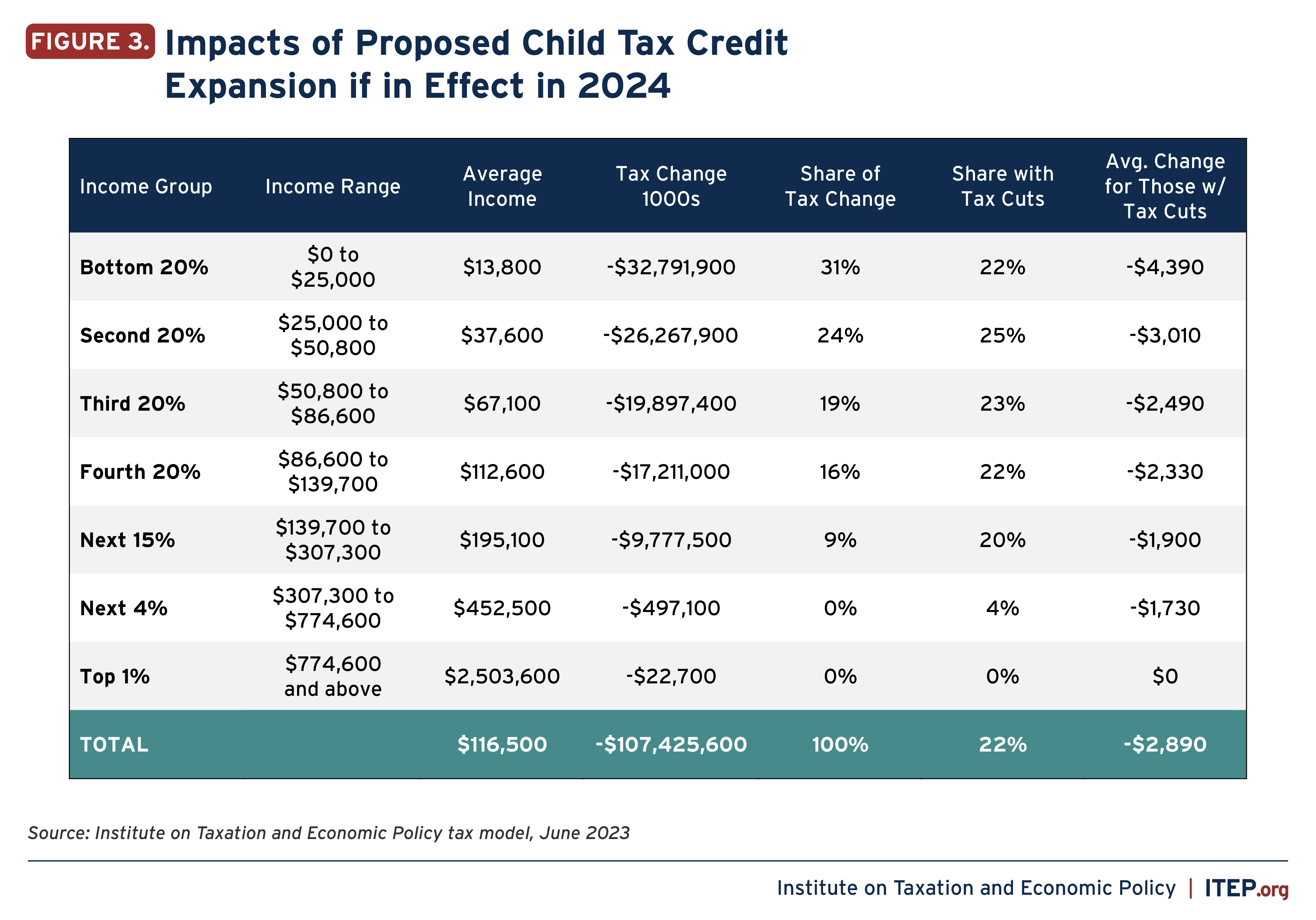

ITEP estimates that if this plan were in effect next year, it would benefit nearly 60 million children. Three-quarters of the benefit would go to families in the bottom three quintiles, consisting of households with less than $86,600 in income. This proposal stands in contrast to a recent proposal from House Republicans, which would mostly benefit the richest Americans and foreign investors.

The House Proposal Increases the Credit Amount and Makes it More Useful for Middle-Class Families

Mirroring the temporary expansion from 2021, the House proposal makes several changes to the credit. The proposal:

- Increases the credit amount from $2,000 per child to $3,600 for children aged 5 and younger and to $3,000 for children aged 6 and older (and adjusts the credit annually for inflation, unlike current law).

- Allows parents to claim the CTC for children up to age 17 rather than 16.

- Phases the credit out starting at $150,000 for married couples and $112,500 for most single parents.

- Makes the credit available to parents monthly rather than as a once-a-year lump sum. This helps to match the credit with a household’s normal bills and other expenses. Research found that when the credit was available monthly in 2021, families used it to cover necessities like food, utilities, rent, clothing, and education costs.

- Provides a larger credit in the first month of a child’s life to ensure that all families have enhanced resource access during the critical time immediately following the birth of a child.

It Also Fixes the Biggest Problem with the Current Child Tax Credit

The proposal’s change with the greatest impact is making the CTC fully available to all children in low- and middle-income families. The current rules contain two limits on the refundable part of the Child Tax Credit, making it unavailable to children in the poorest families. The refundable portion of the credit is the amount that parents can receive on top of their tax refund if they have no or low tax liability. The first limit in current rules bars families from receiving the full Child Tax Credit as a refundable credit. (The refundable portion of the credit will be limited to $1,700 per child next year rather than the full $2,000.) The second limit on the refundable part of the credit is an earnings requirement. The refundable portion of the credit is limited to a fraction of the family’s earnings above $2,500.

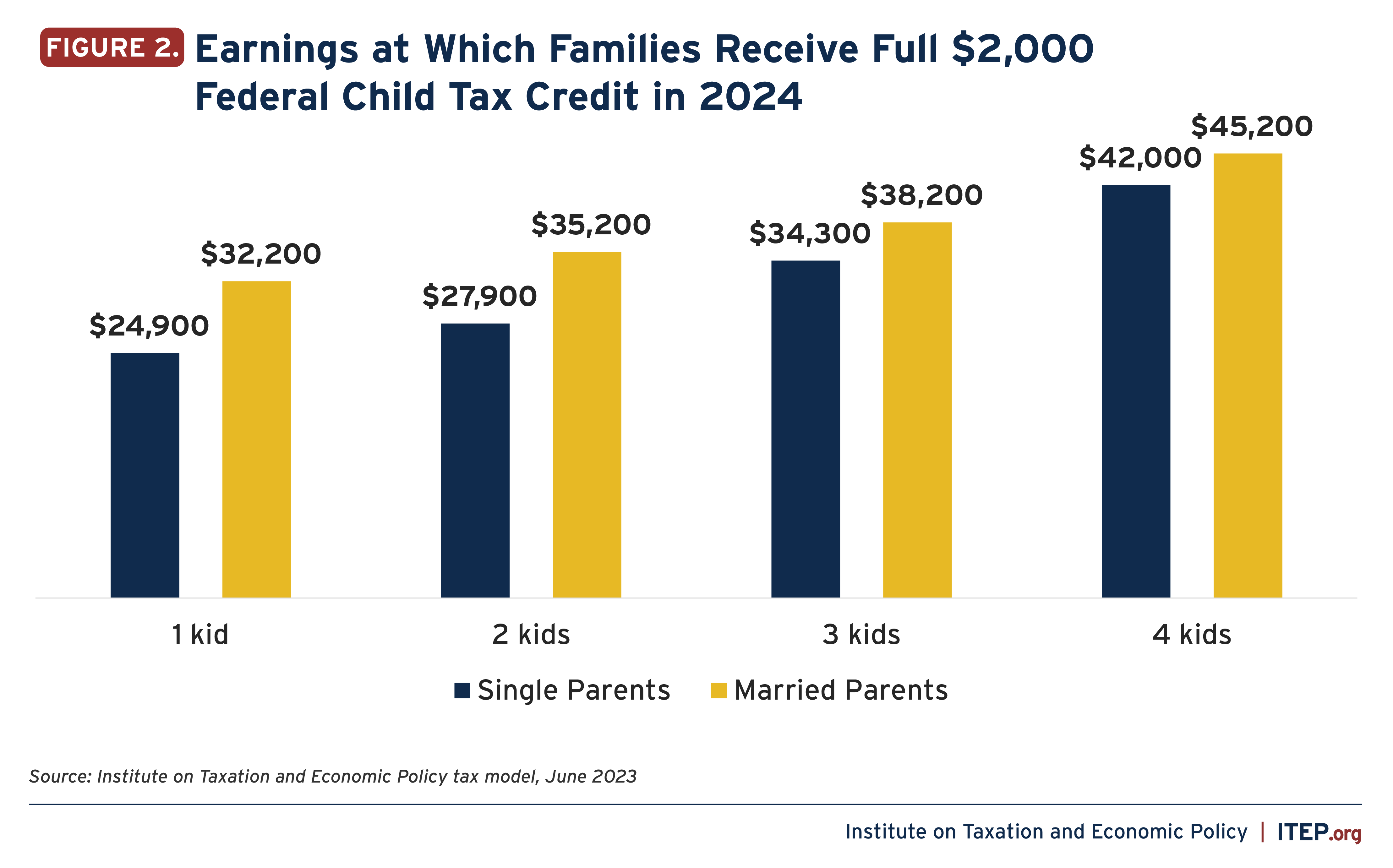

Combined, these two limits mean that the credit is reduced or entirely unavailable to the children who need it most, including children raised by grandparents, parents with disabilities, or parents working as full-time caregivers. Next year, for example, a single-parent household with two children will need at least $27,900 in earnings to receive the full credit under current law.

It is not logical to deny a credit meant to help children to the families who most need the income boost. The House proposal would fix this problem by making the credit fully refundable. This change would make children in low-income families the biggest beneficiaries if the legislation were in effect next year. Families making less than $25,000 would receive nearly a third of the total benefit and would receive an average tax cut of more than $4,000.

Restoring the enhanced Child Tax Credit would help millions of children in low- and middle-income families. Congress achieved a remarkable feat by cutting child poverty by half in 2021. There is no reason that this proven and effective policy should become a thing of the past. This proposal from House Democrats would help orient the tax code toward those who need the support, rather than big businesses and the already wealthy.

Note: Our analysis does not include the effects of the $2,000 credit for newborns. Including the change would increase the impact of this proposal.