During a 2000 presidential debate between George W. Bush and Al Gore, the former said he wanted “to send one-quarter of the surplus back to the people who pay the bills,” and for “everybody who pays taxes to have their tax rates cut.”

Then candidate Bush was defending a proposal that he claimed would cut taxes across the board but conceded would primarily benefit richer taxpayers. At the time, the economy hadn’t yet cooled, the dotcom bubble had not yet burst, and the federal government was running a small budget surplus.

In that context, President Bush’s first round of top-heavy tax cuts passed in March 2001 with more than half of the public’s support and even with some votes from Democratic lawmakers.

Today, the economic climate is starkly different, but it seems GOP leaders are relying on messaging and luck to push through the biggest tax package since 1986. The White House, Republican leaders and anti-tax advocates all have been toeing the same erroneous line: their plans to cut corporate and individual taxes will benefit middle class families and grow the economy. This is, of course, baloney. Congressional leadership and the White House would have to make radical, fundamentally different changes to current proposals for their final tax plan to be anything other than a giveaway to the wealthy and corporations.

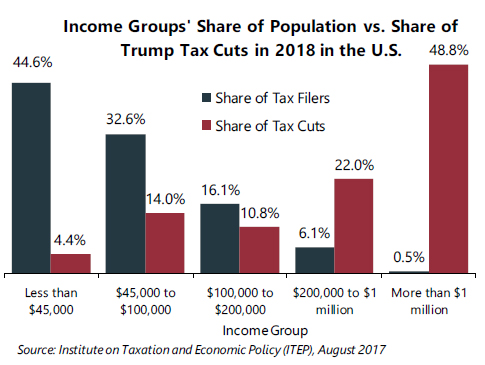

No detailed plan is yet on the table, but an ITEP analysis of President Trump’s tax principles reveals the wealthy would benefit most. The richest 1 percent of taxpayers would receive the greatest share (61.4 percent) of proposed cuts while the bottom 60 percent of taxpayers would receive just 10 percent of the cut.

ITEP took another look at the data to examine how Trump’s tax plan would benefit the most elite taxpayers. The 50-state analysis released this week found that millionaires would receive an average annual tax cut of $217,000, while families earning less than $45,000 would see an average tax cut of $230 (although some wouldn’t receive a tax cut at all.) Millionaires represent 0.5 percent of the population, but would receive 48.8 percent of the cut, while taxpayers with income of $45,000 or less represent nearly half of the population but would receive 4.4 percent of the cut.

We know that anti-tax advocates and their allies will argue that of course the rich would receive bigger tax cuts because they have more money and pay more taxes. But it’s important to note that under Trump’s proposal, they would receive a bigger cut in absolute dollars as well as a share of their income (millionaire tax cuts represent 7 percent of their income on average versus just 0.6 percent for those earning $45,000 or less). In practice, this means middle-income families would pay a bigger share of the national tax bill under Trump’s tax system than they do right now.

Giving away the store to corporations and the wealthy is patently unfair, particularly at a time when corporate profits are growing faster than the economy, when most of the financial gains from the economic recovery have concentrated among the rich, and when current median household income is the same as it was in 1998. In plain speak, the rich have gotten richer but ordinary families have no more buying power today than they did 20 years ago.

The public is acutely aware of these inequities and believes, not without reason, that the deck is stacked against them. They know that tax cuts for corporations and the rich will either dramatically increase the national debt or force spending cuts to education, health care, food security and other programs working people care about—or both. Messaging in favor of top-heavy tax cuts may temporarily conceal these facts, but it will not change them.

Fifteen years ago, the idea of passing tax cuts that disproportionately benefited the highest income taxpayers made no sense to those of us working on tax fairness. But given the federal budget situation, the economic climate and public opinion, fighting the tax cuts was a Sisyphean task. Today, the public is clearly telling lawmakers “No.” Instead of heeding their constituents’ collective opinion, lawmakers and their allies have launched an all-out effort to recycle time-worn, trickle-down economic theories and convince working people that tax cuts for corporations and the wealthy are in our best interest. But this wasn’t true in 2001, and it’s not true today. Lawmakers should not pass one penny in tax cuts for millionaires and corporations.