Corporate Taxes

Biden Tax Reforms Take a $16 Billion Bite Out of Trump’s Big Tax Giveaway to Meta

October 30, 2025 • By Matthew Gardner

Meta’s earnings setback is entirely attributable to an important tax reform championed by the Biden administration in 2022.

Oil and Gas Companies Are Paying Less Tax to the U.S. than to Foreign Governments

October 30, 2025 • By Matthew Gardner

Since 2017, these companies paid $135 billion in income taxes to foreign governments, but just $29 billion to the U.S.

Why States Shouldn’t Go Along With OBBBA’s Corporate Tax Breaks: A Practical Guide

October 27, 2025 • By Nick Johnson, Michael Mazerov

States should immediately decouple from four costly corporate tax provisions in the new federal tax law.

Well, That Was Fast: Trump Tax Law’s New Corporate Breaks are Already Worsening the Deficit

October 9, 2025 • By ITEP Staff

Corporate income taxes for the fiscal year that ended in September are $77 billion lower than in the previous year, a 15 percent drop.

Coca-Cola To Shareholders: $18 Billion Tax Bill? What $18 Billion Tax Bill?

October 1, 2025 • By Matthew Gardner

If Coca-Cola only pays 3% of the $18 billion tax bill it's facing, then the rest of us will have to pick up the remaining 97%.

Leaving Billions on the Table: Trump-Induced Brain Drain Leaves the IRS Struggling to Prevent Corporate Tax Avoidance

September 25, 2025 • By Matthew Gardner

The IRS's capacity to prevent big multinational corporations from avoiding income taxes is facing a generational crisis.

What currently stands in the way of better corporate tax transparency.

Who Can Make a Billion Dollar Mistake and Not Lose Their Jobs? Congress

September 5, 2025 • By Matthew Gardner

A drafting error in the 2017 tax law will cost U.S. taxpayers over $1 billion in unintended tax cuts for big multinationals.

Americans Want to Know Which Corporations Aren’t Paying Taxes, but House Republicans Want to Keep this Information Secret

July 23, 2025 • By Matthew Gardner

The appropriations plan released by House Republicans this weekend threatens to withhold funding for an obscure but vital financial oversight board because that board now requires corporations to disclose basic information about their income tax payments (or lack thereof).

This country’s biggest historical challenge has been delivering this progress to all Americans, but Republicans have cut it back for everyone, retreating from many 20th century achievements in ways that will slam doors, rather than opening them, for the next generation.

Five Issues for States to Watch in the Federal Tax Debate

June 3, 2025 • By Dylan Grundman O'Neill, Kamolika Das, Marco Guzman, Miles Trinidad, Neva Butkus

This post covers five particularly notable provisions for states: increasing deductions for state and local taxes (SALT) paid, allowing more generous tax write-offs for businesses, offering new avenues for capital gains tax avoidance to people contributing to private school voucher funds, carving tips and overtime out of the tax base, and re-upping Opportunity Zone tax breaks for wealthy investors.

House Bill’s $164 Billion Giveaway to Multinational Corporations Puts America Last

May 27, 2025 • By Sarah Austin

The House of Representatives’ recently passed tax bill changes course on taxing multinational corporations engaged in shifting U.S. profits overseas, offering massive tax giveaways that weaken American revenues and risk sending more American corporate investment offshore.

Want to know more about the tax and spending megabill that President Trump recently signed into law? We've got you covered.

It’s Tax Day. You’ve Paid Your Share, but the Billionaires Haven’t.

April 15, 2025 • By Amy Hanauer

You likely had most of your federal taxes deducted from your paychecks throughout the year. This is not true, however, for mega-millionaires and billionaires, some of whom are practically running our government right now.

Philadelphia Mayor’s Proposal to Cut Business Taxes is Illogical and Imprudent

April 7, 2025 • By Kamolika Das

Mayor Cherelle L. Parker’s proposal to cut the city’s business income and receipts tax (BIRT), based off the Philadelphia Tax Reform Commission’s recommendation, is illogical and imprudent. This is more than the city spends each year on homelessness services, public health, the streets department, and countless other programs that directly benefit residents.

What the Wall Street Journal Editorial Board Got Wrong About Tesla’s Tax Avoidance

April 4, 2025 • By Matthew Gardner

Tesla’s income tax avoidance is still in the news, and that’s a good thing.

Advantaging Affluence: A Distributional Analysis of Missouri HB 798’s Uneven Tax Cuts for Wealth and Work

March 28, 2025 • By Aidan Davis, Carl Davis, Dylan Grundman O'Neill, Eli Byerly-Duke, Matthew Gardner

Missouri House Bill 798 would reduce personal and corporate income tax rates, fully eliminate taxes on capital gains income from sale of assets, and eliminates the state’s modest Earned Income Tax Credit that assists many working people in lower-paid jobs. HB 798 would radically transform Missouri’s income tax code into a system that privileges income from wealth over income from work, leaving many middle-income families to pay a higher income tax rate than wealthy people living off their investments.

Why Americans Are Right to Be Unhappy About Corporate Tax Avoidance

March 26, 2025 • By Matthew Gardner

If lawmakers wanted to reduce income inequality and racial inequality, shutting down or at least limiting corporate tax breaks would be one option to achieve that goal. Unfortunately, President Trump and the current Congress show little interest in this and may even move in the opposite direction by introducing new corporate tax breaks.

The U.S. needs a tax code that is more adequate, meaning any major tax legislation should increase revenue, not reduce it. The U.S. also needs a tax code that is more progressive, meaning any significant tax legislation should require more, not less, from those most able to pay.

In last night’s address to Congress, President Trump spent more time insulting Americans, lying, and bragging than he did talking about taxes. But regardless of what President Trump and Elon Musk talk about most loudly and angrily, there is one clear policy that they and the corporations and billionaires that support them will try hardest […]

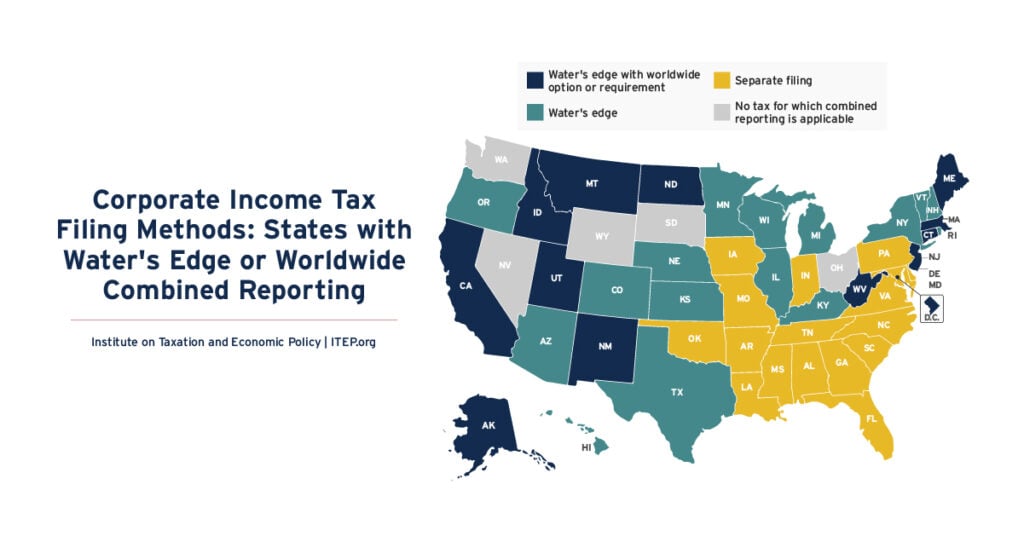

Corporate Income Tax Filing Methods: States with Water’s Edge or Worldwide Combined Reporting

February 21, 2025 • By ITEP Staff

The purpose of state corporate income taxes is to tax the profit, or net income, an incorporated business earns in each state. Ascertaining the state where profits are earned is, however, complicated for companies that conduct business in multiple jurisdictions. Twenty-eight states plus D.C. now require a limited version of combined reporting called “water’s edge” […]

A Revenue Analysis of Worldwide Combined Reporting in the States

February 20, 2025 • By Carl Davis, Matthew Gardner, Michael Mazerov

Universal adoption of mandatory worldwide combined reporting would boost state corporate income tax revenues by roughly 14 percent. Thirty-eight states and the District of Columbia would experience revenue increases totaling $19.1 billion.

The Five Biggest Corporations Represented at Trump’s Inauguration Could Save $75 Billion from One Tax Break Before Congress

February 11, 2025 • By Matthew Gardner, Spandan Marasini

New financial reports indicate five of America’s biggest corporations—Alphabet, Amazon, Apple, Meta, and Tesla—could win $75 billion in tax breaks if Congress and the President satisfy demands from corporate lobbyists to reinstate a provision repealed under the 2017 Trump tax law.

Trump and Congress’ Tax Package Likely to Worsen Racial Inequities

January 29, 2025 • By Brakeyshia Samms

While the country transitions to a new, yet familiar, presidential administration, lawmakers must keep in mind: fighting racial injustice should still be one of the focal points of this year’s tax debates. In theory, the debate over extending much of 2017’s Trump tax law represents an opportunity to advance racial equity. In practice, the tax package is likely to do the opposite, worsening racial inequities that already exist.

How Would the Harris and Trump Tax Plans Affect Different Income Groups?

October 23, 2024 • By Jon Whiten

Presidential candidates Kamala Harris and Donald Trump have put forward a wide range of different tax proposals during this year’s campaign. We have now fully analyzed the distributional impacts of the major proposals of both Vice President Harris and former President Trump in separate analyses. In all, the tax proposals announced by Harris would, on average, lead to a tax cut for all income groups except the richest 1 percent of Americans, while the proposals announced by Trump would, on average, lead to a tax increase for all income groups except the richest 5 percent of Americans.