Minnesota

Trends We’re Watching in 2019: The Use of Targeted Tax Breaks to Help Address Poverty and Inequality

February 7, 2019 • By Aidan Davis

Continuing to build upon the momentum of previous years, states are taking steps to create and improve targeted tax breaks meant to lift their most in-need state residents up and out of poverty. Most notably, a range of states are exploring ways to restore, enhance or create state Earned Income Tax Credits (EITC). EITCs are an effective tool to help struggling families with low wages make ends meet and provide necessities for their children. The policy, designed to bolster the earnings of low-wage workers and offset some of the taxes they pay, allows struggling families to move toward meaningful economic…

State Rundown 1/24: States Reflect on MLK’s Dream and Teacher Uprisings

January 24, 2019 • By ITEP Staff

This week, as Americans in every state celebrated Martin Luther King Jr. Day and reflected on his dream of peaceful protest and racial and economic justice, many eyes were on the teachers’ strike pressing for parts of this dream amid the “curvaceous slopes of California.” Governors and lawmakers in many states—including Arizona, Georgia, Indiana, Louisiana, Nevada, New Mexico, South Carolina, and Wisconsin—discussed ways to raise pay for teachers and/or enhance education investments generally.

State policy toward cannabis is evolving rapidly. While much of the debate around legalization has rightly focused on potential health and criminal justice impacts, legalization also has revenue implications for state and local governments that choose to regulate and tax cannabis sales. This report describes the various options for structuring state and local taxes on cannabis and identifies approaches currently in use. It also undertakes an in-depth exploration of state cannabis tax revenue performance and offers a glimpse into what may lie ahead for these taxes.

A Simple Fix for a $17 Billion Loophole: How States Can Reclaim Revenue Lost to Tax Havens

January 17, 2019 • By Richard Phillips

Enacting Worldwide Combined Reporting or Complete Reporting in all states, this report calculates, would increase state tax revenue by $17.04 billion dollars. Of that total, $2.85 billion would be raised through domestic Combined Reporting improvements, and $14.19 billion would be raised by addressing offshore tax dodging (see Table 1). Enacting Combined Reporting and including known tax havens would result in $7.75 billion in annual tax revenue, $4.9 billion from income booked offshore.

Who Pays and Why It Matters | MECEP Policy Insights Conference Keynote Address

January 16, 2019 • By Aidan Davis

States have broad discretion in how they secure the resources to fund education, health care, infrastructure, and other priorities important to communities and families. Aidan Davis with the Institute on Taxation and Economic Policy will offer a national perspective on state-level approaches to funding public investments and the implications of those approaches on tax fairness and revenue adequacy, and their economic outcomes. She’ll also provide insight on what’s in store for 2019 among the states.

State Rundown 1/10: States Should Resolve to Pursue Equitable Tax Options

January 10, 2019 • By ITEP Staff

This week we released a handy guide of policy options for Moving Toward More Equitable State Tax Systems, and are pleased to report that many state lawmakers are promoting policies that are in line with our recommendations. For example, Puerto Rico lawmakers recently enacted a targeted EITC-like credit for working families, and leaders in Virginia and elsewhere are working toward similar improvements. Arkansas residents also saw their tax code improve as laws reducing regressive consumption taxes and enhancing income tax progressivity just went into effect. And there is still time for governors and legislators pushing for regressive income tax cuts…

State Rundown 12/19: Time to Rest and Recharge for Big Year Ahead

December 19, 2018 • By ITEP Staff

With many people enjoying time off over the next couple weeks, and the longest nights of the year coming over the weekend, now is a good time to get plenty of rest and relaxation in advance of what is likely to be a very busy 2019 for state fiscal policy and other debates. Among those debates, Kentucky lawmakers will be returning to topics they could not resolve in a brief special session held this week, New Jersey and New York will both be deciding how to legalize and tax cannabis, and gas tax updates will be on the agenda in…

State Rundown 11/16: Election Results Clarify Agendas as Real Work Begins

November 16, 2018 • By ITEP Staff

State policymakers, voters, and observers have been reflecting on this year’s campaigns and looking ahead to how the policy opportunities in their states have shifted as a result. For example, Arkansas’s governor sees a fresh chance to slash income taxes on the state’s wealthiest residents, while the governor-elect of Illinois will be doing just the opposite, launching into a promised effort to shore up the state’s budget by asking the wealthy to pay more. New York and Virginia residents may end up with buyers’ remorse after Amazon accepted their combined $2 billion tax subsidy offers for its HQ2 project. And…

Today Amazon announced major expansions in New York and Virginia, where it intends to hire up to 50,000 full-time employees. The announcement marks the culmination of a highly publicized search that lasted more than a year and involved aggressive courting of the company by cities across the nation. The following are three tax-related observations on the announcement.

Tuesday’s elections shook up statehouses, governors’ offices, and tax laws in many states, and in this week’s Rundown we bring you the top 3 election state tax policy stories to emerge. First, voters in Kansas and other states sent a message that regressive tax cuts and supply-side economics have not succeeded and are not welcome among their state fiscal policies. Meanwhile, residents of many other states, including most notably Illinois, voted for representatives who reflect their preference for equitable, sustainable policies to improve their state economies through smart public investments and improve the lives of all residents through progressive tax structures. Lastly, while some states missed…

Minnesota Budget Project: Minnesota Ranks High for Tax Fairness in 50-State Study

October 17, 2018

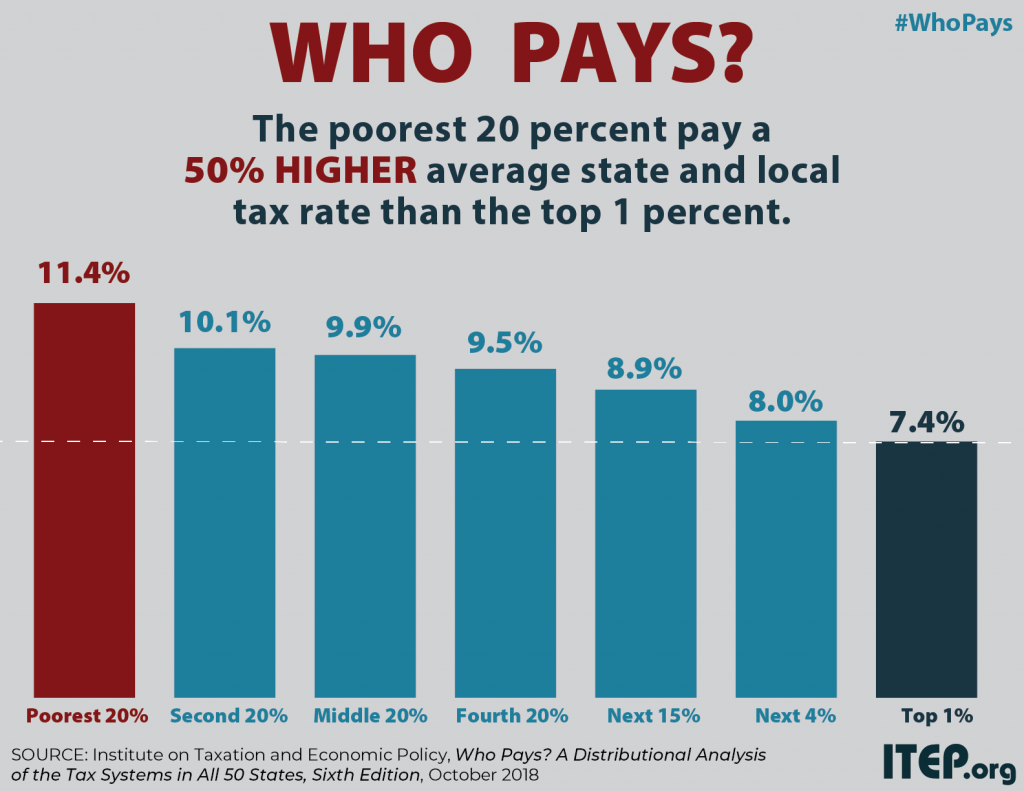

In an era of income inequality and growing concentration of wealth, a new 50-state study released today analyzes whether state tax systems make income inequality better or worse. The Institute on Taxation and Economic Policy (ITEP) finds that nearly every state fails basic measures of fairness, but Minnesota is among a small number of states where income inequality is reduced by state tax policy.

New Report Finds that Upside-down State and Local Tax Systems Persist, Contributing to Inequality in Most States

October 17, 2018 • By Aidan Davis

State and local tax systems in 45 states worsen income inequality by making incomes more unequal after taxes. The worst among these are identified in ITEP’s Terrible 10. Washington, Texas, Florida, South Dakota, Nevada, Tennessee, Pennsylvania, Illinois, Oklahoma, and Wyoming hold the dubious honor of having the most regressive state and local tax systems in the nation. These states ask far more of their lower- and middle-income residents than of their wealthiest taxpayers.

Minnesota: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

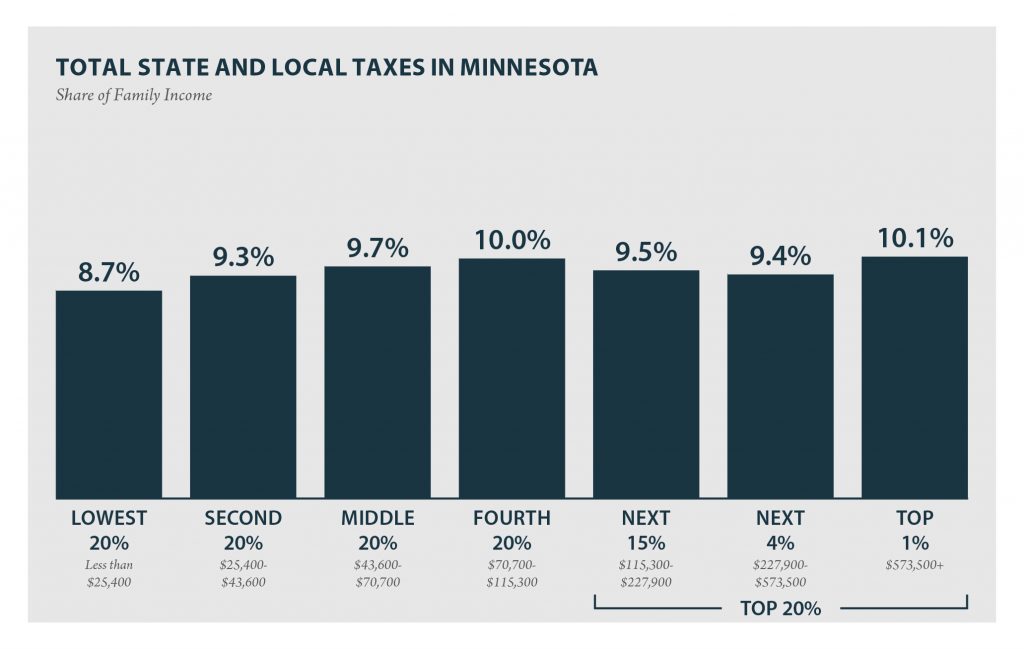

MINNESOTA Read as PDF MINNESOTA STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $25,400 $25,400 to $43,600 $43,600 to $70,700 $70,700 to $115,300 $115,300 to $227,900 $227,900 to $573,500 over $573,500 […]

State Rundown 10/12: Local Jurisdictions Fighting for Revenues, Independence

October 12, 2018 • By ITEP Staff

Voters all around the country are educating themselves for the upcoming elections, notably this week around ballot initiatives in Arizona and Colorado and competing gubernatorial tax proposals in Georgia and Illinois. But not all eyes are on the elections, as the relationship between state and local policy made news in Delaware, Idaho, North Dakota, and Ohio.

Tax Cuts 2.0 – Minnesota

September 26, 2018 • By ITEP Staff

The $2 trillion 2017 Tax Cuts and Jobs Act (TCJA) includes several provisions set to expire at the end of 2025. Now, GOP leaders have introduced a bill informally called “Tax Cuts 2.0” or “Tax Reform 2.0,” which would make the temporary provisions permanent. And they falsely claim that making these provisions permanent will benefit […]

State Rundown 9/26: States Cleaning Up from Florence, Gearing Up for November

September 26, 2018 • By ITEP Staff

Affordable housing efforts made news in Minnesota and Virginia this week, as tax breaks for homeowners and other victims of Hurricane Florence were made available in multiple states. Meanwhile, New Jersey is still looking into legalizing and taxing cannabis, and Wyoming continues to consider a corporate income tax. And gubernatorial candidates and ballot initiative efforts will give voters in many states much to consider in the November elections.

The Rundown is back after a few-week hiatus, with lots of state fiscal news and quality research to share! Maine lawmakers found agreement on a response to the federal tax-cut bill, states continue to sort out how they’ll collect online sales taxes in the wake of the Wayfair decision, and policymakers in several states have been working on summer tax studies and other preparations for 2019 legislative sessions. Meanwhile, work on ballot measures and candidate tax plans to go before voters in November has been even more active, particularly in Arizona, California, Florida, Hawaii, and Missouri. Our “What We’re Reading” section has lots of great research and reading on inequalities, cities turning…

State Tax Codes as Poverty Fighting Tools: 2018 Update on Four Key Policies in All 50 States

September 17, 2018 • By Aidan Davis, Misha Hill

This report presents a comprehensive overview of anti-poverty tax policies, surveys tax policy decisions made in the states in 2018, and offers recommendations that every state should consider to help families rise out of poverty. States can jumpstart their anti-poverty efforts by enacting one or more of four proven and effective tax strategies to reduce the share of taxes paid by low- and moderate-income families: state Earned Income Tax Credits, property tax circuit breakers, targeted low-income credits, and child-related tax credits.

State Rundown 8/22: Wayfair Fallout Could Hit the Pavement Soon

August 22, 2018 • By ITEP Staff

Arizona voters learned this week that they will have an opportunity this fall to restore school funding through a progressive tax measure. The effects of the Supreme Court’s Wayfair decision could soon be seen on Michigan and Mississippi roads, as leaders in both states have proposed devoting new online sales tax revenues to infrastructure needs. And new research highlighted in our “What We’re Reading” section discredits one-size-fits-all prescriptions for state economic growth such as supply-side tax-cut orthodoxy, advocating instead for more nuanced and state-specific policymaking.

Although most state legislatures are out of session during the summer, the pursuit of better fiscal policy has no "off-season." Here at ITEP, we've been revamping the State Rundown to bring you your favorite summary of state budget and tax news in the new-and-improved format you see here. Meanwhile, leaders in Massachusetts and New Jersey have been hard at work in recent weeks and are already looking ahead their next round of budget and tax debates. Lawmakers in many states are using their summer break to prepare for next year's discussions over how to implement online sales tax legislation. And…

Understanding and Fixing the New International Corporate Tax System

July 17, 2018 • By Richard Phillips

The Tax Cuts and Jobs Act (TCJA) radically changed the international tax system. It slashed taxes on corporate income, both domestic and foreign. It encouraged U.S. multinational corporations to shift jobs, profits, and tangible property abroad, and keep intangibles home. This report describes the new international tax system—and its many gaps—and also provides a road map for how to fix these gaps and surveys recent legislative approaches.

Building on Momentum from Recent Years, 2018 Delivers Strengthened Tax Credits for Workers and Families

July 10, 2018 • By Aidan Davis

Despite some challenging tax policy debates, a number of which hinged on states’ responses to federal conformity, 2018 brought some positive developments for workers and their families. This post updates a mid-session trends piece on this very subject. Here’s what we have been following:

With many state fiscal years beginning July 1, most states that will make decisions this year about federal tax conformity have now done so, so it is now time for an update on how well state policymakers have kept to, or veered from, the path we charted out earlier this year. Most states that have enacted laws in response to the federal changes have adhered to some but not all of the principles we laid out, with a few responding rather prudently and a handful charting a much more treacherous course of unfair, unsustainable policy based on unfounded promises of…

Urban Milwaukee: What’s Wrong with Illinois?

May 30, 2018

Although Illinois is widely viewed as a blue state because of its recent record of supporting Democratic presidential candidates, from a “who pays” angle it looks much more like a red state, collecting a much higher proportion of taxes from low earners than high earners. The next chart, based on data developed by the Institute […]

State Rundown 5/23: Special Sessions Abound Amid Budget Vetoes, Stalemates, Federal Tax Bill

May 23, 2018 • By ITEP Staff

This week the governors of Louisiana and Minnesota both vetoed budget bills, leading to another special session in Louisiana and unanswered questions in Minnesota, and Missouri legislators managed to push through a tax shift bill just before adjourning their regular session and heading right into a special session to impeach their governor. Wisconsin and Wyoming localities are both looking at ways to raise revenues as state funding drops. And our What We're Reading section contains helpful pieces on changing demographics, the effects of wealth inequality on families with children, and the impacts of the Supreme Court sports gambling and online…