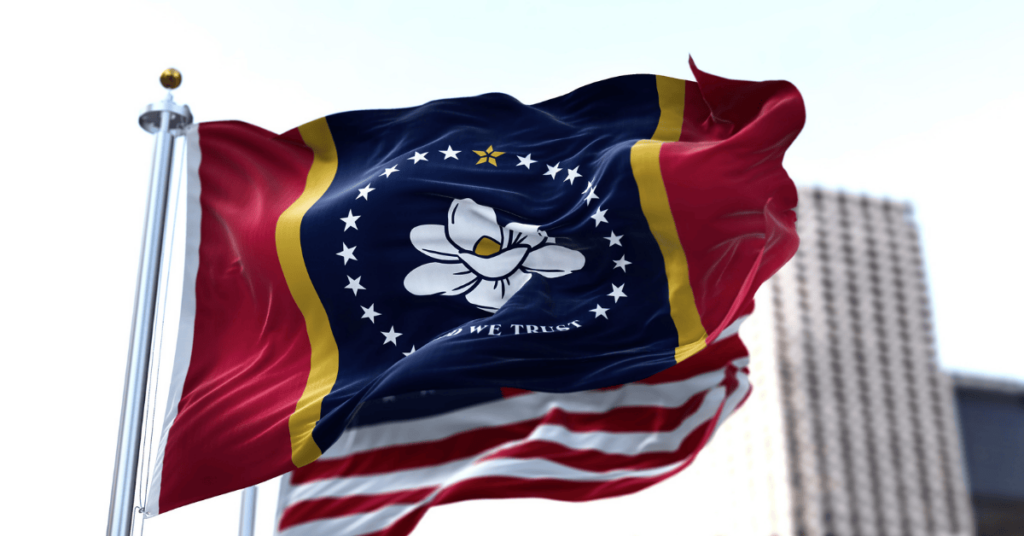

Mississippi

State Tax Watch 2026

March 9, 2026 • By ITEP Staff

ITEP tracks tax discussions in legislatures across the country and uses our unique data capacity to analyze the revenue, distributional, and racial and ethnic impacts of many of these proposals. State Tax Watch offers the latest news and movement from each state.

What Did 2025 State Tax Changes Mean for Racial and Economic Equity?

February 9, 2026 • By Brakeyshia Samms

The results are a mixed bag, with some states enacting promising policies that will improve tax equity and others going in the opposite direction.

Despite wintry conditions across much of the country, that hasn’t stopped state lawmakers from debating major tax policy changes.

As state legislative sessions ramp up across the country, property taxes are one of many issues dominating tax policy conversations in statehouses.

From Congressional discussions over the so-called "One Big Beautiful Bill Act" to debates on property taxes, ITEP kept busy this year analyzing tax proposals and showing Americans across the country how tax decisions affect them.

State Rundown 11/13: States Tackle Impending Deficits, Pennsylvania Secures an EITC

November 13, 2025 • By ITEP Staff

Revenue forecasts look increasingly grim as states anticipate shortfalls due to the slowing economy and impacts of the new federal tax law.

State Tax Dollars Shouldn’t Subsidize Federal Opportunity Zones

November 12, 2025 • By Eli Byerly-Duke

The Opportunity Zones program benefits wealthy investors more than it benefits disadvantaged communities.

State and Local Policymakers Can Resist Austerity Even Amid Historic Federal Retreat

November 6, 2025 • By Kamolika Das

The progressivity of the federal tax code has been waning. State and local policymakers should respond by protecting their revenue bases, promoting equity, and safeguarding vulnerable communities from harmful budget cuts.

States Begin Decoupling from Flawed ‘QSBS’ Tax Break

November 6, 2025 • By Nick Johnson, Sarah Austin

A costly tax break for wealthy venture capitalists is drawing some critical attention from state policymakers.

States across the nation are debating how best to respond to costly new federal tax cuts.

New Report: Five States with the Biggest Tax Cuts for Millionaires in 2025

October 16, 2025 • By ITEP Staff

Contact: Jon Whiten (ITEP) [email protected] A new analysis from the Institute on Taxation and Economic Policy (ITEP) reveals that five states—Kansas, Mississippi, Missouri, Ohio, and Oklahoma—enacted the most significant income tax cuts for millionaires in 2025, collectively reducing state revenues by more than $800 million in 2026 and an estimated $2.2 billion a year once […]

The 5 Biggest State Tax Cuts for Millionaires this Year

October 16, 2025 • By Dylan Grundman O'Neill, Aidan Davis

Some states continue to hand out huge tax cuts to millionaires. The five largest tax cuts this year will cost states a total of $2.2 billion per year once fully implemented.

Quite Some BS: Expanded ‘QSBS’ Giveaway in Trump Tax Law Threatens State Revenues and Enriches the Wealthy

October 2, 2025 • By Sarah Austin, Nick Johnson

States should decouple from the federal Qualified Small Business Stock (QSBS) exemption.

Trump’s Tax Law Clobbers State Budgets. Now’s the Time to Prepare.

August 13, 2025 • By ITEP Staff

The Trump megabill hands the richest 1% a trillion-dollar windfall while gutting funding for health care, education, and disaster relief — leaving communities to pick up the pieces. State and local leaders must step up, tax the wealthiest fairly, and safeguard the essentials that keep America healthy, educated, and safe.

Mississippi’s Path to Income Tax Elimination Hinders Racial and Economic Equity

August 7, 2025 • By Vanessa Woods

Mississippi policymakers this year took a big step to worsen the state’s racial income and wealth divides by passing a radical plan to eventually eliminate the state’s income tax.

State Tax Action in 2025: Amid Uncertainty, Tax Cuts and New Revenue

July 28, 2025 • By Aidan Davis, Neva Butkus, Marco Guzman

Federal policy choices on tariffs, taxes, and spending cuts will be deeply felt by all states, which will have less money available to fund key priorities. This year some states raised revenue to ensure that their coffers were well-funded, some proceeded with warranted caution, and many others passed large regressive tax cuts that pile on to the massive tax cuts the wealthiest just received under the federal megabill.

Sales Tax Holidays Miss the Mark When it Comes to Effective Sales Tax Reform

July 17, 2025 • By Miles Trinidad

Sales tax holidays are often marketed as relief for everyday families, but they do little to address the deeper inequities of regressive sales taxes. In 2025, 18 states offer these holidays at a collective cost of $1.3 billion.

How Much Would Every Family in Every State Get if the Megabill’s Tax Cuts Given to the Rich Had Instead Been Evenly Divided?

July 14, 2025 • By Michael Ettlinger

If instead of giving $117 billion to the richest 1 percent, that money had been evenly divided among all Americans, we'd each get $343 - or nearly $1,400 for a family of four.

Analysis of Tax Provisions in the Trump Megabill as Signed into Law: National and State Level Estimates

July 7, 2025 • By Steve Wamhoff, Carl Davis, Joe Hughes, Jessica Vela

President Trump has signed into law the tax and spending “megabill” that largely favors the richest taxpayers and provides working-class Americans with relatively small tax cuts that will in many cases be more than offset by Trump's tariffs.

Trump Megabill Will Give $117 Billion in Tax Cuts to the Top 1% in 2026. How Much In Your State?

June 30, 2025 • By Michael Ettlinger

The predominant feature of the tax and spending bill working its way through Congress is a massive tax cut for the richest 1 percent — a $114 billion benefit to the wealthiest people in the country in 2026 alone.

How Much Do the Top 1% in Each State Get from the Trump Megabill?

June 30, 2025 • By Carl Davis

The Senate tax bill under debate right now would bring very large tax cuts to very high-income people. In total, the richest 1 percent would receive $114 billion in tax cuts next year alone. That would amount to nearly $61,000 for each of these affluent households.

Sweeping Federal Tax and Spending Changes Threaten Local Governments

June 3, 2025 • By Kamolika Das

Given this environment, local leaders must do what they can to preserve and strengthen progressive revenue tools, advocate for expanded local taxing authorities and flexibility, and push their state leaders to decouple from harmful federal tax changes.

Analysis of Tax Provisions in the House Reconciliation Bill: National and State Level Estimates

May 22, 2025 • By Carl Davis, Jessica Vela, Joe Hughes, Steve Wamhoff

The poorest fifth of Americans would receive 1 percent of the House reconciliation bill's net tax cuts in 2026 while the richest fifth of Americans would receive two-thirds of the tax cuts. The richest 5 percent alone would receive a little less than half of the net tax cuts that year.

Want to know more about the tax and spending megabill that President Trump recently signed into law? We've got you covered.

Center on Budget and Policy Priorities: Mississippi Moves to Eliminate Income Tax, Deepening Inequality and Threatening Public Services

April 25, 2025

Mississippi policymakers have taken one of the most extreme steps in state tax policy in recent years: enacting a law that will gradually phase out the state’s personal income tax. Signed by Gov. Tate Reeves in March, the move begins the final stage of a years-long push to dismantle a key pillar of the state’s tax system, which has long helped fund education, health care, infrastructure, and other core services.