Mississippi

Summer is quickly (and sadly) coming to an end and if you’ve been away enjoying the great outdoors or off the grid, we’re here to help keep you up to date on what’s been happening on the tax front around the country...

One Voice: Who Pays, Mississippi? An Overview of State Tax Policy and Racial Equity Impacts

August 17, 2021

Historic and current injustices, both in public policy and in society more broadly, have resulted in vast disparities in income across race and ethnicity in Mississippi. State and local tax codes are not the sole contributors to, nor will they be the sole solution to, racial economic inequities. However, the state’s tax system is playing […]

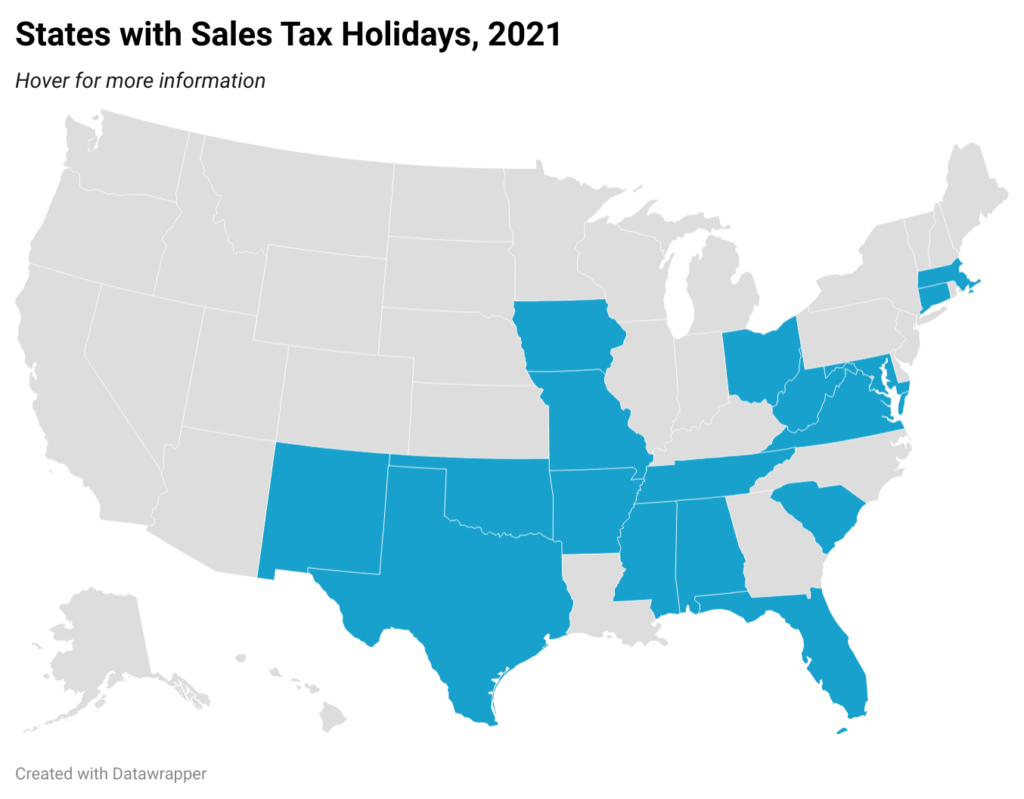

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

August 6, 2021 • By Dylan Grundman O'Neill

Policymakers tout sales tax holidays as a way for families to save money while shopping for “essential” goods. On the surface, this sounds good. However, a two- to three-day sales tax holiday for selected items does nothing to reduce taxes for low- and moderate-income taxpayers during the other 362 days of the year. Sales taxes are inherently regressive. In the long run, sales tax holidays leave a regressive tax system unchanged, and the benefits of these holidays for working families are minimal. Sales tax holidays also fall short because they are poorly targeted, cost revenue, can easily be exploited, and…

State Rundown 8/4: Tis the Season…for Unnecessary Sales Tax Holidays

August 4, 2021 • By ITEP Staff

It’s beginning to look a lot like that time of year again. That’s right, it’s sales tax holiday season and states across the country are doing their best to induce spending that would probably occur regardless...

State Rundown 7/21: States Go for Tax Policy Gold This Olympics Season

July 21, 2021 • By ITEP Staff

It’s Olympics season! As countries around the globe battle for first place in a plethora of sports and contests it’s as good a time as any to look around America to see which states deserve a gold medal in the ‘Equitable Tax Policy’ event...

The Child Tax Credit in Practice: What We Know About the Payoffs of Payments (Webinar)

July 7, 2021 • By ITEP Staff

Join us for a discussion on why tax credits like the Child Tax Credit (CTC) expansion are good economic policy. You’ll hear from anti-poverty experts on why Congress should extend the policy beyond 2021 and what we can learn from an initiative providing low-income mothers in Jackson, Miss., $1,000 cash on a monthly basis, no strings attached. From theory to practice and what it means for American families, this CTC webinar will provide a unique angle through which to view this transformative policy.

State Rundown 5/27: State Legislatures Step Back, Advocates Push Forward

May 27, 2021 • By ITEP Staff

As more and more state legislatures wrap up their sessions and we reflect on the whirlwind that is this past year, it’s easy to focus on the steps back that states like Oklahoma have taken and Nebraska, North Carolina, and Arizona are trying to take. We have had some significant wins in states over the course of the year, but not every development will be a good one. However, we know advocates are on the ground, working tirelessly to help states maintain equity and progressivity in their tax codes. And for that, we have many of you—our intrepid readers of…

Income Tax Increases in the President’s American Families Plan

May 25, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

President Biden’s American Families Plan includes revenue-raising proposals that would affect only very high-income taxpayers.[1] The two most prominent of these proposals would restore the top personal income tax rate to 39.6 percent and eliminate tax breaks related to capital gains for millionaires. As this report explains, these proposals would affect less than 1 percent of taxpayers and would be confined almost exclusively to the richest 1 percent of Americans. The plan includes other tax increases that would also target the very well-off and would make our tax system fairer. It would raise additional revenue by more effectively enforcing tax…

Take a minute on this Tax Day to reflect on all that you survived, accomplished, and contributed to the collective good this past year, and be proud. There is always more work to be done to build the communities we desire, and paying your share is what allows that work to continue.

Mississippi Today: Mississippi could help long-neglected poor with Rescue Plan payments

May 16, 2021

For instance, those earning less than $16,100 pay 10.2% of their income on state and local taxes, primarily because of Mississippi’s high sales tax rate, which includes the 7% tax on groceries. Those in the middle — earning between $43,000 and $77,500 pay — pay 9.2% of their income on state and local taxes, while […]

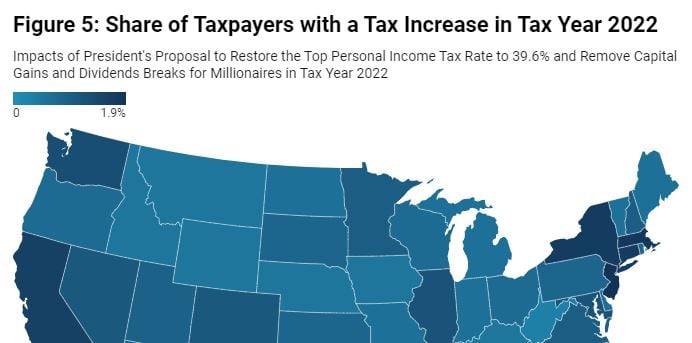

Effects of the President’s Capital Gains and Dividends Tax Proposals by State

May 6, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

President Biden’s proposal to eliminate the lower income tax rate on capital gains (profits from selling assets) and stock dividends for millionaires would affect less than half of one percent (0.4 percent) of U.S. taxpayers if it goes into effect in 2022. The share of taxpayers affected would be less than 1 percent in every state.

Bloomberg: N.Y., New Jersey, California Hit Hardest by Biden Tax Changes

April 29, 2021

President Joe Biden’s plan to ramp up the income tax rate and capital gains tax rate as part of a $1.8 trillion stimulus plan would hit high-tax states like New York and California the hardest, while New Mexico and Mississippi would be least affected, according to research from the Institute on Taxation and Economic Policy. […]

Bold Progressive State Tax Victories Provide Bright Spots in Difficult Year

April 27, 2021 • By Dylan Grundman O'Neill

“Bold progressive victories” is probably not the first phrase that comes to mind when thinking about state laws enacted so far in 2021...But progressive advocates, lawmakers, and voters have won some tremendous victories in states recently...We should celebrate them for the achievements they are—and closely study them for lessons they can teach about how to bring about positive progressive change in these and other states.

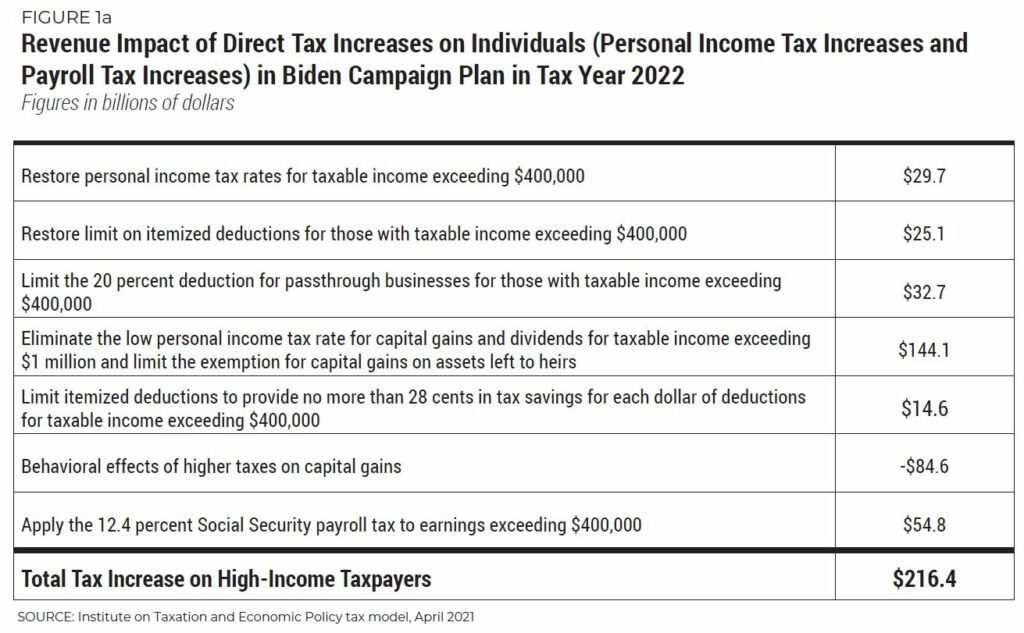

National and State-by-State Estimates of President Biden’s Campaign Proposals for Revenue

April 8, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

During his presidential campaign, Joe Biden proposed to change the tax code to raise revenue directly from households with income exceeding $400,000. More precisely, Biden proposed to raise personal income taxes on unmarried individuals and married couples with taxable income exceeding $400,000, and he also proposed to raise payroll taxes on individual workers with earnings exceeding $400,000. Just 2 percent of taxpayers would see a direct tax hike (an increase in either personal income taxes, payroll taxes, or both) if Biden’s campaign proposals were in effect in 2022. The share of taxpayers affected in each state would vary from a…

State Rundown 4/7: Tax Justice Advocates Applaud New York Budget Deal

April 7, 2021 • By ITEP Staff

New York lawmakers stole the spotlight this week as they were able to agree on—and convince reluctant Gov. Andrew Cuomo to support—strong progressive tax increases on the highest-income households and corporations in the state to fund shared priorities like K-12 education and pandemic recovery efforts. Minnesota leaders are attempting a similar performance off Broadway with progressive reforms of their own, while Kansas legislators are getting poor reviews for cutting a number of taxes and worsening their budget situation. Thankfully major tax changes stayed backstage as sessions concluded in Georgia and Mississippi.

State Rundown 4/1: Most States Resisting Foolish Tax Cut Games That Tear Revenues Apart

April 1, 2021 • By ITEP Staff

Supporters of tax fairness and adequate funding for public needs are hoping West Virginia’s income tax elimination effort turns out to be a prank, but most states are not fooling around with such harmful policies this year. For example...

Taxes and Racial Equity: An Overview of State and Local Policy Impacts

March 31, 2021 • By ITEP Staff

Historic and current injustices, both in public policy and in broader society, have resulted in vast disparities in income and wealth across race and ethnicity. Employment discrimination has denied good job opportunities to people of color. An uneven system of public education funding advantages wealthier white people and produces unequal educational outcomes. Racist policies such as redlining and discrimination in lending practices have denied countless Black families the opportunity to become homeowners or business owners, creating extraordinary differences in intergenerational wealth. These inequities have long-lasting effects that compound over time.

Jackson (Miss.) Clarion-Ledger: Eliminating state income tax would hurt Mississippi working families, widen inequities

March 25, 2021

This is because individual income taxes are the only major tax in which the state’s highest-income earners pay a larger percentage of their income in taxes than the state’s lower-income earners. Not surprisingly, then, the state’s wealthiest households stand to gain the most from eliminating the tax. On average, Mississippians in the lowest 20% of […]

It was a relatively quiet week in state fiscal policy, likely partly due to states waiting for federal guidance on some of the details in the American Rescue Plan. As they await those details, lawmakers in Mississippi and West Virginia continue to wrangle over whether to recklessly eliminate their income taxes, while leaders in states including Connecticut and New York considered more productive and progressive reforms. And in the meantime, groundbreaking work on the intersection of race and tax policy is now available.

State Rundown 3/17: Momentum for Sound Progressive Tax Reforms Continues to Build

March 17, 2021 • By ITEP Staff

We wrote last week that the inclusion of fiscal relief for states and localities in Congress’s American Rescue Plan should free up state lawmakers’ time and attention to focus on the comprehensive reforms needed to address upside-down and inadequate tax codes, and some states are already doing just that.

One Voice Mississippi: Bill Analysis: House Bill 1439: Tax Proposal Moves State Away from a Better, More Equitable Mississippi

March 16, 2021

Mississippi’s House of Representatives recently passed House Bill 1439 (“the Mississippi Tax Freedom Act of 2021”). The House passed the 300-page bill less than 24 hours after they introduced it with little debate and no fiscal note. The plan revives the recurring attempts of some lawmakers to cut state income taxes, but does much more. […]

Trickle-Down Myths Swamp Tax Policy Debates in Mississippi and West Virginia

March 15, 2021 • By Aidan Davis

Recent proposals in both Mississippi and West Virginia seek to pare back, and ultimately eliminate, each state’s income tax while shifting the responsibility of funding services even more onto low- and middle-income taxpayers through increased consumption taxes. The states are moving forward with this tax experiment even though a similar experiment notoriously and immediately sent Kansas into a financial tailspin.

State Rundown 3/10: Federal Pandemic Aid Means States Can Focus on the Big Picture

March 10, 2021 • By ITEP Staff

State and local policymakers will be preoccupied for a short time with celebrating and deciphering the federal pandemic relief package approved today, but ultimately the federal aid should free them to focus on even bigger concerns such as tax codes that often fail to adequately fund core priorities even in good years and exacerbate the economic and racial inequities that this pandemic has laid bare.

Mississippi Today: Study: House Tax Proposal Increases Burden on Poor Mississippians

March 9, 2021

The bottom 60% of Mississippi’s income earners would be paying more taxes under legislation that has passed the House while the top 40% would be paying less, according to an analysis conducted by a Washington, D.C.-based policy think tank. A person in the top 1% with average income of $924,000 would pay $28,610 less in […]

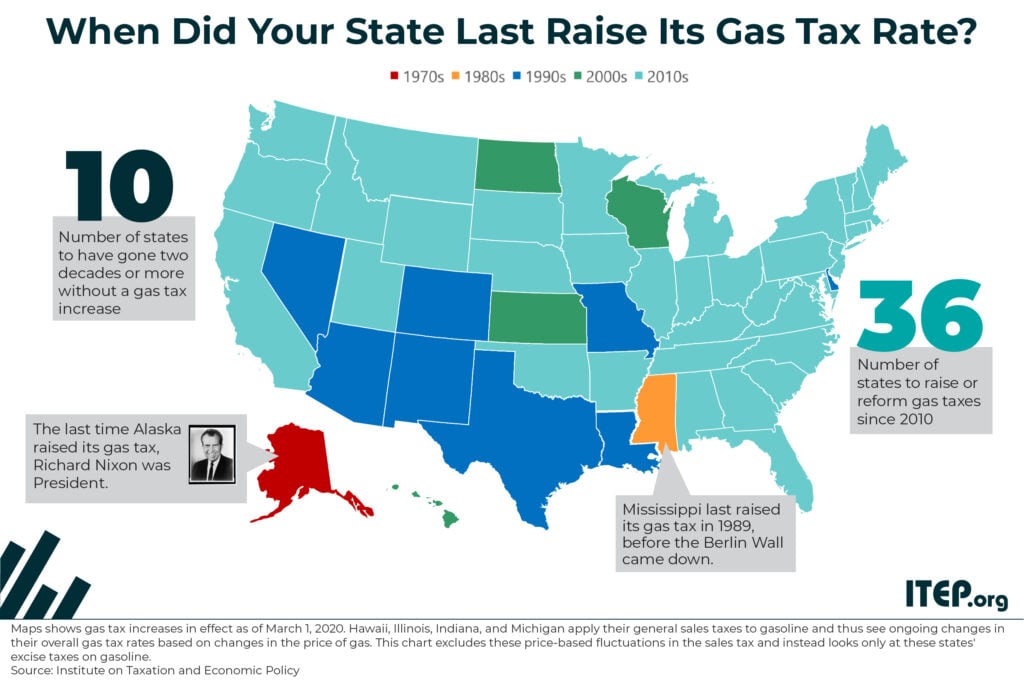

Many state governments are struggling to repair and expand their transportation infrastructure because they are attempting to cover the rising cost of asphalt, machinery, and other construction materials with fixed-rate gasoline taxes that are rarely increased.