This blog was updated on November 6, 2024 to include the unofficial results for most of the ballot questions below.

As we approach November’s election, voters in several states will be weighing in on tax policy changes. The outcomes will impact the equity of state and local tax systems and the adequacy of the revenue those systems are able to raise to fund public services. (Worth noting: there are a lot of local tax ballot questions as well; we run those down here.)

Before we dive into the states with tax ballot questions, a quick note about one that’s not happening. The California Supreme Court in June removed a sweeping measure placed on the ballot by anti-tax activists that would have devastated public services across the state by requiring the legislature to seek approval from the voters for any new or higher state tax, creating a restrictive two-thirds supermajority requirement for voter-initiated local taxes.

This would have certainly been the highest-profile and most harmful tax measure on this year’s state ballots. But there are still plenty of other tax policy changes being put before state voters this November.

Washington

Voters in Washington state will decide whether to keep or repeal the state’s new pathbreaking tax on capital gains. The 7 percent Capital Gains Excise Tax, which was created in 2021 and went into effect in 2022, has a modest impact on only the wealthiest families in the state – those who sell more than a quarter-million dollars worth of stocks and similar assets per year (homes, farms, and most business assets are exempt).

Initiative 2109 asks Washington voters if they would like to repeal the tax. Doing so would give the wealthiest 0.2 percent of Washingtonians a tax cut and eliminate over $2 billion in critical funding for child care, early learning, and school construction over the next five years, according to the Washington State Budget and Policy Center.

For decades, Washington had long been home to the most regressive tax code in the nation due to its lack of an income tax and heavy reliance on sales and excise taxes. But the creation of the state’s Capital Gains Excise Tax and the new Working Families Tax Credit helped Washington shed that dubious distinction and rise one spot on ITEP’s Tax Inequality Index.

Update (11/6/24): This measure failed, with 63 percent voting “no.”

North Dakota

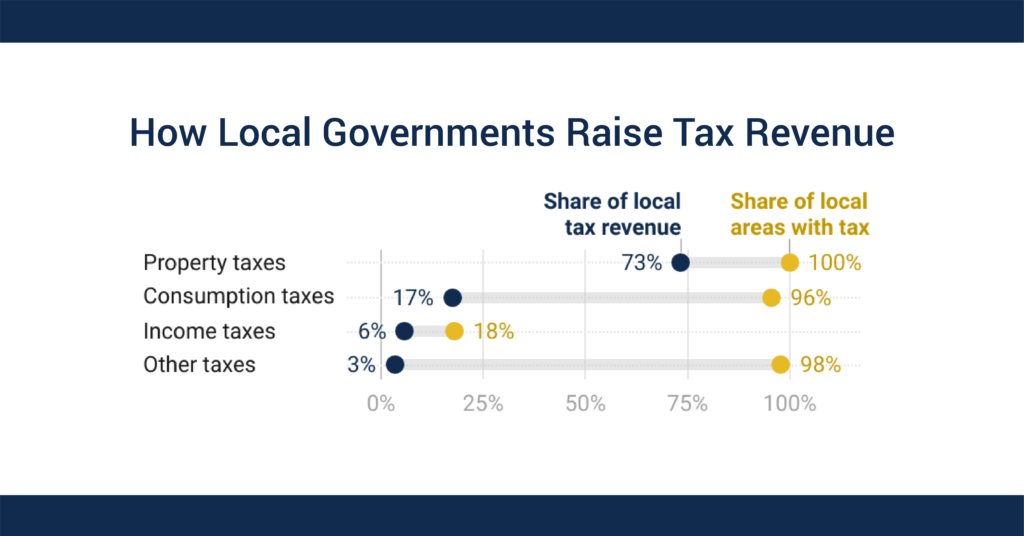

North Dakota voters will decide whether to eliminate property taxes across the state. In 2023, property taxes raised $1.4 billion a year in North Dakota to fund schools, libraries, emergency responders, and other services. As we’ve shown, the property tax is a critical revenue source for local governments, comprising 73 percent of all local revenue raised nationwide.

North Dakota’s Measure 4 would force the state government to replace that lost property tax revenue, and there is no plan to raise new revenue at the state level to keep public services funded at current levels. Despite the insistence of the measure’s key backer, who claims the state has enough extra money to cover the cost, the end result would have to include deep cuts to services, other tax increases – likely from sources that ask more of low- and middle-income families, or both.

Property taxes in North Dakota and elsewhere can be a pain point for many families as property values have been increasing much more than wages. But the solution is not to eliminate them or put artificial caps on their growth. Instead, policymakers should adopt circuit breakers, which prevent property taxes from exceeding a percentage of household income through refunds or credits.

Update (11/6/24): This measure failed, with 64 percent voting “no.”

Oregon

Oregon voters will decide whether to increase the state’s corporate minimum tax to fund a new rebate that would send cash payments to all the state’s residents. Measure 118 would increase the tax to 3 percent on in-state business sales of more than $25 million, and then distribute it via tax refunds or direct payments to every resident of the state. The state estimates the rebate is likely to be as much as $1,286 in 2026 and $1,790 by 2027.

This measure is well-intentioned but comes with significant downsides.

First and foremost, it is poorly targeted and would deliver tax rebates or payments to all Oregonians, regardless of need. Tax rebate or credit programs work best and are most equitable when they are targeted to those most in need. And that’s particularly important in a state like Oregon where the state’s overall tax system, on balance, asks low-income families to pay the highest tax rates.

This proposal would also divert some existing revenue that pays for education, health, and other services to help pay for the rebates – a revenue loss that would grow to over $1 billion per fiscal year by FY 2029, according to the state’s estimates. As the Oregon Center for Public Policy notes, the measure would also likely result in vulnerable Oregonians losing public benefits and would make it harder to raise revenue for critical needs in the future.

Raising the corporate minimum tax would help improve the equity of Oregon’s tax code while raising revenue to invest in important priorities. Tying it to a blanket rebate program that would help the wealthy as much as the poor, however, diminishes the state’s ability to meaningfully improve equity.

Update (11/6/24): This measure failed, with 79 percent voting “no.”

South Dakota

Voters in South Dakota will decide whether to eliminate the sales tax on groceries, though some observers have warned that Measure 28’s vague language could lead to a much broader sales tax carveout.

The proposal to eliminate the state’s grocery tax seems straightforward in theory, but the measure states that a yes vote bars state sales taxes “on anything sold for human consumption, not including alcoholic beverages or prepared food.” Depending on interpretation, this could extend to items like tobacco, toiletries, and utilities. That’s why legislative analysts estimate the annual revenue loss could be anywhere from $134 million to $646 million out of a $7.3 billion budget.

While eliminating the sales tax on groceries would slightly improve the fairness of South Dakota’s tax system, the revenue loss could lead to other tax increases or cuts to public services that would especially harm low- and moderate-income families, especially since the state has no personal income tax. What’s more, despite the trend toward reducing or eliminating state grocery taxes, we know there are more targeted ways to help families struggling to afford food and other basics, like refundable tax credits.

Update (11/6/24): This measure failed, with 70 percent voting “no.”

Illinois

In Illinois, voters will weigh in on a non-binding ballot measure asking whether the state should create a 3 percent surtax on income over $1 million to fund property tax cuts. The advisory question comes four years after Illinois voters narrowly rejected the Illinois Fair Tax ballot measure, which would have allowed the state to create a progressive, graduated personal income tax.

This year’s question takes a slightly different approach by not directly changing the state’s constitutionally enshrined flat income tax and by tying the revenue explicitly to the reduction of property taxes. It comes just two years after Massachusetts voters approved the Fair Share Amendment, which created a 4 percent surcharge on income over $1 million to fund education and transportation. Like Illinois, Massachusetts’ constitution previously required a flat income tax. As we have shown, flat taxes are key drivers of regressive state tax systems and guarantee that wealthy families will pay a lower share of their income to state and local taxes than families of more modest means.

Creating a more equitable income tax in Illinois would improve the state’s overall tax system, which is the 8th most regressive in the nation. It would also raise billions in new revenue to fund important priorities; the state estimates that this proposed surcharge could raise $4.5 billion a year.

Update (11/6/24): This measure passed, with 60 percent voting “yes.”

Nevada

Nevada voters will decide whether to exempt diapers from the state sales tax. If Question 5 is approved, Nevada would join 19 states plus D.C. that exempt diapers from taxation. The exemption would narrow the state’s sales tax base and lead to a revenue loss of approximately $8 million each year, according to state estimates.

Update (11/6/24): This measure passed, with 68 percent voting “yes.”

Arizona

Arizonans will vote on a measure that would allow residents to request property tax refunds if they feel they have suffered property damage due to the local government not properly enforcing Arizona’s vagrancy and nuisance laws against homeless residents.

Proposition 312 represents a perfect storm of anti-tax and anti-homeless ideologies. The measure is not only cruel, but counterproductive. Vagrancy laws are often used as criminal punishments for people with nowhere else to go. Arizona municipalities could be forced to raid their general fund to pay back dissatisfied residents, which in turn hurts the funding needed to help people who are homeless.

Update (11/7/24): This measure passed, with 58 percent voting “yes.”

A grab-bag of other property tax measures

Three states – Colorado, New Mexico, and Virginia – have ballot measures that would expand their disabled veterans’ exemptions to veterans or their surviving spouses. New Mexico voters will also weigh in on increasing the value of the veterans’ exemption and tying it to inflation. Update (11/6/24): All of these measures passed.

Florida voters will consider amending the state constitution to require annual inflation adjustments to property tax values for homeowners who apply for homestead property tax exemptions. If approved, this would amount to a tax cut for municipalities, costing them as much as $112 million annually in just a few years. Update (11/6/24): This measure passed, with 66% voting “yes.”

Georgia has two property tax measures on the ballot. Referendum A would exempt personal property valued at less than $20,000 from personal property taxation. This is an exemption that would primarily benefit business owners and farms, as personal property is only taxed on things like farm equipment, manufacturing equipment, and raw materials. And Referendum 1 would change the local homestead exemption program from an opt-in program for counties to an opt-out program for all localities. Only 39 of the state’s 159 counties currently participate. Update (11/6/24): Both these measures passed, with 65% and 63% voting “yes,” respectively.

Louisiana voters in December will consider allowing the state more flexibility on designing and administering property tax sales. Amendment 4 would take the current structure out of the state constitution and require the legislature to create a new process. Tax sales, and particularly tax lien sales, can separate low- or fixed-income property owners from their homes through the tax foreclosure process. By allowing for more flexibility, this referendum could help ensure all owners are treated equally under the law and are not stripped of their home equity.

Lastly, Wyoming has a ballot measure that would create a new class designation for residential property. Currently, commercial and residential property are all lumped together. If the measure passes, the legislature could also create a sub-class of owner-occupied residences, which may allow assessment at a different rate than non-owner-occupied residences. Property classification is a useful tool that allows for different property tax rates or assessment levels and is often used to reduce taxes on homeowners. Update (11/6/24): This measure looks likely to pass, with 59 percent voting “yes.”

This blog was updated on October 29, 2024 to include South Dakota’s ballot measure.