New Hampshire

Education Week: How Do Schools Solve a Problem Like Property Taxes?

February 19, 2026

As tax season dawns, backlash to a nationwide surge in property-tax bills is spurring states to double down on proposals to diminish one of the main revenue sources for school districts. At least 10 states are pitching the end of one of schools’ chief revenue sources. Read more.

NCTI is an Important Part of the Federal Corporate Tax. States Should Adopt It Too.

February 12, 2026 • By Carl Davis

Including NCTI in state corporate tax law is an effective way to neutralize much of the tax avoidance that occurs when multinational companies artificially shift their profits into overseas tax havens.

State Rundown 2/11: This Valentine’s Day, Conscious Decoupling Is Our Love Language

February 11, 2026 • By ITEP Staff

While some may be excited for a romantic Valentine’s Day this weekend, many state lawmakers are breaking up and decoupling from recent federal tax changes that are poised to leave states with revenue shortfalls – much like a bad date who forgets their wallet and asks you to pick up the tab.

State Tax Watch 2026

February 2, 2026 • By ITEP Staff

ITEP tracks tax discussions in legislatures across the country and uses our unique data capacity to analyze the revenue, distributional, and racial and ethnic impacts of many of these proposals. State Tax Watch offers the latest news and movement from each state.

State Rundown 1/22: Cautious Tone Noticeable in Most Statehouses

January 22, 2026 • By ITEP Staff

Most states are adopting a very cautious approach so far this year as legislators begin their sessions and governors make their annual addresses, thanks to ongoing economic uncertainty and federal retrenchment.

State Rundown 1/14: New Year Brings New Resolutions for Funding Key Priorities

January 14, 2026 • By ITEP Staff

State governors are beginning to lay out their top priorities as legislatures reconvene in statehouses around the country.

Texas Property Tax Plan Mimics California’s Damaging Prop 13

December 19, 2025 • By Neva Butkus, Rita Jefferson

This proposal would disrupt the state’s housing market and jeopardize local revenues while doing very little to help workers and families struggling to pay their property tax bills – just as Prop 13 did in California.

New Hampshire Fiscal Policy Institute: New Federal Reconciliation Law Reduces Taxes, Health Access, and Food Assistance Supports for Granite Staters

August 6, 2025

The new federal reconciliation law, signed on July 4, 2025, makes significant changes to programs that will impact Granite Staters. These changes include direct interactions with individuals and families, including reducing taxes for most residents, particularly those with higher incomes, and limiting access to both health services and food assistance. The new law also impacts the financial outlooks for both the State and federal governments, which may affect subsequent policy choices and services.

How Much Would Every Family in Every State Get if the Megabill’s Tax Cuts Given to the Rich Had Instead Been Evenly Divided?

July 14, 2025 • By Michael Ettlinger

If instead of giving $117 billion to the richest 1 percent, that money had been evenly divided among all Americans, we'd each get $343 - or nearly $1,400 for a family of four.

Analysis of Tax Provisions in the Trump Megabill as Signed into Law: National and State Level Estimates

July 7, 2025 • By Steve Wamhoff, Carl Davis, Joe Hughes, Jessica Vela

President Trump has signed into law the tax and spending “megabill” that largely favors the richest taxpayers and provides working-class Americans with relatively small tax cuts that will in many cases be more than offset by Trump's tariffs.

Trump Megabill Will Give $117 Billion in Tax Cuts to the Top 1% in 2026. How Much In Your State?

June 30, 2025 • By Michael Ettlinger

The predominant feature of the tax and spending bill working its way through Congress is a massive tax cut for the richest 1 percent — a $114 billion benefit to the wealthiest people in the country in 2026 alone.

How Much Do the Top 1% in Each State Get from the Trump Megabill?

June 30, 2025 • By Carl Davis

The Senate tax bill under debate right now would bring very large tax cuts to very high-income people. In total, the richest 1 percent would receive $114 billion in tax cuts next year alone. That would amount to nearly $61,000 for each of these affluent households.

State legislatures are enjoying a relatively quiet period right now, though it is merely a temporary calm before the storm of the federal tax and budget debate begins raging again.

As the Washington, D.C. region heads toward a likely recession, local policymakers will need to look to new revenue sources to help lessen the pain. In D.C., lawmakers ought to adopt a simple reform that would raise substantial revenue and make the District’s business tax system fairer.

State Rundown 6/5: States Wrap Sessions, Some Prepare for Fiscal Uncertainty

June 5, 2025 • By ITEP Staff

States use the final hours of their legislative sessions to address deficits and preserve revenue in preparation for the times ahead.

Analysis of Tax Provisions in the House Reconciliation Bill: National and State Level Estimates

May 22, 2025 • By Carl Davis, Jessica Vela, Joe Hughes, Steve Wamhoff

The poorest fifth of Americans would receive 1 percent of the House reconciliation bill's net tax cuts in 2026 while the richest fifth of Americans would receive two-thirds of the tax cuts. The richest 5 percent alone would receive a little less than half of the net tax cuts that year.

America Has Left the Building: U.S. Loses from Our Global Tax Policy Choices, Others Could Gain

May 5, 2025 • By Amy Hanauer

Countries that once looked to the U.S. for direction on tax policy have concluded they need to form alliances without us. If so, it will often be to the benefit of other people around the globe and to the deficit of U.S. communities.

Want to know more about the tax and spending megabill that President Trump recently signed into law? We've got you covered.

Trump Administration’s Decision to End Direct File is Another Gift to Big Corporations

April 16, 2025 • By ITEP Staff

Contact: Jon Whiten ([email protected]) According to multiple reports, the Trump administration plans to eliminate the IRS Direct File program, a free electronic system for filing tax returns directly to the agency. Statement from ITEP Executive Director Amy Hanauer “The tax preparation industry has for years lobbied to prevent the IRS from providing a tool to […]

IRS Cooperation with ICE Will Damage Public Trust, Putting Tax Revenues in Jeopardy

April 10, 2025 • By Marco Guzman

Attempts by the Department of Homeland Security to secure private information from the IRS on people who file taxes with an Individual Taxpayer Identification Number is a violation of federal privacy laws that protect taxpayers. It is also a change that could seriously damage public trust in the IRS, which could jeopardize billions of dollars in tax payments by hardworking immigrant families.

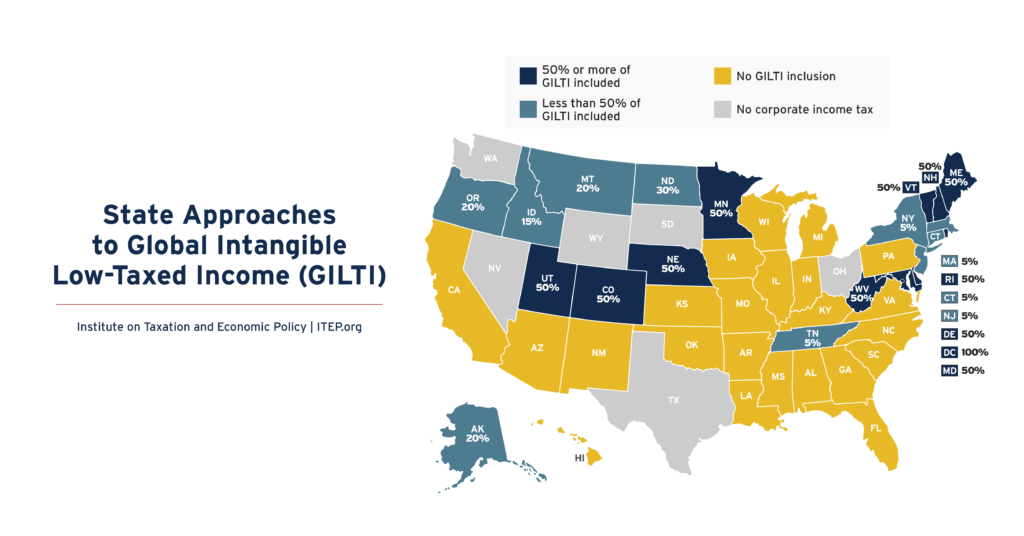

Many states with corporate income taxes include some amount of federally defined Global Intangible Low-Taxed Income (GILTI) in their tax bases. Twenty-one states plus D.C. include some amount of GILTI in their tax calculations in 2025.

Below is a list of tax expenditure reports published in the states.

A Revenue Analysis of Worldwide Combined Reporting in the States

February 20, 2025 • By Carl Davis, Matthew Gardner, Michael Mazerov

Universal adoption of mandatory worldwide combined reporting would boost state corporate income tax revenues by roughly 14 percent. Thirty-eight states and the District of Columbia would experience revenue increases totaling $19.1 billion.

Turning IRS Agents to Deportation Will Reduce Public Revenues

February 11, 2025 • By Carl Davis, Jon Whiten

The Trump Administration’s plan to turn IRS agents into deportation agents will result in lower tax collections in addition to the harm done to the families and communities directly affected by deportations.

Trump’s Plan to Extend His 2017 Tax Provisions: Updated National and State-by-State Estimates

January 8, 2025 • By Steve Wamhoff

Trump’s plan to make most of the temporary provisions of his 2017 tax law permanent would disproportionately benefit the richest Americans. This includes all major provisions except the $10,000 cap on deductions for state and local taxes (SALT) paid.