New Jersey

Bloomberg: Trump’s SALT `War’ Revisited: Most Blue Staters Will Get Tax Cut

January 12, 2018

n blue New Jersey, for instance, the new law will raise taxes on about 285,000 filers earning between $79,890 and $336,620, with a typical hike of about $1,400, according to an analysis by the liberal Institute on Taxation and Economic Policy. However, more than 1.2 million New Jerseyans in the same income range will get a […]

New York Magazine: California, New Jersey, and New York Designing Workarounds to Blunt GOP Tax Bill Impact

January 12, 2018

In a memo released in 2011, the Internal Revenue Service gave its blessing for taxpayers to claim federal deductions on those gifts. The combination of a 100 percent state-tax credit and a federal deduction actually makes the gifts profitable for some donors, said Carl Davis, research director for the Institute on Taxation and Economic Policy. […]

The Problems with State Workarounds to the Federal SALT Deduction

January 12, 2018 • By Alan Essig

From the outset, states—particularly wealthier states—objected to the GOP’s proposal to limit SALT deductions in part because it reduces the amount of state and local taxes that the federal government essentially picks up for taxpayers (by allowing a SALT deduction, the federal government is, in effect, paying part of taxpayers’ state and local tax bill), which could hinder states’ ability to raise revenue. Simply focusing on SALT, though, misses the bigger picture. The fact remains that the overall tax bill disproportionately benefits higher-income taxpayers even with the $10,000 SALT cap in place. Responding to federal tax cuts that disproportionately benefit…

State Rundown 1/4: Will States Show Resolve in a Challenging Year?

January 4, 2018 • By ITEP Staff

This week marks the beginning of what is bound to be a wild year for state tax and budget debates. Essentially every state is already working to sort through the complicated ramifications of the federal tax cuts passed in December, including Kansas, Michigan, Montana, and New Jersey highlighted below. These and other states will have important decisions to make about how to incorporate, reject, or mitigate various aspects of the new federal law, and will need considerable resolve to improve state tax policy to be more fair and more adequate – even as federal taxes become less so.

New Jersey Policy Perspectives: Failure to Act on DACA and Dream Act Would Harm New Jersey’s Tax Revenues

December 20, 2017

There are 53,000 young immigrants who were potentially eligible for DACA that call New Jersey home. They have attended our public schools, graduated high school and many have enrolled in our public colleges. And many are our coworkers, our neighbors and loved ones. They currently pay a total of $57 million to state and local […]

Bloomberg: These Are the Tricks States May Use to Get Around the SALT Deduction

December 19, 2017

Republican Senate and House negotiators in Washington agreed last week on a $10,000 cap on state and local tax deductions, or SALT. In high-tax states, that’s bad news. Personal taxes are poised to rise for 13 percent of New Yorkers and 11 percent of California and New Jersey residents, according to an analysis by left-leaning […]

Final GOP-Trump Bill Still Forces California and New York to Shoulder a Larger Share of Federal Taxes Under Final GOP-Trump Tax Bill; Texas, Florida, and Other States Will Pay Less

December 17, 2017 • By Meg Wiehe

Residents of California and New York pay a large amount of the nation’s federal personal income taxes relative to their share of the population. As illustrated by the table below, the final GOP-Trump tax bill expected to be approved this week would substantially increase the share of total federal personal income taxes (PIT) paid by both states. Connecticut, Maryland, Massachusetts, and New Jersey would also see their share of federal PIT increase.

How the Final GOP-Trump Tax Bill Would Affect New Jersey Residents’ Federal Taxes

December 16, 2017 • By ITEP Staff

The final tax bill that Republicans in Congress are poised to approve would provide most of its benefits to high-income households and foreign investors while raising taxes on many low- and middle-income Americans. The bill would go into effect in 2018 but the provisions directly affecting families and individuals would all expire after 2025, with […]

The Final Trump-GOP Tax Plan: National and 50-State Estimates for 2019 & 2027

December 16, 2017 • By ITEP Staff

The final Trump-GOP tax law provides most of its benefits to high-income households and foreign investors while raising taxes on many low- and middle-income Americans. The bill goes into effect in 2018 but the provisions directly affecting families and individuals all expire after 2025, with the exception of one provision that would raise their taxes. To get an idea of how the bill will affect Americans at different income levels in different years, this analysis focuses on the bill’s impacts in 2019 and 2027.

ITEP researchers have produced new reports and analyses that look at various pieces of the tax bill, including: the share of tax cuts that will go to foreign investors; how the plans would affect the number of taxpayers that take the mortgage interest deduction or write off charitable contributions, and remaining problems with the bill in spite of proposed compromises on state and local tax deductions.

State Rundown 12/13: Supermajority Laws Considered in Some States Even as They Confound Others

December 13, 2017 • By ITEP Staff

Supermajority requirements for tax increases are proving a major obstacle to responsible budgeting in Oklahoma, while ballot initiatives are being filed to alter or abolish Oregon‘s similar requirement, but a similar requirement is slowly advancing toward the ballot in Florida nonetheless. Displeasure with agricultural property taxes are spawning both a ballot initiative drive and a […]

New Republic: Tax Reform to Own the Libs

December 8, 2017

According to analysis from the Institute on Taxation and Economic Policy, New York, New Jersey, Maryland, and California would pay $17 billion more in taxes by 2027, while Texas and Florida, two large states that Trump won, would pay $31 billion less. “You can definitely see the ideological tilt here,” Carl Davis, the institute’s research […]

Mother Jones: Republican Plan Threatens School Funding to Pay for Corporate Tax Cuts

December 8, 2017

In New Jersey, 41 percent of taxpayers write off state and local taxes, averaging a $17,200 deduction. In Texas, 22 percent deduct an average of $7,600 apiece. Taxes and the cost of living are high enough in some blue states that many middle-class taxpayers would see their taxes go up if SALT is repealed. In New Jersey, […]

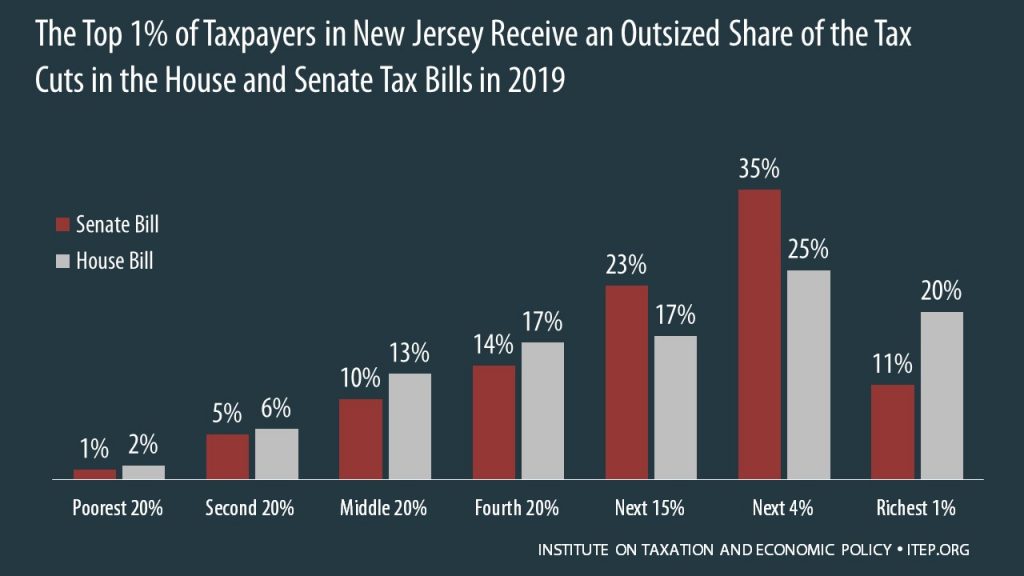

How the House and Senate Tax Bills Would Affect New Jersey Residents’ Federal Taxes

December 6, 2017 • By ITEP Staff

The House passed its “Tax Cuts and Jobs Act” November 16th and the Senate passed its version December 2nd. Both bills would raise taxes on many low- and middle-income families in every state and provide the wealthiest Americans and foreign investors substantial tax cuts, while adding more than $1.4 trillion to the deficit over ten years. The graph below shows that both bills are skewed to the richest 1 percent of New Jersey residents.

National and 50-State Impacts of House and Senate Tax Bills in 2019 and 2027

December 6, 2017 • By ITEP Staff

The House passed its “Tax Cuts and Jobs Act” November 16th and the Senate passed its version December 2nd. Both bills would raise taxes on many low- and middle-income families in every state and provide the wealthiest Americans and foreign investors substantial tax cuts, while adding more than $1.4 trillion to the deficit over ten years. National and 50-State data available to download.

Quartz: The Republican tax plan takes aim at one of the biggest engines of US growth

November 30, 2017

As Los Angeles Times Jim Puzzanghera pointed out recently, California is already one of a handful of states that pays more to the federal government than it receives. The Republican plan currently being debated in the Senate is likely to make this imbalance even larger. While most of the country can expect to benefit from […]

The State Rundown is back from Thanksgiving break with a heaping helping of leftover state tax news, but beware, some of it may be rotten.

The Atlantic: The Big Blue Losers in the GOP Tax Plan

November 28, 2017

Between the mortgage and SALT limits, the bills hit many upper-middle-class taxpayers, especially in blue states. The Institute on Taxation and Economic Policy calculates that by 2027 the Senate bill would raise taxes on about 45 percent of households between the 80th and 95th income percentiles in California, Virginia, New Jersey, and New York; and […]

ITEP has analyzed each of the tax proposals advanced by the House and Senate in recent weeks. While some details have changed, the bottom line is the same: The plans would disproportionately benefit corporations and the wealthy. The Senate tax plan ITEP’s latest analysis examined the proposal that passed the Senate Finance Committee on Nov. […]

Revised Senate Plan Would Raise Taxes on at Least 29% of Americans and Cause 19 States to Pay More Overall

November 18, 2017 • By ITEP Staff

The tax bill reported out of the Senate Finance Committee on Nov. 16 would raise taxes on at least 29 percent of Americans and cause the populations of 19 states to pay more in federal taxes in 2027 than they do today.

New York Times: Confused by Tax Bills?

November 17, 2017

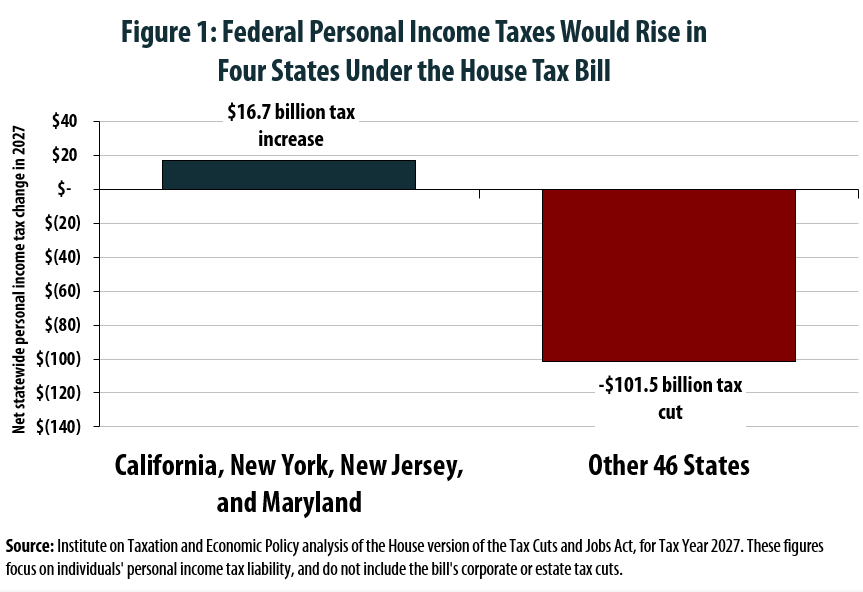

Compared with current law, the House bill, which was passed Thursday, would raise personal federal income taxes on California, New Jersey, New York and Maryland residents by $16.7 billion in 2027, according to an Institute on Taxation and Economic Policy analysis. Florida and Texas, however, would get $31.2 billion in cuts. Read more

Los Angeles Times: A Tax Bill No Responsible California Lawmaker Should Support

November 16, 2017

But the bill’s cuts in personal tax rates, its increase in the standard deduction and other benefits for individual taxpayers are partially offset by reductions in some popular tax deductions — including those for state and local taxes and mortgage interest payments, many of whose beneficiaries live in states with high income or sales taxes […]

CNN: GOP Tax Plans Could Fuel the Suburban Revolt Against Trump

November 15, 2017

The bite from the GOP bill is deeper for upper-middle-class families in major metropolitan areas, particularly in Democratic-leaning states where taxes, and usually property values, are higher. While only about one-in-five families between the 80th and 95th income percentiles in most red states would face higher taxes by 2027 under the House GOP bill, that […]

House Tax Plan Offers an Exceptionally Bad Deal for California, New York, New Jersey, and Maryland

November 14, 2017 • By Carl Davis

An ITEP analysis reveals that four states would see their residents pay more in aggregate federal personal income taxes under the House’s Tax Cuts and Jobs Act. While some individual taxpayers in every state would face a tax increase, only California, New York, Maryland, and New Jersey would see such large increases that their residents’ overall personal income tax payments rise when compared to current law.

How the Revised Senate Tax Bill Would Affect New Jersey Residents’ Federal Taxes

November 14, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In New Jersey, 50 percent of the federal tax cuts would go to the richest 5 percent of residents, and 22 percent of households would face a tax increase, once the bill is fully implemented.