New Mexico

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

August 2, 2023 • By Marco Guzman

Nineteen states have sales tax holidays on the books in 2023, and these suspensions will cost nearly $1.6 billion in lost revenue this year. Sales tax holidays are poorly targeted and too temporary to meaningfully change the regressive nature of a state’s tax system. Overall, the benefits of sales tax holidays are minimal while their downsides are significant.

States and Localities are Making Progress on Curbing Unjust Fees and Fines

July 18, 2023 • By Andrew Boardman

Too many state and local governments tap legal-system collections, rather than adequate tax systems, to fund shared essentials like public safety and education. But a growing number of states and localities are choosing a better approach. Momentum for change has continued to build in 2023, with no fewer than seven states enacting substantial improvements.

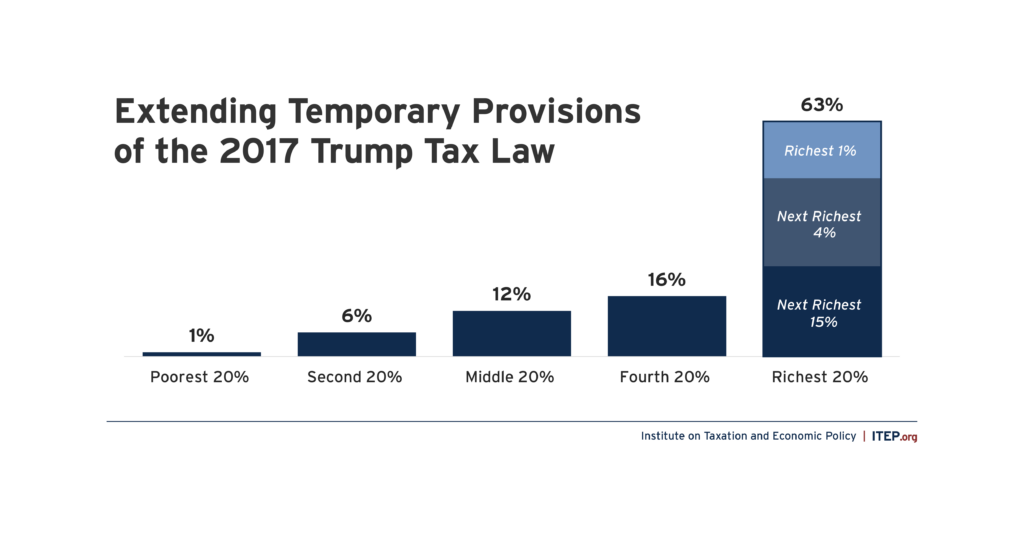

Extending Temporary Provisions of the 2017 Trump Tax Law: National and State-by-State Estimates

May 4, 2023 • By Joe Hughes, Matthew Gardner, Steve Wamhoff

The push by Congressional Republicans to make the provisions of the 2017 Tax Cuts and Jobs Act permanent would cost nearly $300 billion in the first year and deliver the bulk of the tax benefits to the wealthiest Americans.

State Rundown 4/12: Tax Day 2023 – A Good Reminder of the Impact of Our Collective Investments

April 12, 2023 • By ITEP Staff

With Tax Day quickly approaching it’s worth taking some time to reflect not just on tax forms (though those are important!), but also on the current state of state tax policy...

As nature bursts into life and color with the arrival of spring, state tax proposals are doing the same as the legislative seeds planted by lawmakers earlier this year start to grow, blossom, and in some cases rot. However, some governors are not entirely happy with what state lawmakers have produced.

State Rundown 3/9: The Whirlwind 2023 Legislative Session Continues

March 9, 2023 • By ITEP Staff

State 2023 legislative sessions are proving to be eventful ones. With many states eager to make use of their budget surpluses, major tax changes are still being proposed and others signed into law. Michigan residents will soon see an increase to their state Earned Income Tax Credit (from 6 percent to 30 percent) after the […]

This week, a fresh bouquet of tax proposals was delivered by state lawmakers, but not all of them have left us with that warm, fuzzy feeling in our stomachs...

State Rundown 2/1: February Brings New (and Some Old) Tax Policy Conversations

February 1, 2023 • By ITEP Staff

Tax bills across the U.S. are winding their way through state legislatures and governors continue to set the tone for this year’s legislative sessions...

State Rundown 1/11: Governors Ready to Talk Tax in 2023 State Addresses

January 11, 2023 • By ITEP Staff

Governors have begun their annual trek to the podium in statehouses across the U.S. to lay out their visions for 2023, and so far, taxes look like they will play a major role in debates throughout state legislative sessions...

State Rundown 12/15: State Priorities for 2023 Begin to Take Shape

December 15, 2022 • By ITEP Staff

State leaders have begun to release budget projections for 2023 and a familiar theme has emerged once again: big revenue surpluses, which have many state lawmakers pushing for another round of tax cuts despite the monumental challenges that we as a country face that call for sustainable revenues...

State Child Tax Credits and Child Poverty: A 50-State Analysis

November 16, 2022 • By Aidan Davis

Regardless of future Child Tax Credit developments at the federal level, state policies can supplement the federal credit to deliver additional benefits to children and families. State credits can be specifically tailored to meet the needs of local populations while also producing long-term benefits for society as a whole

Do you remember/the big tax news innn September? Well, if not, we at ITEP got you covered...

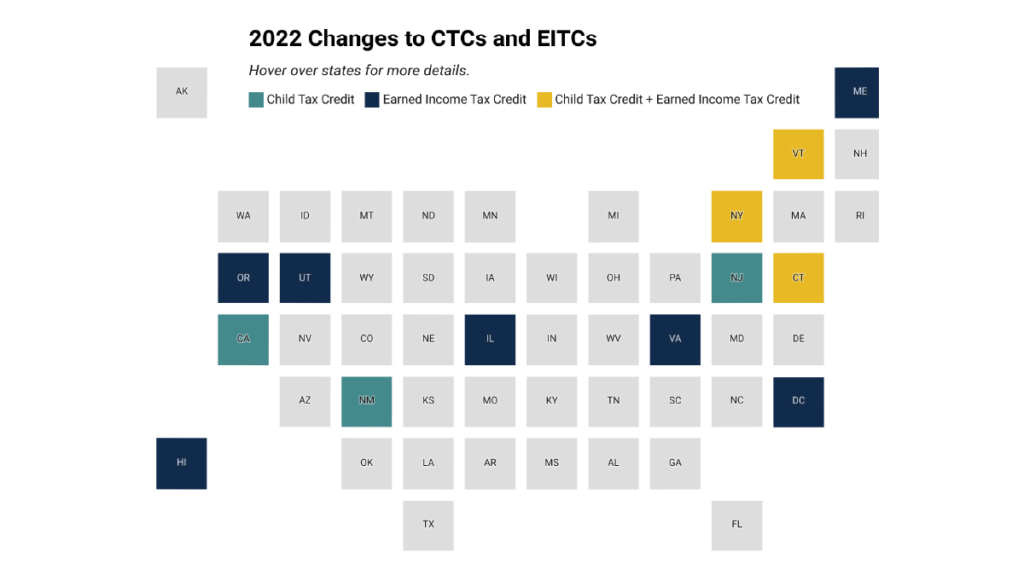

ITEP Policy Briefs: More and More States Are Helping Low-Income Families with New and Expanded Tax Credits

September 15, 2022 • By ITEP Staff

13 states plus D.C. created or expanded state CTCs or EITCs this year, helping create more equitable state tax systems WASHINGTON, D.C.: In 2022’s state legislative sessions, lawmakers across the country advanced tax policies that will bolster the economic security of millions of low- and moderate-income working families through new and enhanced Child Tax Credits […]

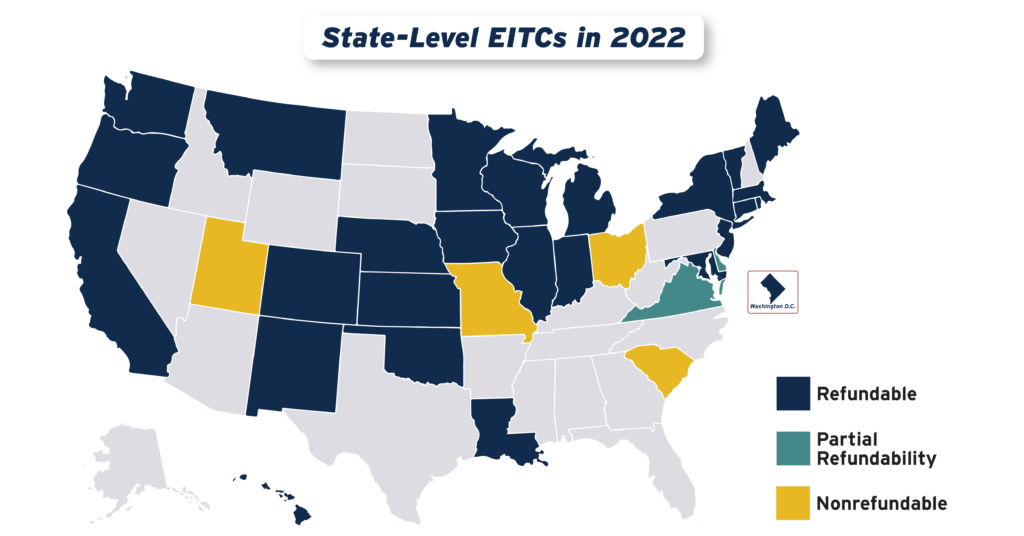

Boosting Incomes and Improving Tax Equity with State Earned Income Tax Credits in 2022

September 15, 2022 • By Aidan Davis

States continued their recent trend of advancing EITCs in 2022, with nine states plus the District of Columbia either creating or improving their credits. Utah enacted a 15 percent nonrefundable EITC, while the District of Columbia, Hawaii, Illinois, Maine, Vermont and Virginia expanded existing credits. Meanwhile, Connecticut, New York and Oregon provided one-time boosts to their EITC-eligible populations.

More States are Boosting Economic Security with Child Tax Credits in 2022

September 15, 2022 • By Aidan Davis

After years of being limited in reach, there is increasing momentum at the state level to adopt and expand Child Tax Credits. Today ten states are lifting the household incomes of families with children through yearly multi-million-dollar investments in the form of targeted, and usually refundable, CTCs.

Census Data Shows Need to Make 2021 Child Tax Credit Expansion Permanent

September 14, 2022 • By Joe Hughes

The Child Tax Credit expansion led to a 46 percent decline in childhood poverty. That it could be accomplished during the largest economic disruption in most of our lifetimes underscores a basic fact: thoughtful, decisive government action to combat poverty works.

Legislative Momentum in 2022: New and Expanded Child Tax Credits and EITCs

July 22, 2022 • By Neva Butkus

State legislatures across the country made investments in their future, centering children, families, and workers by enacting and expanding state Earned Income Tax Credits (EITCs), Child Tax Credits (CTCs), and other refundable credits this session. In total, seven states either expanded or created CTCs this session. Connecticut, New Mexico, New Jersey, Rhode Island and Vermont […]

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

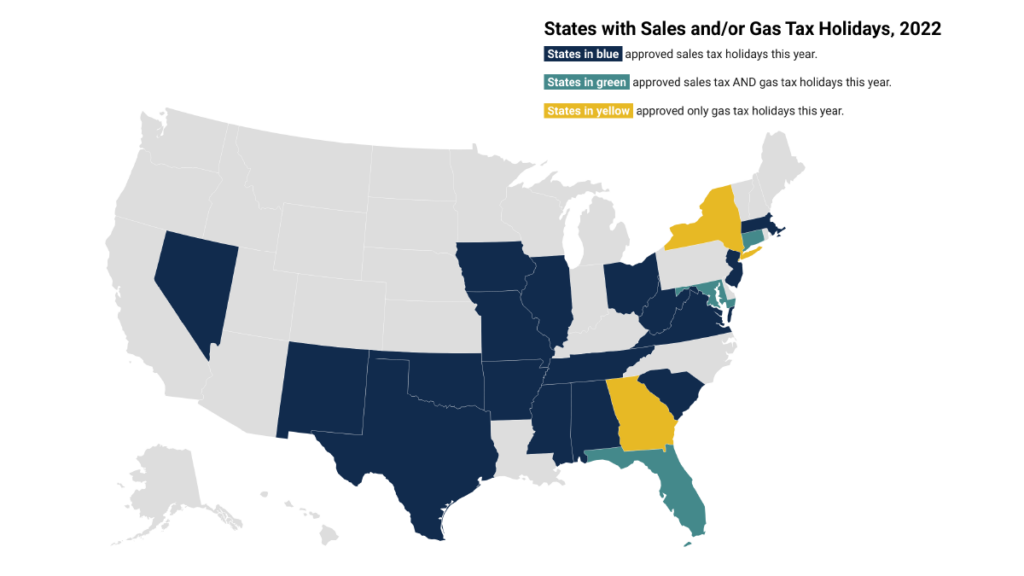

July 20, 2022 • By Marco Guzman

Lawmakers in many states have enacted “sales tax holidays” (20 states will hold them in 2022) to temporarily suspend the tax on purchases of clothing, school supplies, and other items. These holidays may seem to lessen the regressive impacts of the sales tax, but their benefits are minimal while their downsides are significant—particularly as lawmakers have sought to apply the concept as a substitute for more meaningful, permanent reform or arbitrarily reward people with specific hobbies or in certain professions. This policy brief looks at sales tax holidays as a tax reduction device.

From the Bay State to the Golden State, lawmakers across the nation are making deals and negotiating budgets with major tax implications...

Last week we highlighted how several states were pushing through regressive tax cuts as their legislative sessions are coming to a close. Well, this week many of those same states took further actions on those bills and it’s safe to say we’re even less impressed than before...

Bloomberg: Did You Pay Your ‘Fair Share’ of Federal Income Tax This Year?

March 31, 2022

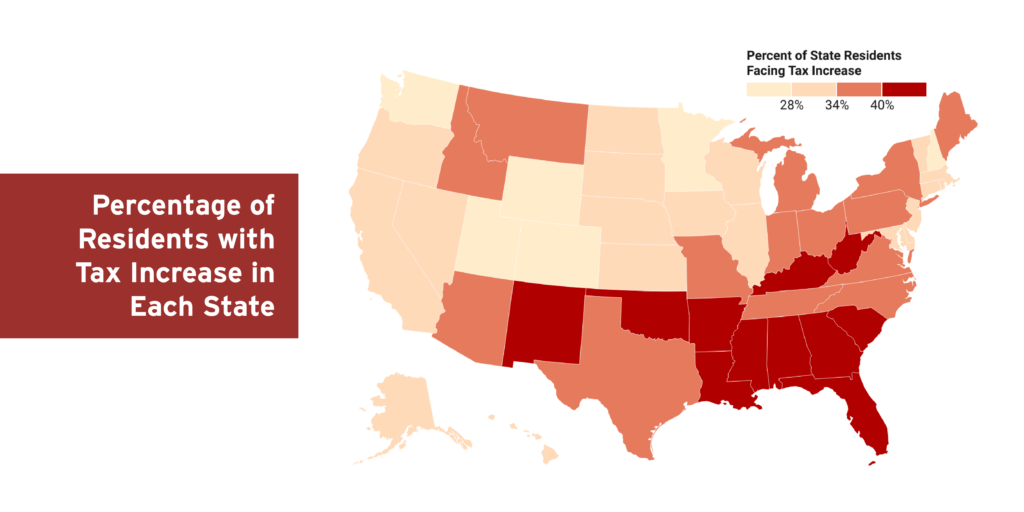

And according to the Institute on Taxation and Economic Policy, the impact would have a definite geographic tilt. The states where more than 40% of residents would face tax increases are largely in the South, including Mississippi, West Virginia, Arkansas, Louisiana, Alabama, Kentucky, Oklahoma, Georgia, New Mexico, South Carolina, and Florida. read more

Spring is around the corner and like those pesky allergies that come along with it, equally pesky tax proposals continue to pop up in states across the U.S....

State Rundown 3/9: One State Stands Out Amid the Avalanche of Tax Cuts

March 9, 2022 • By ITEP Staff

The avalanche of regressive tax-cut proposals coming out of state legislatures has not slowed over the course of the winter months, but one state has provided a shot of hope to advocates of tax equity...

A Better Alternative: New Mexico Prioritizes Targeted, Temporary Tax Cuts

March 9, 2022 • By Marco Guzman

New Mexico stands in stark contrast to the many examples of poorly targeted tax-cut proposals currently being considered around the country.

New 50-State Analysis: Poorest Two-Fifths Would Bear the Brunt of Sen. Rick Scott’s Proposed Tax Increase

March 7, 2022 • By ITEP Staff

“Billionaires are getting richer, and some of them are altogether avoiding taxes or paying a tiny percentage relative to their income and wealth. The 2017 tax law further worsened inequality by giving huge tax breaks to the rich. It’s inconceivable that a lawmaker would propose to single out the most vulnerable households for higher taxes.” --Steve Wamhoff