New York

Bloomberg: The Myth of the Middle-Class SALT Cap Victim

April 23, 2021

Once again, if you make well under $1 million a year and your tax rate really did go up from 2017 to 2018 because of the SALT cap, I’m not denying that your suffering is real. But you appear to be in a distinct minority even in New York, New Jersey, Connecticut, California and other […]

Jacobin: Democrats’ Lies About Tax Breaks Sound a Lot Like Republicans’

April 20, 2021

If you only listened to Democratic lawmakers, you might think these numbers are dramatically different in Democratic states with higher state and local taxes — but “there is no state where this is a primarily middle-class issue,” reported the Institute on Taxation and Economic Policy. As just one example: the group’s state-by-state analysis found that […]

A new ITEP analysis provides critical data for the debate over whether to repeal the $10,000 cap on state and local tax (SALT) deductions. The report finds that repeal of the SALT cap without other reforms would worsen economic disparities and exacerbate racial inequities baked into the federal tax system.

Not Worth Its SALT: Tax Cut Proposal Overwhelmingly Benefits Wealthy, White Households

April 20, 2021 • By Carl Davis, ITEP Staff, Jessica Schieder

A previous ITEP analysis showed the lopsided distribution of SALT cap repeal by income level. The vast majority of families would not benefit financially from repeal and most of the tax cuts would flow to families with incomes above $200,000. This report builds on that work by using a mix of tax return and survey data within our microsimulation tax model to estimate the distribution of SALT cap repeal across race and ethnicity. It shows that repealing the SALT cap would be the latest in a long string of inequitable policies that have conspired to create the vast racial income…

Nike’s Tax Avoidance Response Does not Dispute It Paid $0 in Federal Income Tax

April 19, 2021 • By Matthew Gardner

It was (allegedly) P.T. Barnum who first said “there’s no such thing as bad publicity.” But the public relations professionals at the Nike Corporation clearly disagree with this maxim. Last week, after multiple media outlets, including the New York Times, wrote about ITEP’s conclusion that Nike avoided federal corporate income taxes under the Trump tax law, the company contacted these news organizations to… change the subject.

New York Times: Make Tax-Dodging Companies Pay for Biden’s Infrastructure Plan

April 18, 2021

American companies and companies that make money in the United States are not paying enough money in taxes. Even as profits have soared, tax payments have declined. Fifty-five of the nation’s largest corporations — including FedEx, Nike and the agribusiness giant Archer Daniels Midland — paid nothing in federal income taxes in 2020, despite collectively […]

City & State (NY): Correcting disinformation about the excluded workers fund

April 14, 2021

Technically, no employee in New York pays into unemployment as it’s a tax on employers, but their employment is what leads to the pay-ins. While it’s impossible to know whether every person who will receive benefits has paid state, local or federal taxes, the available research shows that the majority of undocumented immigrants do pay […]

State Rundown 4/14: More Progressive Wins in the Headlines this Week, but Mind the Fine Print

April 14, 2021 • By ITEP Staff

Two significant victories headlined state tax debates in the past week, as New Mexico leaders improved existing targeted tax credits to give bigger boosts and reach more families in need, and West Virginia lawmakers unanimously shut down a destructive effort to eliminate the state’s progressive income tax. These developments follow last week’s major wins for progressive taxation and targeted assistance in New York, and more good news is likely soon as Washington legislators continue to advance their own targeted credit for working families. Not all the news is positive though, as costly and/or regressive tax cuts remain on the table…

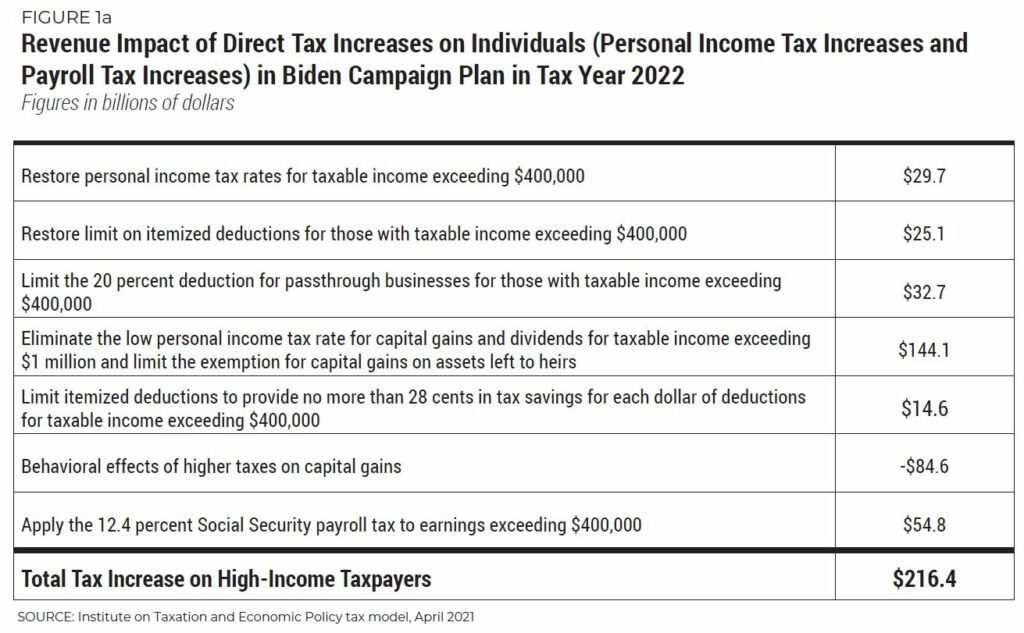

National and State-by-State Estimates of President Biden’s Campaign Proposals for Revenue

April 8, 2021 • By ITEP Staff, Matthew Gardner, Steve Wamhoff

During his presidential campaign, Joe Biden proposed to change the tax code to raise revenue directly from households with income exceeding $400,000. More precisely, Biden proposed to raise personal income taxes on unmarried individuals and married couples with taxable income exceeding $400,000, and he also proposed to raise payroll taxes on individual workers with earnings exceeding $400,000. Just 2 percent of taxpayers would see a direct tax hike (an increase in either personal income taxes, payroll taxes, or both) if Biden’s campaign proposals were in effect in 2022. The share of taxpayers affected in each state would vary from a…

New York Times: Corporate Taxes Are Wealth Taxes

April 8, 2021

Since the mid-20th century, however, politicians of both political parties have supported cuts in the corporate-tax rate, often under intense lobbying from corporate America. The cuts have been so large — including in President Donald Trump’s 2017 tax overhaul — that at least 55 big companies paid zero federal income taxes last year, according to […]

State Rundown 4/7: Tax Justice Advocates Applaud New York Budget Deal

April 7, 2021 • By ITEP Staff

New York lawmakers stole the spotlight this week as they were able to agree on—and convince reluctant Gov. Andrew Cuomo to support—strong progressive tax increases on the highest-income households and corporations in the state to fund shared priorities like K-12 education and pandemic recovery efforts. Minnesota leaders are attempting a similar performance off Broadway with progressive reforms of their own, while Kansas legislators are getting poor reviews for cutting a number of taxes and worsening their budget situation. Thankfully major tax changes stayed backstage as sessions concluded in Georgia and Mississippi.

New York Times: Jeff Bezos says Amazon, a Notable Tax Avoider, Supports Raising Corporate Taxes.

April 7, 2021

For years, Amazon has been a model for corporate tax avoidance, fielding criticism of its tax strategies from Democrats and former President Donald J. Trump. In 2019, Amazon had an effective tax rate of 1.2 percent, which was offset by tax rebates in 2017 and 2018, according to the Institute on Taxation and Economic Policy, […]

Shelton Herald: Houston-based Kinder Morgan among Large Corporations that Didn’t Pay Federal Taxes in 2020

April 2, 2021

Houston-based Kinder Morgan is one of the largest infrastructure companies in North America — and they’re among the at least 55 American corporations that paid absolutely nothing in federal taxes on billions of dollars in profits in 2020. Citing a report from the Institute on Taxation and Economic Policy, Patricia Cohen reported for the New […]

Complex: Nike Hasn’t Paid Any Federal Income Tax for the Last Three Years

April 2, 2021

Nike has made $4.1 billion in profits over the last three years but didn’t pay a dime in federal income tax for its earnings, according to new reports by the New York Times. The publication’s latest findings revealed that the sportswear giant was among the companies that were able to evade federal income tax payments […]

New York Times: No Federal Taxes for Dozens of Big, Profitable Companies

April 2, 2021

Just as the Biden administration is pushing to raise taxes on corporations, a new study finds that at least 55 of America’s largest paid no taxes last year on billions of dollars in profits. The sweeping tax bill passed in 2017 by a Republican Congress and signed into law by President Donald J. Trump reduced […]

State Rundown 4/1: Most States Resisting Foolish Tax Cut Games That Tear Revenues Apart

April 1, 2021 • By ITEP Staff

Supporters of tax fairness and adequate funding for public needs are hoping West Virginia’s income tax elimination effort turns out to be a prank, but most states are not fooling around with such harmful policies this year. For example...

The New York Times: Biden Tax Plan Challenges G.O.P. Formula for Economic Growth

March 31, 2021

The Institute on Taxation and Economic Policy, which has long criticized American businesses for managing to avoid paying what they owe, conducted a study of Fortune 500 companies that were profitable and that provided enough information to calculate effective tax rates. The institute found that those companies on average paid 11.3 percent on their 2018 […]

Taxes and Racial Equity: An Overview of State and Local Policy Impacts

March 31, 2021 • By ITEP Staff

Historic and current injustices, both in public policy and in broader society, have resulted in vast disparities in income and wealth across race and ethnicity. Employment discrimination has denied good job opportunities to people of color. An uneven system of public education funding advantages wealthier white people and produces unequal educational outcomes. Racist policies such as redlining and discrimination in lending practices have denied countless Black families the opportunity to become homeowners or business owners, creating extraordinary differences in intergenerational wealth. These inequities have long-lasting effects that compound over time.

The Street: Cannabis Stocks Rise as New York Moves Closer to Legalization

March 30, 2021

New York would be the 16th state, plus the District of Columbia, to fully legalize marijuana after decades of imprisoning people who participated in the cannabis black market. About one in three Americans live in a state with legal sales of recreational cannabis, according to the Institute on Taxation and Economic Policy. Read more

The Biden administration has made clear that its top priorities include a major recovery package with critical investments to boost the nation’s economy and tax increases for corporations and the wealthy. Adequately funding the IRS must be part of that agenda. It seems every week, a new study, data set or research-driven commentary reveals how […]

The Street: New York Inches Closer to Legalizing Recreational Cannabis

March 24, 2021

Last November, voters in New Jersey and Arizona voted to legalize marijuana. And in December, New Jersey placed a social equity excise tax on cannabis sales in order to address the disparate effect of anti-marijuana laws on communities of color. About one in three Americans live in a state with legal sales of recreational cannabis, […]

It was a relatively quiet week in state fiscal policy, likely partly due to states waiting for federal guidance on some of the details in the American Rescue Plan. As they await those details, lawmakers in Mississippi and West Virginia continue to wrangle over whether to recklessly eliminate their income taxes, while leaders in states including Connecticut and New York considered more productive and progressive reforms. And in the meantime, groundbreaking work on the intersection of race and tax policy is now available.

New York Post: Zoom Paid No Federal Income Tax Last Year amid Pandemic Profit Surge

March 23, 2021

The Silicon Valley firm appears to have achieved that feat largely thanks to its use of stock-based compensation for employees, which helped reduce its worldwide tax bill by more than $302 million for the year ending Jan. 31. Corporations that pay their executives in stock often benefit from a provision in the federal tax code […]

State Rundown 3/17: Momentum for Sound Progressive Tax Reforms Continues to Build

March 17, 2021 • By ITEP Staff

We wrote last week that the inclusion of fiscal relief for states and localities in Congress’s American Rescue Plan should free up state lawmakers’ time and attention to focus on the comprehensive reforms needed to address upside-down and inadequate tax codes, and some states are already doing just that.

New York Times: Democrats Narrow Stimulus Payments as Biden Works to Keep Aid Plan on Track

March 4, 2021

If adopted, the change in income limits would mean that about 12 million adults and five million children who received stimulus payments under the last round of aid signed in December by President Donald J. Trump would not receive them under Mr. Biden’s bill, according to an analysis by the liberal Institute on Taxation and […]