New York

State Rundown 1/24: States Reflect on MLK’s Dream and Teacher Uprisings

January 24, 2019 • By ITEP Staff

This week, as Americans in every state celebrated Martin Luther King Jr. Day and reflected on his dream of peaceful protest and racial and economic justice, many eyes were on the teachers’ strike pressing for parts of this dream amid the “curvaceous slopes of California.” Governors and lawmakers in many states—including Arizona, Georgia, Indiana, Louisiana, Nevada, New Mexico, South Carolina, and Wisconsin—discussed ways to raise pay for teachers and/or enhance education investments generally.

New York Times: Warren’s Plan Is Latest Push by Democrats to Raise Taxes on the Rich

January 24, 2019

Ms. Warren appears to be the first declared Democratic candidate to release a plan for a wealth tax, but the idea is quickly gaining steam among liberal activists and policy experts. Two think tanks, the Institute on Taxation and Economic Policy and the Washington Center for Equitable Growth, released wealth-tax-themed policy briefs this week in […]

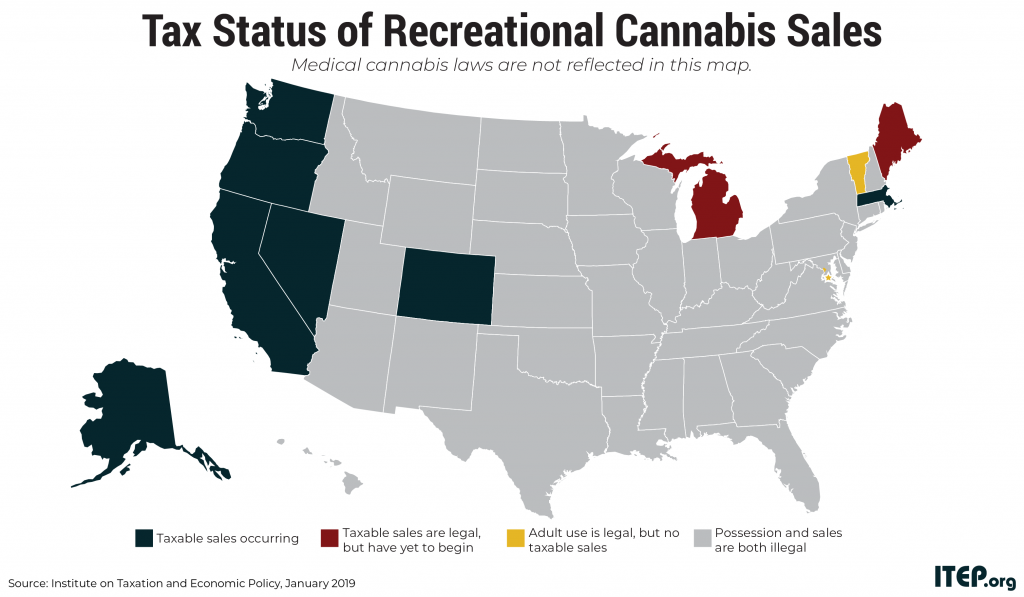

State policy toward cannabis is evolving rapidly. While much of the debate around legalization has rightly focused on potential health and criminal justice impacts, legalization also has revenue implications for state and local governments that choose to regulate and tax cannabis sales. This report describes the various options for structuring state and local taxes on cannabis and identifies approaches currently in use. It also undertakes an in-depth exploration of state cannabis tax revenue performance and offers a glimpse into what may lie ahead for these taxes.

Cannabis Tax Debates are Ramping Up; Here’s What We’ve Learned from Five Years of Cannabis Taxation Thus Far

January 23, 2019 • By Carl Davis

This year lawmakers in Connecticut, Delaware, Hawaii, Illinois, New Jersey, New York, Rhode Island, and Vermont will all be debating the taxation of recreational cannabis. A new ITEP report reviews the track record of recreational cannabis taxes thus far and offers recommendations for structuring cannabis taxes to achieve stable revenue growth over the long haul.

State Rundown 1/18: Governors’ Speeches Kick Off State Fiscal Debates

January 18, 2019 • By ITEP Staff

Gubernatorial speeches and budget proposals dominated state fiscal news this week, as governors proposed a wide array of policies including positive reforms such as Earned Income Tax Credit (EITC) enhancements in CALIFORNIA, a capital gains tax on wealthy households in WASHINGTON, and investments in education in several states. Proposals to exempt more retirement income from tax, particularly for veterans, are a common theme so far this year, having been raised in multiple states including MARYLAND, MICHIGAN, and SOUTH CAROLINA. And NEW JERSEY became the fourth state with a $15 minimum hourly wage. Those wishing to better understand and influence important debates about equitable tax policy should mark their…

A Simple Fix for a $17 Billion Loophole: How States Can Reclaim Revenue Lost to Tax Havens

January 17, 2019 • By Richard Phillips

Enacting Worldwide Combined Reporting or Complete Reporting in all states, this report calculates, would increase state tax revenue by $17.04 billion dollars. Of that total, $2.85 billion would be raised through domestic Combined Reporting improvements, and $14.19 billion would be raised by addressing offshore tax dodging (see Table 1). Enacting Combined Reporting and including known tax havens would result in $7.75 billion in annual tax revenue, $4.9 billion from income booked offshore.

Who Pays and Why It Matters | MECEP Policy Insights Conference Keynote Address

January 16, 2019 • By Aidan Davis

States have broad discretion in how they secure the resources to fund education, health care, infrastructure, and other priorities important to communities and families. Aidan Davis with the Institute on Taxation and Economic Policy will offer a national perspective on state-level approaches to funding public investments and the implications of those approaches on tax fairness and revenue adequacy, and their economic outcomes. She’ll also provide insight on what’s in store for 2019 among the states.

Gov. Cuomo Has the Right Idea on How to Tax Recreational Cannabis

January 15, 2019 • By ITEP Staff

Following is a statement by Carl Davis, research director at the Institute on Taxation and Economic Policy, regarding the cannabis tax structure unveiled by New York Gov. Andrew Cuomo.

State Rundown 1/10: States Should Resolve to Pursue Equitable Tax Options

January 10, 2019 • By ITEP Staff

This week we released a handy guide of policy options for Moving Toward More Equitable State Tax Systems, and are pleased to report that many state lawmakers are promoting policies that are in line with our recommendations. For example, Puerto Rico lawmakers recently enacted a targeted EITC-like credit for working families, and leaders in Virginia and elsewhere are working toward similar improvements. Arkansas residents also saw their tax code improve as laws reducing regressive consumption taxes and enhancing income tax progressivity just went into effect. And there is still time for governors and legislators pushing for regressive income tax cuts…

How to Think About the 70% Top Tax Rate Proposed by Ocasio-Cortez (and Multiple Scholars)

January 8, 2019 • By Steve Wamhoff

The uproar deliberately steers clear of any real policy discussion about what a significantly higher marginal tax rate would mean. Her critics are mostly the same lawmakers who enacted a massive tax cut for the rich last year that was not debated seriously or supported by serious research. Meanwhile, multiple scholarly studies conclude a 70 percent top tax rate would be an optimal way to tax the very rich. Ocasio-Cortez has brought more attention to the very real need to raise revenue and do it in a progressive way.

State Rundown 12/19: Time to Rest and Recharge for Big Year Ahead

December 19, 2018 • By ITEP Staff

With many people enjoying time off over the next couple weeks, and the longest nights of the year coming over the weekend, now is a good time to get plenty of rest and relaxation in advance of what is likely to be a very busy 2019 for state fiscal policy and other debates. Among those debates, Kentucky lawmakers will be returning to topics they could not resolve in a brief special session held this week, New Jersey and New York will both be deciding how to legalize and tax cannabis, and gas tax updates will be on the agenda in…

The Federal Estate Tax: An Important Progressive Revenue Source

December 6, 2018 • By ITEP Staff

For years, wealth and income inequality have been widening at a troubling pace. One study estimated that the wealthiest 1 percent of Americans held 42 percent of the nation’s wealth in 2012, up from 28 percent in 1989. Lawmakers have exacerbated this trend by dramatically cutting federal taxes on inherited wealth, most recently by doubling the estate tax exemption as part of the 2017 Tax Cuts and Jobs Act. Further, lawmakers have done little to stop aggressive accounting schemes designed to avoid the estate tax altogether. This report explains how the percentage of estates subject to the federal estate tax…

New York Daily News: Cyber Monday Shopping Deals Blunting by Supreme Court Ruling

November 26, 2018

“This is about improved enforcement of a tax that’s already on the books,” echoed Carl Davis, research director at the Institute on Taxation and Economic Policy, to CNBC. “For years, shoppers have been able to evade these taxes by shopping with certain online retailers.” Read more

New York Times: Did a Tax Increase Tucked Into Trump’s Tax Cut Come Back to Bite Republicans?

November 19, 2018

Simply reinstating the unlimited cap, without also reversing the changes to the alternative minimum tax, would deliver no benefit to low-income and middle-class Americans, according to a new analysis by the Institute on Taxation and Economic Policy, a liberal think tank. More than 85 percent of the benefits would go to the top 5 percent […]

State Rundown 11/16: Election Results Clarify Agendas as Real Work Begins

November 16, 2018 • By ITEP Staff

State policymakers, voters, and observers have been reflecting on this year’s campaigns and looking ahead to how the policy opportunities in their states have shifted as a result. For example, Arkansas’s governor sees a fresh chance to slash income taxes on the state’s wealthiest residents, while the governor-elect of Illinois will be doing just the opposite, launching into a promised effort to shore up the state’s budget by asking the wealthy to pay more. New York and Virginia residents may end up with buyers’ remorse after Amazon accepted their combined $2 billion tax subsidy offers for its HQ2 project. And…

CBS News: Can New York Make Back Its Amazon Investment

November 14, 2018

Opponents of corporate subsidies said Amazon’s choices prove taxpayer incentives matter much less than advertised. “[A]ccess to an educated workforce and high-quality public amenities are what drive business location decisions — not the presence of low or regressive taxes,” the Institute on Taxation and Economic Policy said in a statement. “These cross-state bidding wars are […]

The cap on federal tax deductions for state and local taxes (SALT) that is in effect now under the Tax Cuts and Jobs Act (TCJA) is a flawed provision but repealing it outright would be costly and provide a windfall to the rich. Congress should consider replacing the SALT cap with a different type of limit on deductions that would avoid both of these outcomes. Using the ITEP microsimulation tax model, this report provides revenue estimates and distributional estimates for several such options, assuming they would be in effect in 2019.

Today Amazon announced major expansions in New York and Virginia, where it intends to hire up to 50,000 full-time employees. The announcement marks the culmination of a highly publicized search that lasted more than a year and involved aggressive courting of the company by cities across the nation. The following are three tax-related observations on the announcement.

Tuesday’s elections shook up statehouses, governors’ offices, and tax laws in many states, and in this week’s Rundown we bring you the top 3 election state tax policy stories to emerge. First, voters in Kansas and other states sent a message that regressive tax cuts and supply-side economics have not succeeded and are not welcome among their state fiscal policies. Meanwhile, residents of many other states, including most notably Illinois, voted for representatives who reflect their preference for equitable, sustainable policies to improve their state economies through smart public investments and improve the lives of all residents through progressive tax structures. Lastly, while some states missed…

Amazon HQ2 Finalists Should Disclose the Financial Incentives They Promised

November 6, 2018 • By Guest Blogger

The Crystal City and Long Island City subsidy offers are among the many Amazon HQ2 bids that remain completely hidden. Citizens have no idea what their elected officials have promised to a company headed by the richest person on earth.

Comments to be delivered during IRS hearing on “Contributions in Exchange for State or Local Tax Credits” (REG-112176-18)

November 5, 2018 • By Carl Davis

ITEP views this proposal as a sensible improvement, and one that is actually overdue, to the way the charitable deduction is administered. At the end of my remarks I will discuss a few ways that the regulation could be improved. But the core point I want to emphasize is that the general approach taken here, where quid pro quo rules are applied in a broad-based fashion to all significant state and local tax credits, is the correct one.

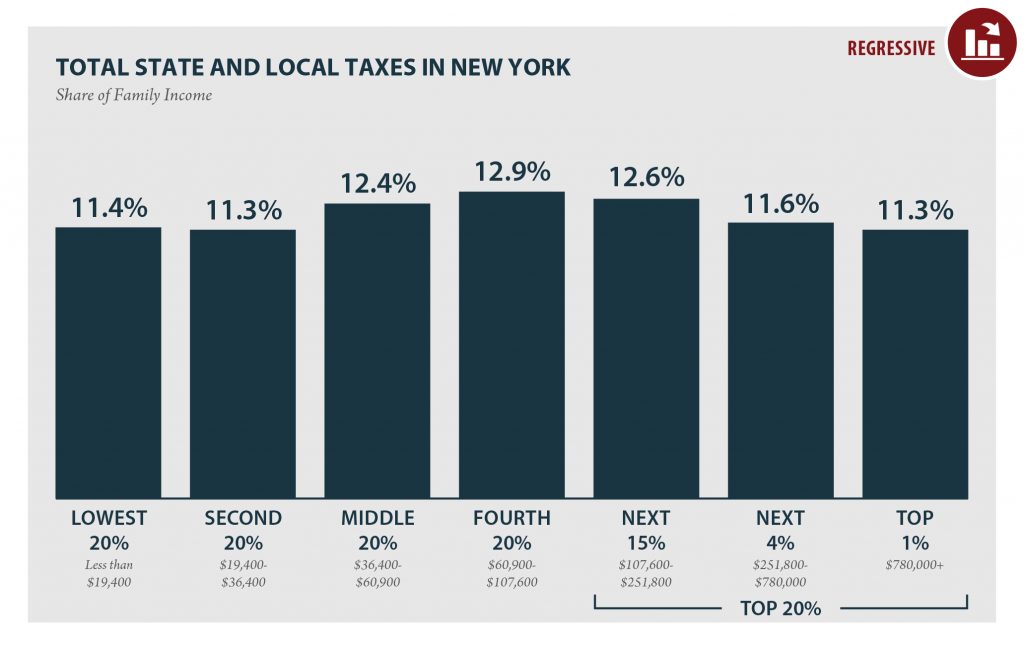

Policymakers and residents in all 50 states and the District of Columbia got new ITEP data this week on how their tax structures and decisions affect their high-, middle-, and low-income residents. As our “Who Pays?” report outlines, most state and local tax codes exacerbate economic inequalities and all states have room to improve. The data can serve as an important informative backdrop to all state and local tax policy debates, such as whether to change the valuation of commercial property in California, how to improve funding for early childhood education in Indiana, and how to evaluate tax-related ballot measures…

New York: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

NEW YORK Read as PDF NEW YORK STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $19,400 $19,400 to $36,400 $36,400 to $60,900 $60,900 to $107,600 $107,600 to $251,800 $251,800 to $780,000 […]

State Rundown 10/12: Local Jurisdictions Fighting for Revenues, Independence

October 12, 2018 • By ITEP Staff

Voters all around the country are educating themselves for the upcoming elections, notably this week around ballot initiatives in Arizona and Colorado and competing gubernatorial tax proposals in Georgia and Illinois. But not all eyes are on the elections, as the relationship between state and local policy made news in Delaware, Idaho, North Dakota, and Ohio.

New York Times: White Americans Gain the Most From Trump’s Tax Cuts, a Report Finds

October 11, 2018

The tax cuts that President Trump signed into law last year are disproportionately helping white Americans over African-Americans and Latinos, a disparity that reflects longstanding racial economic inequality in the United States and the choices that Republicans made in crafting the law.