New York

ITEP Comments and Recommendations on Proposed Section 170 Regulation (REG-112176-18)

October 11, 2018 • By Carl Davis

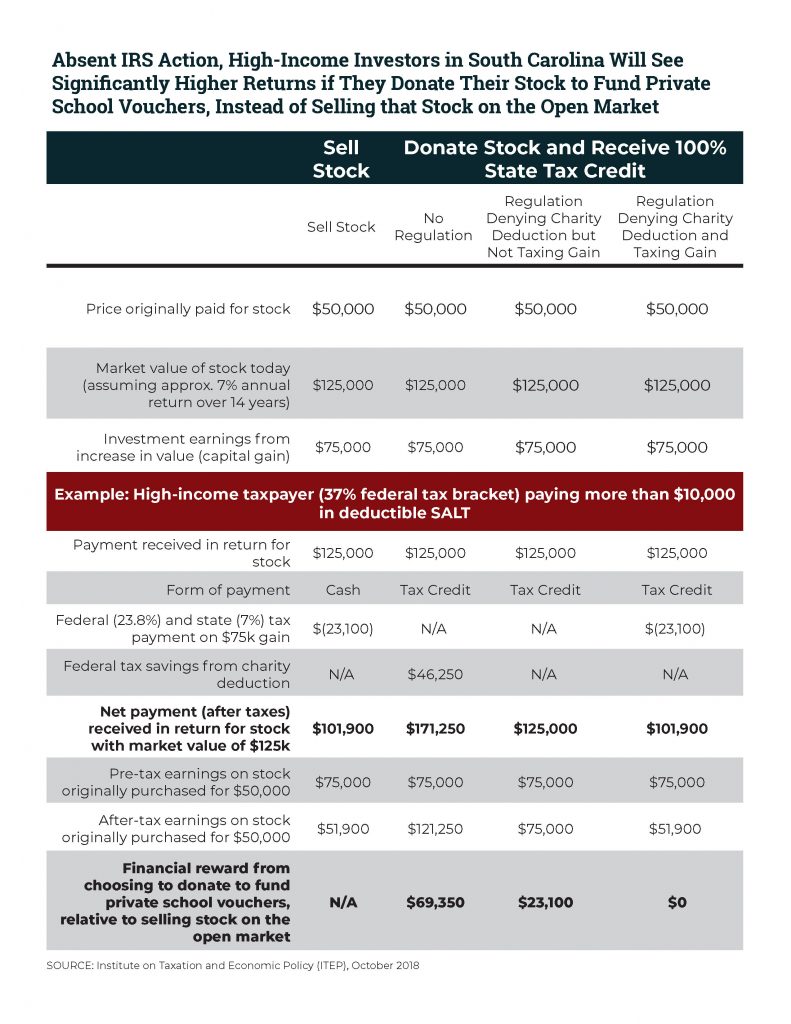

The IRS recently proposed a commonsense improvement to the federal charitable deduction. If finalized, the regulation would prevent not just the newest workarounds to the $10,000 deduction for state and local taxes (SALT), but also a longer-running tax shelter abused by wealthy donors to private K-12 school voucher programs. ITEP has submitted official comments outlining four key recommendations related to the proposed regulation.

Concerned about Trump-family tax gaming? His law may prompt others to dodge.

October 5, 2018 • By Steve Wamhoff

“The IRS is wildly outgunned,” says Steve Wamhoff, director of federal tax policy at the Institute on Taxation and Economic Policy, a think tank in Washington. “You can’t keep cutting IRS funding and not expect more things like what The New York Times wrote about the Trumps. That’s bound to happen even more now.”

South Carolina lawmakers have finally passed a federal conformity bill in response to last year’s federal tax-cut legislation. Voters in many states are hearing a lot about tax-related questions they’ll see on the ballot in November, particularly residents of Florida, Montana, and Oregon, where corporate donors and other anti-tax interests are spending major sums to alter policy in their states. And states continue to work on ensuring they can collect online sales taxes and, in some states, online sports betting taxes.

The New Yorker: The Trump Family’s Tax Dodging Is Symptomatic of a Larger Problem

October 3, 2018

This experience points to an enduring scandal that goes well beyond the Trumps. “The key takeaway from the New York Times article . . . is that the wealthy and powerful abide by a different set of rules than the rest of us,” Alan Essig, the executive director of the Institute on Taxation and Economic Policy, a nonpartisan […]

NYT Expose on Trump Family Tax Avoidance Demonstrates There’s a Different Set of Rules for the Rich and Powerful

October 2, 2018 • By Alan Essig

Following is a statement by Alan Essig, executive director of the Institute on Taxation and Economic Policy, regarding an expose in today’s New York Times that reveals Donald Trump’s family engaged in complex schemes to avoid taxes.

Tax Cuts 2.0 – New York

September 26, 2018 • By ITEP Staff

The $2 trillion 2017 Tax Cuts and Jobs Act (TCJA) includes several provisions set to expire at the end of 2025. Now, GOP leaders have introduced a bill informally called “Tax Cuts 2.0” or “Tax Reform 2.0,” which would make the temporary provisions permanent. And they falsely claim that making these provisions permanent will benefit […]

NJ.com: Murphy Pushes Plan to Save Property Tax Breaks

September 26, 2018

Only residents of New York, Connecticut, and California deduct more from federal taxes than New Jerseyans, according the progressive Institute on Taxation and Economic Policy. Most of the states hit hardest send billions of dollars more to Washington than they get back in services. Read more

The Rundown is back after a few-week hiatus, with lots of state fiscal news and quality research to share! Maine lawmakers found agreement on a response to the federal tax-cut bill, states continue to sort out how they’ll collect online sales taxes in the wake of the Wayfair decision, and policymakers in several states have been working on summer tax studies and other preparations for 2019 legislative sessions. Meanwhile, work on ballot measures and candidate tax plans to go before voters in November has been even more active, particularly in Arizona, California, Florida, Hawaii, and Missouri. Our “What We’re Reading” section has lots of great research and reading on inequalities, cities turning…

State Tax Codes as Poverty Fighting Tools: 2018 Update on Four Key Policies in All 50 States

September 17, 2018 • By Aidan Davis, Misha Hill

This report presents a comprehensive overview of anti-poverty tax policies, surveys tax policy decisions made in the states in 2018, and offers recommendations that every state should consider to help families rise out of poverty. States can jumpstart their anti-poverty efforts by enacting one or more of four proven and effective tax strategies to reduce the share of taxes paid by low- and moderate-income families: state Earned Income Tax Credits, property tax circuit breakers, targeted low-income credits, and child-related tax credits.

Education Week: How a Proposed Tax Rule Could Hurt School Vouchers

September 11, 2018

Under the Tax Cuts and Jobs Act passed in 2017, wealthy residents in states such as New York and California face sizable increases in their federal tax bills because of a $10,000 cap on state and local tax deductions they can make on their federal returns. Democratic lawmakers allege the so-called SALT-cap unfairly targets left-leaning […]

Reuters: U.S. Treasury, IRS move to block states dodging tax deduction cap

August 23, 2018

Under the proposed rule, however, a New York taxpayer could not receive a federal charitable deduction for the portion of their donation to the fund for which they received a state tax credit, unless the credit was for 15 percent or less. “If you make a donation of $100 and you get a big chunk […]

New Jersey Online: Trump Administration Rejects Efforts to Save Your Property Tax Break

August 23, 2018

And in New Jersey, more than four in 10 taxpayers claimed that tax break and deducted an average deduction of $17,850 in 2015, according to the Pew Charitable Trusts. Only residents of New York, Connecticut and California deduct more from federal taxes than New Jerseyans, according the progressive Institute on Taxation and Economic Policy. Read more

State Rundown 8/16: November Ballots and 2019 Debates Coming into Focus

August 16, 2018 • By ITEP Staff

Even as the haze from western wildfires reduced visibility across the nation this week, voters got more clarity on what to expect to see on their ballots this fall, particularly in California (commercial property taxes and corporate surcharges), Colorado (income taxes for education), Missouri (gas tax update), and North Dakota (recreational cannabis). Meanwhile, although Virginia lawmakers won’t return until 2019, they got a preview of a clear-headed federal conformity plan they should strongly consider. And look to our “What We’re Reading“ section for further enlightenment from researchers on the [in]effectiveness of charitable contribution credits, the [lack of] wage growth for…

State Rundown 8/8: States Setting Rules for Upcoming Tax Decisions

August 8, 2018 • By ITEP Staff

August is often a season for states to define the parameters of tax debates to come, and that is true this week in several states: a tax task force in Arkansas is nearing its final recommendations; residents of Missouri, Montana, and North Carolina await results of court challenges that will decide whether tax measures will show up on their ballots this fall; and Michigan and South Dakota are taking different approaches to making sure they’re ready to collect online sales taxes next year.

Consumers’ growing interest in online shopping and “gig economy” services like Uber and Airbnb has forced states and localities to revisit their sales taxes, for instance. Meanwhile new evidence on the dangers and causes of obesity has led to rising interest in soda taxes, but the soda industry is fighting back. Carbon taxes are being discussed as a tool for combatting climate change. And changing attitudes toward cannabis use have spurred some states to move away from outright prohibition in favor of legalization, regulation and taxation.

Although most state legislatures are out of session during the summer, the pursuit of better fiscal policy has no "off-season." Here at ITEP, we've been revamping the State Rundown to bring you your favorite summary of state budget and tax news in the new-and-improved format you see here. Meanwhile, leaders in Massachusetts and New Jersey have been hard at work in recent weeks and are already looking ahead their next round of budget and tax debates. Lawmakers in many states are using their summer break to prepare for next year's discussions over how to implement online sales tax legislation. And…

State Rundown 7/19: Wayfair Fallout and Ballot Preparation Dominate State Tax Talk

July 19, 2018 • By ITEP Staff

In the wake of the U.S. Supreme Court's recent Wayfair decision authorizing states to collect taxes owed on online sales, Utah lawmakers held a one-day special session that included (among other tax topics) legislation to ensure the state will be ready to collect those taxes, and a Nebraska lawmaker began pushing for a special session for the same reason. Voters in Colorado and Montana got more clarity on tax-related items they'll see on the ballot in November. And Massachusetts moves closer toward becoming the final state to enact a budget for the new fiscal year that started July 1 in…

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 12, 2018 • By Dylan Grundman O'Neill

An updated version of this brief for 2019 is available here. Read this report in PDF. Overview Sales taxes are an important revenue source, composing close to half of all state tax revenues.[1] But sales taxes are also inherently regressive because the lower a family’s income, the more the family must spend on goods and […]

New York Times: $111 Billion in Tax Cuts for the Top 1 Percent

July 11, 2018

Think of it this way: Income inequality has soared in recent decades, with the wealthy pulling away from everyone else and the upper-middle-class doing better than the working class or poor. Yet our federal government has responded by aggravating these trends. It has handed huge tax cuts to the small segment of Americans who need […]

With many state fiscal years beginning July 1, most states that will make decisions this year about federal tax conformity have now done so, so it is now time for an update on how well state policymakers have kept to, or veered from, the path we charted out earlier this year. Most states that have enacted laws in response to the federal changes have adhered to some but not all of the principles we laid out, with a few responding rather prudently and a handful charting a much more treacherous course of unfair, unsustainable policy based on unfounded promises of…

Wall Street Journal: As Treasury Targets Workarounds to Tax Law, Impact May Extend Beyond High-Tax States

June 27, 2018

Tax experts say the federal government will find it difficult if not impossible to write rules to stop the workarounds in New York, New Jersey and Connecticut without also limiting existing tax credits in Georgia, Alabama, South Carolina and elsewhere. According to a recent paper from law professors, 33 states currently have more than 100 […]

The Other SALT Cap Workaround: Accountants Steer Clients Toward Private K-12 Voucher Tax Credits

June 27, 2018 • By Carl Davis

On May 23, 2018, the IRS and Treasury Department announced that they “intend to propose regulations addressing the federal income tax treatment of certain payments made by taxpayers for which taxpayers receive a credit against their state and local taxes.” They made the announcement in response to new “workaround tax credits” enacted in New York […]

New York Times: Supreme Court Widens Reach of Sales Tax for Online Retailers

June 22, 2018

The decision, in South Dakota v. Wayfair Inc., was a victory for brick-and-mortar businesses that have long complained they are put at a disadvantage by having to charge sales taxes while many online competitors do not. And it was also a victory for states that have said that they are missing out on tens of […]

Buffalo News: Sales Tax Ruling Will Help Stores Compete Against Online Retailers

June 22, 2018

Carl Davis, research director at the Institute on Taxation and Economic Policy, a Washington think tank, was quoted in The New York Times saying, “State and local governments have really been dealing with the nightmare scenario for several years now.” He added that “this is going to allow state and local governments to improve their […]

Market Insider: Trump Praises Supreme Court Decision on Sales Tax

June 22, 2018

A Trump Organization representative did not respond to a request for comment from Business Insider on how the Supreme Court decision could affect TrumpStore.com. When New York was added to the list of states, a Trump Store spokesperson told Business Insider the online retailer has “always, and will continue to collect, report, and remit sales […]