Recent Work by ITEP

Comments on Senate Finance Committee Paper on Anti-Deferral Accounting

September 12, 2019 • By Steve Wamhoff

Comments on Senate Finance Committee Paper on Anti-Deferral Accounting

Promoting Greater Economic Security Through A Chicago Earned Income Tax Credit: Analyses of Six Policy Design Options

September 12, 2019 • By Lisa Christensen Gee

A new report reveals that a city-level, Chicago Earned Income Tax Credit would boost the economic security of 546,000 to 1 million of the city’s working families. ITEP produced a cost and distributional analysis of six EITC policy designs, which outlines the average after-tax income boost for families at varying income levels. The most generous policy option would increase after-tax income for more than 1 million working families with an average benefit, depending on income, ranging from $898 to $1,426 per year.

Census Numbers Show the Power of the Tax Code to Direct Resources to Low-Income Families

September 10, 2019 • By Jessica Schieder

Refundable federal tax credits, including the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC), lifted 7.9 million people out of poverty in 2018. This latest analysis from the U.S. Census Bureau demonstrates the power of federal programs to alleviate poverty and help low-income families keep up with the increasing cost of living.

How Tax Policy Can Help Mitigate Poverty, Address Income Inequality

September 10, 2019 • By ITEP Staff

Analysts at the Institute on Taxation and Economic Policy have produced multiple recent briefs and reports that provide insight on how current and proposed tax policies affect family economic security and income inequality.

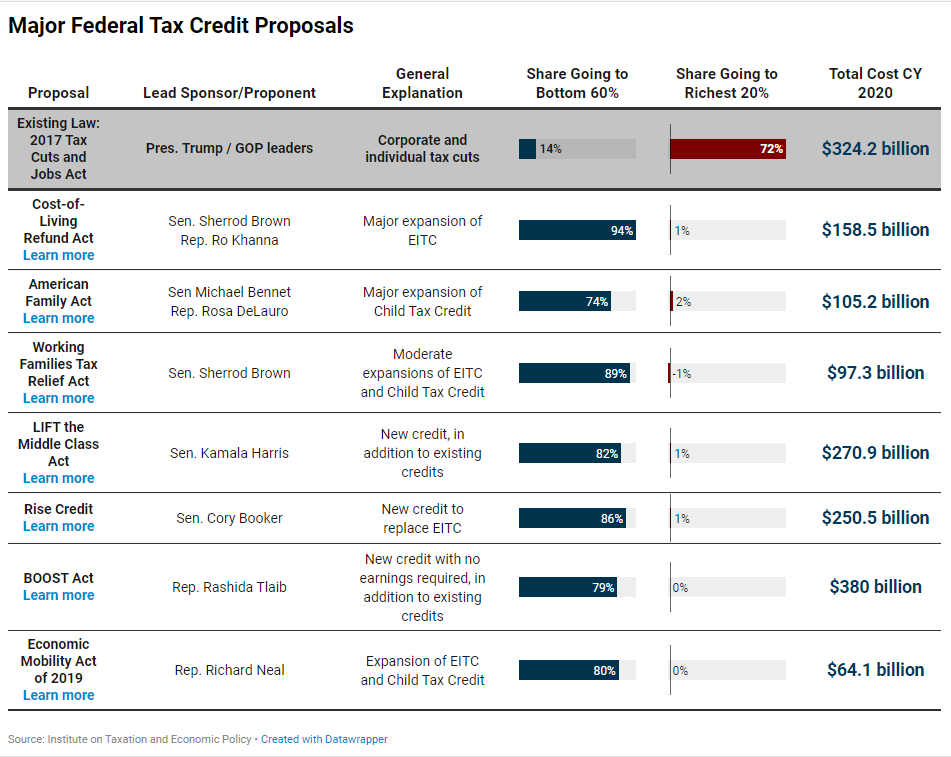

In 2019, several federal lawmakers have introduced tax credit proposals to significantly expand existing tax credits or create new ones to benefit low- and moderate-income people. While these proposals vary a great deal and take different approaches, all build off the success of the EITC and CTC and target their benefits to families in the bottom 60 percent of the income distribution who have an annual household income of $70,000 or less.

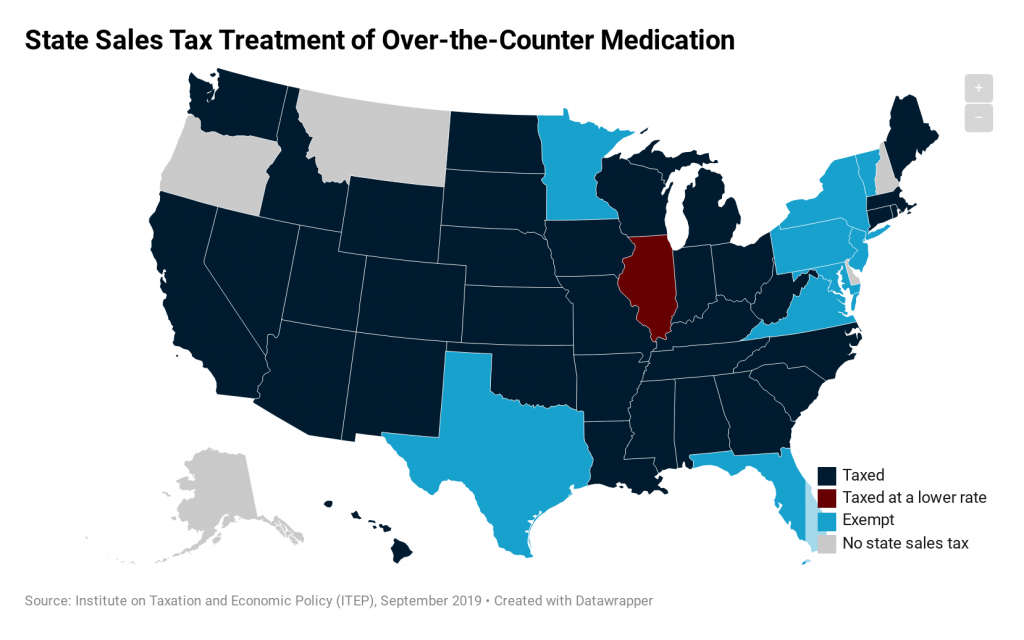

While most states levy general sales taxes on items that consumers purchase every day, those taxes often contain carveouts for some necessities such as rent, groceries, and medicine. Prescription drugs, for instance, are currently exempt from state sales tax in 44 of the 45 states levying such taxes (Illinois is the only exception, charging a […]

Why Local Jurisdictions’ Heavy Reliance on Fines and Fees Is a Tax Policy Issue

September 4, 2019 • By Meg Wiehe

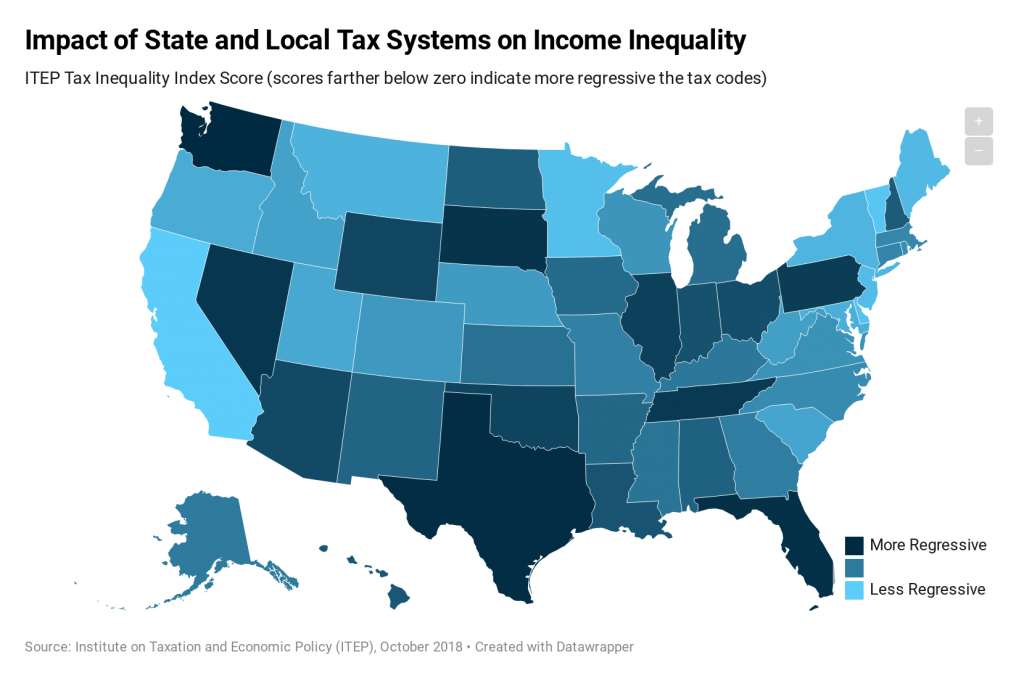

The exposé (Addicted to Fines: Small Towns Are Dangerously Dependent) raises two important issues that policymakers have the power to address. One, lack of revenue at the local level is linked to a broader challenge with state tax systems. Two, fines and fees often entrap lower-income people in a cycle of debt and, in some jurisdictions, ultimately criminalize poverty by casting unpaid fines as misdemeanor crimes.

The vast majority of state and local tax systems exacerbate the economic divide by taxing low- and middle-income families at higher rates than the wealthy. This map distills an exhaustive analysis of state and local tax codes into one key number, the ITEP Tax Inequality Index, to show the degree to which each state’s tax […]

DESPITE CONTRARY CLAIMS, NUMBERS SHOW TRUMP TAX LAW STILL FAVORS THE WEALTHY GOP leaders continue to misrepresent who benefits from the 2017 Trump-GOP tax law, most recently claiming most “of the tax overhaul went into the pockets of working families and Main Street businesses who need it most, not Wall Street.” But the numbers prove […]

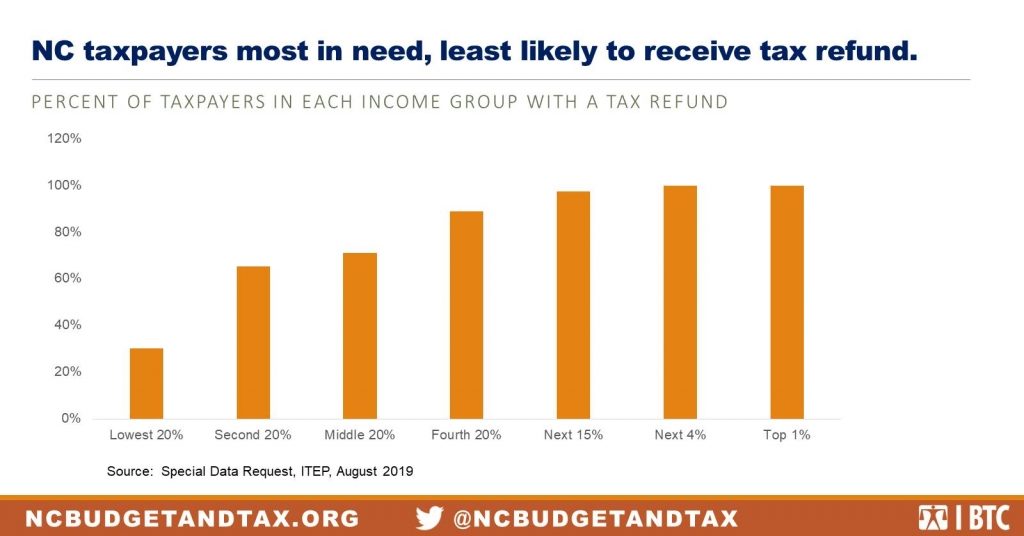

New Analysis: A Third of NC Taxpayers Won’t Benefit from Proposed Tax Refund Plan

August 29, 2019 • By Guest Blogger

North Carolina Senate and House leaders are moving forward with a flawed proposal to spend the majority of the state’s revenue over collections, more than $600 million, to issue tax refund checks of $125 per taxpayer ($250 for married couples).