Recent Work by ITEP

The BOOST Act would provide a new tax credit of up to $3,000 for single people and up to $6,000 for married couples, which would be in addition to existing tax credits. Income limits would prevent well-off households from receiving the credit. Unlike other refundable tax credit proposals, the BOOST Act would not be limited to people with earnings or people with children.

What to Watch for on Tax Policy During the Presidential Primary

June 25, 2019 • By Steve Wamhoff

America needs a new tax code. The Democratic presidential debates beginning this week present an opportunity for candidates to make clear how they would address inequality or to raise enough revenue to make public investments that make the economy work for everyone. Here are some of the big tax issues that we hope they will touch on.

The SALT Cap Isn’t Harming State and Local Revenues. Myths About It May Be.

June 24, 2019 • By Carl Davis

A House Ways and Means subcommittee hearing on Tuesday will explore a highly controversial provision of the Tax Cuts and Jobs Act (TCJA) that prevents individuals and families from writing off more than $10,000 in state and local tax (SALT) payments on their federal tax forms each year. The focus of the hearing will be whether the cap negatively affects state and local revenue streams that fund schools, firefighters, and other services. There are at least three ways this could happen though only one of those is plausible, and it’s not the one that the organizers of this hearing likely…

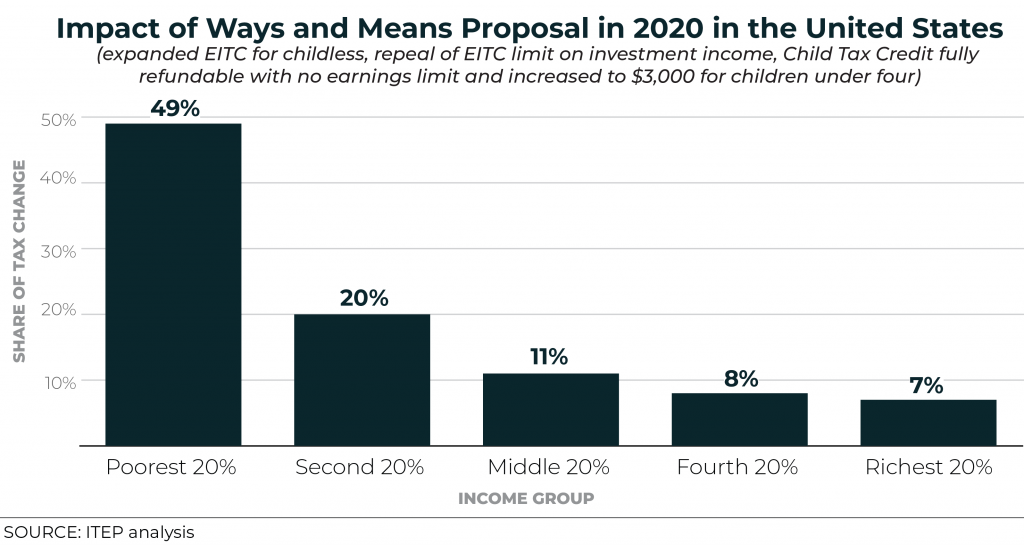

UPDATED: New ITEP Data Shows the House Ways and Means Bill to Expand EITC and Child Tax Credit Would Benefit Low- and Moderate-Income People and Families

June 20, 2019 • By Steve Wamhoff

Today the House Ways and Means Committee is marking up the Economic Mobility Act of 2019, a bill introduced by Chairman Richard Neal to expand some key tax credits to help low- and moderate-income people and families. New data generated with the ITEP microsimulation tax model show how adults and children would benefit nationally and in each state.

State Rundown 6/19: Juneteenth Highlights Role of State Policy in Racial Equity Fight

June 19, 2019 • By ITEP Staff

As Americans observe Juneteenth today–the day two years after the Emancipation Proclamation on which news of the end of the Civil War and slavery reached some of the last slaves in Texas—most people’s attention should be on celebrating victories, remembering losses, gathering strength to continue the fight for racial justice, and the accompanying Congressional reparations hearings. In comparison, state tax debates over matters such as reluctance to invest in infrastructure in Michigan and Missouri, approval of income tax cuts in Wisconsin, and a budget standoff in New Jersey may seem unimportant and irrelevant. But we encourage our readers to think about how state policies often serve to enrich and empower white and wealthy households, and…

Join our team! ITEP has an opening for a Senior Software Engineer (Full Stack) to join our creative, passionate and productive staff as Lead Tax Model Platform Developer. This position will work directly with the technical engine behind our work: ITEP’s Microsimulation Tax Model. The Lead Tax Model Platform Developer reports directly to ITEP’s senior economist and works closely with the entire policy analyst team.

Calling Progressive Tax Proposals “Extreme” Are Taunts Meant to Distract

June 18, 2019 • By Steve Wamhoff

Dismissing calls for progressive taxes as “radical,” “extreme,” or “socialism” are taunts meant to distract from the real question: Why should we ignore the bottom half of Americans, whose share of the economic pie shrank and now have negative net worth, while allowing the wealthy and powerful, whose net worth more than tripled, to dictate our public policies?

State Rundown 6/12: Progress in Taxing the Rich, Expanding EITCs, and Taming Tax Subsidies

June 12, 2019 • By ITEP Staff

This week saw lawmakers in Ohio propose significant harmful tax cuts, leaders in California and Oregon work toward strengthening the state Earned Income Tax Credits (EITCs), and governors in Missouri and Kansas declare a truce to end the practice of bribing businesses in the Kansas City area with tax cuts to move from one side of the state line to the other. Meanwhile, Massachusetts leaders are discussing ways of raising taxes on their richest households, which our latest Just Taxes blog post notes is a promising trend this year across many states.

States are putting evidence into practice with multiple efforts to improve services and tax codes through more progressive taxes on the wealthy. Clear evidence has spread widely this year, informing a national conversation about progressive taxation and leading lawmakers in multiple states to eschew supply-side superstition and act on real evidence instead. Taxing the rich works, and in this Just Taxes blog we review state-level efforts to put these proven findings into effect.

New SALT Workaround Regulations Narrow a Tax Shelter, but Work Remains to Close it Entirely

June 11, 2019 • By Carl Davis

Today the Internal Revenue Service (IRS) released its final regulations cracking down on a tax shelter long favored by private and religious K-12 schools, and more recently adopted by some “blue state” lawmakers in the wake of the 2017 Trump tax cut. The regulations come more than a year after the IRS first announced the […]