Recent Work by ITEP

Comments to be delivered during IRS hearing on “Contributions in Exchange for State or Local Tax Credits” (REG-112176-18)

November 5, 2018 • By Carl Davis

ITEP views this proposal as a sensible improvement, and one that is actually overdue, to the way the charitable deduction is administered. At the end of my remarks I will discuss a few ways that the regulation could be improved. But the core point I want to emphasize is that the general approach taken here, where quid pro quo rules are applied in a broad-based fashion to all significant state and local tax credits, is the correct one.

State Rundown 10/31: Trick or Treat Advice to Savor for Tonight

October 31, 2018 • By ITEP Staff

Look out for potholes if you’re out trick-or-treating in Alabama tonight, where crumbling infrastructure figures to be a dominant debate in the coming legislative session. And be prepared to share the streets with disgruntled teachers if you‘re in Louisiana, where teachers are walking out to protest regressive tax policies that are sucking the lifeblood from the state’s schools. Meanwhile, Wisconsin residents are sharing scary stories of grotesquely large business tax subsidies and the “dark store” tax loophole they’ll be voting on next week. And you better expect the unexpected if you’re in Delaware, where Gov. John Carney shocked everyone by vetoing two broadly supported tax bills last week.

In this special edition of the Rundown we bring you a voters’ guide to help make sense of tax-related ballot questions that will go before voters in many states in November. Interests in Arizona, Florida, North Carolina, Oregon, and Washington state have placed process-related questions on those states’ ballots in attempts to make it even harder to raise revenue or improve progressivity of their state and/or local tax codes. In response to underfunded schools and teacher strikes around the nation, Colorado voters will have a chance to raise revenue for their schools and improve their upside-down tax system at the…

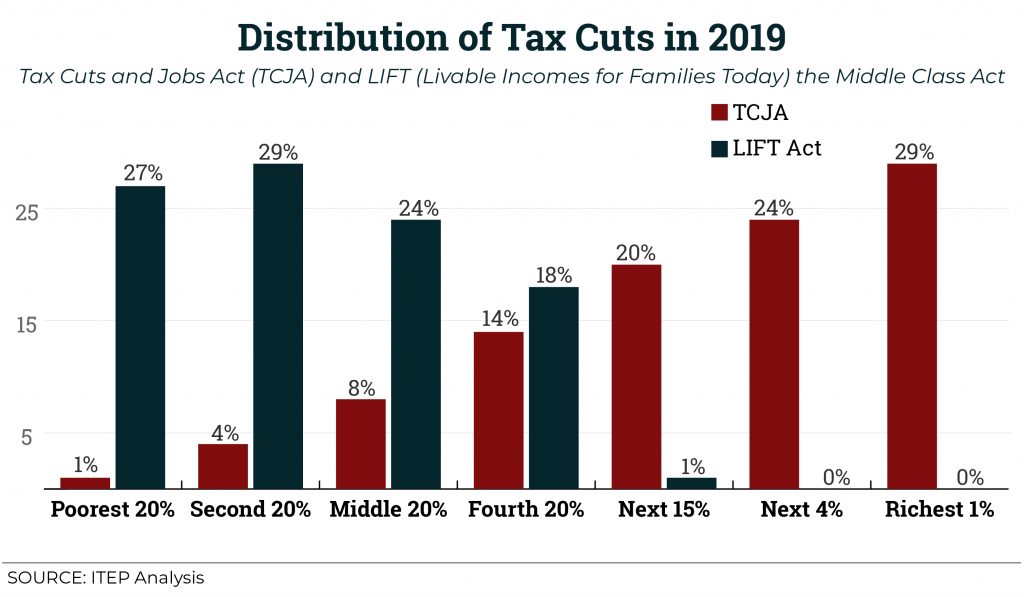

Shaking up TCJA: How a Proposed New Credit Could Shift Federal Tax Cuts from the Wealthy and Corporations to Working People

October 24, 2018 • By Aidan Davis

A new federal proposal, the Livable Incomes for Families Today (LIFT) the Middle Class Act, would create a new refundable tax credit for low- and middle-income working families who were little more than an afterthought in last year’s federal tax overhaul. This proposal would take the place of TCJA, providing tax cuts similar in cost to the recent federal tax law but targeted toward working people rather than the wealthy. ITEP analyzed the bill, proposed by California Senator Kamala Harris, and compared its potential impact to TCJA.

Tax Policies Have Increased Inequality, and So Would Entitlement Cuts

October 23, 2018 • By Steve Wamhoff

Conversations about economics often take place on different planets, it seems. Economists and analysts note rising inequality in America. And it’s not just lefty analysts. The credit ratings firm Moody’s chimed in earlier this month, warning that inequality “is a key social consideration that will impact the U.S.’ credit profile through multiple rating factors, including economic, institutional and fiscal strength.”

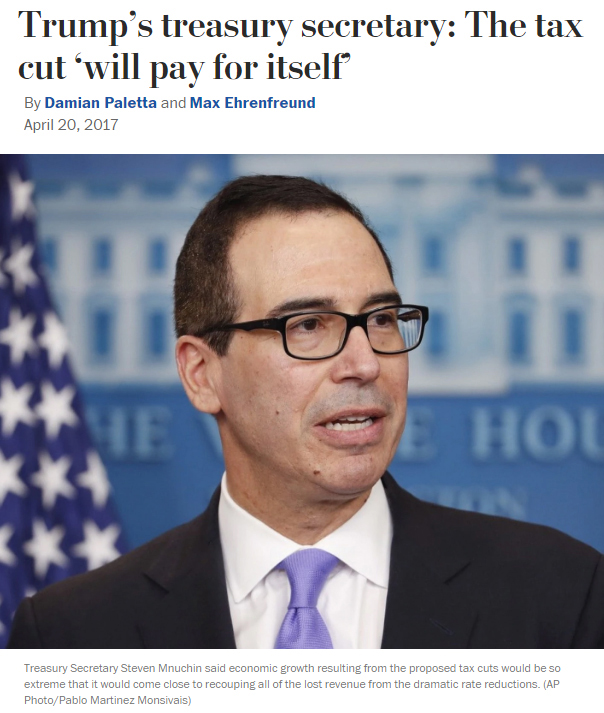

Lawmakers Want Working People to Foot the Bill for Top-Heavy Tax Cuts

October 18, 2018 • By ITEP Staff

Earlier this week, the Treasury Department reported that the federal deficit this fiscal year climbed by 17 percent to $779 billion, and next year is expected to be at least $1 trillion. The increased deficit comes after Congress last December passed an unpopular tax cut (The Tax Cuts and Jobs Act) that will cost nearly $2 trillion over a decade. GOP leaders repeatedly claimed the measure would pay for itself and not increase annual deficits, in spite of multiple economic predictions to the contrary.

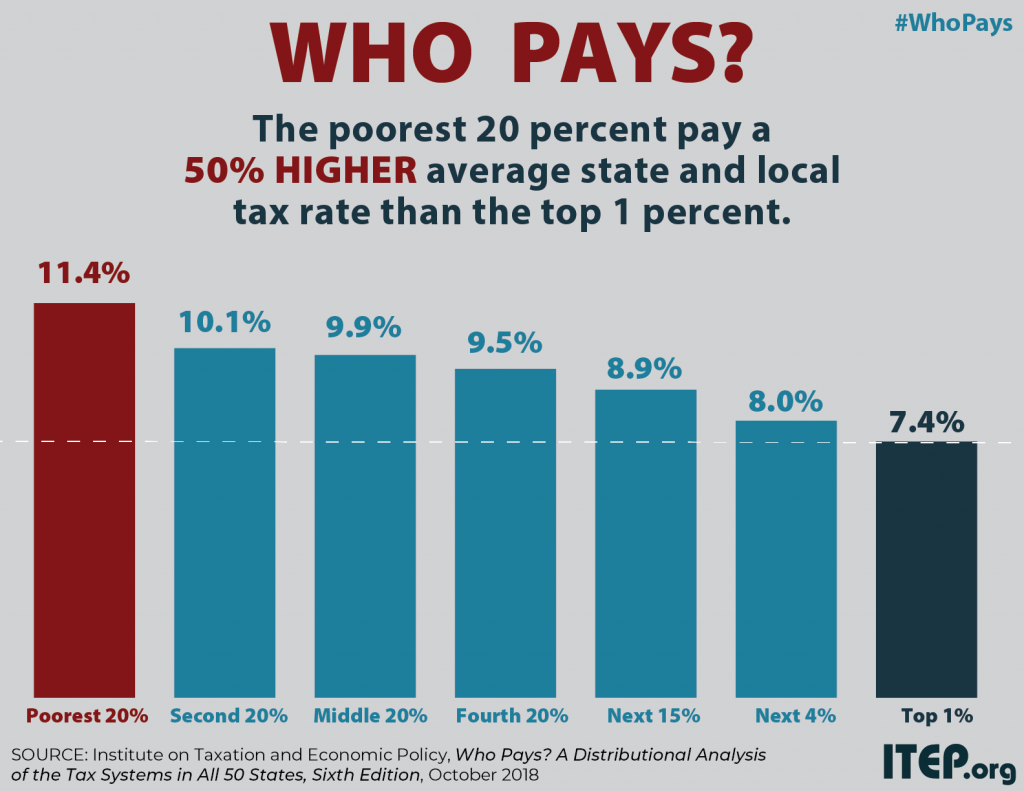

Policymakers and residents in all 50 states and the District of Columbia got new ITEP data this week on how their tax structures and decisions affect their high-, middle-, and low-income residents. As our “Who Pays?” report outlines, most state and local tax codes exacerbate economic inequalities and all states have room to improve. The data can serve as an important informative backdrop to all state and local tax policy debates, such as whether to change the valuation of commercial property in California, how to improve funding for early childhood education in Indiana, and how to evaluate tax-related ballot measures…

New Report Finds that Upside-down State and Local Tax Systems Persist, Contributing to Inequality in Most States

October 17, 2018 • By Aidan Davis

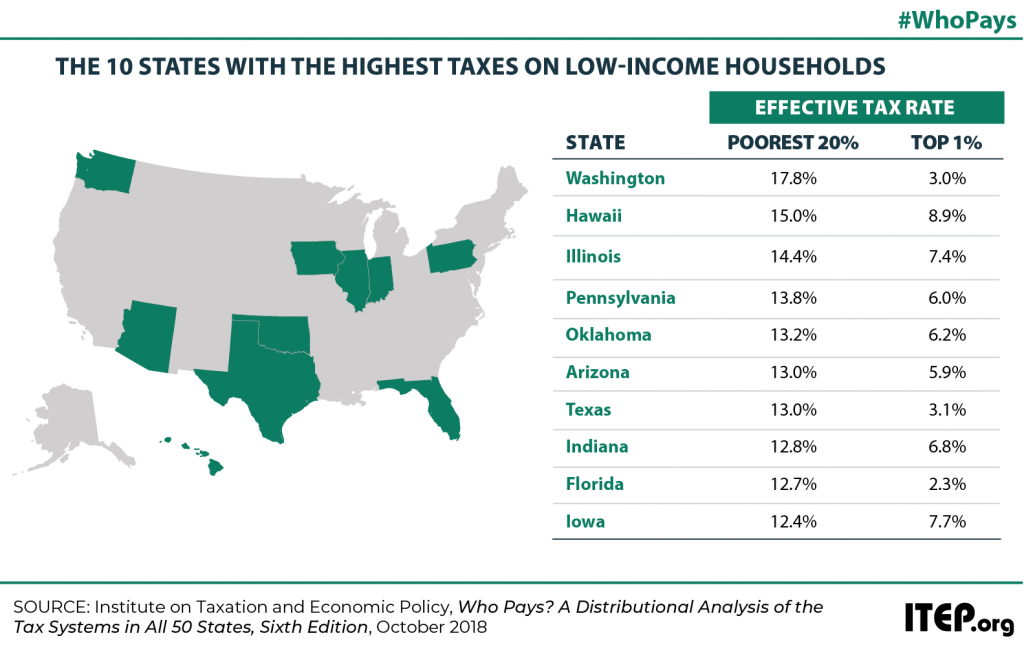

State and local tax systems in 45 states worsen income inequality by making incomes more unequal after taxes. The worst among these are identified in ITEP’s Terrible 10. Washington, Texas, Florida, South Dakota, Nevada, Tennessee, Pennsylvania, Illinois, Oklahoma, and Wyoming hold the dubious honor of having the most regressive state and local tax systems in the nation. These states ask far more of their lower- and middle-income residents than of their wealthiest taxpayers.

ITEP analysis reveals that many states traditionally considered to be “low-tax states” are actually high-tax for their poorest residents. The “low tax” label is typically assigned to states that either lack a personal income tax or that collect a comparatively low amount of tax revenue overall. But a focus on these measures can cause lawmakers to overlook the fact that state tax systems impact different taxpayers in very different ways, and that low-income taxpayers often do not experience these states as being even remotely “low tax.”

Low Tax for Whom? Indiana is a “Low Tax State” Overall, But Not for Families Living in Poverty

October 17, 2018 • By ITEP Staff

Indiana’s tax system has vastly different impacts on taxpayers at different income levels. For instance, the lowest-income 20 percent of Hoosiers contribute 12.8 percent of their income in state and local taxes — considerably more than any other income group in the state. For low-income families, Indiana is far from being a low tax state; in fact, it is the eighth highest-tax state in the country for low-income families.