Recent Work by ITEP

Short-sighted tax cuts continue to make their way to Governors’ desks this week. In Florida, Gov. DeSantis signed a $1.3 billion tax cut package with $550 million of the tax cuts from sales tax holidays, alone. The Nebraska legislature also sent $6.4 billion in tax cuts to Gov. Pillen’s desk which includes an enormous personal income tax cut that will reduce taxes on the top 1 percent by tens of thousands of dollars.

Congress Should Consider Attaching Work Requirements to the Biggest Tax Break for the Rich

May 25, 2023 • By Steve Wamhoff

Instead of focusing on low-income people who are already mostly employed or facing significant barriers to employment, lawmakers who want to encourage labor force participation should revisit existing tax breaks subsidizing wealthy individuals who live off their assets rather than work.

State Rundown 5/25: The North Star State Leads the Way on Tax Fairness

May 24, 2023 • By ITEP Staff

As we approach the midpoint of 2023, it’s a good time to look back at the progress states have made in the name of tax fairness and equity...

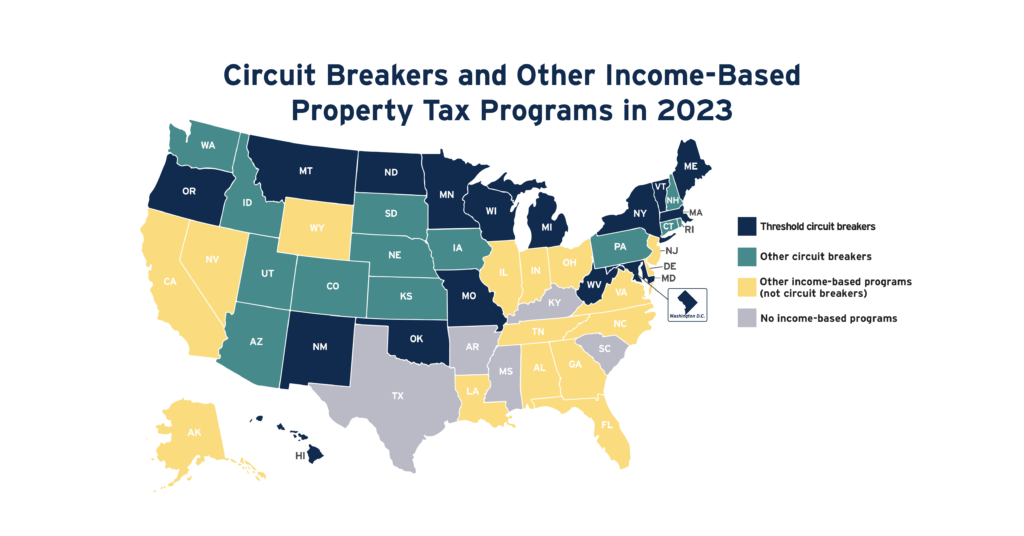

Circuit Breakers and Other Income-Based Property Tax Programs in 2023

May 19, 2023 • By ITEP Staff

No tax cut offers a more targeted solution to property tax affordability problems than circuit breaker credits. This is because circuit breakers are the only tools for reducing property taxes that measure the affordability of property taxes relative to families’ ability to pay. Circuit breakers protect families from property tax “overload” much like how traditional […]

This past week, in statehouses around the country, tax policy decisions are moving fast as budgets were signed and budget plans were released and passed...

States are Talking About the Wrong Kind of Property Tax Cuts

May 11, 2023 • By Brakeyshia Samms, Carl Davis

Concerns over property tax affordability have been at the forefront this year as housing prices have climbed and property tax bills have often increased along with them. As lawmakers mull a range of property tax cuts, circuit breakers are the best possible approach—and these policies are receiving far too little attention in the states.

Preventing an Overload: How Property Tax Circuit Breakers Promote Housing Affordability

May 11, 2023 • By Brakeyshia Samms, Carl Davis

Circuit breaker credits are the most effective tool available to promote property tax affordability. These policies prevent a property tax “overload” by crediting back property taxes that go beyond a certain share of income. Circuit breakers intervene to ensure that property taxes do not swallow up an unreasonable portion of qualifying households’ budgets.

State Rundown 5/10: Momentum on State Tax Credits Continues to Build

May 10, 2023 • By ITEP Staff

This week, in states across the country the momentum to center improvements to family economic security remains strong...

At nearly every turn, Oregon’s tax policies widen inequality; as a result, the top 1 percent pay less state and local taxes as a share of income than the poorest residents. Taxing capital gains at the local level is an important and exciting move in the other direction – to tax income from wealth and use it to address crucial needs.

The House’s Debt Ceiling Smoke Screen: The GOP Budget Plan Gives Cover for Tax Cuts for the Rich

May 9, 2023 • By Joe Hughes

While it isn’t reasonable in the first place for Congress to debate whether it will pay the bills it has already incurred, some of the same lawmakers who are holding the economy hostage to exact budget cuts have decided to make the conversation even more irrational by proposing to increase deficits with tax cuts that enrich the already rich.