Recent Work

2144 items

The tariffs proposed by Donald Trump, which are far larger than any on the books today, would significantly raise the prices faced by American consumers across the income scale.

Missouri is Sleepwalking into a Half-Billion Dollar Tax Cut for the Rich

April 22, 2025 • By Carl Davis

Missouri lawmakers are debating a tax cut that will mostly benefit the wealthiest in the state, while relying on an unrealistic estimate of what it will cost.

Ending Direct File Program is a Gift to the Tax-Prep Industry That Will Cost Taxpayers Time and Money

April 17, 2025 • By Jon Whiten

The Trump administration reportedly plans to shutter the IRS Direct File program before it has a chance to get fully off the ground, taking away a free option for people to file their tax returns directly to the agency. Ending Direct File is another gift from this administration to large corporations, this time to the multibillion-dollar tax prep industry that profits from you filing your taxes.

State Rundown 4/16: No Vacation from Spring Tax Breaks as Bills Advance

April 16, 2025 • By ITEP Staff

While students and families are enjoying spring break vacations, legislative sessions are still in full swing. And some are poised for a spring tax break season as proposals advance with major implications for the sustainability of state budgets.

It’s Tax Day. You’ve Paid Your Share, but the Billionaires Haven’t.

April 15, 2025 • By Amy Hanauer

You likely had most of your federal taxes deducted from your paychecks throughout the year. This is not true, however, for mega-millionaires and billionaires, some of whom are practically running our government right now.

IRS Cooperation with ICE Will Damage Public Trust, Putting Tax Revenues in Jeopardy

April 10, 2025 • By Marco Guzman

Attempts by the Department of Homeland Security to secure private information from the IRS on people who file taxes with an Individual Taxpayer Identification Number is a violation of federal privacy laws that protect taxpayers. It is also a change that could seriously damage public trust in the IRS, which could jeopardize billions of dollars in tax payments by hardworking immigrant families.

Residents and state lawmakers across the country are pushing back against anti-tax measures and are looking for ways to protect revenue and advance proposals that would raise revenue in progressive ways. This comes at a time when federal policy brings significant risks for state tax revenue.

Sharp Turn in Federal Policy Brings Significant Risks for State Tax Revenues

April 9, 2025 • By Carl Davis

Summary The new presidential administration and Congress have indicated that they intend to bring about a dramatic federal retreat in funding for health care, food assistance, education, and other services that will push more of the responsibility for providing these essential services to the states. Meeting these new obligations would be a challenging task for […]

A Windfall for the Wealthy: A Distributional Analysis of Mississippi HB 1

April 8, 2025 • By Aidan Davis, Dylan Grundman O'Neill, Neva Butkus

Mississippi lawmakers have approved the most radical and costly change to the state’s personal income tax system to date. House Bill 1 ultimately eliminates the state's personal income tax and cuts state revenues by nearly $2.7 billion a year when fully implemented. This deeply regressive legislation will create a windfall for the wealthiest residents of the poorest state in the nation while simultaneously jeopardizing the state’s ability to fund public services that support Mississippians and the state’s economy.

Philadelphia Mayor’s Proposal to Cut Business Taxes is Illogical and Imprudent

April 7, 2025 • By Kamolika Das

Mayor Cherelle L. Parker’s proposal to cut the city’s business income and receipts tax (BIRT), based off the Philadelphia Tax Reform Commission’s recommendation, is illogical and imprudent. This is more than the city spends each year on homelessness services, public health, the streets department, and countless other programs that directly benefit residents.

What the Wall Street Journal Editorial Board Got Wrong About Tesla’s Tax Avoidance

April 4, 2025 • By Matthew Gardner

Tesla’s income tax avoidance is still in the news, and that’s a good thing.

Senate Republicans Rig Congressional Rules to Make Their Tax Cuts Appear Cost-Free

April 4, 2025 • By Steve Wamhoff

This week, members of Congress are arguing about whether extending Trump’s 2017 tax cuts would cost trillions of dollars over a decade or cost nothing.

State Rundown 4/3: Amidst Tariff Uncertainty, State Lawmakers Talk Taxes

April 3, 2025 • By ITEP Staff

While all eyes are on the Trump administration’s tariffs on foreign imports, state lawmakers are moving forward with a mix of deep, regressive tax cuts and progressive revenue raisers.

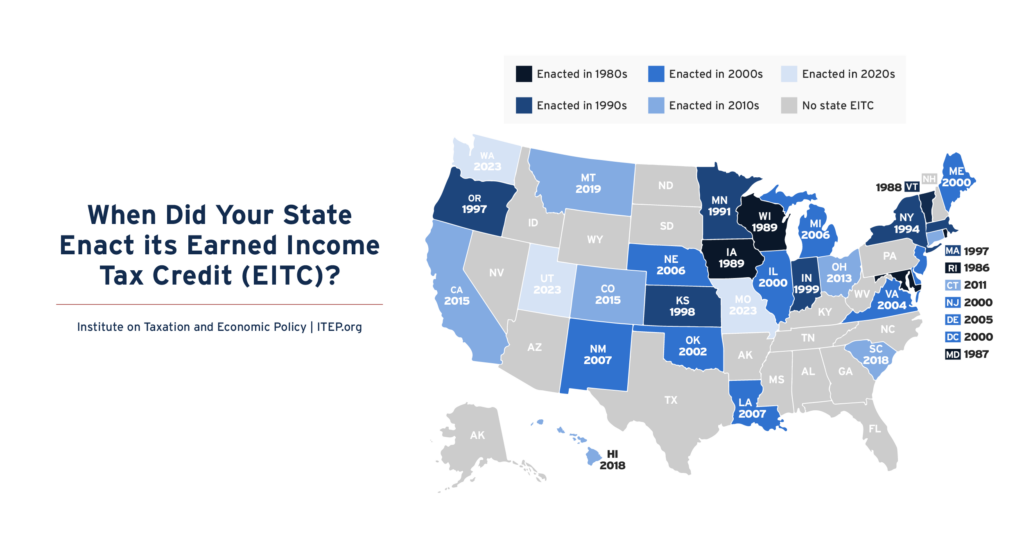

The Earned Income Tax Credit (EITC) supports millions of workers and families and continues to grow in states and localities across the country. Today, 31 states plus the District of Columbia and Puerto Rico offer EITCs. Local EITCs can also now be found in Montgomery County, Maryland, New York City, and San Francisco, where they benefited 700,000 households in 2023.

This week, we celebrate 50 years of the federal Earned Income Tax Credit (EITC) and the impact it's had on millions of workers and families. In 2023 alone, the latest year of available data, the federal EITC alongside the refundable portion of the Child Tax Credit lifted 6.4 million people and 3.4 million children out of poverty.