Recent Work

2161 items

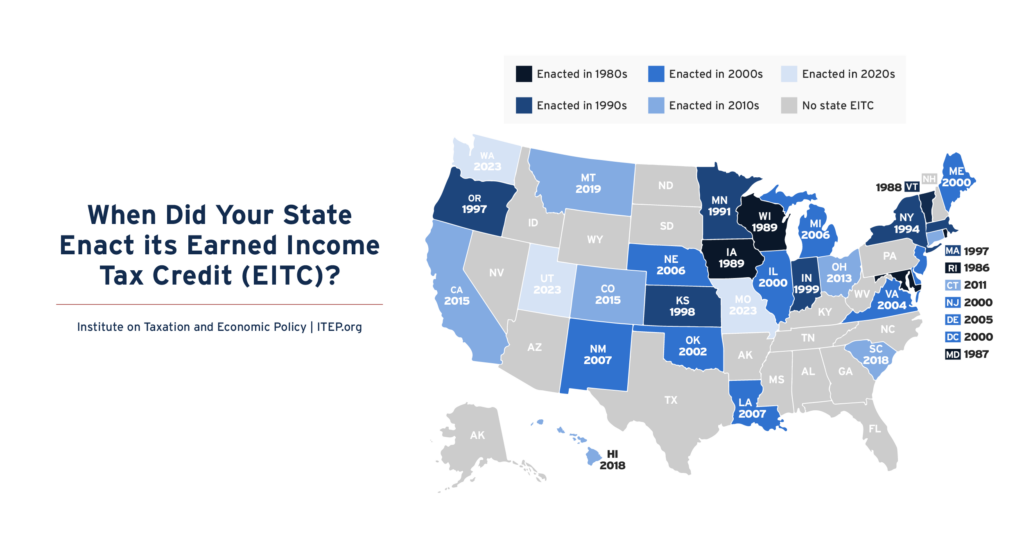

The Earned Income Tax Credit (EITC) supports millions of workers and families and continues to grow in states and localities across the country. Today, 31 states plus the District of Columbia and Puerto Rico offer EITCs. Local EITCs can also now be found in Montgomery County, Maryland, New York City, and San Francisco, where they benefited 700,000 households in 2023.

This week, we celebrate 50 years of the federal Earned Income Tax Credit (EITC) and the impact it's had on millions of workers and families. In 2023 alone, the latest year of available data, the federal EITC alongside the refundable portion of the Child Tax Credit lifted 6.4 million people and 3.4 million children out of poverty.

Advantaging Affluence: A Distributional Analysis of Missouri HB 798’s Uneven Tax Cuts for Wealth and Work

March 28, 2025 • By Aidan Davis, Carl Davis, Dylan Grundman O'Neill, Eli Byerly-Duke, Matthew Gardner

Missouri House Bill 798 would reduce personal and corporate income tax rates, fully eliminate taxes on capital gains income from sale of assets, and eliminates the state’s modest Earned Income Tax Credit that assists many working people in lower-paid jobs. HB 798 would radically transform Missouri’s income tax code into a system that privileges income from wealth over income from work, leaving many middle-income families to pay a higher income tax rate than wealthy people living off their investments.

State Rundown 3/26: Lawmakers Navigate Shortfalls, Potholes, and Pitfalls

March 26, 2025 • By ITEP Staff

State lawmakers around the country are navigating a range of potential hazards this week. Leaders in Maryland and Washington are facing budget holes but are smartly working to get out of them through progressive taxes on those with the most ability to pay. Both North Dakota and Washington state are looking to fill literal potholes […]

Why Americans Are Right to Be Unhappy About Corporate Tax Avoidance

March 26, 2025 • By Matthew Gardner

If lawmakers wanted to reduce income inequality and racial inequality, shutting down or at least limiting corporate tax breaks would be one option to achieve that goal. Unfortunately, President Trump and the current Congress show little interest in this and may even move in the opposite direction by introducing new corporate tax breaks.

Two Ways a 2025 Federal Tax Bill Could Worsen Income and Racial Inequality

March 26, 2025 • By Joe Hughes

Two parts of Trump’s 2017 tax law that are particularly expensive and beneficial to the richest individuals are the changes in income tax rates and brackets and the special deduction for “pass-through” business owners. Lawmakers should not extend these provisions for high-income households past the end of this year, when they are scheduled to expire.

The U.S. needs a tax code that is more adequate, meaning any major tax legislation should increase revenue, not reduce it. The U.S. also needs a tax code that is more progressive, meaning any significant tax legislation should require more, not less, from those most able to pay.

Tip Exemptions Have No Place in State Income Tax

March 25, 2025 • By Eli Byerly-Duke, Nick Johnson

Creating a special tax break for tipped income – as at least 20 states are considering this spring – would harm state budgets, encourage tax avoidance, and fail to reach the vast majority of low- and middle-income workers.

March Madness kicks off today and the pressure is on as many states’ legislative sessions are nearing the final buzzer. Some state lawmakers are seemingly competing for the title of most regressive state tax policies while others are looking to lift up best practices for more equitable outcomes. The Mississippi legislature landed on a […]

Housing Affordability and Property Taxes: How to Actually Move the Needle

March 19, 2025 • By Kamolika Das, Rita Jefferson

Tax policy alone cannot solve the housing crisis but lawmakers who are focused on tax policy solutions have better options available than sweeping property tax cuts and caps: property tax circuit breakers, renter credits, vacancy taxes, land value taxes, and changes to existing property tax assessments can move the needle on the affordable housing crisis.

Shelter Skelter: How the Educational Choice for Children Act Would Use Tax Avoidance to Fuel School Privatization

March 18, 2025 • By Carl Davis

The Educational Choice for Children Act of 2025 would ostensibly provide a tax break on charitable donations to organizations that give out private K-12 school vouchers. Most of the so-called “contributions,” however, would be made by wealthy people solely for the tax savings, as those savings would typically be larger than their contributions.

A Revenue Impact Analysis of the Educational Choice for Children Act of 2025

March 18, 2025 • By Carl Davis

The Educational Choice for Children Act of 2025 would provide donors to nonprofit groups that distribute private K-12 school vouchers with a dollar-for-dollar federal tax credit in exchange for their contributions. In total, the ECCA would reduce federal and state tax revenues by $10.6 billion in 2026 and by $136.3 billion over the next 10 years. Federal tax revenues would decline by $134 billion over 10 years while state revenues would decline by $2.3 billion.

Circuit Breakers Are a Better Option for Property Tax Relief

March 13, 2025 • By Brakeyshia Samms

To curb the impact of property taxes on working families, lawmakers should improve or implement a property tax circuit breaker program. The program works like this: when families are overloaded with their property taxes, the circuit breaker kicks in and helps alleviate the pressure these taxes put on family budgets.

State Rundown 3/12: Last-Minute Tax Cut Mayhem and New Progressive Revenue Raisers

March 12, 2025 • By ITEP Staff

A bevy of tax cut proposals sprung to life this week while others were signed into law. In Kentucky, lawmakers are working to make it easier for the legislature to enact income and business tax cuts. The governor in Idaho signed into law a personal and corporate income tax cut.

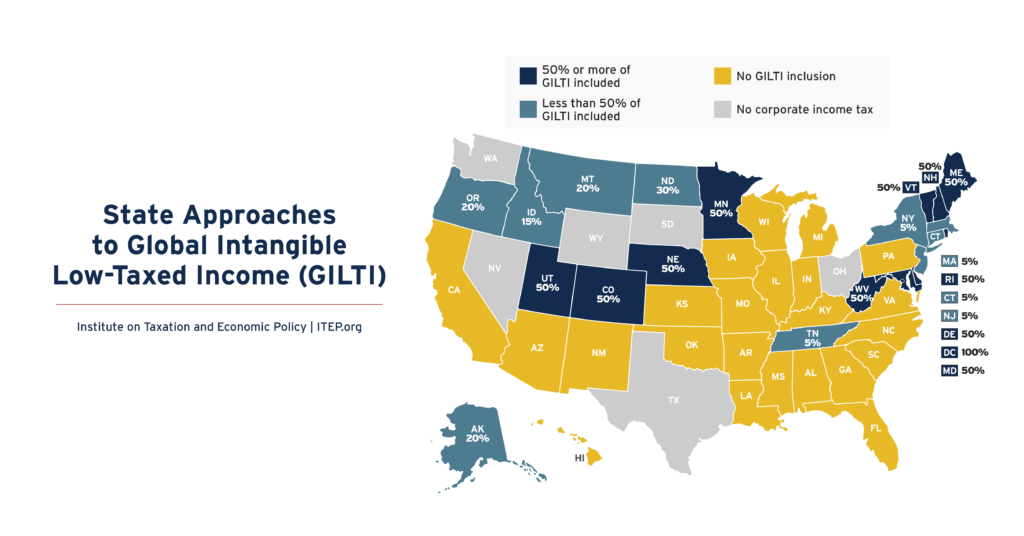

Many states with corporate income taxes include some amount of federally defined Global Intangible Low-Taxed Income (GILTI) in their tax bases. Twenty-one states plus D.C. include some amount of GILTI in their tax calculations in 2025.