Recent Work

2146 items

State Rundown 11/30: ‘Lame Duck’ December Could Have Major Tax Implications

November 30, 2022 • By ITEP Staff

As federal lawmakers begin their lame duck deliberations, the revival of the expanded child tax credit remains a strong possibility...

Child Tax Credit Expansion Would Shrink the Racial Wealth Gap

November 21, 2022 • By ITEP Staff

Extending the expanded Child Tax Credit would benefit nearly every child in low- and middle-income families. Under current rules, 24% of white children, 45% of Black children, and 42% of Hispanic children will not receive the full credit in 2023 because their families make too little. These figures would drop to zero if the provisions were extended, helping families of all races and disproportionately helping families of color.

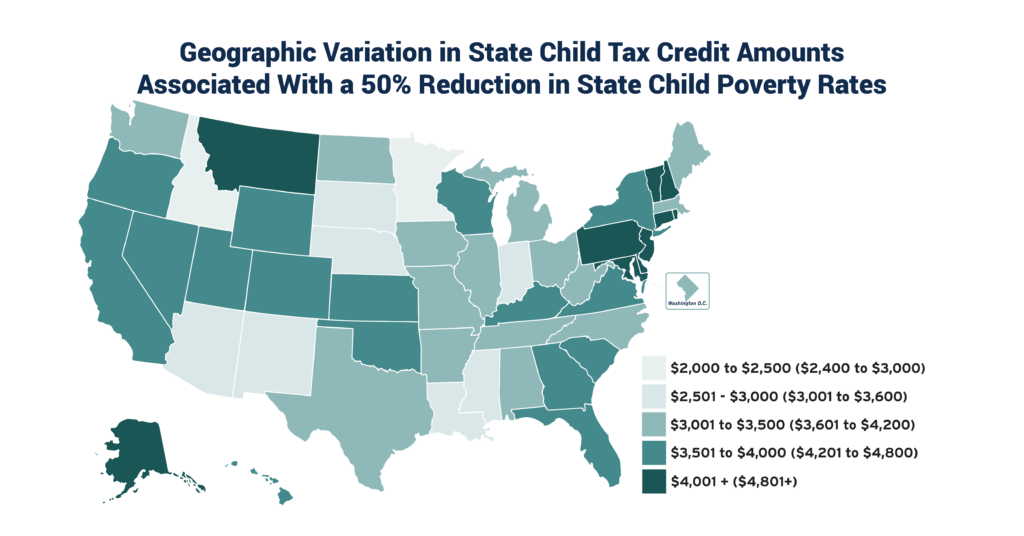

State policymakers have the tools they need to drastically reduce child poverty within their borders. A new ITEP report, coauthored with Columbia University’s Center on Poverty and Social Policy, explores state Child Tax Credit (CTC) options that would reduce child poverty by up to 50 percent. Temporary expansion of the federal CTC in 2021 reduced […]

State Child Tax Credits and Child Poverty: A 50-State Analysis

November 16, 2022 • By Aidan Davis

Regardless of future Child Tax Credit developments at the federal level, state policies can supplement the federal credit to deliver additional benefits to children and families. State credits can be specifically tailored to meet the needs of local populations while also producing long-term benefits for society as a whole

As states continue to tally the remaining votes and the news stories roll out at a breakneck pace, the unofficial results of the 2022 midterm elections have brought with it significant changes across the state tax policy landscape...

Election Day in the States: Voters Deliver Important Victories for Tax Justice

November 10, 2022 • By Jon Whiten

Voters in Massachusetts and Colorado raised taxes on their wealthiest residents to fund schools, public transportation and school lunches for kids while making their tax codes more equitable. And voters in West Virginia defeated a proposal to deeply cut taxes, mostly for businesses, and drain the coffers of county and local governments.

Twenty-Three Corporations Saved $50 Billion So Far Under Trump Tax Law’s “Bonus Depreciation” that Many Lawmakers Want to Extend

November 10, 2022 • By Matthew Gardner, Steve Wamhoff

Nearly two dozen of America’s largest corporations together received roughly $50 billion in tax breaks from 2018 through 2021 under a Trump tax law provision that many lawmakers now want to extend. Corporate lobbyists are even asking Congress to extend this “accelerated depreciation” tax break as part of a possible year-end tax bill.

Massachusetts Voters Score Win for Tax Fairness with ‘Fair Share Amendment’

November 9, 2022 • By Marco Guzman

In a significant victory for tax fairness, Massachusetts voters approved Question 1—commonly known as the Fair Share Amendment—Tuesday night with 52 percent of the vote. The new constitutional amendment creates a 4 percent surcharge on income over $1 million, and the revenue will specifically fund education and transportation projects in the Bay State.

Key Republicans Say Negligible Decline in Economic Growth Outweighs Enormous Drop in Child Poverty

November 3, 2022 • By Joe Hughes

The expanded Child Tax Credit reduced child poverty dramatically and immediately. There is no debate or murkiness on this. Some lawmakers have decided that cutting child poverty in half is not worth the cost if it means an ambiguous and negligible decline in GDP growth. This view is not just cruel, it is bad economics.

Next Tuesday, voters will head to the polls to not only elect local and national leaders, but also let their voices be heard on a range of tax policy issues that could improve or worsen their state tax codes...

Tax Foundation’s ‘State Business Tax Climate Index’ Bears Little Connection to Business Reality

October 31, 2022 • By Carl Davis, Matthew Gardner

The big problem with the Index is that it peddles a solution that not only falls short of the goal of generating business investment, but one that actively harms state lawmakers’ ability to provide the kinds of public goods – like good schools and modern, efficient transportation networks – that businesses need and want.

Measures on the November Ballot Could Improve or Worsen State Tax Codes

October 26, 2022 • By Jon Whiten

In a couple of weeks, voters in a handful of states will weigh in on several tax-related ballot measures that could make state tax codes more equitable and raise money for public services, or take states in the opposite direction, making tax systems less fair and draining state coffers of dollars needed to maintain critical […]

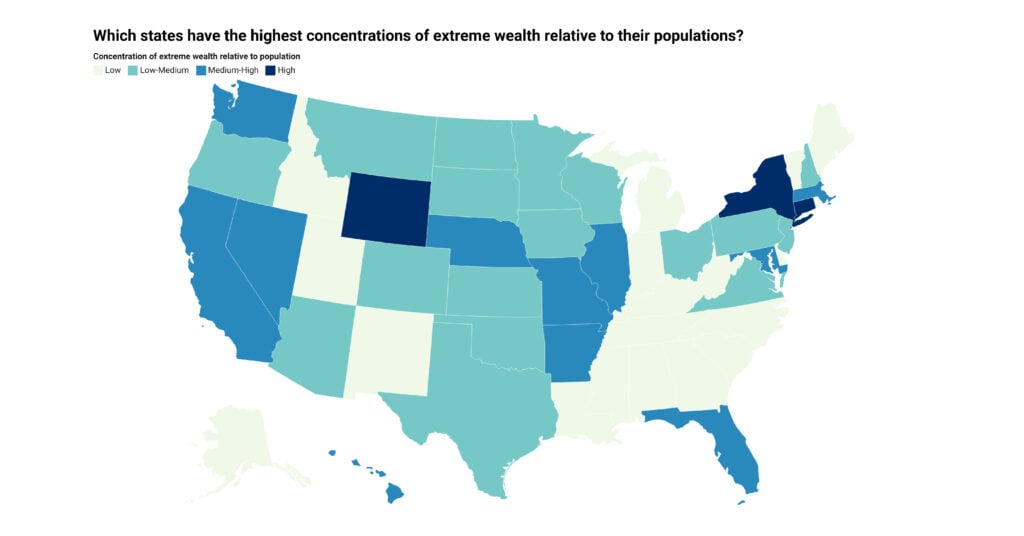

More than one in four dollars of wealth in the U.S. is held by a tiny fraction of households with net worth over $30 million. This extreme wealth is geographically concentrated, with the top 10 states accounting for more than 70 percent of nationwide extreme wealth and with New York and California alone accounting for nearly a third.

More than one in four dollars of wealth in the U.S. is held by a tiny fraction of households with net worth over $30 million. Nationally, we estimate that wealth over $30 million per household will reach $26 trillion in 2022 with roughly one-fifth of that amount ($4.5 trillion) held by billionaires.

Although the weather is beginning to cool down in parts of the country, the same cannot be said for many state economies, which are still running hot. That, however, doesn’t mean that the good times are guaranteed to last...