Recent Work

2146 items

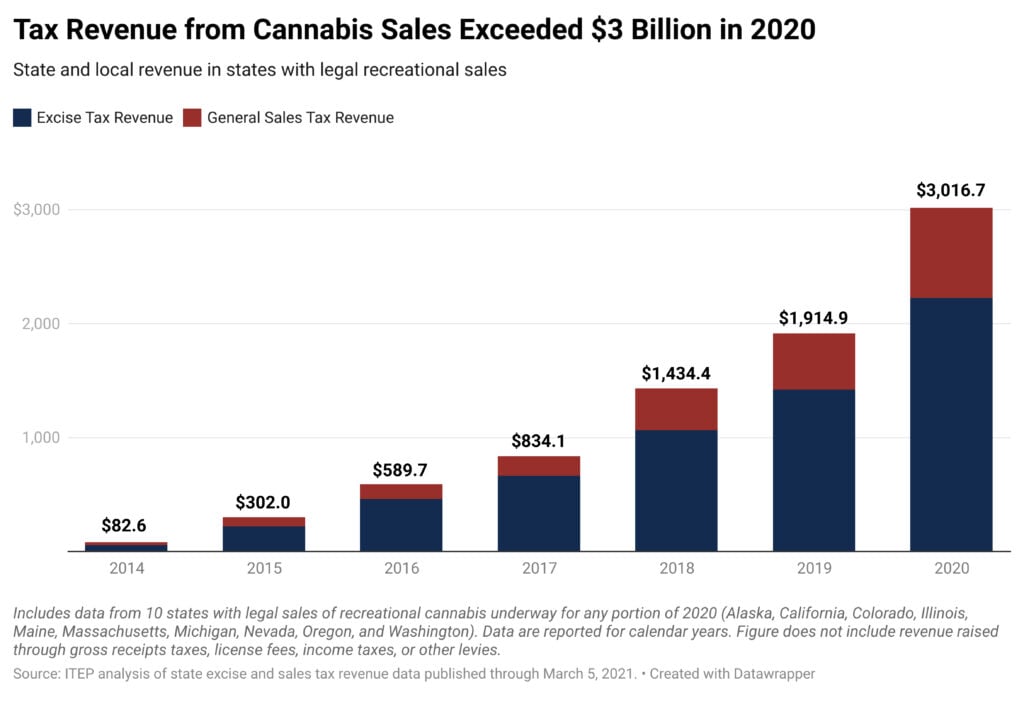

State and Local Cannabis Tax Revenue Jumps 58%, Surpassing $3 Billion in 2020

March 15, 2021 • By Carl Davis

Cannabis taxes are a small part of state and local budgets, clocking in at less than 2 percent of tax revenue in the states with legal adult-use sales. But they’re also one of states’ fastest-growing revenue sources. Powered by an expanding legal market and a pandemic-driven boost in cannabis use, excise and sales taxes on […]

Rep. Doggett and Sen. Whitehouse Introduce Bill to Crack Down on Offshore Corporate Tax-Dodging

March 11, 2021 • By Steve Wamhoff

The 2017 tax law simply replaced one set of loophole-ridden rules that favored offshore profits over domestic profits with a new set of loophole-ridden rules doing the same thing. A bill introduced today by Rep. Lloyd Doggett and Sen. Sheldon Whitehouse would finally fix this to follow a simple principle: we should tax the offshore profits and domestic profits of our corporations the same way.

State Rundown 3/10: Federal Pandemic Aid Means States Can Focus on the Big Picture

March 10, 2021 • By ITEP Staff

State and local policymakers will be preoccupied for a short time with celebrating and deciphering the federal pandemic relief package approved today, but ultimately the federal aid should free them to focus on even bigger concerns such as tax codes that often fail to adequately fund core priorities even in good years and exacerbate the economic and racial inequities that this pandemic has laid bare.

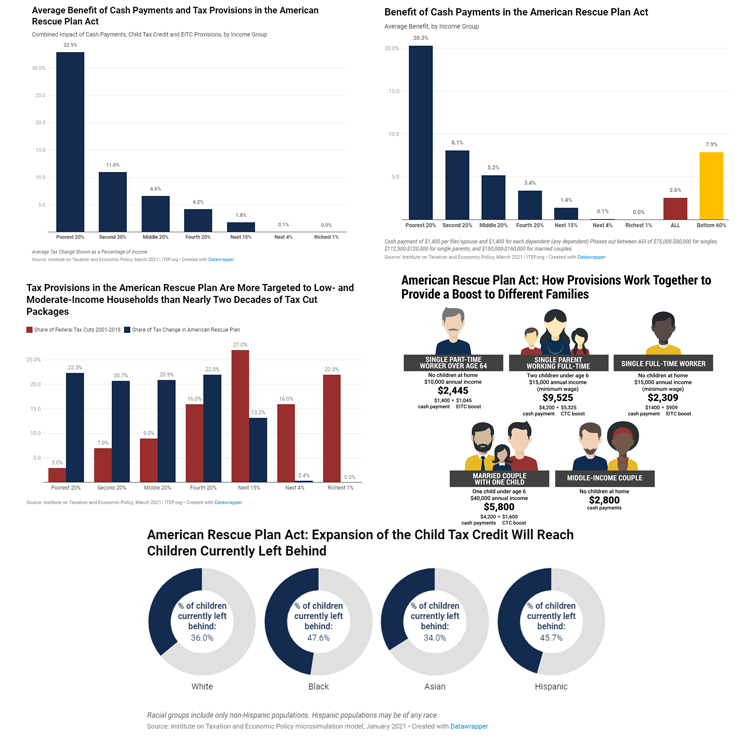

Targeted Relief and the American Rescue Plan in Five Charts

March 10, 2021 • By Stephanie Clegg

The American Rescue Plan Act is unique in that it employs the tax code to deliver relief to those struggling most. These five charts provide a glimpse of how the plan helps families across the income spectrum and also targets economic relief to low- and moderate-income families in the form of cash payments and expansions to the Child Tax Credit and Earned Income Tax Credit.

Estimates of Cash Payment and Tax Credit Provisions in American Rescue Plan

March 7, 2021 • By Steve Wamhoff

Update: On March 10, the House passed the Senate version of the COVID relief bill, called the American Rescue Plan Act, and sent it to President Biden for his signature. This means that the Senate version of the bill described herein is the final legislation enacted into law.

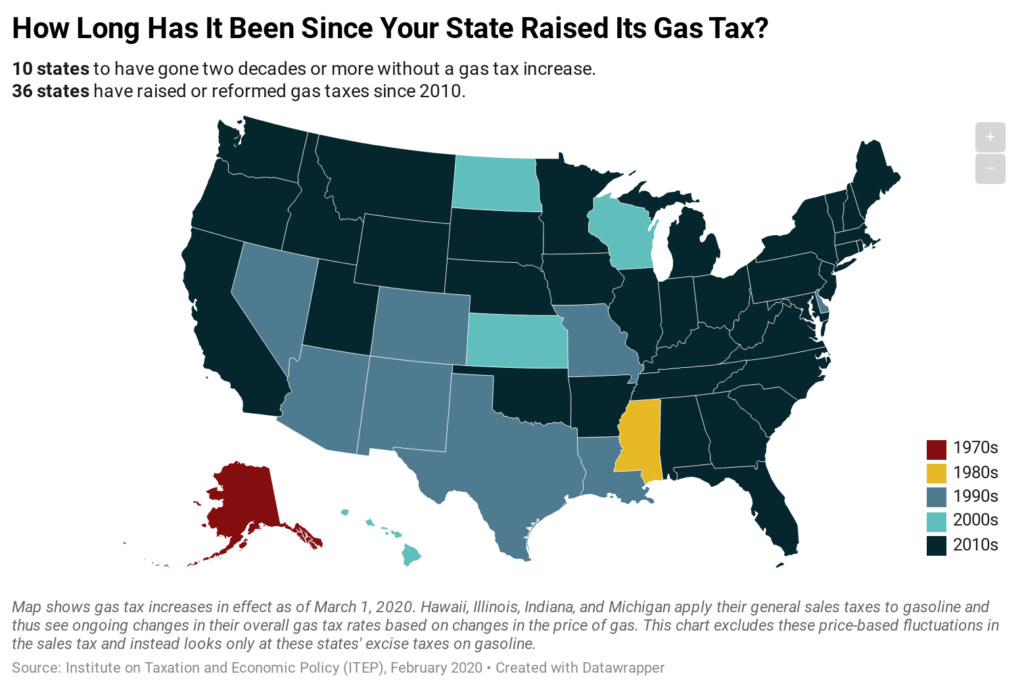

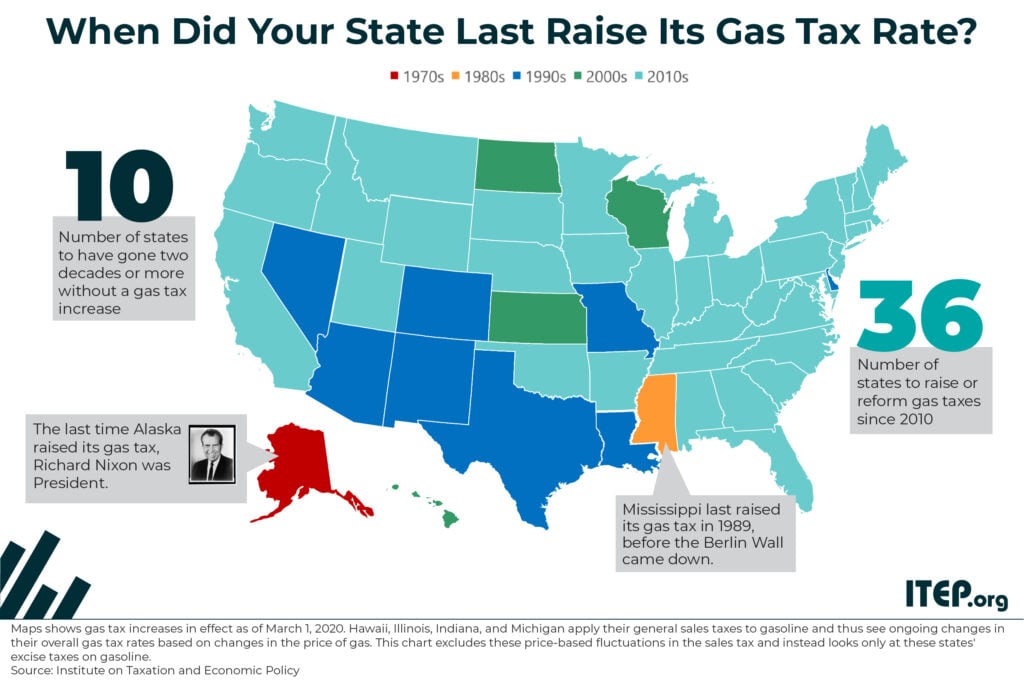

10 states to have gone two decades or more without a gas tax increase.

Many state governments are struggling to repair and expand their transportation infrastructure because they are attempting to cover the rising cost of asphalt, machinery, and other construction materials with fixed-rate gasoline taxes that are rarely increased.

Although lawmakers in some states continue to push for expensive and regressive tax cuts that would primarily benefit wealthy households, worsen economic and racial injustices, and undermine funding for key public services, this week’s state fiscal news is dominated by efforts to do the opposite. Leaders in the District of Columbia, Maine, Nebraska, New York, Washington, and Wyoming made recent headlines by advocating for policies that improve on upside-down tax codes and generate needed funding for shared priorities like schools and health care.

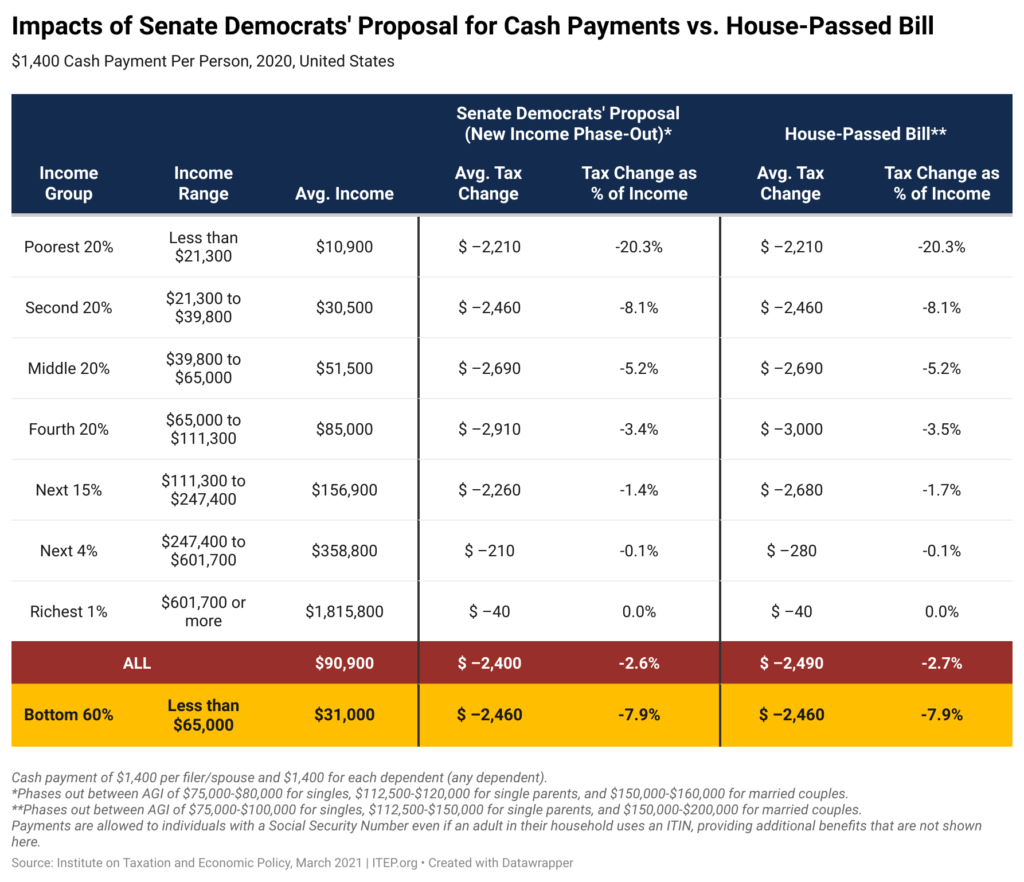

As the Senate takes up the COVID relief bill passed by the House last week, Senate Democrats have proposed to lower the income level at which the $1,400 cash payments would be phased out. New estimates from ITEP demonstrate that, for most people, the change would make no difference.

With the onslaught of news about billionaire wealth soaring while low- and moderate-income families have trouble making ends meet, a federal wealth tax makes good economic and fiscal sense—and the public supports it. One poll found that 64 percent of respondents favor the idea, including a majority of Republicans.

The federal minimum wage is almost comically low. At $7.25 an hour, it is 29 percent below its inflation-adjusted peak in the 1960s. Raising the minimum wage to $15 an hour would lift 900,000 Americans out of poverty. A solid 61 percent of voters support the idea. A majority of lawmakers in both the House and Senate support at least some version of a minimum wage hike. The popular $1.9 trillion American Rescue Plan includes a measure that would raise the minimum wage over the next few years to $15. So, what is the problem? And why are lawmakers now…

An Unequal Recession Will Breed Unequal Recovery Without Bold Investments

February 26, 2021 • By Stephanie Clegg

Without bold investments now, experts predict a longer, more unequal recovery. President Biden's American Rescue Plan, the framework for legislation expected to pass this week in the House, would boost economic well-being for those whose livelihoods were most affected by the pandemic-induced economic crisis.

State Rundown 2/24: State Tax Debates Quickly Thaw Out with Warmer Weather

February 24, 2021 • By ITEP Staff

Warming temperatures in many parts of the country this week seem to be thawing out state fiscal debates as well. Multiple states including California, Colorado, Maryland, and New Jersey saw movement on efforts to improve tax credits for low- and middle-income families. Mississippi House lawmakers suddenly rushed through a dangerous bill to eliminate the state’s income tax and shift those taxes onto lower-income households. Montana senators also approved regressive income tax cuts and South Dakota legislators advanced an anti-tax constitutional amendment, while lawmakers in Hawaii, Rhode Island, and Washington made progress on improving the progressivity of their tax codes. Gas…

Alaska is notoriously reliant on tax and royalty revenue from oil to fund vital public services and institutions, but declining oil prices and production levels have rendered those revenues inadequate to meet the state’s needs. ITEP analysis of potential state income tax options in Alaska shows the potential to raise between $526 million and $696 million per year yet are quite modest compared to personal income tax structures in other states. When measured relative to state residents’ incomes, any of these options would rank among the bottom five lowest state income taxes in the nation.

Alaska lawmakers are facing an unprecedented fiscal crisis. The state is more dependent than any other on oil tax and royalty revenues but declines in oil prices and production levels have sapped much of the vitality of these revenue sources. One way of diversifying the state’s revenue stream and narrowing the yawning gap between state revenues and expenses would be to reinstitute a statewide personal income tax. Alaska previously levied such a tax until 1980. This report contains ITEP’s analysis of the distributional impact and revenue potential of a variety of flat-rate income tax options for Alaska, based on draft…