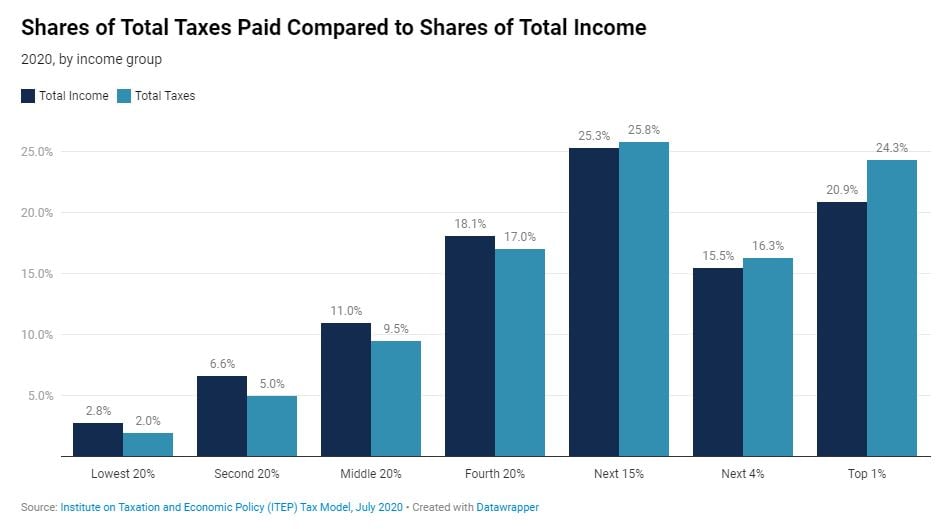

Taxes not only provide revenue so we can have a functioning government, they also shape broader society. Currently, economic inequality is one of the most pressing challenges of our time. ITEP has produced research over the years that shows the nation’s overall tax system (local, state and federal combined) is barely progressive. With real tax reform that centers ordinary people, tax policy can help create a more equitable society.

Here are a few reasons why federal policymakers should enact progressive tax reforms.

- The rich are getting a whole lot richer. During the pandemic, billionaire wealth soared while ordinary people struggled to make ends meet. According to the Institute for Policy Studies and Americans for Tax Fairness, billionaire wealth catapulted from $2.95 trillion to $4.56 trillion from March 2020 to April 2021.

NEW: The wealth of U.S. billionaires has steadily grown over the last thirty-one years.

But 1/3 of billionaire wealth gains since 1990 have come during the last 13 months of the pandemic.

More from our @inequalityorg team & @4TaxFairness:https://t.co/rCI4sFzvLI pic.twitter.com/rscadUgxwq

— Institute for Policy Studies (@IPS_DC) April 15, 2021

- Winners take most, if not all. The financial gains from increased worker productivity have flowed to the executive suite. From 1978 to 2019, CEO compensation grew by 1,117 percent and CEOs now make 320 times more than the average worker, according to a study by the Economic Policy institute. Meanwhile, average workers’ wages grew only modestly during this period and the federal minimum wage has not kept pace with inflation.

CEO compensation has a lot to do with top 1% wage growth, and especially the relationship to stock market:https://t.co/lCl5pWLo7s

— Larry Mishel (@LarryMishel) December 2, 2020

- Trickle-up economics. For the last four decades, more and more of the nation’s wealth has concentrated at the top. Before the pandemic, the top 10 percent owned 76 percent of the nation’s wealth while the bottom 50 percent owned just 1 percent of all wealth, according to the Federal Reserve.

More evidence that trickle-down economic policies are truly gush up economic polices.

As supply-siders and their political allies influenced policies over the last few decades, the top 1 % got $50 trillion (TRILLION!) richer. https://t.co/DQIwfREHTE

— Citizens for Tax Justice (@taxjustice) September 16, 2020

- Misplaced appreciation. It’s worth repeating again and again: The stock market is not the economy. A roaring stock market does not translate into widespread financial security. According to the Federal Reserve’s Survey of Consumer Finances, the top 1 percent own 38 percent of all stock. The top 10 percent own 84 percent.

It’s more obvious than ever that myths of sole economic indicators don’t capture how working people are faring.

Stock Market ≠ Economy https://t.co/MoOREy7V1P pic.twitter.com/6Qs1zHuW5x

— ITEP (@iteptweets) May 1, 2020

- Helping corporations helps the rich. Congress further enriches those (mostly wealthy) households who own corporate stocks whenever it cuts corporate taxes or allows corporations to avoid taxes. This robs the nation of critical resources to fund our common priorities and is also unfair to small businesses and corporations that don’t engage in aggressive tax avoidance. This year alone, 55 profitable corporations avoided federal income taxes.

55 of America’s Largest Companies

$40 Billion in Profits in 2020

$0 in Corporate Income TaxesREPORT: https://t.co/xtWC10Myj0https://t.co/rGQoG0DceA

— ITEP (@iteptweets) April 2, 2021

- Don’t believe the hype. Anti-tax advocates are on a mission to torpedo President Biden’s proposed tax increases, falsely claiming that the pre-pandemic economy was a time of utopic shared prosperity. The truth is that more workers were getting by on gig economy jobs, two jobs or low-wage jobs in general. As for economic security, four in 10 of us didn’t have $400 cash or equivalent on hand to cover an emergency expense, according to a Federal Reserve Survey.

We live in a country where 40% of people can’t afford a $400 emergency expense.

Now layoffs are starting. Many are being sent home unpaid. Others are stuck with huge hospital bills.

Fellow CEOs & gov’t: if we don’t step up now it could be catastrophichttps://t.co/D1s3JmSJLV

— Dan Price (@DanPriceSeattle) March 12, 2020

POLICY SOLUTIONS

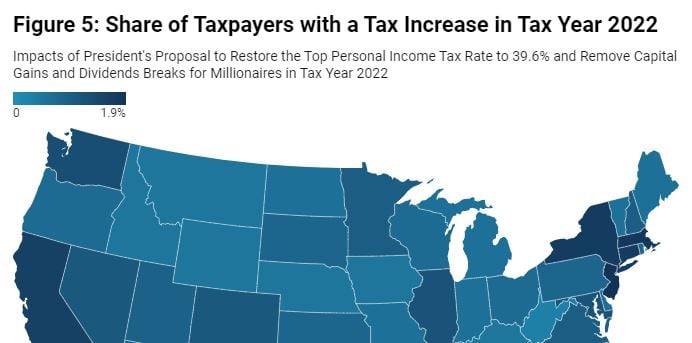

Economic inequality is not inevitable. A myriad of policy solutions can work in tandem to address it, including strengthening workers’ right to collectively bargain, cracking down on excessive CEO pay, boosting the minimum wage—and more progressive tax policies. President Biden has proposed increasing taxes for individuals earning more than $400,000 a year as well as corporate tax increases. He’s also proposed using the tax code to shore up economic security for low-income families. ITEP’s research reveals these policies would be transformative for millions of lower-income families.