While the country transitions to a new, yet familiar, presidential administration, lawmakers must keep in mind: fighting racial injustice should still be one of the focal points of this year’s tax debates. In theory, the debate over extending much of 2017’s Trump tax law represents an opportunity to advance racial equity. In practice, the tax package is likely to do the opposite, worsening racial inequities that already exist.

People tend to think the tax code has nothing to do with race. But that is far from the truth. The federal tax code taxes earnings from wealth at a lower rate than earnings from work. It also rewards people who earn enough to put aside more money for retirement. And it has benefits for homeowners that are higher for owners of more expensive homes. All of these elements of the tax code mean that the way white households typically accumulate wealth is far more tax-advantaged than the situation facing households of color. This is a contributing factor to the large racial wealth gap we see today.

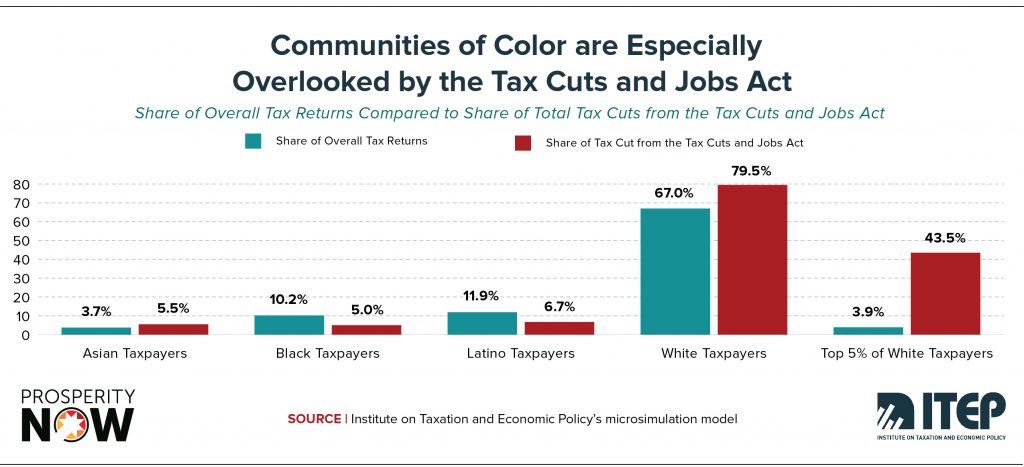

Lawmakers can use tax policy to create financial security programs and raise revenue that helps shrink the racial wealth divide. But the 2017 tax law did nothing to reduce racial injustice in the tax code. Rather it further divided the rich and the poor, and increased disparities between white households and households of color. In 2018, ITEP and Prosperity Now found that white households made up 67 percent of households but received 80 percent of the tax cuts ($218 billion of the total $257 billion in tax cuts) from the 2017 law that year.

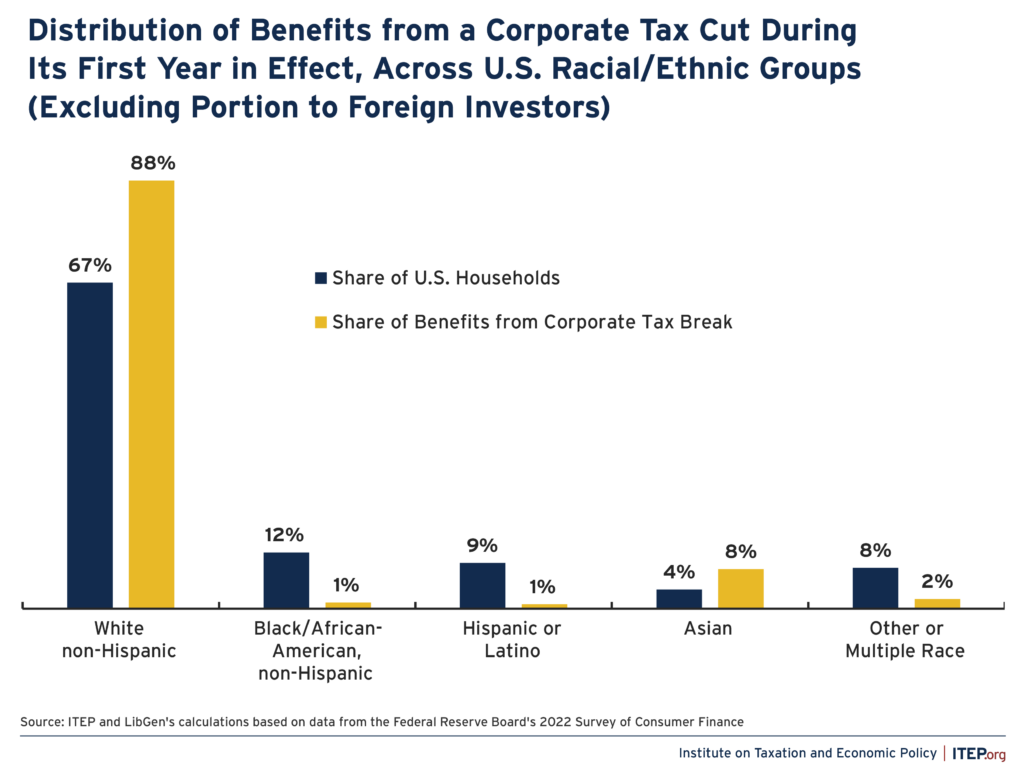

The law’s corporate tax cuts were particularly inequitable. A 2024 study found that corporate tax cuts generally disproportionately benefit white households because they disproportionately own corporate stocks and corporate bonds. Without including the share of benefits that went to foreign investors, White households receive 88 percent of the benefits of any given corporate tax break, even though they make up only 67 percent of the population. Black and Hispanic households make up 12 percent and 9 percent of U.S. households, respectively but only receive 1 percent each of the benefits of corporate tax breaks.

Some of these racially-skewed results are caused by the overrepresentation of households of color at the bottom of the income ladder. This means that any tax policy that redistributes benefits up the ladder will disproportionately help white households and leave behind others. But certain tax breaks, like cuts in the estate tax and cuts in the corporate income tax, are even more inequitable because they favor those who have wealth. The distribution of wealth in the United States is even more racially skewed than the distribution of income. A white family is statistically more likely to benefit from these types of tax cuts than a Black family, even if both families have the same overall income, because the white family is likely to have more wealth.

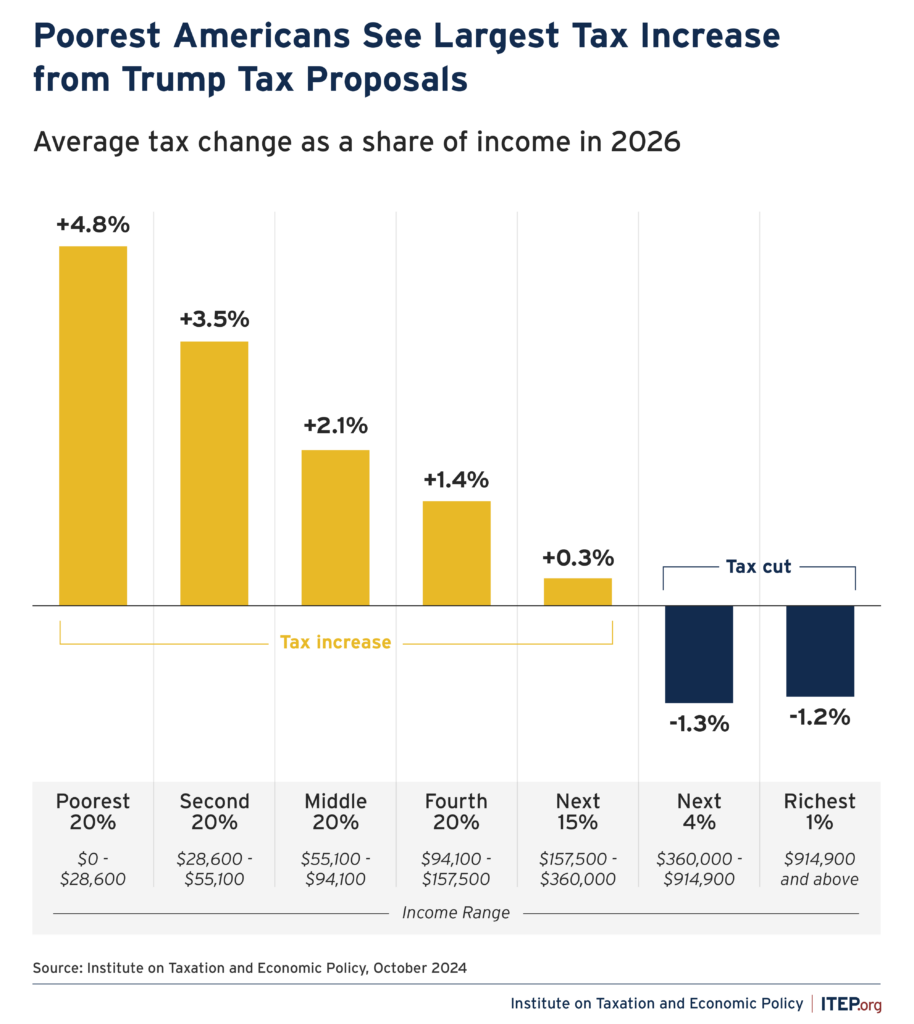

This year while lawmakers revisit this piece of legislation, they could choose a different path for the federal tax code and make it more racially equitable. But again, it appears that lawmakers want to move in the opposite direction: our research shows that the Trump tax plan would fall hardest on low-income families, who are disproportionately households of color.

That analysis above includes the effects from across-the-board tariffs, which would essentially raise taxes on most American households, with the lowest-income families bearing the brunt of this policy. But even if we leave out the tariffs which are unlikely to be implemented as Trump presented them during the campaign, a straightforward extension of the 2017 tax law would disproportionately help the wealthiest Americans, thereby exacerbating racial inequities.

What’s more, the tax package is shaping up to be very expensive: up to $5.5 trillion over the next decade if extensions of certain business provisions are also included. To help defray the cost of these tax cuts, leading Republican lawmakers are considering a number of policies that would harm families of color. For example, one proposal would require parents and now children to both have Social Security numbers to claim the Child Tax Credit (CTC). If this passes, ITIN filers, who are disproportionately people of color, will no longer be able to claim the CTC, which is a financial lifeline for many families with children. Having contributed nearly $20 billion in federal income taxes in 2022, ITIN filers are taxpayers, too, and deserve to have the same benefits afforded to others in their tax bracket.

These tax changes won’t be enough to cover the costs of the bigger tax cuts, so lawmakers are likely to cut funding for programs and services aimed at reducing barriers to opportunity for low- and moderate-income households – particularly those of color – in areas like health, financial security, job training, and education.

America’s wealthiest families are overwhelmingly white, so it is inevitable that a tax cut geared to the very top would shower outsized benefits on white households relative to the overall population and households of color. The first Trump tax law widened the racial wealth gap the year after it was enacted, and lawmakers seem on track for a repeat this year.

It doesn’t have to be this way. Policymakers could, for example, raise the corporate tax rate, which has been suggested by observers all along the political spectrum, and which would undo some of the racial inequity caused by the 2017 tax law. The revenue raised could go towards refundable tax credits and public services that further reduce racial inequities. In other words, the opportunity exists to use this year’s tax fight to reduce racial inequality. The real question is: will lawmakers take it?