Capital Gains

It’s No Secret—To Save State Budgets End Preferential Treatment of Capital Gains

September 25, 2020 • By Marco Guzman

In an updated policy brief, ITEP explores the flaws in state capital gains tax breaks and highlights how ending special tax breaks provides one of the simplest ways to raise additional revenue and increase equity in the tax system.

State Taxation of Capital Gains: The Folly of Tax Cuts & Case for Proactive Reforms

September 25, 2020 • By Marco Guzman

The federal tax system and every state treat income from capital gains more favorably than income from work. Preferential capital gains tax treatment includes exclusions and seldom-discussed provisions like deferral and stepped-up basis, as well as more direct tax subsidies for profits realized from local investments and, in some instances, from investments around the world. This policy brief explains state capital gains taxation, examines the flaws in state capital gains tax breaks, and proposes reform options that will help make state tax systems more progressive and more equitable.

Trump Administration Stops Pretending to Care About the Economy with Its Capital Gains Tax Proposal

May 28, 2020 • By Steve Wamhoff

Proponents of capital gains tax breaks have always offered a weak argument that they encourage investment and thereby grow the economy. But the Trump administration is now floating a temporary capital gains tax break, which is supported by no argument at all. It would only reward investments made in the past while doing nothing to encourage new investment.

Addressing the COVID-19 Economic Crisis: Advice for the Next Round

April 7, 2020 • By Steve Wamhoff

Americans need many things right now beyond tax cuts or cash payments. But for people whose incomes have declined or evaporated, money is the obvious, immediate need to prevent missed rent or mortgage payments, skipped hospital visits and other cascading catastrophes. So, what should Congress do next to get money to those who need it?

How Democratic Presidential Candidates Would Raise Revenue

February 19, 2020 • By Steve Wamhoff

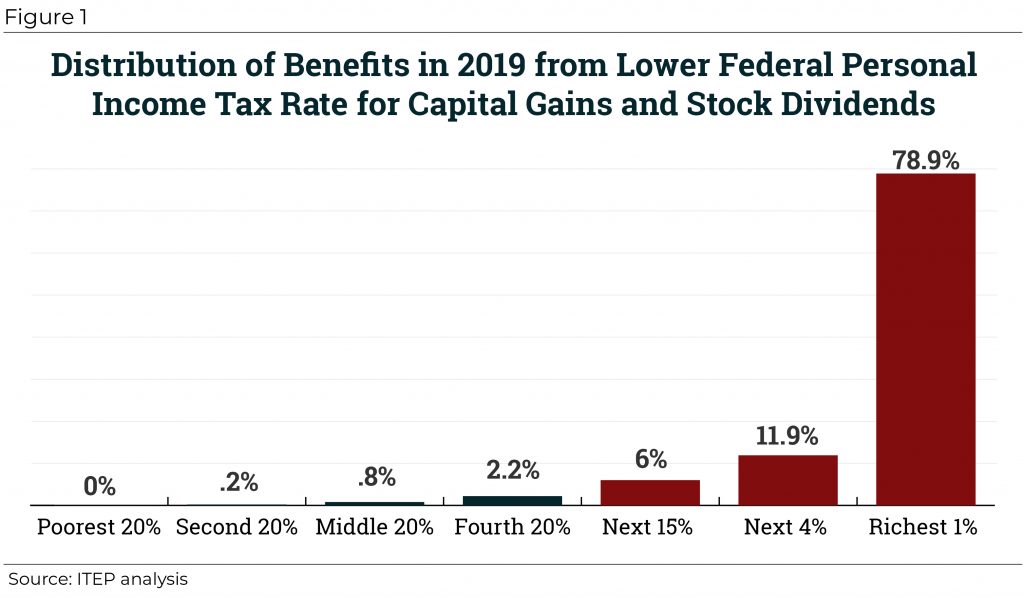

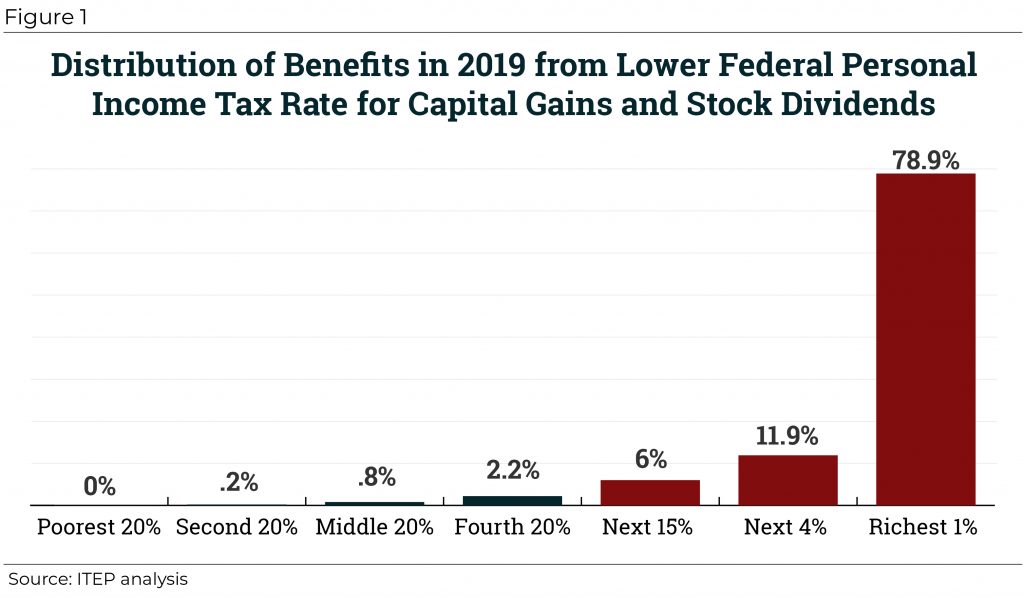

One of the biggest problems with the U.S. tax code in terms of fairness is that investment income, which mostly flows to the rich, is taxed less than the earned income that makes up all or almost all of the income that working people live on.

One of the most glaring sources of unfairness in the federal tax code are rules that tax capital gains, which mostly go to the rich, less than wages and other types of income that most of us depend on. The capital gains tax breaks have for decades been comfortably ensconced behind trenches filled with special interests who would defend them until the end. But the end is now conceivable.

Comments on Senate Finance Committee Paper on Anti-Deferral Accounting

September 12, 2019 • By Steve Wamhoff

Comments on Senate Finance Committee Paper on Anti-Deferral Accounting

How Tax Policy Can Help Mitigate Poverty, Address Income Inequality

September 10, 2019 • By ITEP Staff

Analysts at the Institute on Taxation and Economic Policy have produced multiple recent briefs and reports that provide insight on how current and proposed tax policies affect family economic security and income inequality.

The nation’s tax policies and their role in economic inequality are front and center during this election cycle. For those interested in how the nation can move toward a fairer tax system and or more detailed information about progressive tax policy ideas, ITEP created this quick guide.

Why Trump Administration’s Plan to Index Capital Gains to Inflation Is Just Another Giveaway to the Wealthy

June 28, 2019 • By Steve Wamhoff

The White House is reported to be planning to unilaterally adjust the way capital gains are assessed to benefit the wealthiest Americans. The proposal would adjust capital gains for inflation, reducing taxes disproportionately for the wealthiest households who own most assets by limiting their taxable gains to those above and beyond the inflation rate.

What to Watch for on Tax Policy During the Presidential Primary

June 25, 2019 • By Steve Wamhoff

America needs a new tax code. The Democratic presidential debates beginning this week present an opportunity for candidates to make clear how they would address inequality or to raise enough revenue to make public investments that make the economy work for everyone. Here are some of the big tax issues that we hope they will touch on.

ITEP Testimony Supporting H.B. No. 7415, An Act Concerning a Surcharge on Capital Gains

April 26, 2019 • By Aidan Davis

Comments are intended to offer some perspective on the broader tax policy context in which this proposal is being considered. We find that this proposal would help to lessen long-running inequities in Connecticut’s state and local tax law that have allowed high-income taxpayers to pay lower overall effective tax rates than most low- and middle-income families.

Sen. Ron Wyden of Oregon, the ranking Democrat on the Senate Finance Committee, announced that he would soon release a proposal to eliminate massive tax breaks enjoyed by the wealthy on their capital gains income. If successful, the proposal would ensure that income from wealth is taxed just like income from work.

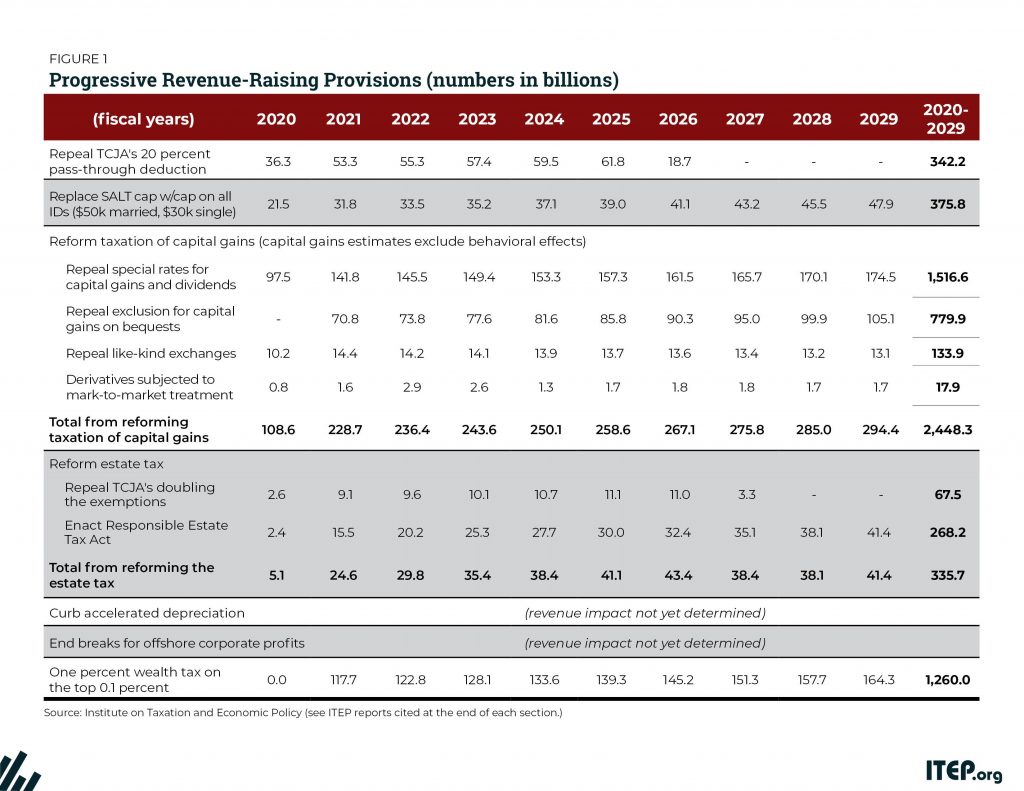

America has long needed a more equitable tax code that raises enough revenue to invest in building shared prosperity. The Tax Cuts and Jobs Act (TCJA), enacted at the end of 2017, moved the federal tax code in the opposite direction, reducing revenue by $1.9 trillion over a decade, opening new loopholes, and providing its most significant benefits to the well-off. The law cut taxes on the wealthy directly by reducing their personal income taxes and estate taxes, and indirectly by reducing corporate taxes.

Congress Should Reduce, Not Expand, Tax Breaks for Capital Gains

February 1, 2019 • By Steve Wamhoff

Even though income derived from capital gains receives a special lower tax rate and is therefore undertaxed, some proponents of lower taxes on the wealthy claim that capital gains are overtaxed due to the effects of inflation. But existing tax breaks for capital gains more than compensate for any problem related to inflation. Congress should repeal or restrict special tax provisions for capital gains rather than creating even more breaks.

The Preferential Tax Treatment of Capital Gains Income Should Be Curbed, Not Substantially Expanded

August 1, 2018 • By Richard Phillips

For true believers in supply-side economics, however, one major flaw of the TCJA is that it did not further cut taxes for the wealthy by reducing capital gains tax rates. But now the Trump Administration is considering using executive action to remedy this by indexing capital gains to inflation for tax purposes.