Delaware

State Rundown 5/22: (Some) State Lawmakers Can (Partly) Relax This Weekend

May 22, 2019 • By ITEP Staff

Lawmakers and advocates can enjoy their barbeques with only one eye on their work email this weekend in states that have essentially finished their budget debates such as Alaska, Minnesota, Nebraska, and Oklahoma, though both Alaska and Minnesota require special sessions to wrap things up. Getting to those barbeques may be a bumpy ride in Louisiana, Michigan, and other states still working to modernize outdated and inadequate gas taxes.

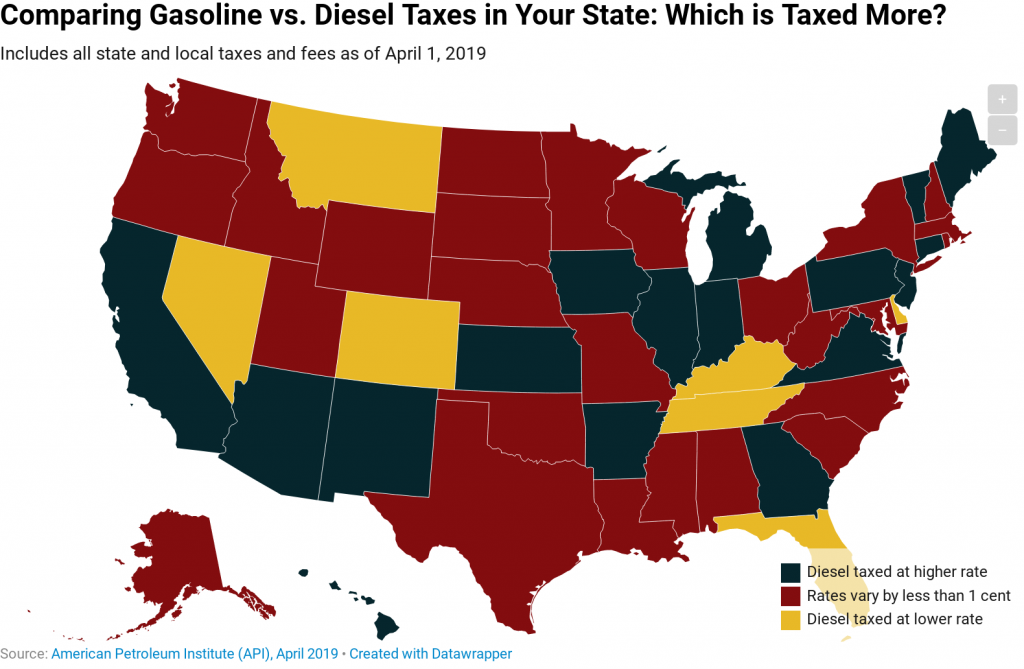

Twenty-six states and the District of Columbia tax these two fuel types at the same rate or very similar rates, as of April 2019, according to data from the American Petroleum Institute.

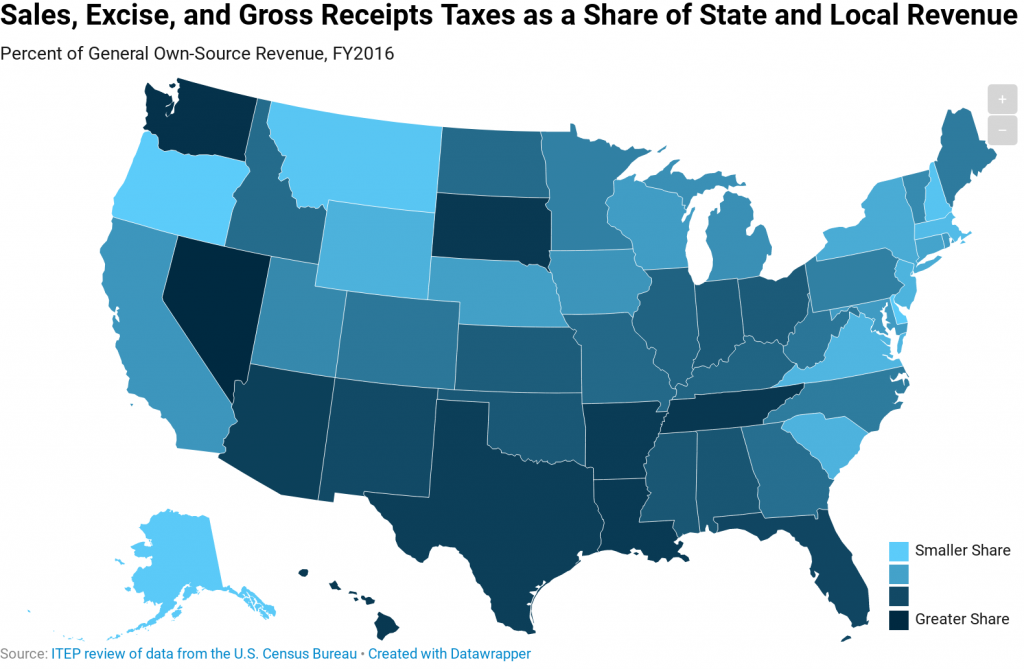

Consumption taxes (including general sales taxes, excise taxes on specific products, and gross receipts taxes) are an important revenue source for state and local governments. While five states lack state-level general sales taxes (Alaska, Delaware, Montana, New Hampshire, and Oregon), every state levies taxes on some types of consumption.

State Rundown 5/9: Illinois Moves Closer to a Progressive Income Tax

May 9, 2019 • By ITEP Staff

Lawmakers in Illinois and Ohio have advanced major tax proposals but cannot rest just yet, as they must still get past the other legislative chamber. Their counterparts in Michigan, Minnesota, Nebraska, and Oregon, meanwhile, are all at impasses over education funding, as those in Texas left their school funding disagreement unresolved at least until they reconvene...in 2021. And in an era of many states pre-empting smaller jurisdictions by revoking local decision-making powers, leaders in Colorado and Delaware made moves in the opposite direction, entrusting cities and school districts with more local control.

Tax and budget debates are now mostly complete in Alabama, Arkansas, and Colorado, but just starting or just getting interesting in several other states. Delaware and Massachusetts lawmakers, for example, are looking at progressive income tax increases on wealthy households, and New Hampshire may use a progressive tax on capital gains to simultaneously improve its upside-down tax code and invest in education. Nebraska and Texas, on the other hand, are also looking to improve school funding but plan to do so on the backs of low- and middle-income families through regressive sales tax increases. Fiscal debates are heating up in…

The Case for Extending State-Level Child Tax Credits to Those Left Out: A 50-State Analysis

April 17, 2019 • By Aidan Davis, Meg Wiehe

As of 2017, 11.5 million children in the United States were living in poverty. A national, fully-refundable Child Tax Credit (CTC) would effectively address persistently high child poverty rates at the national and state levels. The federal CTC in its current form falls short of achieving this goal due to its earnings requirement and lack of full refundability. Fortunately, states have options to make state-level improvements in the absence of federal policy change. A state-level CTC is a tool that states can employ to remedy inequalities created by the current structure of the federal CTC. State-level CTCs would significantly reduce…

State Rundown 4/11: An Estate Tax Win, Opioid Progress, and Teacher Uprising Updates

April 11, 2019 • By ITEP Staff

Hawaii made progress in pushing back against the increasing concentration of wealth and power by beefing up its estate tax. Delaware, New Jersey, and Rhode Island all took steps toward taxing opioid producers to raise funds to address the ongoing opioid crisis. Oregon lawmakers continue to try to address their chronic school underfunding with a $2 billion annual investment, in contrast to some of their counterparts in North Carolina who are responding to similar issues with the opposite approach, proposing to slash taxes in the face of their school funding issues – just as research highlighted in our What We’re…

State Rundown 3/27: Spring Bringing Smart State Tax Policy So Far

March 27, 2019 • By ITEP Staff

Though a long winter and a rough start to spring weather have wreaked havoc in much of the country, lawmakers are off to a good start in the world of state fiscal policy so far. In the last week, a progressive revenue package was passed in the nick of time in NEW MEXICO, a service-sapping tax cut was vetoed in KANSAS, and a regressive and unsustainable tax shift was soundly defeated in NORTH DAKOTA. Meanwhile, gas tax updates are on the table in MAINE, MINNESOTA, and OHIO. And exemptions for feminine hygiene products and diapers were enacted in VIRGINIA and introduced in MISSOURI.

GQ: Local and State Taxes Are Making the Wealthy More Rich Now Too

March 12, 2019

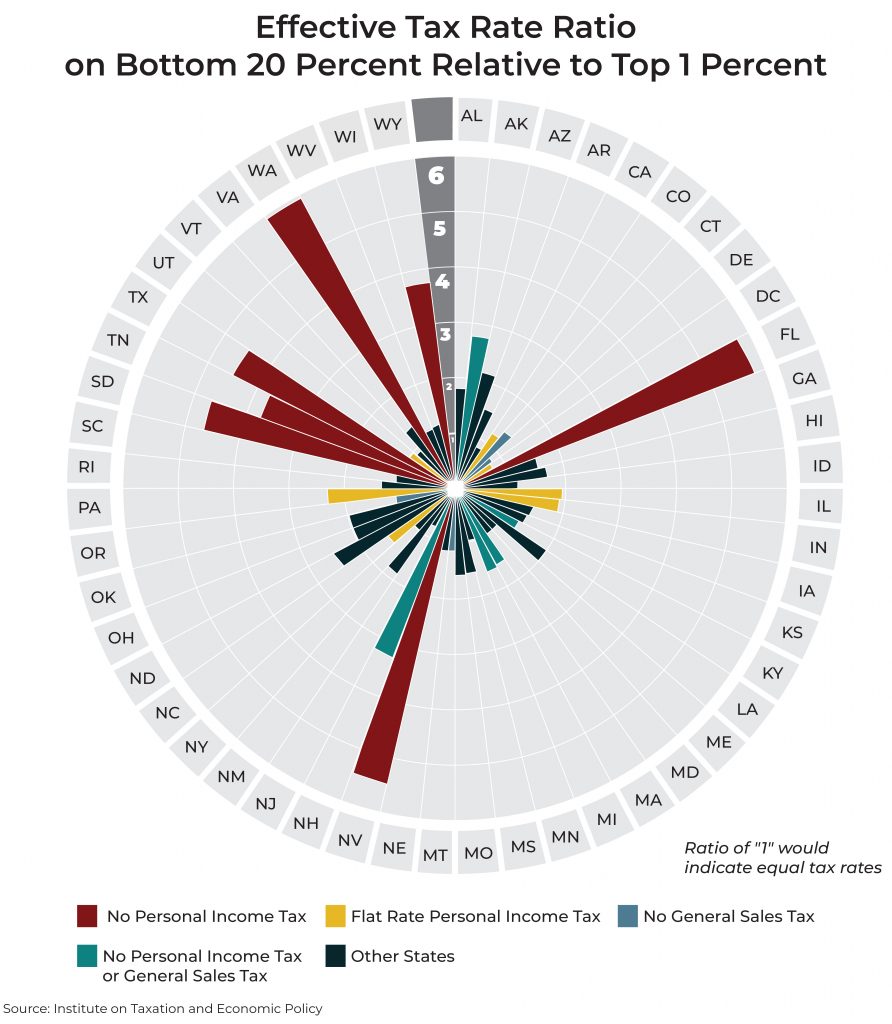

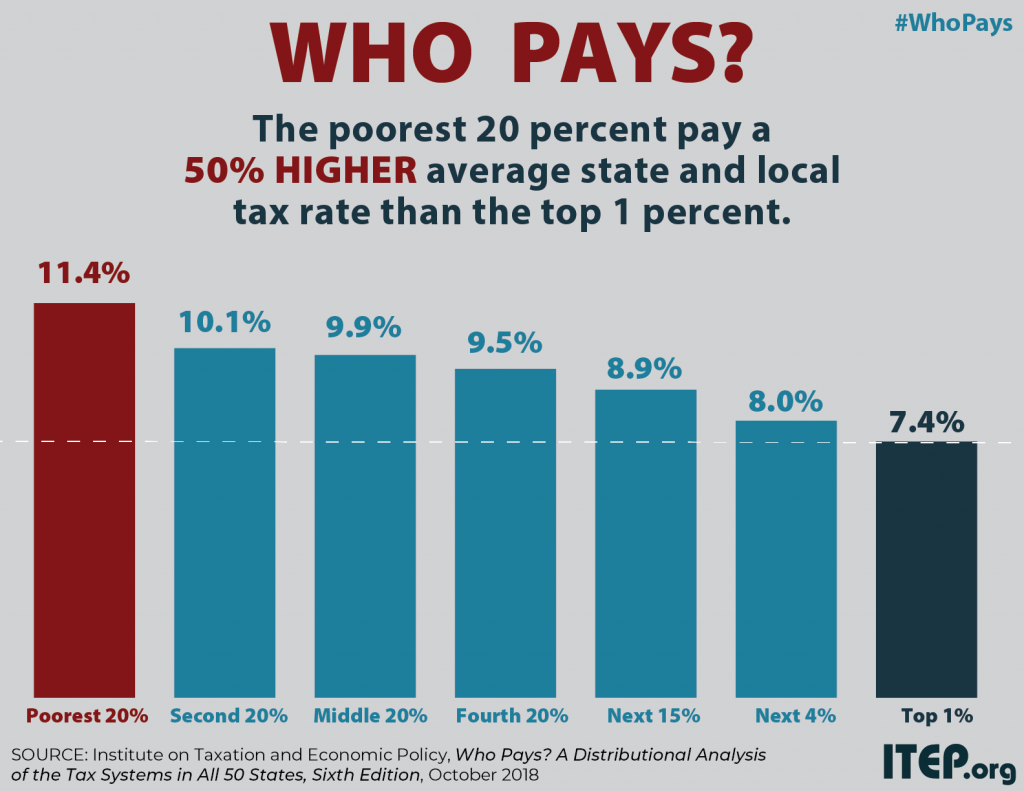

According to a new report by the progressive think tank Institute on Taxation and Economic Policy (ITEP), as relayed in the Washington Post, state and local governments that are heavily reliant on sales and excise taxes, rather than income taxes, shift the economic burden onto low- and moderate-income taxpayers. At every level, those who work […]

Fairness Matters: A Chart Book on Who Pays State and Local Taxes

March 6, 2019 • By ITEP Staff

There is significant room for improvement in state and local tax codes. State tax codes are filled with top-heavy exemptions and deductions and often fail to tax higher incomes at higher rates. States and localities have come to rely too heavily on regressive sales taxes that fail to reflect the modern economy. And overall tax collections are often inadequate in the short-run and unsustainable in the long-run. These types of shortcomings provide compelling reason to pursue state and local tax reforms to make these systems more equitable, adequate, and sustainable.

State Rundown 2/27: Temperatures and Tax Fights Continue to Polarize

February 27, 2019 • By ITEP Staff

As another polar vortex heads for large swaths of the country, state tax debates this week were highly polarized in another way. Lawmakers and advocates in MICHIGAN, OHIO, OREGON, UTAH, and elsewhere fought to enact or improve state Earned Income Tax Credits to give a boost to low- and middle-income working families. But the opposite extreme was heavily represented as well, as others pushed for regressive tax cuts for wealthy individuals and corporations, including in KANSAS, NEBRASKA, NORTH DAKOTA, OHIO, UTAH, and WEST VIRGINIA. Even our “What We’re Reading” section has informative reading on how education funding policy continues to…

Trends We’re Watching in 2019: Cannabis Tax Implementation and Reform

February 7, 2019 • By Carl Davis

Few areas of state tax policy have evolved as rapidly as cannabis taxation over the last few years. The first legal, taxable sale of recreational cannabis in modern U.S. history did not occur until 2014. Now, just five years later, a new ITEP report estimates that recreational cannabis is generating more than $1 billion annually in excise tax revenues and $300 million more in general sales tax dollars.

Trends We’re Watching in 2019: The Use of Targeted Tax Breaks to Help Address Poverty and Inequality

February 7, 2019 • By Aidan Davis

Continuing to build upon the momentum of previous years, states are taking steps to create and improve targeted tax breaks meant to lift their most in-need state residents up and out of poverty. Most notably, a range of states are exploring ways to restore, enhance or create state Earned Income Tax Credits (EITC). EITCs are an effective tool to help struggling families with low wages make ends meet and provide necessities for their children. The policy, designed to bolster the earnings of low-wage workers and offset some of the taxes they pay, allows struggling families to move toward meaningful economic…

State Rundown 1/24: States Reflect on MLK’s Dream and Teacher Uprisings

January 24, 2019 • By ITEP Staff

This week, as Americans in every state celebrated Martin Luther King Jr. Day and reflected on his dream of peaceful protest and racial and economic justice, many eyes were on the teachers’ strike pressing for parts of this dream amid the “curvaceous slopes of California.” Governors and lawmakers in many states—including Arizona, Georgia, Indiana, Louisiana, Nevada, New Mexico, South Carolina, and Wisconsin—discussed ways to raise pay for teachers and/or enhance education investments generally.

A federal wealth tax on the richest 0.1 percent of Americans is a viable approach for Congress to raise revenue and is one of the few approaches that could truly address rising inequality. As this report explains, an annual federal tax of only 1 percent on the portion of any taxpayer’s net worth exceeding the threshold for belonging to the wealthiest 0.1 percent (likely to be about $32.2 million in 2020) could raise $1.3 trillion over a decade.

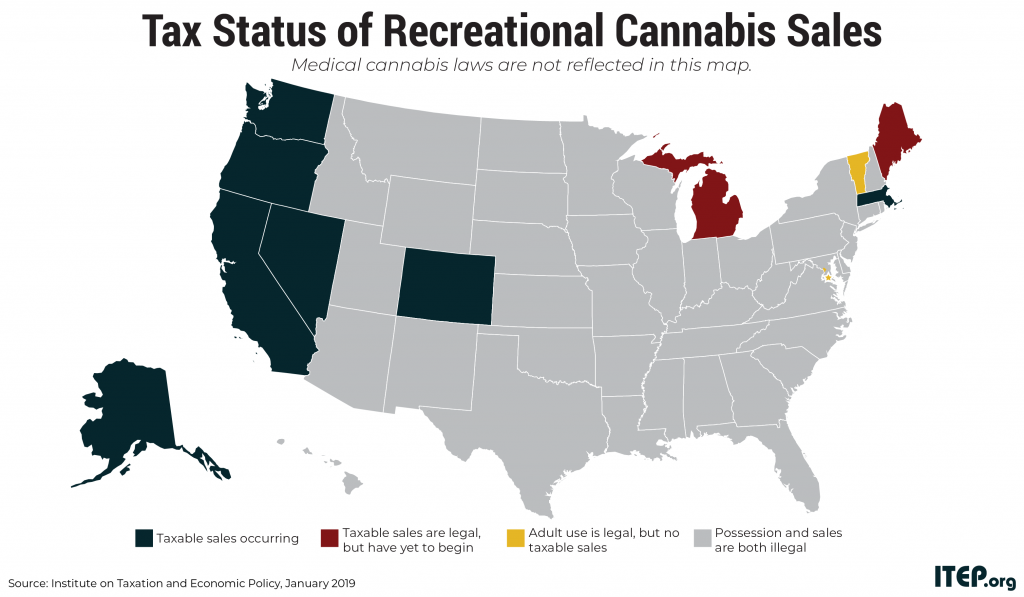

Cannabis Tax Debates are Ramping Up; Here’s What We’ve Learned from Five Years of Cannabis Taxation Thus Far

January 23, 2019 • By Carl Davis

This year lawmakers in Connecticut, Delaware, Hawaii, Illinois, New Jersey, New York, Rhode Island, and Vermont will all be debating the taxation of recreational cannabis. A new ITEP report reviews the track record of recreational cannabis taxes thus far and offers recommendations for structuring cannabis taxes to achieve stable revenue growth over the long haul.

A Simple Fix for a $17 Billion Loophole: How States Can Reclaim Revenue Lost to Tax Havens

January 17, 2019 • By Richard Phillips

Enacting Worldwide Combined Reporting or Complete Reporting in all states, this report calculates, would increase state tax revenue by $17.04 billion dollars. Of that total, $2.85 billion would be raised through domestic Combined Reporting improvements, and $14.19 billion would be raised by addressing offshore tax dodging (see Table 1). Enacting Combined Reporting and including known tax havens would result in $7.75 billion in annual tax revenue, $4.9 billion from income booked offshore.

Who Pays and Why It Matters | MECEP Policy Insights Conference Keynote Address

January 16, 2019 • By Aidan Davis

States have broad discretion in how they secure the resources to fund education, health care, infrastructure, and other priorities important to communities and families. Aidan Davis with the Institute on Taxation and Economic Policy will offer a national perspective on state-level approaches to funding public investments and the implications of those approaches on tax fairness and revenue adequacy, and their economic outcomes. She’ll also provide insight on what’s in store for 2019 among the states.

Gov. Cuomo Has the Right Idea on How to Tax Recreational Cannabis

January 15, 2019 • By ITEP Staff

Following is a statement by Carl Davis, research director at the Institute on Taxation and Economic Policy, regarding the cannabis tax structure unveiled by New York Gov. Andrew Cuomo.

State Rundown 1/10: States Should Resolve to Pursue Equitable Tax Options

January 10, 2019 • By ITEP Staff

This week we released a handy guide of policy options for Moving Toward More Equitable State Tax Systems, and are pleased to report that many state lawmakers are promoting policies that are in line with our recommendations. For example, Puerto Rico lawmakers recently enacted a targeted EITC-like credit for working families, and leaders in Virginia and elsewhere are working toward similar improvements. Arkansas residents also saw their tax code improve as laws reducing regressive consumption taxes and enhancing income tax progressivity just went into effect. And there is still time for governors and legislators pushing for regressive income tax cuts…

State Rundown 12/19: Time to Rest and Recharge for Big Year Ahead

December 19, 2018 • By ITEP Staff

With many people enjoying time off over the next couple weeks, and the longest nights of the year coming over the weekend, now is a good time to get plenty of rest and relaxation in advance of what is likely to be a very busy 2019 for state fiscal policy and other debates. Among those debates, Kentucky lawmakers will be returning to topics they could not resolve in a brief special session held this week, New Jersey and New York will both be deciding how to legalize and tax cannabis, and gas tax updates will be on the agenda in…

State Rundown 10/31: Trick or Treat Advice to Savor for Tonight

October 31, 2018 • By ITEP Staff

Look out for potholes if you’re out trick-or-treating in Alabama tonight, where crumbling infrastructure figures to be a dominant debate in the coming legislative session. And be prepared to share the streets with disgruntled teachers if you‘re in Louisiana, where teachers are walking out to protest regressive tax policies that are sucking the lifeblood from the state’s schools. Meanwhile, Wisconsin residents are sharing scary stories of grotesquely large business tax subsidies and the “dark store” tax loophole they’ll be voting on next week. And you better expect the unexpected if you’re in Delaware, where Gov. John Carney shocked everyone by vetoing two broadly supported tax bills last week.

New Report Finds that Upside-down State and Local Tax Systems Persist, Contributing to Inequality in Most States

October 17, 2018 • By Aidan Davis

State and local tax systems in 45 states worsen income inequality by making incomes more unequal after taxes. The worst among these are identified in ITEP’s Terrible 10. Washington, Texas, Florida, South Dakota, Nevada, Tennessee, Pennsylvania, Illinois, Oklahoma, and Wyoming hold the dubious honor of having the most regressive state and local tax systems in the nation. These states ask far more of their lower- and middle-income residents than of their wealthiest taxpayers.

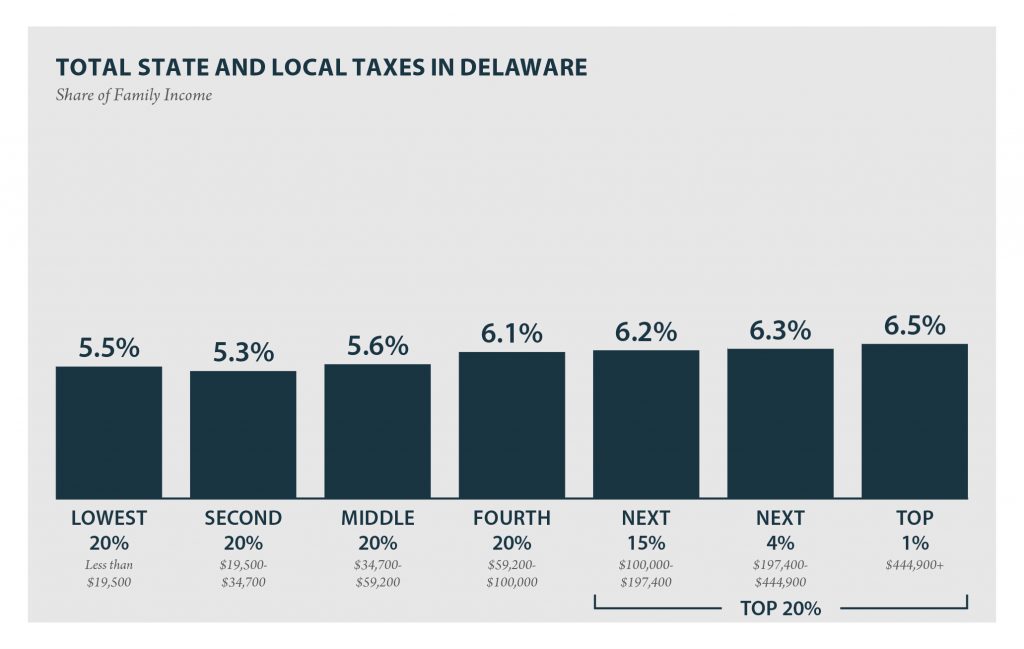

Delaware: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

DELAWARE Read as PDF DELAWARE STATE AND LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 4% Top 1% Income Range Less than $19,500 $19,500 to $34,700 $34,700 to $59,200 $59,200 to $100,000 $100,000 to $197,400 $197,400 to $444,900 over $444,900 […]

WBOC16: Incorporating in Delaware: The Perks and Pitfalls

October 12, 2018

Some critics of Delaware LLCs say until Delaware's corporate code is adjusted, criminal activity will continue to exist in Delaware's corporations. Matthew Gardner, a senior fellow at the Institute on Taxation and Economic Policy, authored a report entitled "Delaware: An Onshore Tax Haven."