District of Columbia

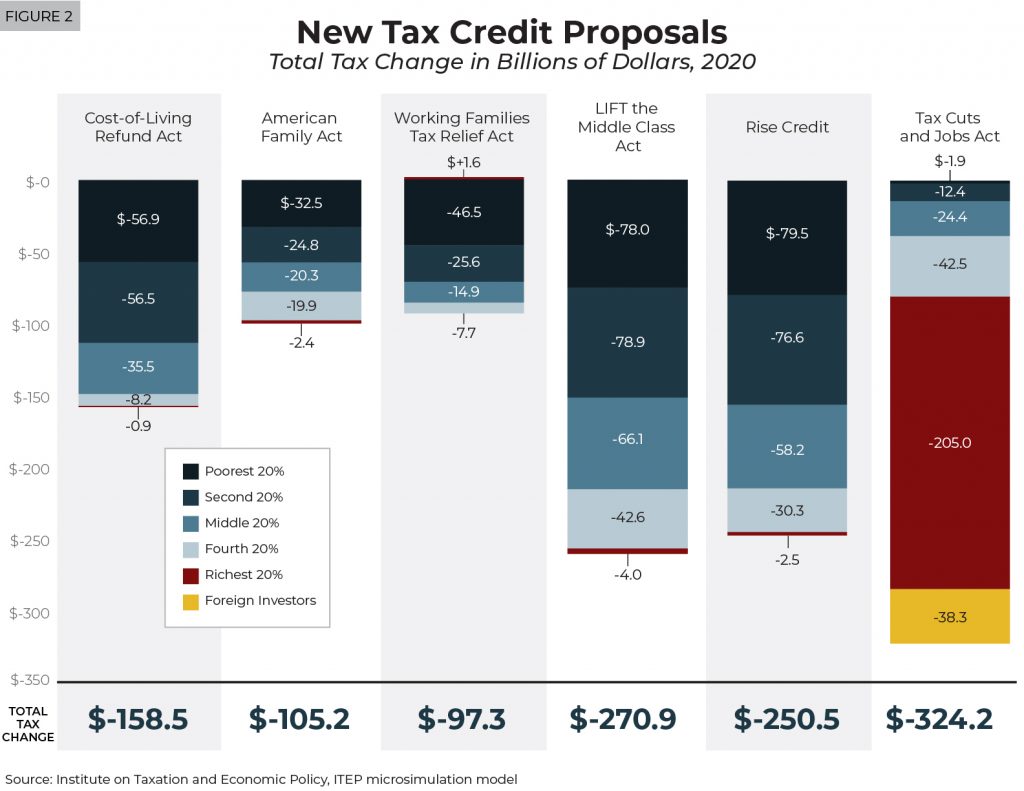

Federal lawmakers have recently announced at least five proposals to significantly expand existing tax credits or create new ones to benefit low- and moderate-income people. While these proposals vary a great deal and take different approaches, all would primarily benefit taxpayers who received only a small share of benefits from the Tax Cuts and Jobs Act.

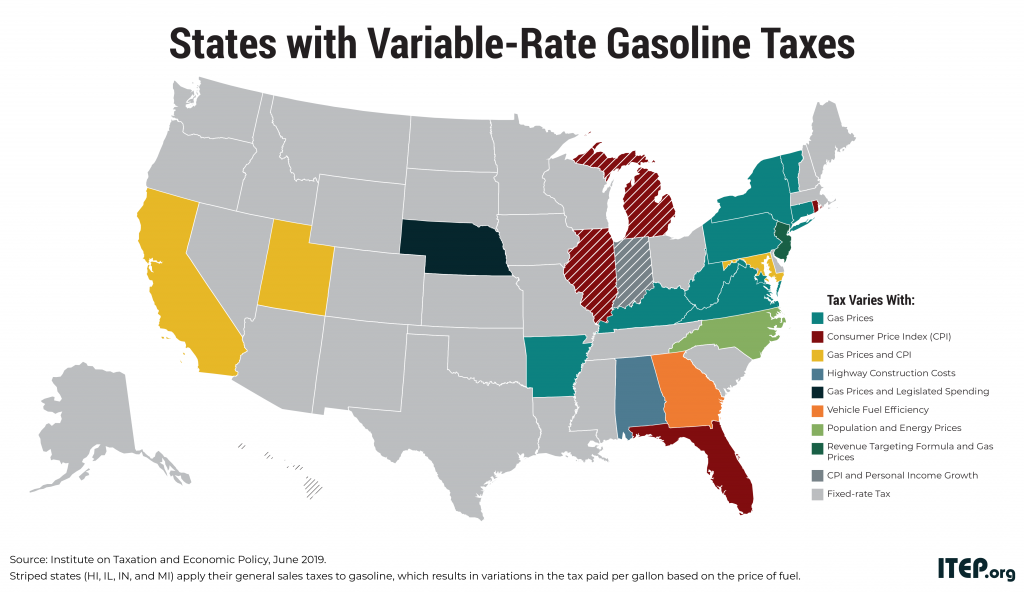

These States Abandoned Old Gas Tax Structures in Favor of More Sustainable Variable-Rate Gas Taxes

May 20, 2019 • By ITEP Staff

Because of these reforms, more than 193 million people (or 59 percent of the U.S. population) now live in places where the state gas tax rate automatically varies over time.

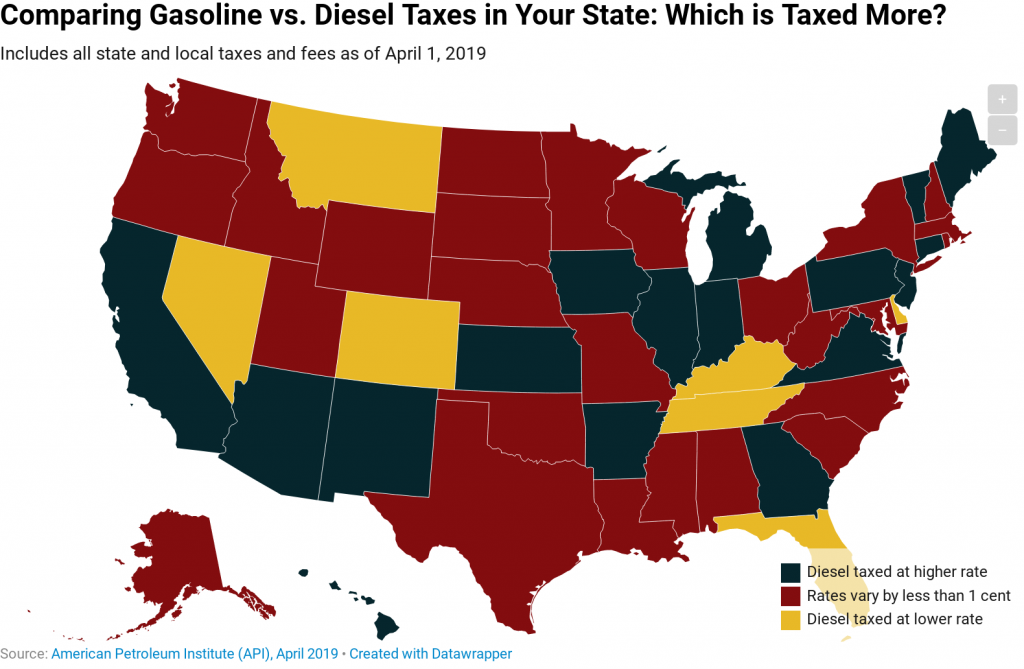

Twenty-six states and the District of Columbia tax these two fuel types at the same rate or very similar rates, as of April 2019, according to data from the American Petroleum Institute.

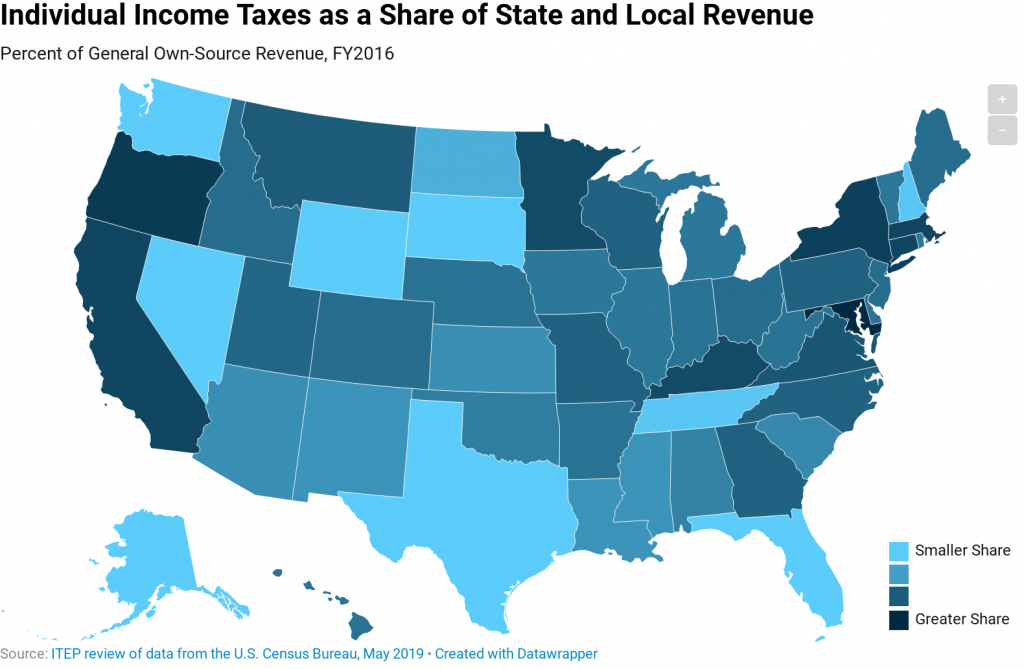

Income taxes vary considerably in their structure across states, though the best taxes are fine-tuned to taxpayers’ ability-to-pay.

State Rundown 5/9: Illinois Moves Closer to a Progressive Income Tax

May 9, 2019 • By ITEP Staff

Lawmakers in Illinois and Ohio have advanced major tax proposals but cannot rest just yet, as they must still get past the other legislative chamber. Their counterparts in Michigan, Minnesota, Nebraska, and Oregon, meanwhile, are all at impasses over education funding, as those in Texas left their school funding disagreement unresolved at least until they reconvene...in 2021. And in an era of many states pre-empting smaller jurisdictions by revoking local decision-making powers, leaders in Colorado and Delaware made moves in the opposite direction, entrusting cities and school districts with more local control.

State Rundown 4/26: Capital Gains Taxes Make Gains and Regressive Proposals Regress

April 26, 2019 • By ITEP Staff

Progressive capital gains tax proposals made news this week in Connecticut and Massachusetts, while Nebraskans came out in force to oppose a regressive tax shift, and North Carolina teachers prepare to rally over their legislature’s proclivity to cut taxes on wealthy households while underfunding schools.

Vox: Democrats don’t have to wait for Trump to leave office to cut child poverty

April 17, 2019

But these plans have one major obstacle: Donald Trump is president. Policymakers in the Democratic fold have been arguing over what should happen in a hypothetical 2021 in which Trump has been defeated, Democrats control the Senate, and the party gets a brief opening to pass legislation. There’s no guarantee that will happen (especially the […]

The Case for Extending State-Level Child Tax Credits to Those Left Out: A 50-State Analysis

April 17, 2019 • By Aidan Davis, Meg Wiehe

As of 2017, 11.5 million children in the United States were living in poverty. A national, fully-refundable Child Tax Credit (CTC) would effectively address persistently high child poverty rates at the national and state levels. The federal CTC in its current form falls short of achieving this goal due to its earnings requirement and lack of full refundability. Fortunately, states have options to make state-level improvements in the absence of federal policy change. A state-level CTC is a tool that states can employ to remedy inequalities created by the current structure of the federal CTC. State-level CTCs would significantly reduce…

New 50-State Analysis: State Child Tax Credits Would Lift 2.1 to 4.5 Million Children out of Poverty

April 17, 2019 • By ITEP Staff

Expanding the Child Tax Credit (CTC) at the state level could lift millions of children out of poverty and help families who benefited little or not at all from the 2017 federal expansion of the CTC, according to a 50-state report released today by the Institute on Taxation and Economic Policy and the Center on Poverty and Social Policy at Columbia University.

For Tax Day, ITEP has released several new reports that tell a broad story about our nation’s federal, state and local tax systems, providing important details about taxes we all pay and research on the tax-paying habits of Fortune 500 corporations. And of course, we have a trove of other tax policy resources.

The Montana Senate this week stopped a bill to restructure the state's temporary tribal tax exemption program, making tribal governments the only sovereignties on which Montana levies a tax and making it more difficult for leaders to buy back illegally seized land. Still, the success of the bill in the House is troubling.

The DC Line: – David Schwartzman: By Offsetting Federal Tax Cuts Locally, We Can Improve the Quality of Life for All DC Residents

April 10, 2019

Misha Hill of the Institute on Taxation and Economic Policy (ITEP) has estimated that the top 20 percent income bracket of DC residents will receive almost $700 million in federal tax cuts this year, with most ($541 million) going to the top 5 percent (with incomes above $319,000 per year). The same study finds that […]

State Rundown 3/27: Spring Bringing Smart State Tax Policy So Far

March 27, 2019 • By ITEP Staff

Though a long winter and a rough start to spring weather have wreaked havoc in much of the country, lawmakers are off to a good start in the world of state fiscal policy so far. In the last week, a progressive revenue package was passed in the nick of time in NEW MEXICO, a service-sapping tax cut was vetoed in KANSAS, and a regressive and unsustainable tax shift was soundly defeated in NORTH DAKOTA. Meanwhile, gas tax updates are on the table in MAINE, MINNESOTA, and OHIO. And exemptions for feminine hygiene products and diapers were enacted in VIRGINIA and introduced in MISSOURI.

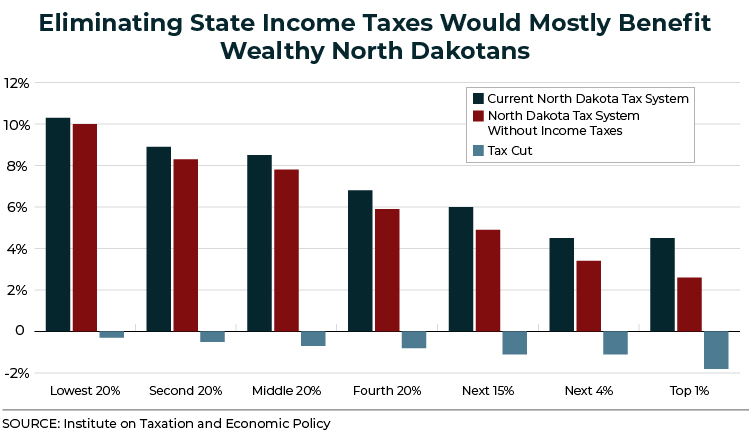

North Dakota Senate Should Put the Freeze on House Tax-Cut Plan

March 11, 2019 • By Dylan Grundman O'Neill

Lawmakers in Bismarck were treated last weekend to the largest single day of snowfall the city has ever seen. As state senators begin weighing a bill recently passed by the House that would replace the state's income taxes with oil revenue, they might want to reflect on how similar oil revenue is to the snow: although both are in extreme abundance right now, both are volatile and unpredictable and will melt away sooner than later. Lawmakers should also consider how eliminating the state's income taxes might warm the hearts of wealthier North Dakotans but would leave most North Dakota families…

State Rundown 3/6: March Tax Debates Contain Sanity Amid Usual Madness

March 6, 2019 • By ITEP Staff

State policymakers around the nation this week served up a handful of harmful and upside-down tax proposals, but these were refreshingly outnumbered by sound tax and budget policy proposals in several other states. NEW JERSEY Gov. Phil Murphy made tax fairness an explicit priority in his budget address, the NEW MEXICO House passed progressive reforms to improve the state’s schools and tax code, states such as VERMONT are looking to raise funds from legalized cannabis and put it to good use, and many states, including ALABAMA, ARKANSAS, OHIO, and WISCONSIN, are seriously considering much-needed gas tax updates to improve their…

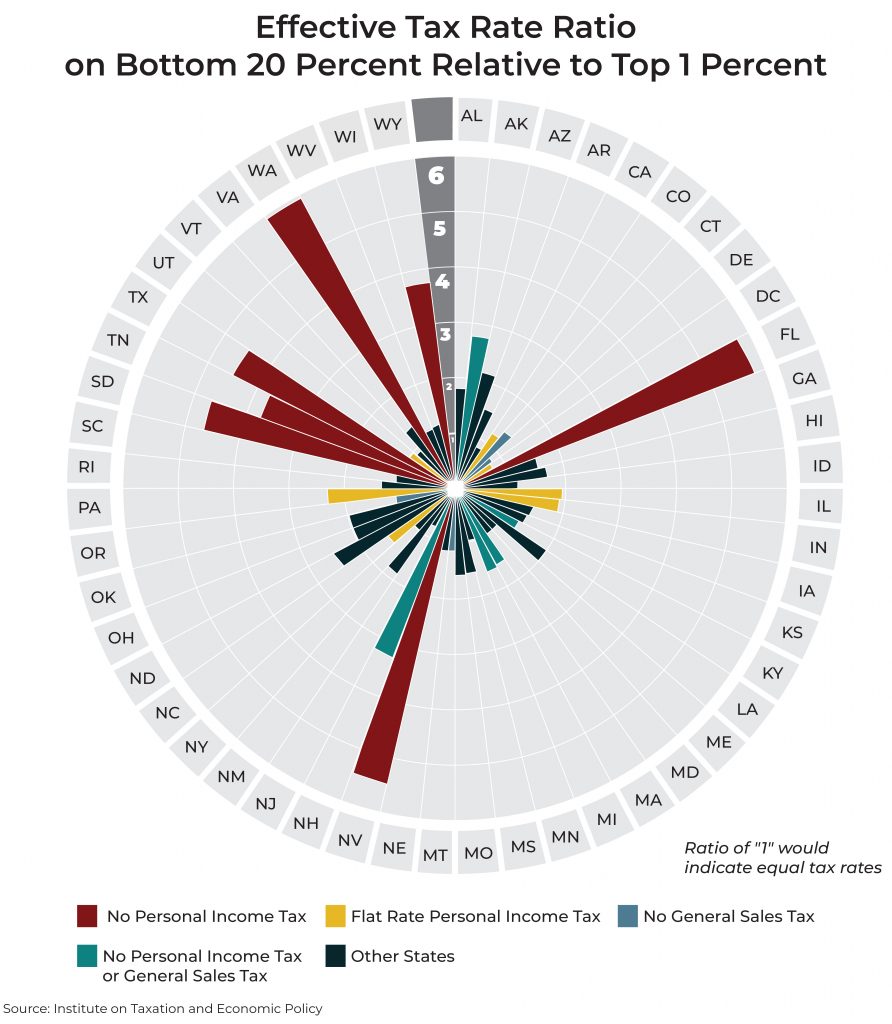

Fairness Matters: A Chart Book on Who Pays State and Local Taxes

March 6, 2019 • By ITEP Staff

There is significant room for improvement in state and local tax codes. State tax codes are filled with top-heavy exemptions and deductions and often fail to tax higher incomes at higher rates. States and localities have come to rely too heavily on regressive sales taxes that fail to reflect the modern economy. And overall tax collections are often inadequate in the short-run and unsustainable in the long-run. These types of shortcomings provide compelling reason to pursue state and local tax reforms to make these systems more equitable, adequate, and sustainable.

State Rundown 2/27: Temperatures and Tax Fights Continue to Polarize

February 27, 2019 • By ITEP Staff

As another polar vortex heads for large swaths of the country, state tax debates this week were highly polarized in another way. Lawmakers and advocates in MICHIGAN, OHIO, OREGON, UTAH, and elsewhere fought to enact or improve state Earned Income Tax Credits to give a boost to low- and middle-income working families. But the opposite extreme was heavily represented as well, as others pushed for regressive tax cuts for wealthy individuals and corporations, including in KANSAS, NEBRASKA, NORTH DAKOTA, OHIO, UTAH, and WEST VIRGINIA. Even our “What We’re Reading” section has informative reading on how education funding policy continues to…

State Rundown 2/20: February and Regressive Tax Cuts, The “Meanest Moons of Winter”

February 20, 2019 • By ITEP Staff

Tom Robbins called February “the meanest moon of winter, all the more cruel because it will masquerade as spring, occasionally for hours at a time, only to rip off its mask with a sadistic laugh and spit icicles into every gullible face, behavior that grows quickly old.” Observers of state fiscal debates might think he was writing about similarly tiresome regressive tax cut proposals, which recently succeeded in Arkansas and advanced in North Dakota despite improved public understanding of the upside-down nature state tax systems, ineffectiveness of supply-side trickle-down tax cuts, and importance of investing in education. But like February…

Trends We’re Watching in 2019: Consumption Taxes: the Good, Bad and the Ugly

February 7, 2019 • By ITEP Staff

Consumption taxes are a significant source of state and local revenue, and we expect that lawmakers will continue to adjust state consumption tax levies to adapt to budget needs and a changing economy.

Trends We’re Watching in 2019: Raising Revenue and Spending Surpluses to Prioritize Critical Public Investments

February 7, 2019 • By Lisa Christensen Gee

A second notable trend in 2019 is states raising revenue to address longstanding needs and states allocating their surpluses to invest in critical public priorities such as early childhood programs, education and other human services.

Trends We’re Watching in 2019: The Use of Targeted Tax Breaks to Help Address Poverty and Inequality

February 7, 2019 • By Aidan Davis

Continuing to build upon the momentum of previous years, states are taking steps to create and improve targeted tax breaks meant to lift their most in-need state residents up and out of poverty. Most notably, a range of states are exploring ways to restore, enhance or create state Earned Income Tax Credits (EITC). EITCs are an effective tool to help struggling families with low wages make ends meet and provide necessities for their children. The policy, designed to bolster the earnings of low-wage workers and offset some of the taxes they pay, allows struggling families to move toward meaningful economic…

City Lab: The Airbnb Effect: It’s Not Just Rising Home Prices

February 4, 2019

And cities with less stringent Airbnb regulations might also be losing out on a lot of tax revenue. Traditional lodging entities (when combining city, state, and county taxes), are taxed at an average rate of 13 percent in the 150 largest cities. But Airbnb is treated differently in different jurisdictions, and is trusted to self-report […]

State Rundown 1/31: Governors and Teachers Dominate Headlines, Much More in Fine Print

January 31, 2019 • By ITEP Staff

Gubernatorial addresses and the prospect of teacher strikes continued to take center stage in state fiscal news this week, as governors of Connecticut, Maryland, and Utah gave speeches that all included significant tax proposals. Meanwhile, teachers walked out in Virginia, and many other states debated school funding increases to avoid similar results. State policymakers have many other debates on their hands as well, including what to do with online sales tax revenue, how to cut property taxes without undermining schools, whether and how to legalize and tax cannabis, and whether to update gas taxes for infrastructure investments.

State policy toward cannabis is evolving rapidly. While much of the debate around legalization has rightly focused on potential health and criminal justice impacts, legalization also has revenue implications for state and local governments that choose to regulate and tax cannabis sales. This report describes the various options for structuring state and local taxes on cannabis and identifies approaches currently in use. It also undertakes an in-depth exploration of state cannabis tax revenue performance and offers a glimpse into what may lie ahead for these taxes.

A Simple Fix for a $17 Billion Loophole: How States Can Reclaim Revenue Lost to Tax Havens

January 17, 2019 • By Richard Phillips

Enacting Worldwide Combined Reporting or Complete Reporting in all states, this report calculates, would increase state tax revenue by $17.04 billion dollars. Of that total, $2.85 billion would be raised through domestic Combined Reporting improvements, and $14.19 billion would be raised by addressing offshore tax dodging (see Table 1). Enacting Combined Reporting and including known tax havens would result in $7.75 billion in annual tax revenue, $4.9 billion from income booked offshore.