District of Columbia

How States Can Help Shut Down Tax Havens by Cracking Down on Profit Shifting

January 17, 2019 • By Richard Phillips

A core problem with our corporate income tax laws at the federal and state levels is that they allow companies to use accounting gimmicks to shift significant amounts of their profits into low or zero-tax jurisdictions. Federal lawmakers had an opportunity to address this with the 2017 tax law, but they failed to do so, and, in fact, the law may incentivize more offshore tax avoidance. State lawmakers, however, can buck the federal trend and crack down on profit shifting themselves.

State Rundown 1/10: States Should Resolve to Pursue Equitable Tax Options

January 10, 2019 • By ITEP Staff

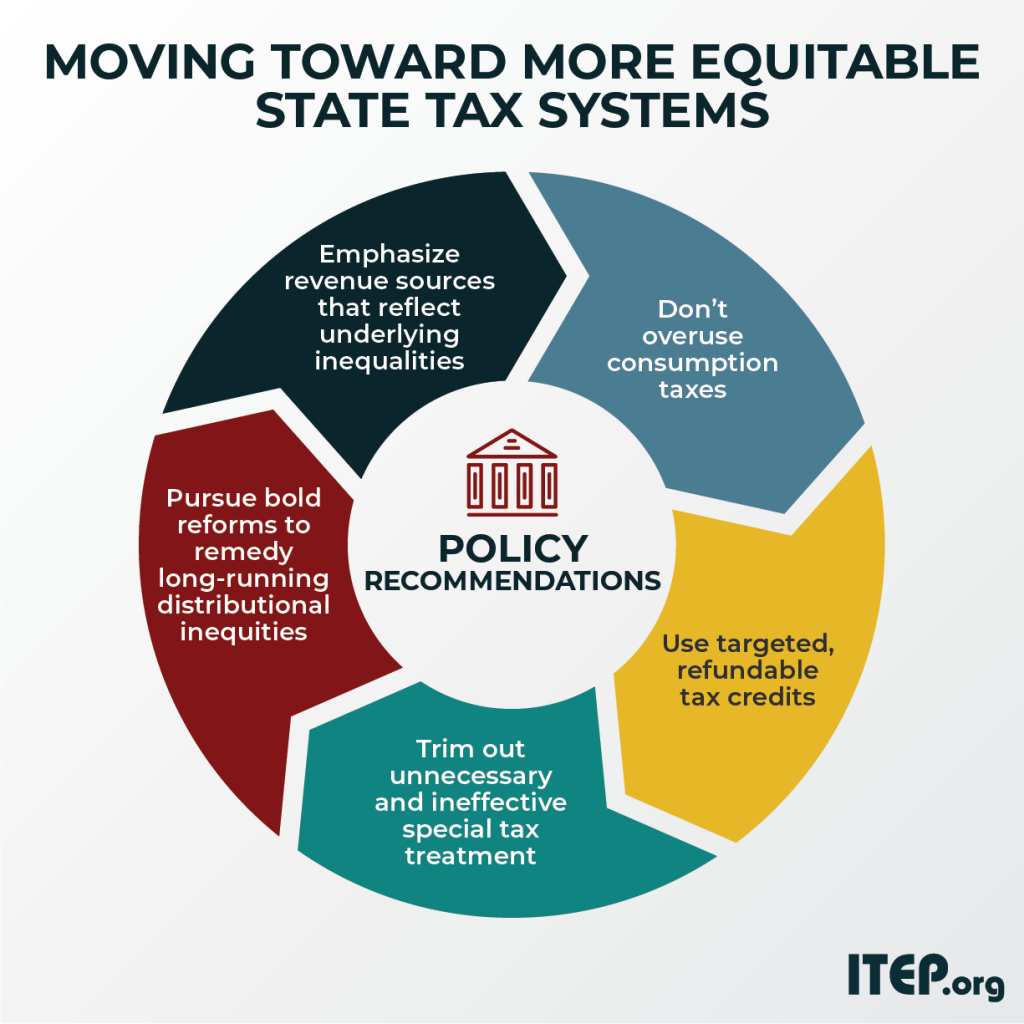

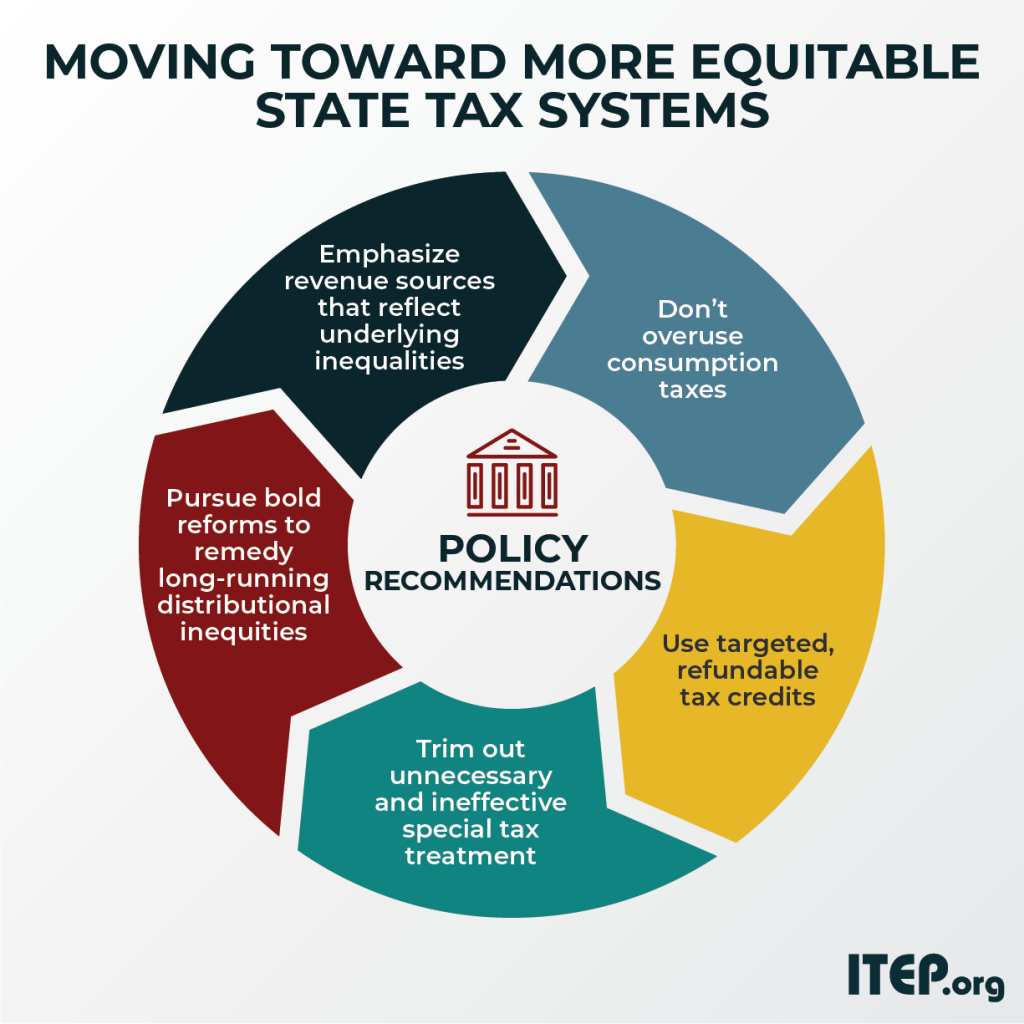

This week we released a handy guide of policy options for Moving Toward More Equitable State Tax Systems, and are pleased to report that many state lawmakers are promoting policies that are in line with our recommendations. For example, Puerto Rico lawmakers recently enacted a targeted EITC-like credit for working families, and leaders in Virginia and elsewhere are working toward similar improvements. Arkansas residents also saw their tax code improve as laws reducing regressive consumption taxes and enhancing income tax progressivity just went into effect. And there is still time for governors and legislators pushing for regressive income tax cuts…

New and returning policymakers have a tremendous opportunity to improve their constituents’ lives and their states’ economies through tax policy. This report distills the findings of “Who Pays?” into policy recommendations that can serve as a guide to new lawmakers, advocates, and others seeking to improve their state’s tax codes. It explains the importance of favoring taxes on income and wealth over taxes on consumption, the value of certain targeted tax benefits for families living in poverty, the need to abandon ineffective, unnecessary tax subsidies for high-income households, and the promise of bold new options for improving the regressive distributional…

For those looking to start improving on these inequitable tax systems today, we now also offer a helpful companion to “Who Pays?” called "Moving Toward More Equitable State Tax Systems." This new report distills the findings of “Who Pays?” into a set of policy recommendations – from the foundational to the aspirational – that residents of every state can draw from and start work on now.

State Rundown 12/19: Time to Rest and Recharge for Big Year Ahead

December 19, 2018 • By ITEP Staff

With many people enjoying time off over the next couple weeks, and the longest nights of the year coming over the weekend, now is a good time to get plenty of rest and relaxation in advance of what is likely to be a very busy 2019 for state fiscal policy and other debates. Among those debates, Kentucky lawmakers will be returning to topics they could not resolve in a brief special session held this week, New Jersey and New York will both be deciding how to legalize and tax cannabis, and gas tax updates will be on the agenda in…

Georgia Budget & Policy Institute: Increase the State Tobacco Tax for Healthier Georgia

December 15, 2018

Georgia could raise more than $400 million a year to make critical investments for the health and well-being of Georgia residents by raising the cigarette tax by at least $1 per pack. Georgia has the third-lowest state cigarette tax rate out of the 50 states and the District of Columbia. At 37 cents per pack, it falls far below the national average of $1.72. Over the past decade, many states have increased tobacco tax rates as a way to raise new revenue while reducing smoking rates and the health care costs associated with smoking. Georgia has not increased its cigarette…

State Rundown 11/16: Election Results Clarify Agendas as Real Work Begins

November 16, 2018 • By ITEP Staff

State policymakers, voters, and observers have been reflecting on this year’s campaigns and looking ahead to how the policy opportunities in their states have shifted as a result. For example, Arkansas’s governor sees a fresh chance to slash income taxes on the state’s wealthiest residents, while the governor-elect of Illinois will be doing just the opposite, launching into a promised effort to shore up the state’s budget by asking the wealthy to pay more. New York and Virginia residents may end up with buyers’ remorse after Amazon accepted their combined $2 billion tax subsidy offers for its HQ2 project. And…

Amazon HQ2 Finalists Should Disclose the Financial Incentives They Promised

November 6, 2018 • By Guest Blogger

The Crystal City and Long Island City subsidy offers are among the many Amazon HQ2 bids that remain completely hidden. Citizens have no idea what their elected officials have promised to a company headed by the richest person on earth.

Christian Science Monitor: A New Candidate Class: Schoolteachers Running For Office

October 22, 2018

North Carolina, one of six states where teachers held strikes before school let out last spring, “is an example of how lawmakers have prioritized tax cuts for corporations and the wealthy over public services,” says Meg Wiehe, deputy director of the Washington, DC-based Institute on Taxation and Economic Policy, and a North Carolina resident. “The big tax-cutting spree started here in 2013, and they’ve continued cutting.”

FOX13 SLC: Middle Income Utahns Bear Brunt of State and Local Tax Burden

October 19, 2018

The Institute on Taxation and Economic Policy released a report showing how every state and the District of Columbia use tax policy in regressive and progressive ways. Their conclusion: all but five states and the District of Columbia have regressive systems, meaning they favor the wealthy over middle and/or low-income earners.

Policymakers and residents in all 50 states and the District of Columbia got new ITEP data this week on how their tax structures and decisions affect their high-, middle-, and low-income residents. As our “Who Pays?” report outlines, most state and local tax codes exacerbate economic inequalities and all states have room to improve. The data can serve as an important informative backdrop to all state and local tax policy debates, such as whether to change the valuation of commercial property in California, how to improve funding for early childhood education in Indiana, and how to evaluate tax-related ballot measures…

DC Fiscal Policy Institute: Narrowing Income Inequality Through the Tax Code

October 17, 2018

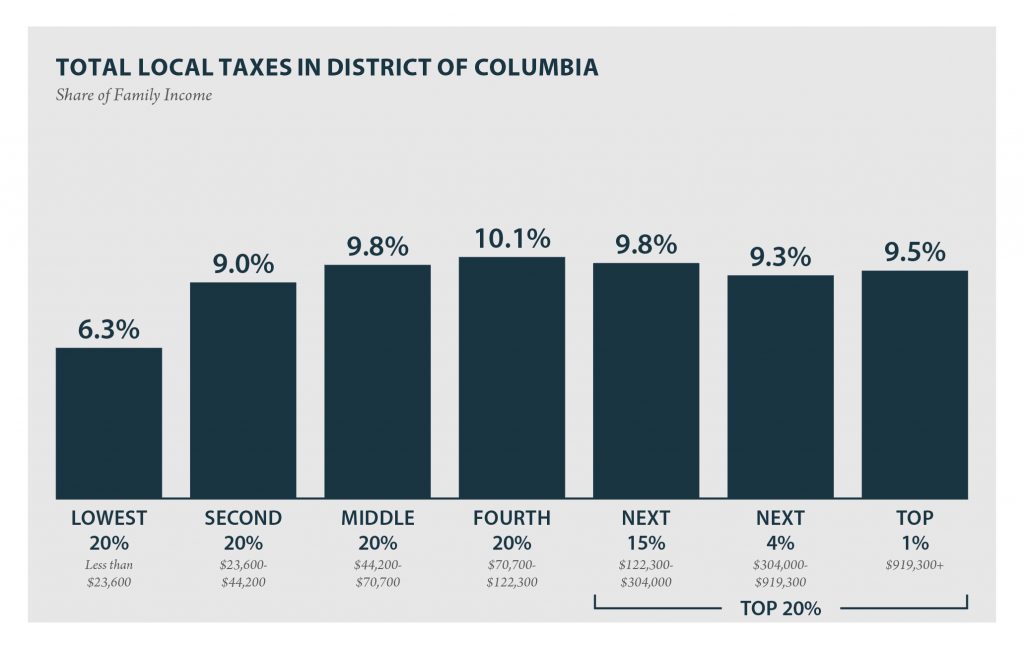

DC’s tax system stands out in two key ways, according to a new analysis on how state tax policies affect families at different income levels. First, taxes on DC families living on very low incomes–below about $24,000 a year–are lower than in any state in the U.S. That good news is due primarily to income and property tax credits targeted to help residents working hard to make ends meet. But the analysis shows that families with incomes just above that level pay the same share of their income in DC taxes (income, sales, and property taxes) as the District’s wealthiest…

Poorest 20 Percent Pays a 50 Percent Higher Effective State and Local Tax Rate than the Top 1 Percent

October 17, 2018 • By ITEP Staff

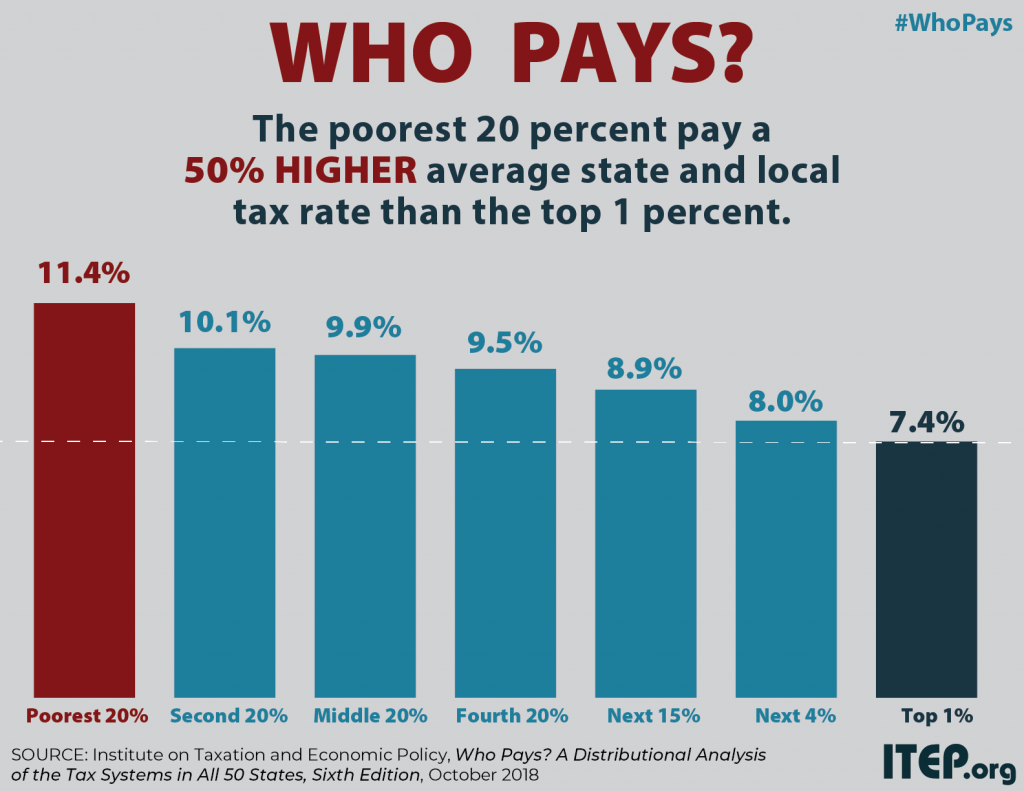

A comprehensive 50-state study released today by the Institute on Taxation and Economic Policy (ITEP) finds that most state and local tax systems tax low- and middle-income households at significantly higher rates than wealthy taxpayers, with the lowest-income households paying an average of 50 percent more of their income in taxes than the very rich.

New Report Finds that Upside-down State and Local Tax Systems Persist, Contributing to Inequality in Most States

October 17, 2018 • By Aidan Davis

State and local tax systems in 45 states worsen income inequality by making incomes more unequal after taxes. The worst among these are identified in ITEP’s Terrible 10. Washington, Texas, Florida, South Dakota, Nevada, Tennessee, Pennsylvania, Illinois, Oklahoma, and Wyoming hold the dubious honor of having the most regressive state and local tax systems in the nation. These states ask far more of their lower- and middle-income residents than of their wealthiest taxpayers.

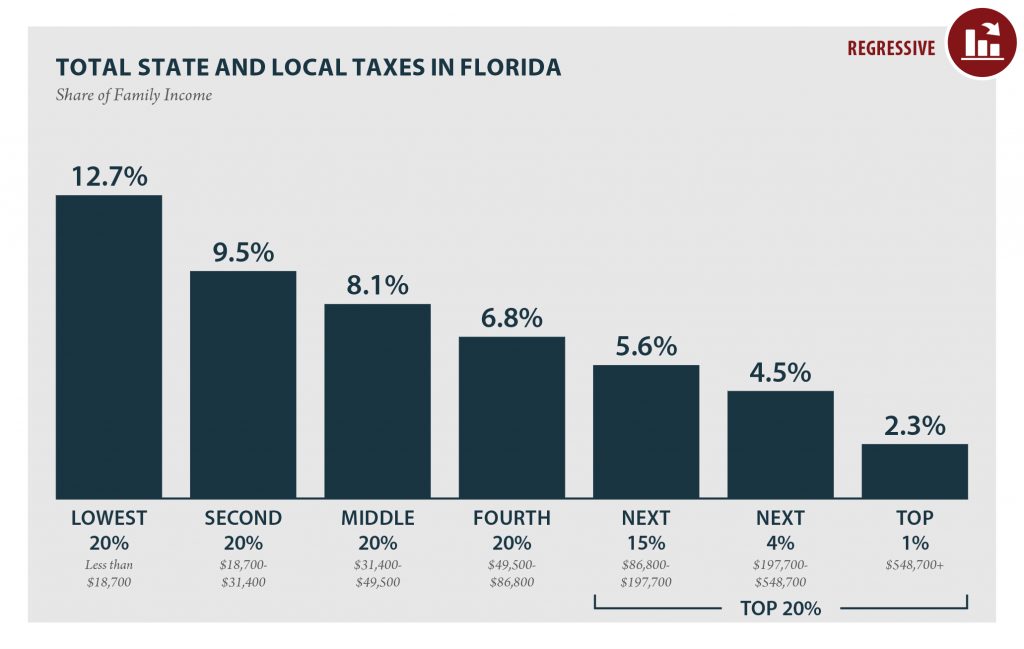

Low Tax for Whom? Florida is a “Low Tax State” Overall, But Not for Families Living in Poverty

October 17, 2018 • By ITEP Staff

Florida’s tax system has vastly different impacts on taxpayers at different income levels. For instance, the lowest-income 20 percent of Floridians contribute 12.7 percent of their income in state and local taxes — considerably more than any other income group in the state. For low-income families, Florida is far from being a low tax state; in fact, it is the ninth highest-tax state in the country for low-income families.

District of Columbia: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

According to ITEP’s Tax Inequality Index, the District of Columbia’s local tax system does not worsen income inequality and ranks 50th on the index. The large income gap between lower- and middle-income taxpayers, as compared to the wealthy, is somewhat narrower after state and local taxes than before.

District of Columbia: Who Pays? 6th Edition

October 17, 2018 • By ITEP Staff

DISTRICT OF COLUMBIA Read as PDF DISTRICT OF COLUMBIA LOCAL TAXES Taxes as Share of Family Income Top 20% Income Group Lowest 20% Second 20% Middle 20% Fourth 20% Next 15% Next 5% Top 1% Income Range Less than $23,600 $23,600 to $44,200 $44,200 to $70,700 $70,700 to $122,300 $122,300 to $304,000 $304,000 to $919,300 […]

South Carolina lawmakers have finally passed a federal conformity bill in response to last year’s federal tax-cut legislation. Voters in many states are hearing a lot about tax-related questions they’ll see on the ballot in November, particularly residents of Florida, Montana, and Oregon, where corporate donors and other anti-tax interests are spending major sums to alter policy in their states. And states continue to work on ensuring they can collect online sales taxes and, in some states, online sports betting taxes.

Tax Cuts 2.0 – District of Columbia

September 26, 2018 • By ITEP Staff

The $2 trillion 2017 Tax Cuts and Jobs Act (TCJA) includes several provisions set to expire at the end of 2025. Now, GOP leaders have introduced a bill informally called “Tax Cuts 2.0” or “Tax Reform 2.0,” which would make the temporary provisions permanent. And they falsely claim that making these provisions permanent will benefit […]

State Tax Codes as Poverty Fighting Tools: 2018 Update on Four Key Policies in All 50 States

September 17, 2018 • By Aidan Davis, Misha Hill

This report presents a comprehensive overview of anti-poverty tax policies, surveys tax policy decisions made in the states in 2018, and offers recommendations that every state should consider to help families rise out of poverty. States can jumpstart their anti-poverty efforts by enacting one or more of four proven and effective tax strategies to reduce the share of taxes paid by low- and moderate-income families: state Earned Income Tax Credits, property tax circuit breakers, targeted low-income credits, and child-related tax credits.

Rewarding Work Through State Earned Income Tax Credits in 2018

September 17, 2018 • By ITEP Staff

The Earned Income Tax Credit (EITC) is a policy designed to bolster the earnings of low-wage workers and offset some of the taxes they pay, providing the opportunity for struggling families to step up and out of poverty toward meaningful economic security. The federal EITC has kept millions of Americans out of poverty since its enactment in the mid-1970s. Over the past several decades, the effectiveness of the EITC has been magnified as many states have enacted and later expanded their own credits. The effectiveness of the EITC as an anti-poverty policy can be increased by expanding the credit at…

Reducing the Cost of Child Care Through State Tax Codes in 2018

September 17, 2018 • By Aidan Davis

Families in poverty contribute over 30 percent of their income to child care compared to about 6 percent for families at or above 200 percent of poverty. Most families with children need one or more incomes to make ends meet which means child care expenses are an increasingly unavoidable and unaffordable expense. This policy brief examines state tax policy tools that can be used to make child care more affordable: a dependent care tax credit modeled after the federal program and a deduction for child care expenses.

Sales taxes are one of the most important revenue sources for state and local governments; however, they are also among the most unfair taxes, falling more heavily on low- and middle-income households. Therefore, it is important that policymakers nationwide find ways to make sales taxes more equitable while preserving this important source of funding for public services. This policy brief discusses two approaches to a less regressive sales tax: broad-based exemptions and targeted sales tax credits.

State Rundown 7/19: Wayfair Fallout and Ballot Preparation Dominate State Tax Talk

July 19, 2018 • By ITEP Staff

In the wake of the U.S. Supreme Court's recent Wayfair decision authorizing states to collect taxes owed on online sales, Utah lawmakers held a one-day special session that included (among other tax topics) legislation to ensure the state will be ready to collect those taxes, and a Nebraska lawmaker began pushing for a special session for the same reason. Voters in Colorado and Montana got more clarity on tax-related items they'll see on the ballot in November. And Massachusetts moves closer toward becoming the final state to enact a budget for the new fiscal year that started July 1 in…

Building on Momentum from Recent Years, 2018 Delivers Strengthened Tax Credits for Workers and Families

July 10, 2018 • By Aidan Davis

Despite some challenging tax policy debates, a number of which hinged on states’ responses to federal conformity, 2018 brought some positive developments for workers and their families. This post updates a mid-session trends piece on this very subject. Here’s what we have been following: