Florida

State Rundown 3/22: Some Spring State Tax Debates in Full Bloom, Others Just Now Surfacing

March 22, 2018 • By ITEP Staff

The onset of spring this week proved to be fertile ground for state fiscal policy debates. A teacher strike came to an end in West Virginia as another seems ready to begin in Oklahoma. Budgets were finalized in Florida, West Virginia, and Wyoming, are set to awaken from hibernation in Missouri and Virginia, and are being hotly debated in several other states. Meanwhile Idaho, Iowa, Maryland, and Minnesota continued to grapple with implications of the federal tax-cut bill. And our What We're Reading section includes coverage of how states are attempting to further public priorities by taxing carbon, online gambling,…

With many state legislative sessions about halfway through, the ripple effects of the federal tax-cut bill took a back seat this week as states focused their energies on their own tax and budget issues. Major proposals were released in Nebraska and New Jersey, one advanced in Missouri, and debates wrapped up in Florida, Utah, and Washington. Oklahoma and Vermont are considering ways to improve education funding, while California, New York, and Vermont look to require more of their most fortunate residents. And check in on "what we're reading" for resources on the online sales tax debate, the role of property…

This week was very active for state tax debates. Georgia, Idaho, and Oregon passed bills reacting to the federal tax cut, as Maryland and other states made headway on their own responses. Florida lawmakers sent a harmful "supermajority" constitutional amendment to voters. New Jersey now has two progressive revenue raising proposals on the table (and a need for both). Louisiana ended one special session with talks of yet another. And online sales taxes continued to make news nationally and in Kansas, Nebraska, and Pennsylvania.

This Valentine's week finds California, Georgia, Missouri, New York, Oregon, and other states flirting with the idea of coupling to various components of the federal tax-cut bill. Meanwhile, lawmakers seeking revenue solutions to budget shortfalls in Alaska, Oklahoma, and Wyoming saw their advances spurned, and anti-tax advocates in many states have been getting mixed responses to their tax-cut proposals. And be sure to check out our "what we're reading" section to see how states are getting no love in recent federal budget developments.

Sometimes, ranking near No. 1 in the world is not a badge of pride. According to the Financial Secrecy Index released by the Tax Justice Network (TJN), the United States is the second largest contributor to financial secrecy in the world, placing it in the company of infamous tax havens such as Switzerland (ranked No. 1) and the Cayman Islands (ranked No. 3). Financial secrecy is enabling people to hide income from the authorities to evade taxes or financial regulation, launder profits from crime, finance terrorism, or otherwise break the law.

State Rundown 1/31: Low-Income Families’ Taxes Getting Some Much-Needed Attention

January 31, 2018 • By ITEP Staff

This week was promising for advocates of Earned Income Tax Credits (EITCs) and other tax breaks for workers and their families, which are making headway in Alabama, Maine, Massachusetts, Missouri, Utah, and Wisconsin. The week also saw the unveiling of a tax cut plan in Missouri, a budget-balancing tax increase package in Oklahoma, the end of an unproductive film tax credit in West Virginia, and a very busy week for tax policy in Utah.

Florida Policy Institute: Dream Act: What’s at Stake for Florida?

December 20, 2017

There are 72,000 young immigrants who were potentially eligible for DACA that call Florida home. They currently contribute a total of $78 million to local and state taxes annually through sales and excise taxes, property taxes and income tax. Read more here

Final GOP-Trump Bill Still Forces California and New York to Shoulder a Larger Share of Federal Taxes Under Final GOP-Trump Tax Bill; Texas, Florida, and Other States Will Pay Less

December 17, 2017 • By Meg Wiehe

Residents of California and New York pay a large amount of the nation’s federal personal income taxes relative to their share of the population. As illustrated by the table below, the final GOP-Trump tax bill expected to be approved this week would substantially increase the share of total federal personal income taxes (PIT) paid by both states. Connecticut, Maryland, Massachusetts, and New Jersey would also see their share of federal PIT increase.

How the Final GOP-Trump Tax Bill Would Affect Florida Residents’ Federal Taxes

December 16, 2017 • By ITEP Staff

The final tax bill that Republicans in Congress are poised to approve would provide most of its benefits to high-income households and foreign investors while raising taxes on many low- and middle-income Americans. The bill would go into effect in 2018 but the provisions directly affecting families and individuals would all expire after 2025, with […]

The Final Trump-GOP Tax Plan: National and 50-State Estimates for 2019 & 2027

December 16, 2017 • By ITEP Staff

The final Trump-GOP tax law provides most of its benefits to high-income households and foreign investors while raising taxes on many low- and middle-income Americans. The bill goes into effect in 2018 but the provisions directly affecting families and individuals all expire after 2025, with the exception of one provision that would raise their taxes. To get an idea of how the bill will affect Americans at different income levels in different years, this analysis focuses on the bill’s impacts in 2019 and 2027.

ITEP researchers have produced new reports and analyses that look at various pieces of the tax bill, including: the share of tax cuts that will go to foreign investors; how the plans would affect the number of taxpayers that take the mortgage interest deduction or write off charitable contributions, and remaining problems with the bill in spite of proposed compromises on state and local tax deductions.

State Rundown 12/13: Supermajority Laws Considered in Some States Even as They Confound Others

December 13, 2017 • By ITEP Staff

Supermajority requirements for tax increases are proving a major obstacle to responsible budgeting in Oklahoma, while ballot initiatives are being filed to alter or abolish Oregon‘s similar requirement, but a similar requirement is slowly advancing toward the ballot in Florida nonetheless. Displeasure with agricultural property taxes are spawning both a ballot initiative drive and a […]

Even with Potential SALT Compromises, Senate Bill Forces California and New York to Shoulder a Larger Share of Federal Taxes While Texas, Florida, and Other States Will Pay Less

December 10, 2017 • By Meg Wiehe, Steve Wamhoff

The Senate tax bill, with or without either of the compromises that could be added to it, would shift personal income taxes away from Florida and Texas to states like California and New York, which are already paying a high share relative to their populations.

New Republic: Tax Reform to Own the Libs

December 8, 2017

According to analysis from the Institute on Taxation and Economic Policy, New York, New Jersey, Maryland, and California would pay $17 billion more in taxes by 2027, while Texas and Florida, two large states that Trump won, would pay $31 billion less. “You can definitely see the ideological tilt here,” Carl Davis, the institute’s research […]

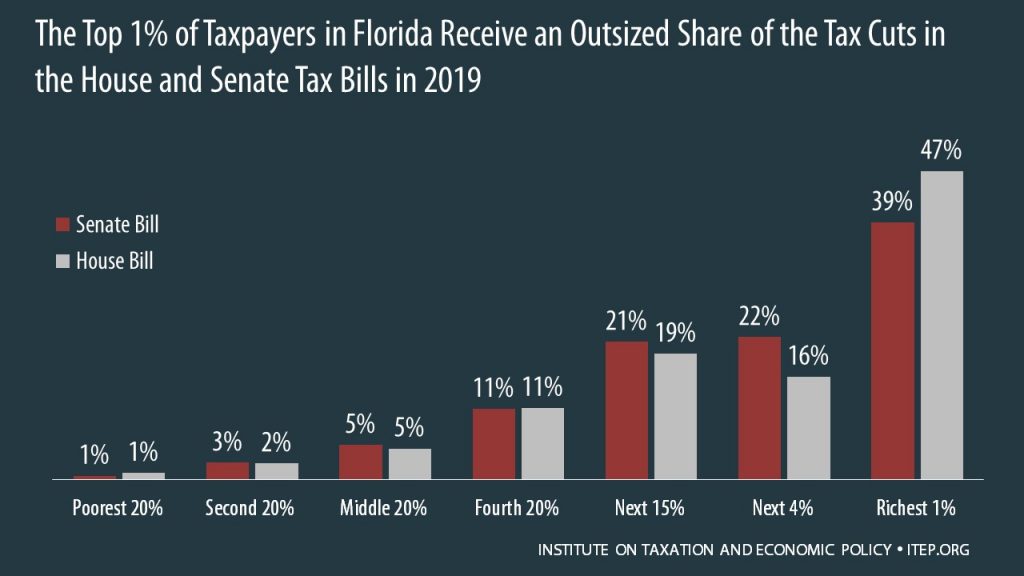

How the House and Senate Tax Bills Would Affect Florida Residents’ Federal Taxes

December 6, 2017 • By ITEP Staff

The House passed its “Tax Cuts and Jobs Act” November 16th and the Senate passed its version December 2nd. Both bills would raise taxes on many low- and middle-income families in every state and provide the wealthiest Americans and foreign investors substantial tax cuts, while adding more than $1.4 trillion to the deficit over ten years. The graph below shows that both bills are skewed to the richest 1 percent of Florida residents.

National and 50-State Impacts of House and Senate Tax Bills in 2019 and 2027

December 6, 2017 • By ITEP Staff

The House passed its “Tax Cuts and Jobs Act” November 16th and the Senate passed its version December 2nd. Both bills would raise taxes on many low- and middle-income families in every state and provide the wealthiest Americans and foreign investors substantial tax cuts, while adding more than $1.4 trillion to the deficit over ten years. National and 50-State data available to download.

How True Tax Reform Would Eliminate Breaks for Real Estate Investors Like Donald Trump

December 1, 2017 • By ITEP Staff

The federal tax code includes several loopholes and special breaks that advantage wealthy real estate investors like President Donald Trump. Under current law, real estate investors can claim losses much more quickly and easily than other taxpayers, but they also have several methods to delay or avoid reporting any profits to the IRS.

The State Rundown is back from Thanksgiving break with a heaping helping of leftover state tax news, but beware, some of it may be rotten.

The Atlantic: The Big Blue Losers in the GOP Tax Plan

November 28, 2017

Between the mortgage and SALT limits, the bills hit many upper-middle-class taxpayers, especially in blue states. The Institute on Taxation and Economic Policy calculates that by 2027 the Senate bill would raise taxes on about 45 percent of households between the 80th and 95th income percentiles in California, Virginia, New Jersey, and New York; and […]

Revised Senate Plan Would Raise Taxes on at Least 29% of Americans and Cause 19 States to Pay More Overall

November 18, 2017 • By ITEP Staff

The tax bill reported out of the Senate Finance Committee on Nov. 16 would raise taxes on at least 29 percent of Americans and cause the populations of 19 states to pay more in federal taxes in 2027 than they do today.

New York Times: Confused by Tax Bills?

November 17, 2017

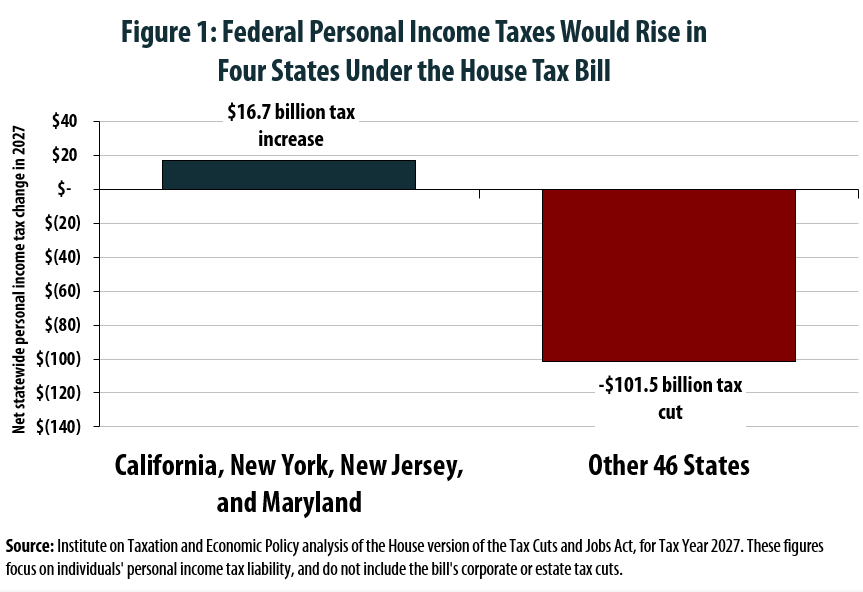

Compared with current law, the House bill, which was passed Thursday, would raise personal federal income taxes on California, New Jersey, New York and Maryland residents by $16.7 billion in 2027, according to an Institute on Taxation and Economic Policy analysis. Florida and Texas, however, would get $31.2 billion in cuts. Read more

Los Angeles Times: A Tax Bill No Responsible California Lawmaker Should Support

November 16, 2017

But the bill’s cuts in personal tax rates, its increase in the standard deduction and other benefits for individual taxpayers are partially offset by reductions in some popular tax deductions — including those for state and local taxes and mortgage interest payments, many of whose beneficiaries live in states with high income or sales taxes […]

House Tax Plan Offers an Exceptionally Bad Deal for California, New York, New Jersey, and Maryland

November 14, 2017 • By Carl Davis

An ITEP analysis reveals that four states would see their residents pay more in aggregate federal personal income taxes under the House’s Tax Cuts and Jobs Act. While some individual taxpayers in every state would face a tax increase, only California, New York, Maryland, and New Jersey would see such large increases that their residents’ overall personal income tax payments rise when compared to current law.

How the Revised Senate Tax Bill Would Affect Florida Residents’ Federal Taxes

November 13, 2017 • By ITEP Staff

The Senate tax bill released last week would raise taxes on some families while bestowing immense benefits on wealthy Americans and foreign investors. In Florida, 60 percent of the federal tax cuts would go to the richest 5 percent of residents, and 8 percent of households would face a tax increase, once the bill is fully implemented.

State Rundown 11/8: Online Sales Tax Fight and Tax Subsidy Absurdity Go National

November 8, 2017 • By ITEP Staff

Internet sales tax fairness efforts gained momentum this week as most states joined together to encourage the US Supreme Court to allow them to collect taxes on online sales. Meanwhile, Montana lawmakers will enter special session next week to plug their revenue shortfall, Mississippi's (self-inflicted) revenue crunch is reaching unprecedented severity, and misguided corporate tax subsidies got mainstream attention from HBO's John Oliver and Rolling Stone.