Montana

While Massachusetts legislators recently dropped a real estate transfer tax from their major housing bill, the District of Columbia council sent a budget to the mayor that includes a mansion tax that would increase the tax rate on properties valued over $2.5 million. Meanwhile, lawmakers in New Jersey and South Carolina continue to, respectively, raise and reduce needed revenues.

Montana Budget & Policy Center: The Great Tax Shift

March 20, 2024

The taxes paid by Montana residents and businesses have created and continue to fund an equitable educational system, roads and bridges, and services that keep our communities safe. Unfortunately, over time, responsibility for our tax system has shifted to everyday Montanans, like our teachers, plumbers, and construction workers, and away from the wealthy. Over the […]

Anti-tax interests finally found the end of the tax cutting appetite in a few states this week...

State Tax Watch 2024

January 23, 2024 • By ITEP Staff

Updated July 15, 2024 In 2024, state lawmakers have a choice: advance tax policy that improves equity and helps communities thrive, or push tax policies that disproportionately benefit the wealthy, drain funding for critical public services, and make it harder for low-income and working families to get ahead. Despite worsening state fiscal conditions, we expect […]

Tax policy themes have begun to crop up in states as governors give their yearly addresses and legislators lay out their plans for the 2024 legislative season...

Montana: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

Montana Download PDF All figures and charts show 2024 tax law in Montana, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.5 percent) state and local tax revenue collected in Montana. State and local tax shares of family income Top 20% Income Group […]

Hidden in Plain Sight: Race and Tax Policy in 2023 State Legislative Sessions

November 21, 2023 • By Brakeyshia Samms

Race was front and center in a lot of state policy debates this year, from battles over what’s being taught in schools to disagreements over new voting laws. Less visible, but also extremely important, were the racial implications of tax policy changes. What states accomplished this year – both good and bad – will acutely affect people and families of color.

States differ dramatically in how much they allow families to make choices about whether and when to have children and how much support they provide when families do. But there is a clear pattern: the states that compel childbirth spend less to help children once they are born.

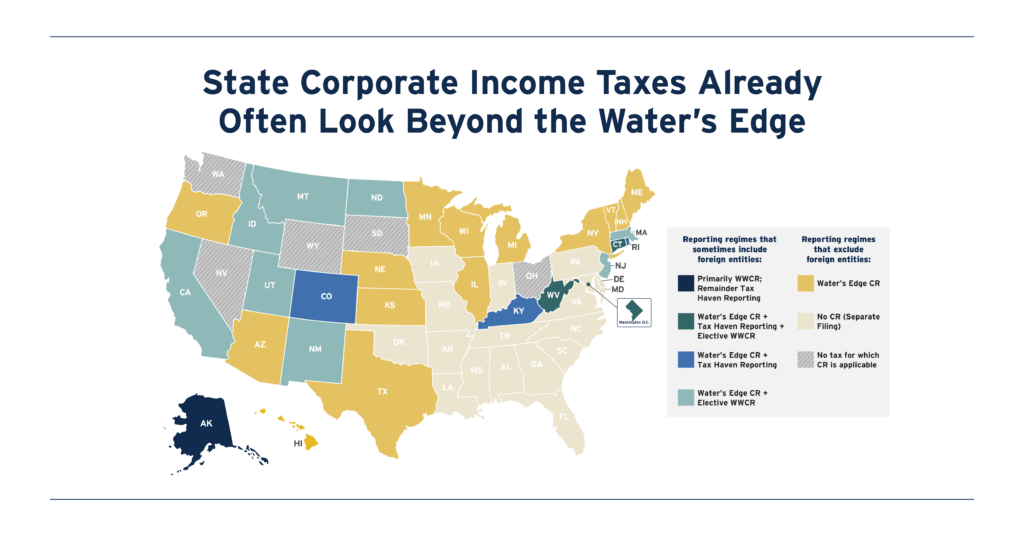

Far From Radical: State Corporate Income Taxes Already Often Look Beyond the Water’s Edge

November 7, 2023 • By Carl Davis, Matthew Gardner

State lawmakers are increasingly interested in reforming their corporate tax bases to start from a comprehensive measure of worldwide profit. This provides a more accurate, and less gameable, starting point for calculating profits subject to state corporate tax. Mandating this kind of filing system, known as worldwide combined reporting (WWCR), would be transformative, as it would all but eliminate state corporate tax avoidance done through the artificial shifting of profits into low-tax countries.

State Rundown 9/27: Some States are Looking to Paint the Budgets Red

September 27, 2023 • By ITEP Staff

When it comes to investments, state lawmakers across the country are positioning their states to be in the red as they pass or debate further tax cuts that will overwhelmingly benefit the wealthy – and some states are now adding an additional coat of red paint...

State Tax Credits Have Transformative Power to Improve Economic Security

September 12, 2023 • By Aidan Davis

The latest analysis from the U.S. Census Bureau provides an important reminder of the compelling link between public investments and families’ economic well-being. Policy decisions can drastically reduce poverty and improve family economic stability for low- and middle-income families alike, as today’s data release shows.

Boosting Incomes, Improving Equity: State Earned Income Tax Credits in 2023

September 12, 2023 • By Aidan Davis, Neva Butkus

Nearly two-thirds of states (31 plus the District of Columbia and Puerto Rico) have an Earned Income Tax Credit, an effective tool that boosts low-paid workers’ incomes and helps lower-income families achieve greater economic security. This year, 12 states expanded and improved EITCs.

States and Localities are Making Progress on Curbing Unjust Fees and Fines

July 18, 2023 • By Andrew Boardman

Too many state and local governments tap legal-system collections, rather than adequate tax systems, to fund shared essentials like public safety and education. But a growing number of states and localities are choosing a better approach. Momentum for change has continued to build in 2023, with no fewer than seven states enacting substantial improvements.

Nearly one-third of states took steps to improve their tax systems this year by investing in people through refundable tax credits, and in a few notable cases by raising revenue from those most able to pay. But another third of states lost ground, continuing a trend of permanent tax cuts that overwhelmingly benefit high-income households and make tax codes less adequate and equitable.

State Rundown 5/25: The North Star State Leads the Way on Tax Fairness

May 24, 2023 • By ITEP Staff

As we approach the midpoint of 2023, it’s a good time to look back at the progress states have made in the name of tax fairness and equity...

States Looking to Make Property Taxes Affordable Should Turn to ‘Circuit Breakers’

May 11, 2023 • By ITEP Staff

Many state legislatures this year have been considering property tax cuts – but too many are ignoring the solution that speaks more directly to questions of property tax affordability than any other policy option: the “circuit breaker."

States are Talking About the Wrong Kind of Property Tax Cuts

May 11, 2023 • By Brakeyshia Samms, Carl Davis

Concerns over property tax affordability have been at the forefront this year as housing prices have climbed and property tax bills have often increased along with them. As lawmakers mull a range of property tax cuts, circuit breakers are the best possible approach—and these policies are receiving far too little attention in the states.

Preventing an Overload: How Property Tax Circuit Breakers Promote Housing Affordability

May 11, 2023 • By Brakeyshia Samms, Carl Davis

Circuit breaker credits are the most effective tool available to promote property tax affordability. These policies prevent a property tax “overload” by crediting back property taxes that go beyond a certain share of income. Circuit breakers intervene to ensure that property taxes do not swallow up an unreasonable portion of qualifying households’ budgets.

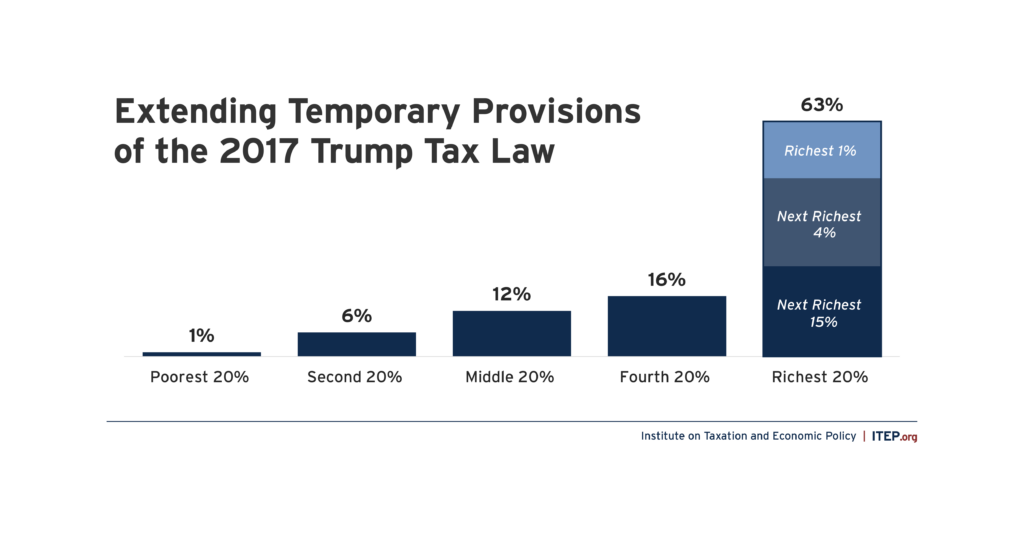

Extending Temporary Provisions of the 2017 Trump Tax Law: National and State-by-State Estimates

May 4, 2023 • By Joe Hughes, Matthew Gardner, Steve Wamhoff

The push by Congressional Republicans to make the provisions of the 2017 Tax Cuts and Jobs Act permanent would cost nearly $300 billion in the first year and deliver the bulk of the tax benefits to the wealthiest Americans.

State governments provide a wide array of tax subsidies to their older residents. But too many of these carveouts focus on predominately wealthy and white seniors, all while the cost climbs.

It’s March and state lawmakers are showing why the Madness isn’t only reserved for the basketball court...

Lured by Promises of Financial Gain, Wealthy Families are Flocking to Voucher Tax Shelters and Eroding Public Education in the Process

March 7, 2023 • By ITEP Staff

Contact: Jon Whiten – [email protected] Lawmakers in several states are discussing enacting or expanding school voucher tax credits, which reimburse individuals and businesses for “donations” they make to organizations that give out vouchers for free or reduced tuition at private K-12 schools, as a new brief released today by the Institute on Taxation and Economic […]

Wealthy families are overwhelmingly the ones using school voucher tax credits to opt out of paying for public education and other public services and to redirect their tax dollars to private and religious institutions instead. Most of these credits are being claimed by families with incomes over $200,000.

This week, several big tax proposals took strides on the march toward becoming law...

The word “tax” appears 97 times and counting in one recent summary of governors’ addresses to state legislators so far this year. The policy visions that governors are bringing, however, vary enormously. While there's good reason to worry about tax cuts for wealthy families and the flattening or elimination of income taxes, there are at least five great tax ideas coming directly out of governors’ offices this year.