Ohio

This op-ed was originally published by Route Fifty and co-written by ITEP State Director Aidan Davis and Center on Budget and Policy Priorities Senior Advisor for State Tax Policy Wesley Tharpe. There’s a troubling trend in state capitols across the country: Some lawmakers are pushing big, permanent tax cuts that primarily benefit the wealthy and […]

Short-sighted tax cuts continue to make their way to Governors’ desks this week. In Florida, Gov. DeSantis signed a $1.3 billion tax cut package with $550 million of the tax cuts from sales tax holidays, alone. The Nebraska legislature also sent $6.4 billion in tax cuts to Gov. Pillen’s desk which includes an enormous personal income tax cut that will reduce taxes on the top 1 percent by tens of thousands of dollars.

Extending Temporary Provisions of the 2017 Trump Tax Law: National and State-by-State Estimates

May 4, 2023 • By Joe Hughes, Matthew Gardner, Steve Wamhoff

The push by Congressional Republicans to make the provisions of the 2017 Tax Cuts and Jobs Act permanent would cost nearly $300 billion in the first year and deliver the bulk of the tax benefits to the wealthiest Americans.

This week the importance of state tax policy is center stage once again...

Policy Matters Ohio: How Ohio’s Income Tax Works – and How the House Budget Would Change It

April 25, 2023

The proposed changes to the state’s personal income tax in the House substitute budget bill are another blow to Ohio’s only tax that is based on the ability to pay, weakening the public programs, institutions, and supports that make the state strong. Read more.

State Rundown 4/19: Revenue Discussions Heat Up Like the Temperature

April 19, 2023 • By ITEP Staff

Tax season has ended for most filers, but the topic remains a hot one in states around the country...

Policy Matters Ohio: Testimony on HB 33 Before the House Finance Committee

April 4, 2023

This general assembly has the good fortune of budgeting in a time of surplus. Smart federal policy drove cash to people and businesses so when the worst of covid passed, the economy could rebound. The federal government has also sent crisis dollars to states, propping up potential shortfalls and funding major investments in many areas […]

Over the past week Washington state saw a major victory for tax fairness after the state Supreme Court held the state’s capital gains tax—passed in 2021—constitutional...

Policy Matters Ohio: Testimony on HB 1 Before the House Ways and Means Committee

March 15, 2023

This bill proposes a substantial rewriting of Ohio’s property and personal income taxes. It is an overly complicated, poorly designed bill that does not achieve what the sponsor claimed it would. It represents a massive wealth transfer from Ohio’s communities to a wealthy few. It is based on unsound economic reasoning and, if passed, it […]

This week, several big tax proposals took strides on the march toward becoming law...

The flat tax plan and others being discussed that would cut even deeper would be windfalls for the wealthy, and expensive ones at that. Families with incomes over $300,000 per year, for example, could expect to gain, as a group, about a billion dollars annually under the flat tax plan. If you asked Ohio families about their top priorities for this legislative session, it’s a safe bet that very few of them would choose a billion-dollar tax cut for this group over funding for schools, parks, and infrastructure.

Policy Matters Ohio: Speaker’s #1 priority – Tax cut for the rich

February 23, 2023

One of Ohio House Speaker Jason Stephens’ top-priority bills, House Bill 1, is a massive giveaway to the rich, and the first of two such proposals by leading Republicans in Ohio’s House. According to a new analysis by Policy Matters Ohio, HB 1 slashes funding to children and all manner of local services, does nothing […]

This week, a fresh bouquet of tax proposals was delivered by state lawmakers, but not all of them have left us with that warm, fuzzy feeling in our stomachs...

State Rundown 2/1: February Brings New (and Some Old) Tax Policy Conversations

February 1, 2023 • By ITEP Staff

Tax bills across the U.S. are winding their way through state legislatures and governors continue to set the tone for this year’s legislative sessions...

State Lawmakers Should Break the 2023 Tax Cut Fever Before It’s Too Late

January 18, 2023 • By Miles Trinidad

Despite mixed economic signals for 2023, including a possible recession, many state lawmakers plan to use temporary budget surpluses to forge ahead with permanent, regressive tax cuts that would disproportionately benefit the wealthy at the expense of low- and middle-income households. These cuts would put state finances in a precarious position and further erode public investments in education, transportation and health, all of which are crucial for creating inclusive, vibrant communities where everyone, not just the rich, can achieve economic security and thrive. In the event of an economic downturn, these results would be accelerated and amplified.

While most states have a graduated rate income tax, some state lawmakers have recently become enamored with the idea of moving away from graduated rate personal income taxes and toward flat rate taxes instead. But flat taxes create problems for ordinary families and let the wealthy off the hook. When faced with a flat income […]

State Child Tax Credits and Child Poverty: A 50-State Analysis

November 16, 2022 • By Aidan Davis

Regardless of future Child Tax Credit developments at the federal level, state policies can supplement the federal credit to deliver additional benefits to children and families. State credits can be specifically tailored to meet the needs of local populations while also producing long-term benefits for society as a whole

Policy Matters Ohio: Increase Family Security and Expand Opportunity in Ohio

November 14, 2022

The expanded federal child tax credit (CTC) improved the lives of millions of children and families. We outline how a simple solution — direct payments to families with children — helped families pay for basic household expenses, relieved parents of stress, and made families more stable and secure. But now, because Congress failed to act, […]

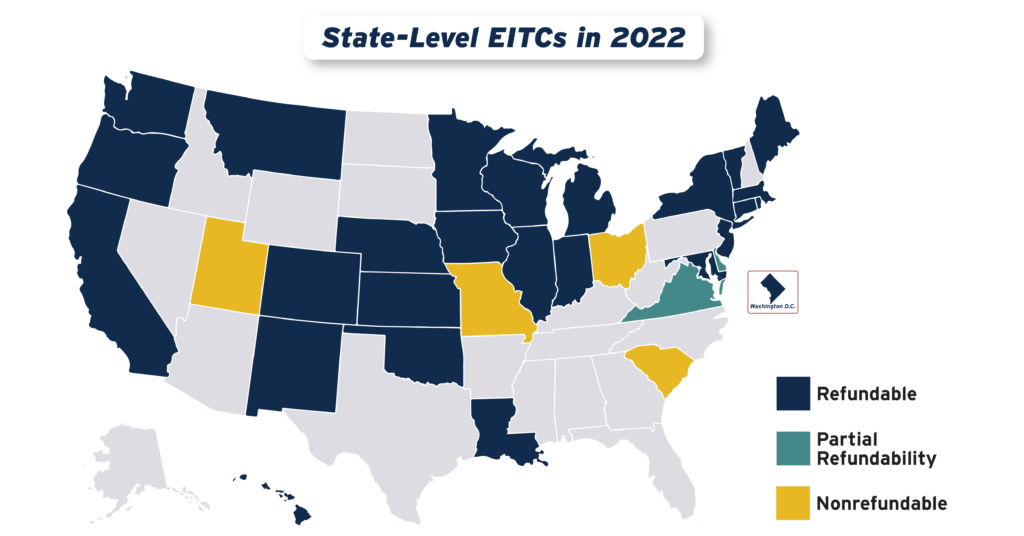

Boosting Incomes and Improving Tax Equity with State Earned Income Tax Credits in 2022

September 15, 2022 • By Aidan Davis

States continued their recent trend of advancing EITCs in 2022, with nine states plus the District of Columbia either creating or improving their credits. Utah enacted a 15 percent nonrefundable EITC, while the District of Columbia, Hawaii, Illinois, Maine, Vermont and Virginia expanded existing credits. Meanwhile, Connecticut, New York and Oregon provided one-time boosts to their EITC-eligible populations.

Putting Cleveland and the Nation on a Path Toward Tax and Climate Justice

August 22, 2022 • By Amy Hanauer

Editor’s note: This originally ran as an opinion piece in the Cleveland Plain Dealer. When I left Cleveland to work on federal tax policy after 20 years running Policy Matters Ohio, I knew Ohio would stay in my heart and fuel my work. Accustomed to an America that often ignores our toughest problems, I understood […]

State Rundown 8/10: States Still Talking Taxes as IRA Dominates Headlines

August 10, 2022 • By ITEP Staff

While federal tax policy has dominated the headlines with the Senate’s recent approval of the Inflation Reduction Act, lawmakers in statehouses across the country...

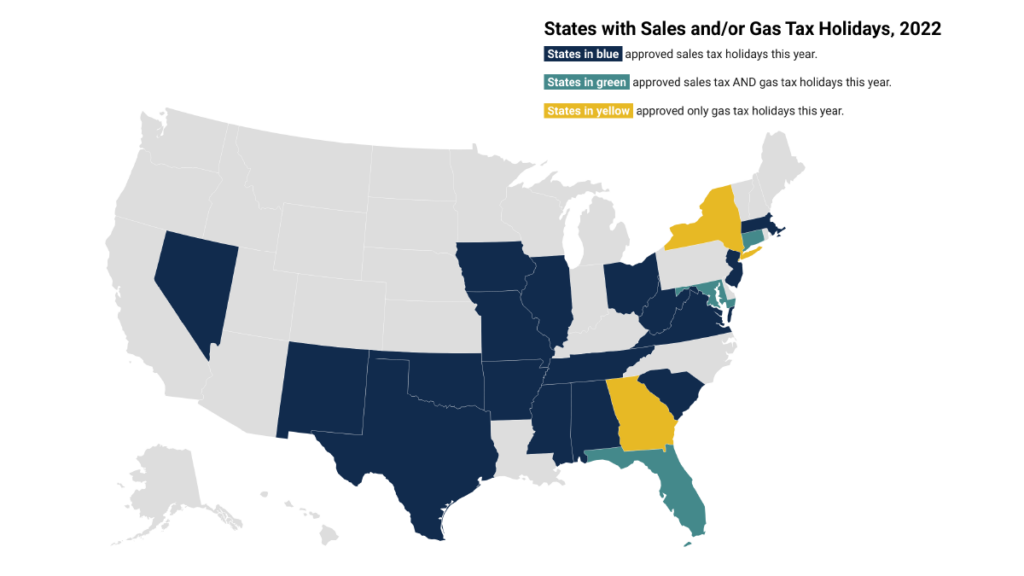

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

July 20, 2022 • By Marco Guzman

Lawmakers in many states have enacted “sales tax holidays” (20 states will hold them in 2022) to temporarily suspend the tax on purchases of clothing, school supplies, and other items. These holidays may seem to lessen the regressive impacts of the sales tax, but their benefits are minimal while their downsides are significant—particularly as lawmakers have sought to apply the concept as a substitute for more meaningful, permanent reform or arbitrarily reward people with specific hobbies or in certain professions. This policy brief looks at sales tax holidays as a tax reduction device.

With many state legislative sessions wrapped or wrapping up, we at ITEP want to take a moment to direct your attention south, and specifically, to the American South...

State Rundown 6/8: Tax Policy Features Prominently During Budget and Primary Season

June 8, 2022 • By ITEP Staff

As voters head to the polls to weigh in on their state’s primary elections and legislators convene to hash out budget deals, tax policy remains atop the agenda...

State Rundown 5/11: Mid-Year Special Elections and Primary Season Kicks Off with Taxes in the Spotlight

May 11, 2022 • By ITEP Staff

As 2022 inches closer to its midpoint, important tax policy decisions are being put in the hands of voters, as special elections and the primary season begin...