Virginia

State Rundown 2/8: Flowers, Chocolates, and Tax Cuts for the Wealthy?

February 8, 2024 • By ITEP Staff

While we were hoping to get progressive tax policy wins for Valentine’s Day, many state lawmakers have another idea in mind...

State Rundown 2/1: Black History Month Begins as Tax Debates Heat Up Nationwide

February 1, 2024 • By ITEP Staff

This week the showdown between the Kansas legislature and governor continued as Gov. Kelly vetoed the legislature’s latest attempt to pass a flat personal income tax. Elsewhere, the focus is on doing more for working families through proposals to expand refundable credits in Maryland and adding a millionaire tax bracket in Rhode Island. Meanwhile, there’s […]

State Tax Watch 2024

January 23, 2024 • By ITEP Staff

Updated July 15, 2024 In 2024, state lawmakers have a choice: advance tax policy that improves equity and helps communities thrive, or push tax policies that disproportionately benefit the wealthy, drain funding for critical public services, and make it harder for low-income and working families to get ahead. Despite worsening state fiscal conditions, we expect […]

The Commonwealth Institute: How the Governor’s Proposal Increases Taxes for Low-Income Families, Gives Significant Cuts to the Wealthy

January 23, 2024

When we all pitch in our fair share, we can invest in the programs and services that help everyone to thrive, like public education, affordable housing, and more. But Virginia’s tax code is upside-down, where those with the most pay the least taxes as a share of income.

Tax policy themes have begun to crop up in states as governors give their yearly addresses and legislators lay out their plans for the 2024 legislative season...

West Virginia: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

West Virginia Download PDF All figures and charts show 2024 tax law in West Virginia, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.3 percent) state and local tax revenue collected in West Virginia. These figures depict West Virginia’s personal income tax at […]

Virginia: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

Virginia Download PDF All figures and charts show 2024 tax law in Virginia, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (98.8 percent) state and local tax revenue collected in Virginia. These figures depict Virginia’s standard deduction at its 2024 levels of $8,500 […]

Washington Post: Va. General Assembly Girds for Fights Over Arena, Taxes, Schools and More

January 7, 2024

Democratic lawmakers have the majorities. Republican Gov. Glenn Youngkin has the veto. That’s the crux as a new-look Virginia General Assembly rolls into town Wednesday, opening a 60-day legislative session in which roughly a third of lawmakers are rookies and Democrats control both chambers but can’t get much done without Youngkin’s cooperation. Read more.

State Rundown 1/4: New Year, New Opportunities, Same Tax Cut Proposals

January 4, 2024 • By ITEP Staff

The year may be new, but state lawmakers seem to have the same old resolution: slashing state income taxes...

Even as revenue collections slow in many states, some are starting the push for 2024 tax cuts early. For instance, policymakers in Georgia and Utah are already making the case for deeper income tax cuts. Meanwhile, Arizona lawmakers are now facing a significant deficit, the consequence of their recent top-heavy tax cuts. There is another […]

Hidden in Plain Sight: Race and Tax Policy in 2023 State Legislative Sessions

November 21, 2023 • By Brakeyshia Samms

Race was front and center in a lot of state policy debates this year, from battles over what’s being taught in schools to disagreements over new voting laws. Less visible, but also extremely important, were the racial implications of tax policy changes. What states accomplished this year – both good and bad – will acutely affect people and families of color.

States differ dramatically in how much they allow families to make choices about whether and when to have children and how much support they provide when families do. But there is a clear pattern: the states that compel childbirth spend less to help children once they are born.

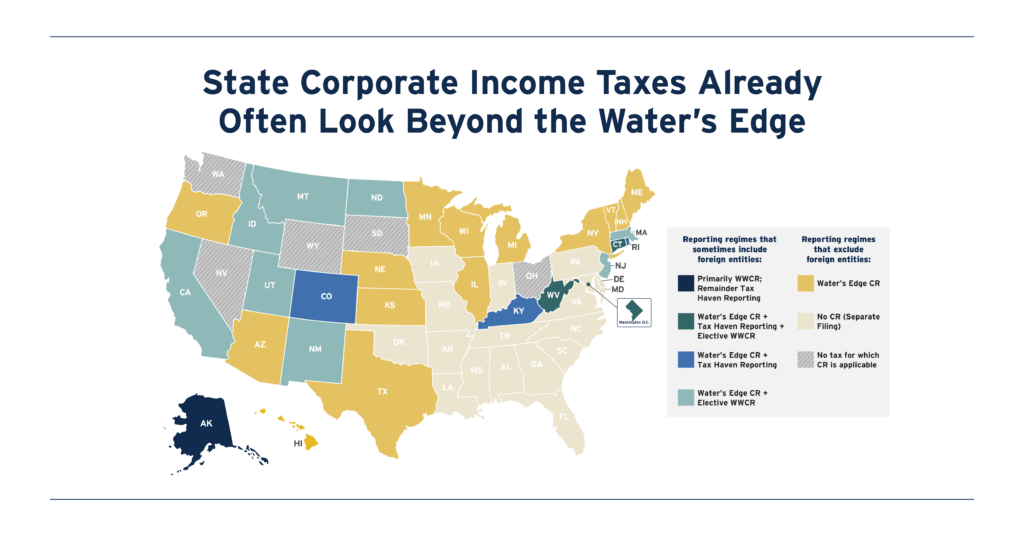

Far From Radical: State Corporate Income Taxes Already Often Look Beyond the Water’s Edge

November 7, 2023 • By Carl Davis, Matthew Gardner

State lawmakers are increasingly interested in reforming their corporate tax bases to start from a comprehensive measure of worldwide profit. This provides a more accurate, and less gameable, starting point for calculating profits subject to state corporate tax. Mandating this kind of filing system, known as worldwide combined reporting (WWCR), would be transformative, as it would all but eliminate state corporate tax avoidance done through the artificial shifting of profits into low-tax countries.

America Used to Have a Wealth Tax: The Forgotten History of the General Property Tax

November 2, 2023 • By Carl Davis, Eli Byerly-Duke

Over time, broad wealth taxes were whittled away to become the narrower property taxes we have today. These selective wealth taxes apply to the kinds of wealth that make up a large share of middle-class families’ net worth (like homes and cars), but usually exempt most of the net worth of the wealthy (like business equity, bonds, and pooled investment funds).The rationale for this pared-back approach to wealth taxation has grown weaker in recent decades as inequality has worsened, the share of wealth held outside of real estate has increased, and the tools needed to administer a broad wealth tax…

The U.S. Census Bureau released its annual assessment of poverty in America this week...

State Tax Credits Have Transformative Power to Improve Economic Security

September 12, 2023 • By Aidan Davis

The latest analysis from the U.S. Census Bureau provides an important reminder of the compelling link between public investments and families’ economic well-being. Policy decisions can drastically reduce poverty and improve family economic stability for low- and middle-income families alike, as today’s data release shows.

Boosting Incomes, Improving Equity: State Earned Income Tax Credits in 2023

September 12, 2023 • By Aidan Davis, Neva Butkus

Nearly two-thirds of states (31 plus the District of Columbia and Puerto Rico) have an Earned Income Tax Credit, an effective tool that boosts low-paid workers’ incomes and helps lower-income families achieve greater economic security. This year, 12 states expanded and improved EITCs.

How to Better Tax the Rich Men North (and South) of Richmond

September 7, 2023 • By Amy Hanauer

When you examine tax policy through the lens of how much working (and poor) people are taxed compared to rich men north (and south) of Richmond, it’s hard not to take Oliver Anthony's runaway hit as a jumping off point to amplify some important facts.

While a number of state tax laws are debated, approved, and vetoed in any given year, many go unnoticed...

State Rundown 8/10: Pump the ‘Breaks’ on Sales Tax Holiday Celebrations

August 10, 2023 • By ITEP Staff

August is here, school is starting, and with that comes back to school shopping...

Gimmicky Sales Tax Holidays to Cost States & Localities $1.6 Billion This Year

August 3, 2023 • By ITEP Staff

Sales tax holidays are bad policies that have too often been used as a substitute for more meaningful, permanent reform.

Sales Tax Holidays: An Ineffective Alternative to Real Sales Tax Reform

August 2, 2023 • By Marco Guzman

Nineteen states have sales tax holidays on the books in 2023, and these suspensions will cost nearly $1.6 billion in lost revenue this year. Sales tax holidays are poorly targeted and too temporary to meaningfully change the regressive nature of a state’s tax system. Overall, the benefits of sales tax holidays are minimal while their downsides are significant.

The Dog Days of summer are upon us, and with most states out of session and extreme heat waves making their way across the country, it’s a perfect time to sit back and catch up on all your favorite state tax happenings (ideally with a cool drink in hand)...

Most state legislatures have adjourned for 2023, and that means it’s a perfect time to look at the tax policy trends that have formed thus far...

We can make modest reforms to better tax those who are taking a larger share of our wealth and income in order to reinforce a major pillar of our promise to Americans.