Washington

The Seattle Times: Education funding-An income tax would solve this

January 9, 2017

“Congratulations citizens of Washington state [“School-funding task force unlikely to have proposed fixes when Legislature convenes,” NWThursday, Jan. 5]. It is official: According to the Institute on Taxation and Economic Policy, the state of Washington is now ranked No. 1 for having the most regressive tax system of all 50 states.” Read more

The Federal Estate Tax: A Critical and Highly Progressive Revenue Source

December 7, 2016 • By Richard Phillips

For years, wealth and income inequality have been widening at a troubling pace. A recent study estimated that the wealthiest 1 percent of Americans held 42 percent of the nation's wealth in 2012, up from 28 percent in 1989. Public policies have exacerbated this trend by taxing income earned from investments at a lower rate than income from an ordinary job and by dramatically cutting taxes on inherited wealth. Further, lawmakers have done little to stop aggressive accounting schemes designed to avoid the estate tax altogether.

McClatchy DC: Undocumented students asked council to make Washington’s Bellingham a sanctuary city

November 16, 2016

“Prado said undocumented immigrants contribute about $292 million in taxes to Washington state each year, according to the Institute on Taxation and Economic Policy. The amount would be higher with full legal status.” Read more

St Louis Post: Missouri’s new governor will need new ideas to fix a broken tax structure

November 14, 2016

“Governor-elect Eric Greitens has bold tax-reduction plans for Missouri but vague budget-balancing ideas. He should pay attention to the advice of Dylan Grundman, a senior analyst with the Institute on Taxation and Economic Policy in Washington. Grundman warned the commission of ‘three paths to avoid.’ One is to cut income taxes in hopes of spurring […]

The Atlantic: Are Washingtonians About to Vote Down a Chance to Fight Climate Change?

November 7, 2016

“Progressives in Washington have argued for years that the state’s tax system is unfair and exacerbates inequality. Indeed, according to a 2015 report by the nonpartisan Institute on Taxation and Economic Policy, the poorest 20 percent of Washingtonians (who make $21,000 per year or less) pay roughly 16.8 percent of their income in taxes every […]

Yahoo! Finance: New Jersey just hiked its gas tax by 159%. Is your state next?

November 7, 2016

“Of course, New Jersey isn’t the only state that has or is toying with raising gasoline taxes. Georgia, Idaho, Iowa, Kentucky, Michigan, Nebraska, North Carolina, South Dakota, Utah, and Washington upped their gas taxes in 2015, notes the Institute on Taxation and Economic Policy. Louisiana, Tennessee, Alaska, Alabama and Minnesota are contemplating increases in 2017.” […]

Casper Star-Tribune: Powerful Wyoming Liberty Group hits reset on image

October 31, 2016

“But Wyoming’s tax system is advantageous to the rich, with the state’s poor and middle classes paying a disproportionate amount of their income on sales and property taxes, said Carl Davis, the research director of the Washington-based Institute on Taxation and Economic Policy.” Read more

American Federation of Teachers: Backdoor ‘Neovouchers’ Allow Wealthy to Profit off Public Funds for Schools

October 14, 2016

“Ten U.S. states are blatantly circumventing public opposition or constitutional obstacles to publicly funded private school vouchers by allowing wealthy taxpayers to turn a profit on ‘charitable’ contributions to private schools, a report released this week by the Institute on Taxation and Economic Policy reveals.” Read more

This report explains the workings, and problems, with state-level tax subsidies for private K-12 education. It also discusses how the Internal Revenue Service (IRS) has exacerbated some of these problems by allowing taxpayers to claim federal charitable deductions even on private school contributions that were not truly charitable in nature. Finally, an appendix to this report provides additional detail on the specific K-12 private school tax subsidies made available by each state.

Think Progress: Opposition to Washington’s historic carbon tax initiative is coming from the unlikeliest of sources

October 11, 2016

“To Bauman and his colleagues at CarbonWA, the initiative seemed like a win-win, something that would drive down carbon emissions while moving Washington’s notoriously regressive tax code — the worst in the entire country, according to the Institute on Taxation and Economic Policy — forward.” Read more

This study explores how in 2015 Fortune 500 companies used tax haven subsidiaries to avoid paying taxes on much of their income. It reveals that tax haven use is now standard practice among the Fortune 500 and that a handful of the country's wealthiest corporations benefit the most from this tax avoidance scheme.

Washington Post:

September 13, 2016

“‘We should be, shareholders should be, angry that Medtronic has access to as much of the benefits of U.S. citizenship as they do,’ said Matt Gardner, executive director of the Institute on Taxation and Economic Policy, a nonpartisan think tank.” Read more

Seattle PI: Labor Day union support for Sound Transit 3

September 8, 2016

“A study by the Institute on Taxation and Economic Policy found that the lowest 20 percent, those with family incomes under $21,000, pay 16.8 percent of their incomes in state taxes. The next 20 percent, with incomes of $21,000 to $40,000, pay 11.7 percent in state taxes.” Read more

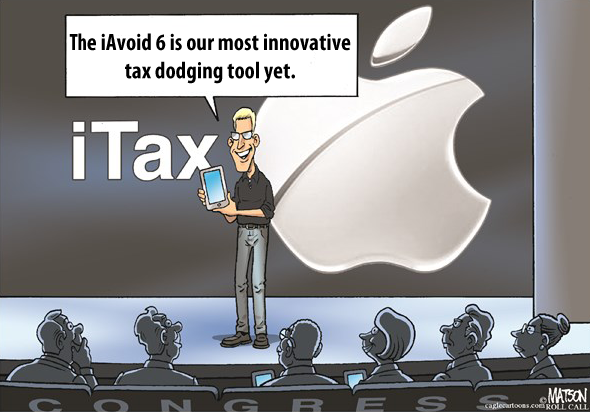

Hartford Courant: European Union orders Apple to pay nearly $15 billion in back taxes

September 2, 2016

“‘To its credit, the European Union understands that when member nations act as tax havens, as Ireland has, there are casualties far beyond the borders of Ireland,’ said Matthew Gardner, executive director of the Institute on Taxation and Economic Policy, a liberal research group in Washington.” Read more

AP: Europe hits Apple with a $15 billion-plus tax bill

August 31, 2016

“‘To its credit, the European Union understands that when member nations act as tax havens, as Ireland has, there are casualties far beyond the borders of Ireland,’ said Matthew Gardner, executive director of the Institute on Taxation and Economic Policy, a liberal research group in Washington.”

Politico: Morning Tech: A look inside Clinton’s extensive tech policy squad

August 24, 2016

“VCs say that such a policy would deter investors from committing to risky, long-term projects that yield large payoffs. Additionally, critics of such reform argue that it could inhibit talent from entering venture capital, since it reduces the financial incentive. The National Venture Capital Association says that up to 60 percent of a venture capitalist’s […]

Bloomberg Technology: As Clinton and Trump Call for Tax Reform, Silicon Valley Must Prove VCs Are Special

August 24, 2016

“In this election cycle, carried interest has become calcified in a larger economic debate. “It’s become the poster child for inequality,” said Matt Gardner, executive director at the Institute on Taxation and Economic Policy, a think tank in Washington. “When you see these tax breaks that aren’t available to the general population of wage earners, […]

Accounting Today: VCs Contend Their Carried Interest Isn’t Like the Other Guys’

August 23, 2016

“In this election cycle, carried interest has become calcified in a larger economic debate. “It’s become the poster child for inequality,” said Matt Gardner, executive director at the Institute on Taxation and Economic Policy, a think tank in Washington. “When you see these tax breaks that aren’t available to the general population of wage earners, […]

Mother Jones: How Hillary Can Rein in Big Finance

August 12, 2016

“Sales and excise taxes are the most regressive element in most state and local tax systems,” says the Institute on Taxation and Economic Policy, which examines state tax systems every year. Last year, it claimed Washington had the most unfair tax system in the country, largely because the state, which lacks an income tax, raises […]

Tim Cook’s Disingenuous Argument to Justify Apple’s $215 Billion Offshore Cash Hoard

August 9, 2016 • By Jenice Robinson

Tim Cook is a persuasive CEO. In a wide-ranging interview published earlier this week in the Washington Post, he discussed his vision for the company, thoughts about leadership succession, and humbly admitted he has made mistakes. So it would be very easy to view as reasonable his declaration that Apple will not repatriate its offshore […]

The Washington Times: First state back-to-school sales tax holiday kicks off at end of July

July 28, 2016

“For its part, the liberal Institute on Taxation and Economic Policy in a July 11 policy brief likewise questioned the propriety of sales tax holidays, concluding they do little to help the working poor, result in less tax revenue and administrative headaches for state tax collectors and provide an opening for “unscrupulous” merchants to “increas[e] […]

Christian Science Monitor: Are sales tax holidays good for anyone?

July 27, 2016

“But as the Washington-based research organization Institute on Taxation and Economic Policy (ITEP) points out, no new states introduced tax holidays this year. In fact several states have reduced or canceled theirs recently.” Read more

The Olympian: Support Olympia by supporting Opportunity for Olympia

July 27, 2016

“The Institute on Taxation and Economic Policy notes that Washington state has the most regressive tax structure in the country. The poorest 20 percent pay 16.8 percent of their income in state and local taxes while the richest 1 percent pay only 2.4 percent.” Read more

St. Louis Post Dispatch: Editorial: Tennessee as tax-cut role model? Never mind

July 22, 2016

“Tennessee’s gains are being subsidized by the poor and working class. The poorest 20 percent of Tennesseans pay 8.9 percent of their income on sales and excise taxes, according to the Washington-based Institute on Taxation and Economic Policy. The state’s richest residents pay just 1.2 percent.” Read more

Washington Examiner: California is going to try charging drivers by the mile

June 22, 2016

“Carl Davis, research director at the Institute of Taxation and Economic Policy, told the Washington Examiner there’s no short-term fix for the “congested and crumbling infrastructure,” but added he’s encouraged to see state legislatures experiment.” Read more