Who Pays?

Iowa: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

Iowa Download PDF All figures and charts show 2024 tax law in Iowa, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.9 percent) state and local tax revenue collected in Iowa. These figures depict Iowa’s 2024 graduated personal income tax, with a top […]

Illinois: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

Illinois Download PDF All figures and charts show 2024 tax law in Illinois, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (98.6 percent) state and local tax revenue collected in Illinois. State and local tax shares of family income Top 20% Income Group […]

Indiana: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

Indiana Download PDF All figures and charts show 2024 tax law in Indiana, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.8 percent) state and local tax revenue collected in Indiana. These figures depict Indiana’s flat personal income tax rate at 3.05 percent. […]

Idaho: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

Idaho Download PDF All figures and charts show 2024 tax law in Idaho, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.7 percent) state and local tax revenue collected in Idaho. As seen in Appendix D, recent legislative changes have increased the regressive […]

Hawaiʻi: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

Hawai’i Download PDF All figures and charts show 2024 tax law in Hawai’i, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.5 percent) state and local tax revenue collected in Hawai’i. State and local tax shares of family income Top 20% Income Group […]

Florida: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

Florida Download PDF All figures and charts show 2024 tax law in Florida, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.9 percent) state and local tax revenue collected in Florida. State and local tax shares of family income Top 20% Income Group […]

Georgia: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

Georgia Download PDF All figures and charts show 2024 tax law in Georgia, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.8 percent) state and local tax revenue collected in Georgia. These figures depict Georgia’s personal income tax rate at its 2024 level […]

District of Columbia: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

District of Columbia Download PDF All figures and charts show 2024 tax law in the District of Columbia, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly 100 percent of DC’s tax revenue. These figures depict the District’s EITC for workers with children at its […]

Delaware: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

Delaware Download PDF All figures and charts show 2024 tax law in Delaware, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly 100 percent of state and local tax revenue collected in Delaware. State and local tax shares of family income Top 20% Income Group […]

Alaska: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

Alaska Download PDF All figures and charts show 2024 tax law in Alaska, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.5 percent) state and local tax revenue collected in Alaska. State and local tax shares of family income Top 20% Income Group […]

Connecticut: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

Connecticut Download PDF All figures and charts show 2024 tax law in Connecticut, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly 100 percent of state and local tax revenue collected in Connecticut. State and local tax shares of family income Top 20% Income Group […]

Arizona: Who Pays? 7th Edition

January 9, 2024 • By ITEP Staff

Arizona Download PDF All figures and charts show 2024 tax law in Arizona, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.9 percent) state and local tax revenue collected in Arizona. As seen in Appendix D, recent legislative changes have significantly increased the […]

Alabama: Who Pays? 7th Edition

January 8, 2024 • By ITEP Staff

Alabama Download PDF All figures and charts show 2024 tax law in Alabama, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99 percent) state and local tax revenue collected in Alabama. These figures depict Alabama’s grocery sales tax rate at its 2024 level […]

Colorado: Who Pays? 7th Edition

January 8, 2024 • By ITEP Staff

Colorado Download PDF All figures and charts show 2024 tax law in Colorado, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.2 percent) state and local tax revenue collected in Colorado. These figures depict Colorado’s EITC at its 2024 level of 38 percent […]

California: Who Pays? 7th Edition

January 8, 2024 • By ITEP Staff

California Download PDF All figures and charts show 2024 tax law in California, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.2 percent) state and local tax revenue collected in California. State and local tax shares of family income Top 20% Income Group […]

Arkansas: Who Pays? 7th Edition

January 8, 2024 • By ITEP Staff

Arkansas Download PDF All figures and charts show 2024 tax law in Arkansas, presented at 2023 income levels. Senior taxpayers are excluded for reasons detailed in the methodology. Our analysis includes nearly all (99.5 percent) state and local tax revenue collected in Arkansas. As seen in Appendix D, recent legislative changes have significantly increased the […]

New York Times: What’s the Matter With Miami?

August 4, 2023

For a couple of years after the pandemic struck, there was considerable buzz to the effect that much of the financial industry might leave New York for Miami. After all, state and local taxes on the richest one percent are much lower in Florida than in New York — about nine points lower as a percentage of income, according […]

Sacramento Bee: Biden, Democrats Want to Increase Tax Break for Parents. It Could Help 15 million Californians

July 12, 2023

The increased tax credit would help an estimated 14.7 million Californians, according to the Institute on Taxation and Economic Policy, a progressive Washington-based research group. While the proposed increase has a long way to go legislatively, and is likely to change, it’s one of several tax cuts under serious discussion. Read more

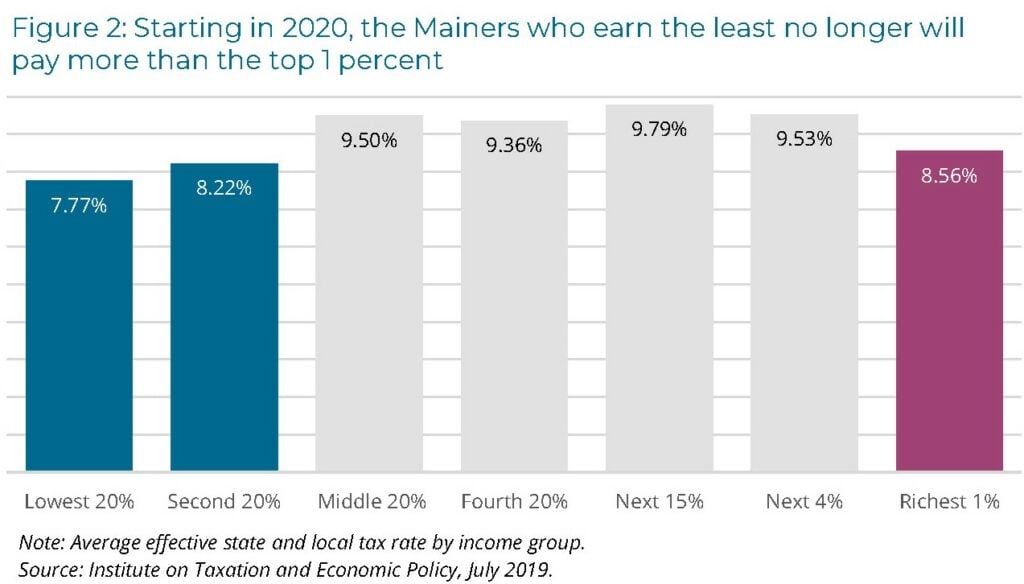

Better tax policies will help communities emerge from the current staggering fiscal crisis with tax structures that reduce inequality at a time when rich people are thriving and public services are under siege. Preserving public spending will boost the economy and improve lives–and cutting these essentials will not only hurt people but also deepen the downturn, a lesson we learned in the Great Recession’s slow recovery. Other states should take note.

Public News Service: Will WA Lawmakers Tackle Tax Fairness in 2020?

January 3, 2020

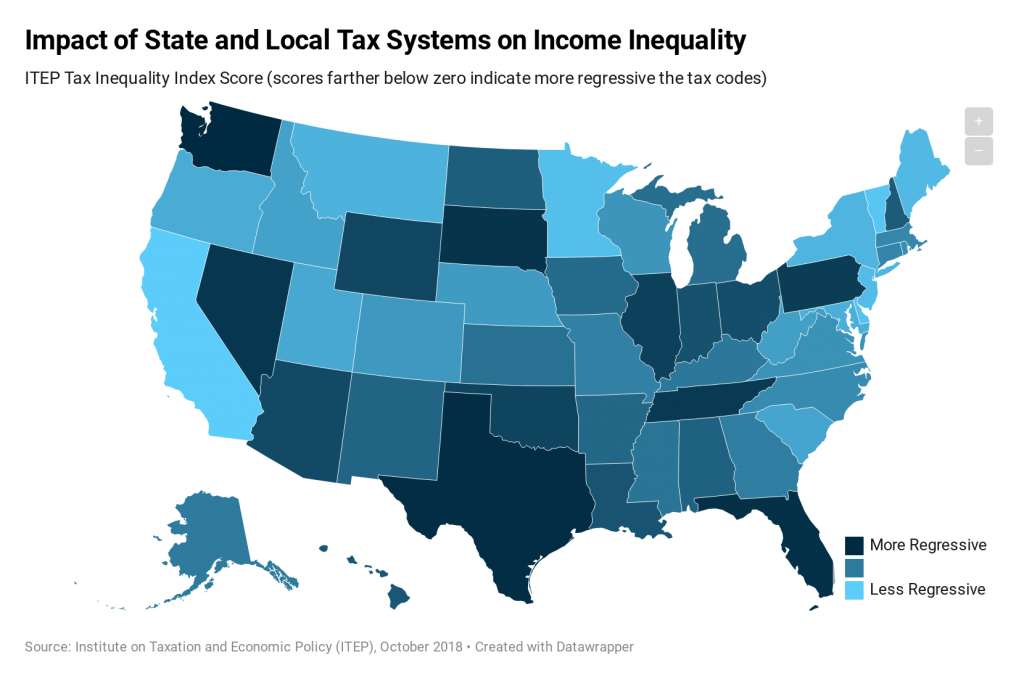

How can Washington state create a more just society in 2020? Two experts say the state should tax its way toward that goal. The Institute on Taxation and Economic Policy ranks Washington last in the nation in terms of tax-system fairness, with low-income residents shouldering the biggest tax burden as a portion of their income. Katie Baird, […]

Real Change: Fishing for Equity in a Regressive Tax System

October 16, 2019

“It’s always about race, and it’s always about taxes,” said Misha Hill, a policy analyst with the Institute on Taxation and Economic Policy (ITEP). ITEP is the source of the frequently cited statistic that Washington has the most regressive tax system in the country. In fact, Hill said, there are no states in the union […]

Lawmakers in Maine this year took bold steps toward making the state’s tax system fairer. Their actions demonstrate that political will can dramatically alter state tax policy landscape to improve economic well-being for low-income families while also ensuring the wealthy pay a fairer share.

State Tax Codes as Poverty Fighting Tools: 2019 Update on Four Key Policies in All 50 States

September 26, 2019 • By Aidan Davis

This report presents a comprehensive overview of anti-poverty tax policies, surveys tax policy decisions made in the states in 2019 and offers recommendations that every state should consider to help families rise out of poverty. States can jump start their anti-poverty efforts by enacting one or more of four proven and effective tax strategies to reduce the share of taxes paid by low- and moderate-income families: state Earned Income Tax Credits, property tax circuit breakers, targeted low-income credits, and child-related tax credits.

How Tax Policy Can Help Mitigate Poverty, Address Income Inequality

September 10, 2019 • By ITEP Staff

Analysts at the Institute on Taxation and Economic Policy have produced multiple recent briefs and reports that provide insight on how current and proposed tax policies affect family economic security and income inequality.

The vast majority of state and local tax systems exacerbate the economic divide by taxing low- and middle-income families at higher rates than the wealthy. This map distills an exhaustive analysis of state and local tax codes into one key number, the ITEP Tax Inequality Index, to show the degree to which each state’s tax […]