President-elect Donald Trump and Republicans in Congress have announced plans to pass a tax bill in spring 2025. We’ve analyzed the Trump campaign proposals and it’s clear: a tax package based on these changes would be disastrous for families, communities, and the country.

Candidate Trump’s proposals would, on average, lead to a tax cut for the richest 5 percent of Americans and a tax increase for the other 95 percent of Americans.

The richest 1 percent, with incomes above $915,000 in 2026, would do particularly well because Trump’s proposals prioritize additional corporate tax decreases and extension of personal income tax cuts that are skewed to the wealthy. These households would get an average tax cut of about $36,300 in 2026.

The middle 20 percent of Americans, families making between $55,000 and $94,000, would face an average tax increase of $1,530 in 2026. Families below that level and most families above that level would also see tax hikes. In fact, the entire bottom 95 percent of Americans would face higher taxes on average because Trump’s proposed tariffs would raise prices for American consumers.

If implemented in their entirety, the Committee for a Responsible Federal Budget has estimated that these plans would increase deficits by about $7.5 trillion over a 10-year budget window (the mid-point of their forecast). It may seem impossible to hike taxes on 95 percent of people while simultaneously adding that much to deficits, but the massive proposed cuts to the wealthy and corporations add up.

Billionaires and big corporations are sharpening their knives in anticipation of huge tax cuts, already lobbying and donating to get the tax plan that gives them the biggest windfall. Those forces have always had tremendous influence in Washington. Now they have more.

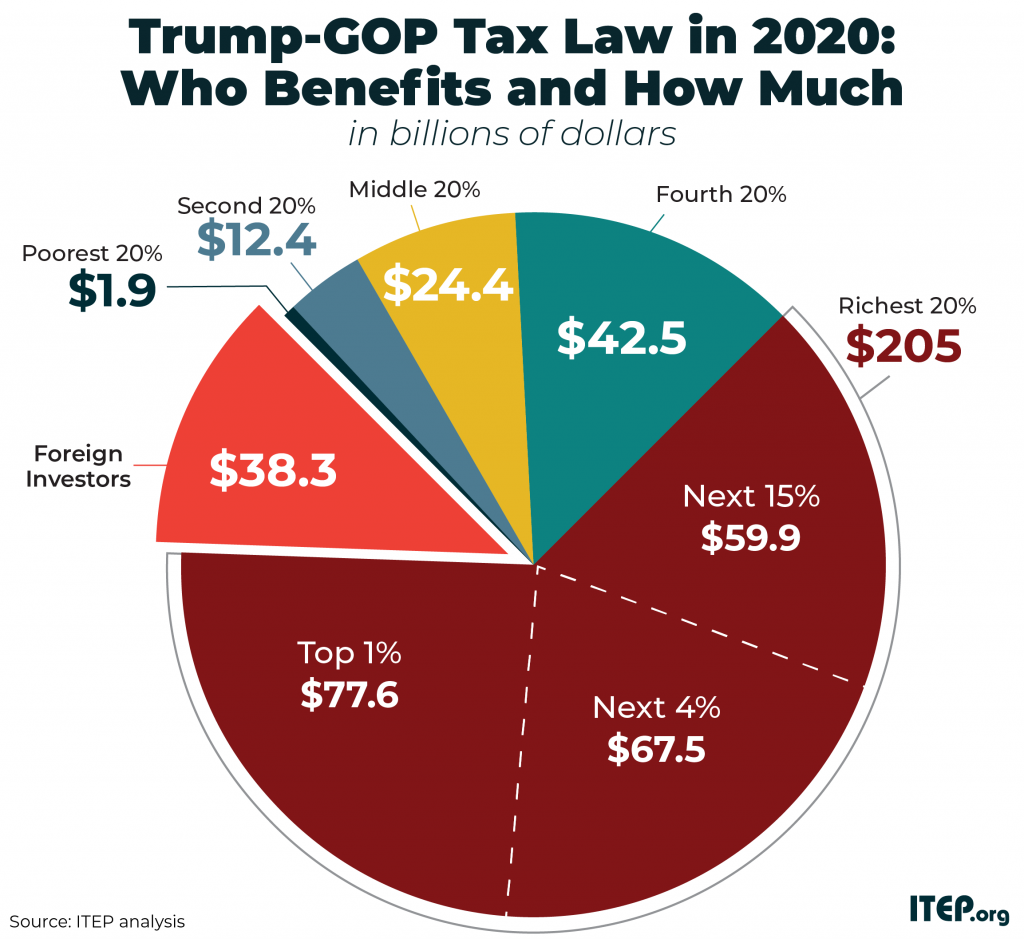

We’ve been here before. In 2017, then President Trump and his allies in Congress passed lopsided tax cuts that ran up the deficit and supercharged inequality. That led to corporations paying significantly less in taxes, even in the face of massive increases in their profits. Those tax cuts turned out to be incredibly unpopular, in some cases leading to voters choosing to eject the people who had promoted them.

At ITEP we are built for this kind of analysis. Every legislative session, we help partners defend fair taxes in 50 states plus D.C. We provide that support in red states and blue, on the coasts and in the plains, in the South, the Midwest, and on the east and west coasts.

We will bring this kind of unassailable, accurate, understandable data to the 2025 federal debate and we will change minds when we do.

People across the country voted for change this week but the full scope of choices were more complex than it might seem. Even as Trump won, we saw support for more robust taxation in other election results.

By a 63 percent majority, voters in the state of Washington defended their historic new tax on capital gains income, something moneyed interests have tried to block and repeal repeatedly and that the voters have always decided to keep. Child care, early education and schools will retain $2 billion in funding because of this vote.

By a 64 percent majority, North Dakota voters opted to keep the state’s property tax so this Republican-controlled state can retain $1.4 billion for schools, libraries, emergency responders, and other services. Illinois voters passed a non-binding measure giving the thumbs-up to a surtax on income over $1 million a year that, if eventually implemented , would raise billions. And voters around the country approved more than $40 billion for state and local transportation needs alone. Find a round-up of state tax ballot initiatives here.

At the local level voters across the country – in Denver, Colorado; Columbus, Ohio; Nashville, Tennessee, and many more places – marched to the ballot box and voted to preserve or raise taxes to fund things that keep their communities strong: transit, health, education, the arts, public safety, affordable housing, senior services, parks, and more.

A lot has changed in the last few days. But some things have not. Billionaires and businesses have too much power in Washington. Tax revenue is needed to pay for things we all need. If we want economic justice, racial justice and climate justice, we must have tax justice.