Racial justice requires tax justice. Economic justice requires tax justice. Climate and health justice require, yes, tax justice.

A country that works for everyone needs tax revenue from those most able to pay—particularly profitable corporations and the wealthiest individuals—at both the state and federal level. And it requires adequate resources for the essentials—for all children to attend great schools and afford college, all families to see a doctor when they feel sick, and all communities to trust the government to address public catastrophes like climate change and COVID.

The United States does not raise enough tax revenue to fund the basics for our people, our communities, and our planet. And tax policies—federal and state—contribute to inequality that has been shooting higher with almost every passing year. A tiny few are walking away with an ever-larger share of the income and wealth that we all work to produce. And, increasingly, the rest of us are left with less of what we need to thrive, even in normal times, but particularly during a pandemic on a baking planet.

We can reset and do things differently. Some of our proudest successes as a nation were built on public spending. Many of our failures stem from ways we made our economy cater to the few—often exclusively wealthy and white—and neglected Black, Native American, Hispanic, and poor or moderate-income communities. At our best, taxes and government investment built the pipes, power lines, public schools, and polio vaccines needed to advance the world’s strongest economy in the middle of the twentieth century. This was a time when, compared to today, the U.S. imposed much higher tax rates on corporate income and on the top levels of individual income. Public spending, enabled in part by those taxes, helped fuel growing education levels, incomes, lifespans, and national wealth.

This is part of our history, but so is a more unequal, less effective approach. That includes the ways that even our best policies often left out Black and brown communities. It also includes the lower taxes, deregulation, and disinvestment, starting in the 1980s, that triggered soaring inequality, less growth for middle-class and poor families, and increasingly precarious lives for working people of all races. Those policies often combined profligate tax cuts for the wealthiest with austerity for the rest of us.

Social movements pushed back, at times winning changes that helped regular people even in this challenging period—on health care, childcare, and even on taxes. Still, in general, the last four decades were marked by reduced taxes and attacks on the public sector, supercharged under the Trump administration, which piled on more tax cuts for corporations and the wealthy. This made the tax code itself a less helpful tool for addressing inequality and further reduced already inadequate funding for public health, green investments, and other necessities.

In 2020, that rejection of government has proven lethal. Insufficient resources to tackle inequality, poverty, and health, combined with what PBS News Hour characterized as presidential “disdain for government,” left the public sector unable to brave the challenges of a pandemic and a recession, making the US “the only affluent nation to have suffered a severe, sustained outbreak for more than four months,” according to recent analysis by New York Times reporter David Leonhardt. Other nations managed these twin crises much better.

Our country differs from other wealthy democracies in doing less through the public sector, leaving much more of the cost for higher education, child care, healthcare, and other essentials on the backs of individual families. While our peer countries on average devoted more than a third of their economy to public needs in 2018, the U.S. directs less than a quarter of our gross domestic product this way. Only Chile, Ireland, and Mexico do worse. The more robust taxes and public services in most comparable nations translate to less poverty, lower inequality and more health coverage, all of which helped in a public health crisis.

Now, in 2020, policymakers need to borrow to provide essential economic relief, health investments, and state and local fiscal aid. But in the long run, the federal government should be collecting more revenue to strengthen our people and communities. We can do this by adequately taxing the income and wealth of the richest people and of corporations, which are capturing an ever-greater share of our economy. While our current failure to invest adequately leads to deep income inequality, gaping racial chasms, and life-threatening health and climate outcomes, a different path is possible. If we want healthy communities, climate sanity, racial equity, and economic justice, we must start with tax justice.

Federal taxes

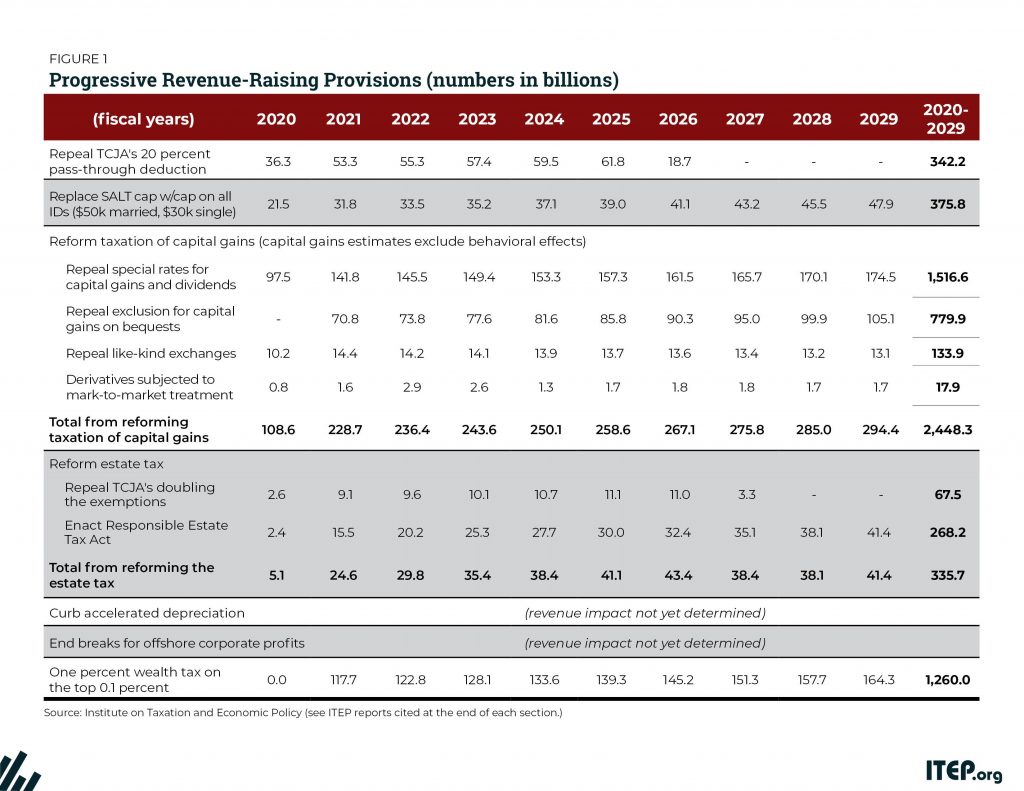

This requires smarter federal taxes, which ITEP describes in our 2019 paper on progressive federal revenue-raising options. We can reform our tax system to ensure that the wealthy pay their fair share and to raise enough revenue for public investments. To do so, we should:

- Tax income from wealth, like capital gains and stock dividends, no less than we tax income from work.

- Tax wealth itself with a stronger estate or inheritance tax and even a federal tax on the net worth of very wealthy households.

- Tax our corporations’ offshore profits at least as much as we tax their U.S. profits.

- End business tax breaks that are promoted as incentives for investment and job creation when there is no evidence that they accomplish this.

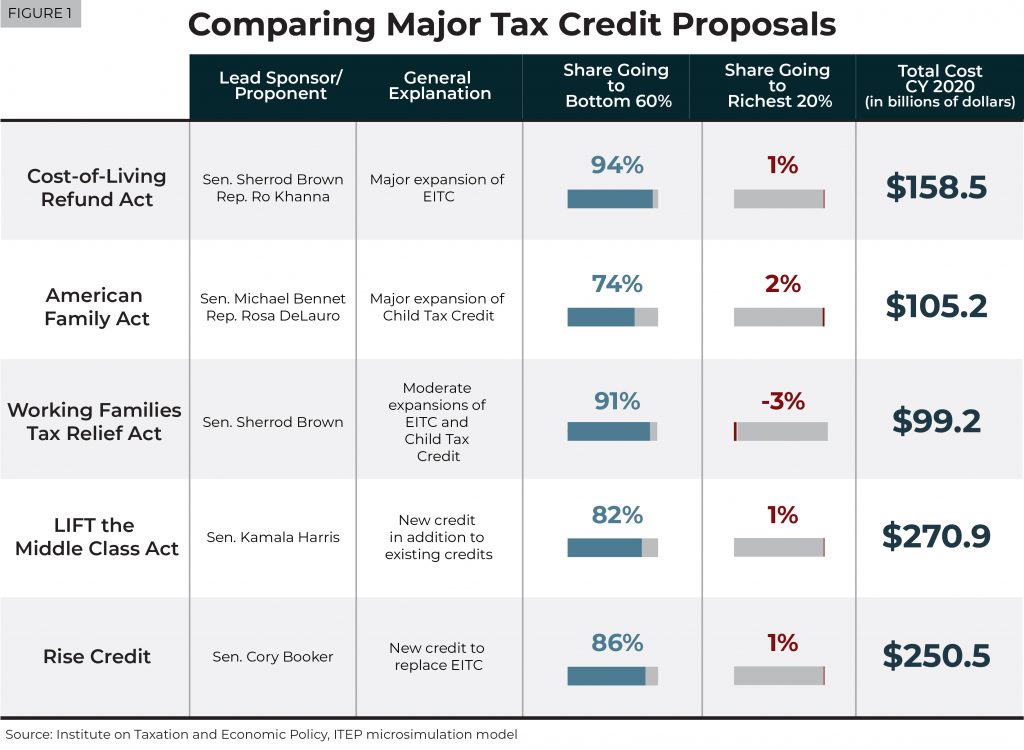

- Explore the creative ideas being generated to make our tax code a better tool for reducing inequality, greening our economy, and improving our lives. This might include new or expanded refundable tax credits, a carbon tax, and other innovative solutions.

The Trump-GOP tax changes passed in 2017 went backward on most of these measures. They slashed personal income taxes for top earners. They cut taxes on large estates, further solidifying already alarming wealth inequality. And they reduced corporate taxes such that the year after the law passed, 91 profitable Fortune 500 corporations paid absolutely nothing in corporate taxes. In total, the law directs roughly half of its largesse to the richest 5 percent and gives the richest 1 percent an average tax break of about $50,000 in 2020, compared to just $800 for middle earners. President Trump has since proposed further capital gains tax cuts, almost entirely for the wealthiest 1 percent.

Restoring adequate federal taxes would reduce economic and racial disparities and give us the funding we need to have good schools in Appalachia, to provide health insurance in Iowa, and to begin preventing fires that now rage across much of the west coast.

State and local taxation

States must also fundamentally transform their fiscal policy. Many investments that directly help people and communities are delivered at the state and local level. Yet, state policymakers have often slashed taxes for the wealthiest and for profitable corporations and raised too little to invest in the needs of today and tomorrow. Most state and local tax systems are upside down, requiring poor and middle-income families to pay a larger share of their income in taxes than wealthy families. On average, the lowest-income 20 percent of taxpayers face a state and local tax rate more than 50 percent higher than the top 1 percent of households. Many states have enacted tax and expenditure limits that don’t allow the public sector to keep up with growing needs or an expanding economy. Some require a supermajority of lawmakers to approve revenue increases or new taxes. Reduced state aid and lack of flexible revenue authority push many localities to use expanded fines and fees to fund basic operations. The practice is wildly regressive, penalizes poor families, and is often implemented in a racist way that targets Black and Hispanic communities.

There is a better path. In some states, pushed by working people, community organizers, and advocates, policymakers are successfully pointing the way to progressive tax change. Tax systems that will help states emerge from the 2020 fiscal and public health crisis and position us for big bold investments in the future would do many things differently, as ITEP detailed in papers in 2020 and 2019. Elements include:

- Enact progressive personal income taxes with higher brackets for the wealthiest, including new brackets for half millionaires and millionaires.

- Restore or create fair corporate income taxes.

- Eliminate tax giveaways, subsidies, and deductions, including special treatment of pass-through business income and tax breaks on capital gains.

- Provide significant and targeted refundable state tax credits, like the Earned Income and Child Tax Credits.

- Get rid of tax and spending limits, supermajority requirements, and constitutional restraints on revenue raising.

- Update sales tax bases to reflect where money is spent today and reform gas taxes and similar taxes to bolster their sustainability.

- Eliminate revenue-raising through fines and fees, which disproportionately hurt poor, Black, and Hispanic communities. Improve property taxes by lifting onerous tax caps, enacting means-tested credits for low-and middle-income homeowners and renters, ending racial disparities in property assessments, and implementing other reforms.

- Explore ways to tax wealth at the state level, including estate or inheritance taxes, mansion taxes, and other approaches.

It’s essential that the federal government provide meaningful fiscal relief to states so they can pay for schools, healthcare, and other needs that have only intensified in the pandemic. But state lawmakers can and should step up to the plate. People benefit when states have more equitable, adequate, sustainable tax systems. In 2020, it is time to embrace that approach.

Conclusion

We need resources to tackle the big problems of 2020: a pandemic; a deeply unequal economy; and a climate that staggers from fires, to hurricanes, to floods. Those resources should come from borrowing in the short term. But moving forward, we must demand that corporations and wealthy individuals contribute more to the economy that gives them so much.

It’s time for a new approach—equity, investment, and a real commitment to the hard work of solving public problems—including paying for the solutions. We can rebuild this country in a way that works for all of us—whether we were born in Detroit, Dallas, or Delhi; whether we drive a delivery truck or do vaccine research; whether we need help affording preschool or more financial aid for college. We can take on hard challenges, as this country has done before, if we put meaningful resources into allowing our people, our communities, and our economy to thrive. Taxes are how we do so.