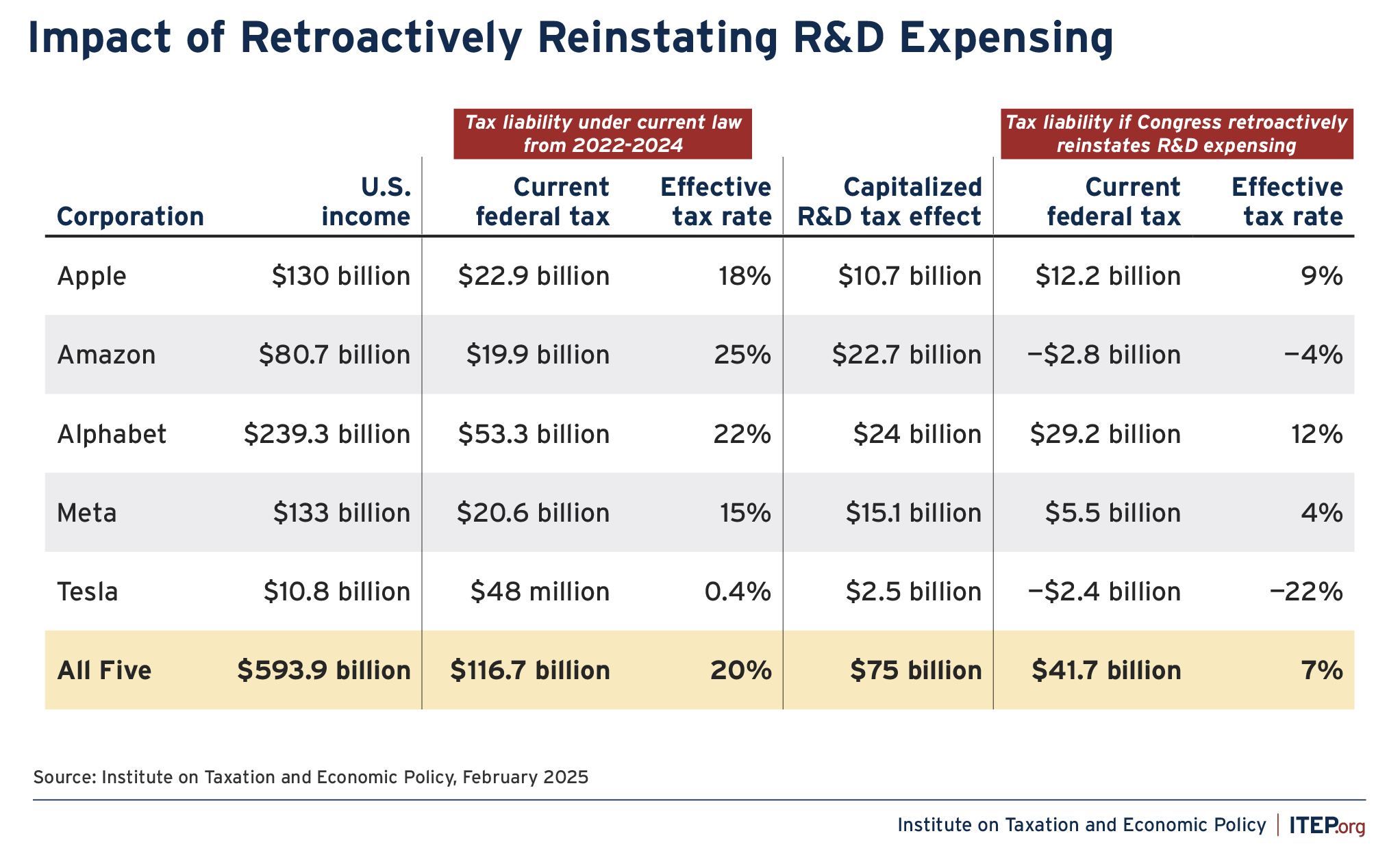

New financial reports indicate five of America’s biggest corporations—Alphabet, Amazon, Apple, Meta, and Tesla—could win $75 billion in tax breaks if Congress and the President satisfy demands from corporate lobbyists to reinstate a provision repealed under the 2017 Trump tax law.

The CEOs of these companies may have hoped to gain any number of benefits from attending the second inauguration of President Trump in January, and this tax break is just one possible example.

The tax break allowed companies to immediately deduct the expenses characterized as research and development in the year they are incurred rather than deducting those expenses over several years like other investments. Repeal of this tax break was one of the few revenue-raising provisions in the Trump tax law and it was supposed to slightly offset the costs of the law’s corporate tax cuts.

The Trump tax law repealed the R&D expensing break starting in 2022, replacing it with a less generous rule requiring R&D expenses to be deducted over five years. In the previous Congress, the House of Representatives passed a bill reinstating the break retroactive to 2022. That bill did not advance in the Senate, but now that Republicans control the House, Senate, and White House, there is every reason to believe the proposal will be considered again.

Proponents of the tax break make a very questionable argument that it encourages companies to engage in research that benefits society. But reinstating this tax break retroactively obviously cannot accomplish this because it would merely reward companies for research and development investments they already made. The $75 billion saved by these companies would be a pure windfall that does not require them to do anything going forward.

The 2024 House-passed bill that would have reinstated this tax break was controversial but that legislation at least offset the costs by shutting down a different tax break that was being fraudulently claimed by unscrupulous accountants on behalf of businesses that were not actually eligible for it. That legislation also included a badly needed expansion in the Child Tax Credit. Republicans in the Senate blocked that bill because they hoped they could later enact tax legislation that would be even more generous to corporations — as they are now trying to do.

The five tech companies profiled here have disclosed that in the three years the R&D tax increase has been in place, their federal income tax bills increased by at least $75 billion as a result of this provision.

These companies have reaped huge windfalls from Donald Trump’s 2017 tax law, which included a reduction in the statutory corporate tax rate from 35 to 21 percent. They also benefit from special breaks and loopholes allowing them to pay effective tax rates that are even lower than the statutory rate of 21 percent. And they will pay even lower effective tax rates if President Trump and Congress reinstate the R&D tax break.

For example, the federal corporate income taxes that Apple reports it paid over the past three years come to 18 percent of its reported income during that period. That is another way of saying Apple paid an effective tax rate of 18 percent during the previous 3 years. If Congress retroactively repeals the R&D tax change, the company’s three-year tax rate would be cut in half, to 9 percent.

Meta’s three-year tax rate on $133 billion of US income would drop from 15 percent to just 4 percent. And the three-year tax rate of Elon Musk’s Tesla would drop from the 0 percent the company currently reports to negative 22 percent.

Restoring the R&D provision would reduce the collective effective tax rate paid by these five companies for this three-year period by almost two-thirds, from 20 percent to 7 percent.

The research and development provision at stake in this year’s tax debate was one of the few revenue-raisers embedded in the 2017 law and served to make the plan overall appear somewhat less costly. Repealing this tax change is a stealthy way to make the corporate tax cuts even bigger than they were when enacted in 2017, and it would allow the five companies profiled here to shelter two-thirds of their US income from federal income tax.